Orderflow Chart

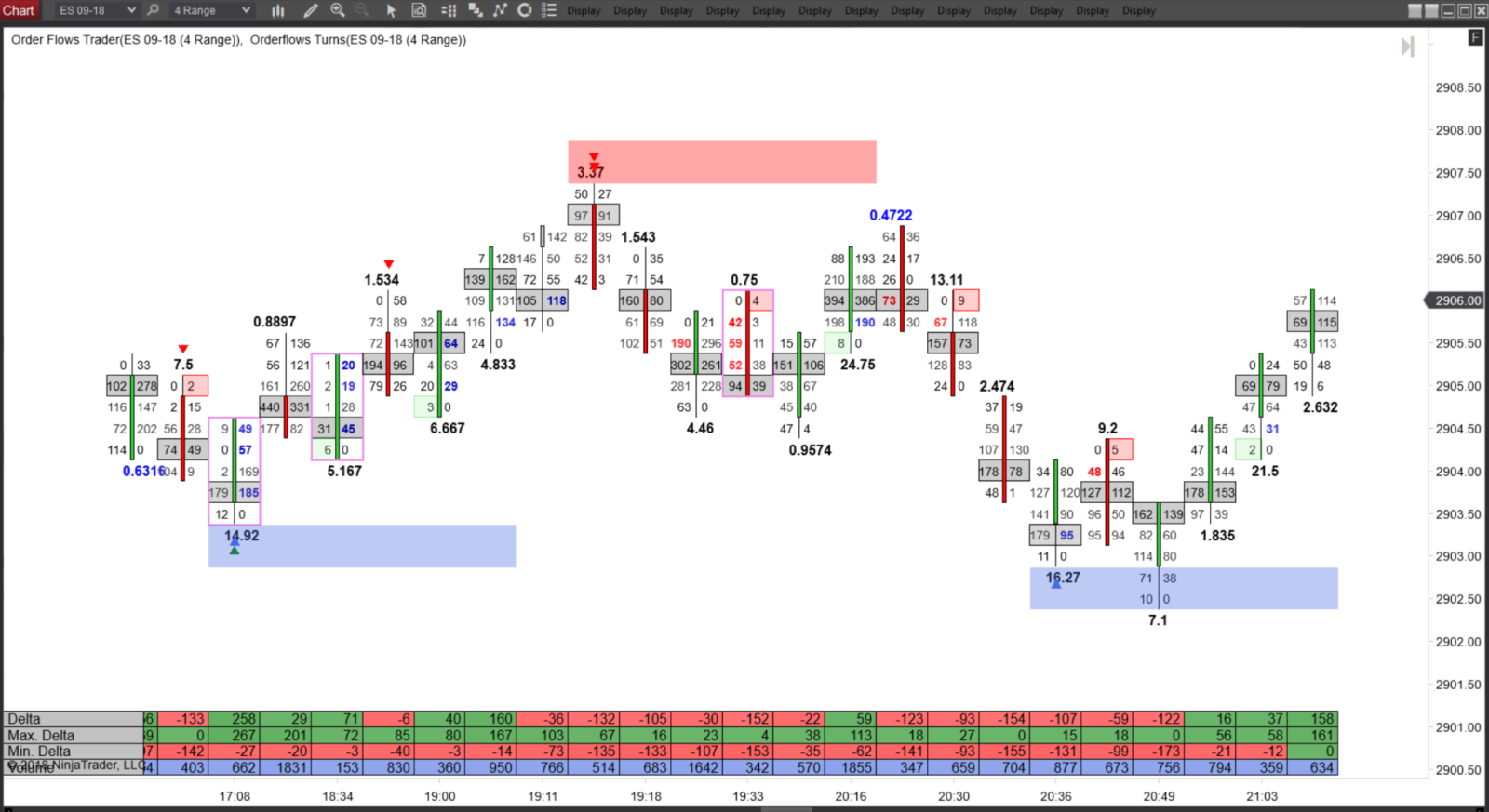

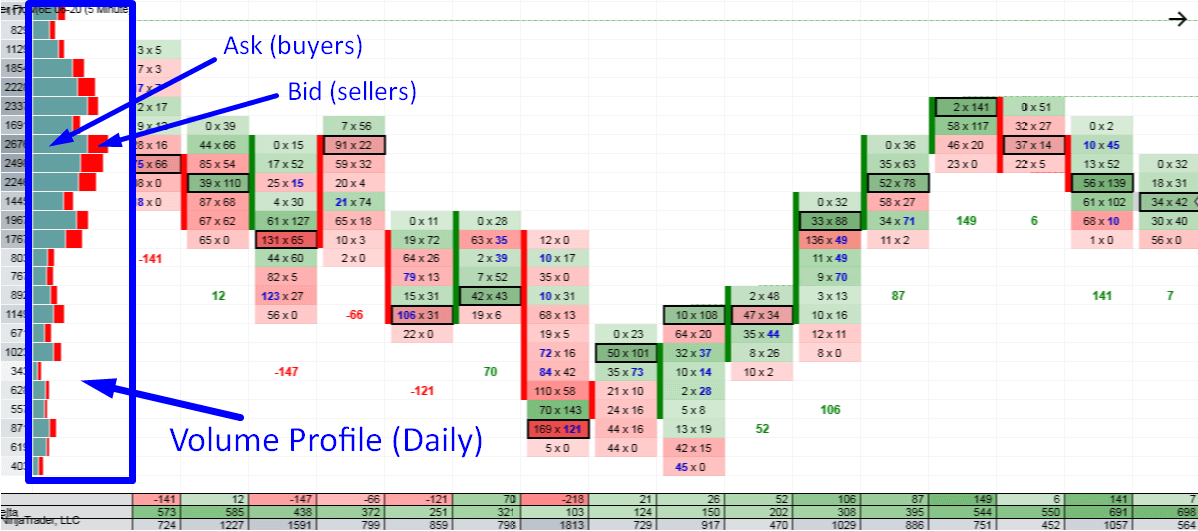

Orderflow Chart - Web this innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Identify volume clusters, absorption, exhaustion and unfinished auction patterns. Web these tpo (time price opportunities) or market profile charts do not need tick data, meaning they do not need information about volume executed at each bid and ask price point, they can work with normal price volume data, and hence its easy to implement. Web order flow trading software by volfort, volgraph 3 professional. Market sentiment refers to the general opinion of investors towards a certain security or financial market. It helps traders understand the sentiment behind the market moves and make. By careful observation of the patterns and the speed from which the bids and deals are coming in, traders have an advantage here to have a glimpse of what others are thinking. Our novel edge imbalance indicator shows you where excess liquidity sits, allowing you to catch retail traders offsides and trade with the market makers. Order flow trading is just like having an offstage ticket to view all the bids and submissions that people are making. Web volumetric bars track buyers and sellers tick by tick giving you a comprehensive view of the activity for order flow trading. It helps traders understand the sentiment behind the market moves and make. Order flow traders look to profit by capitalizing on market imbalances. Web volumetric bars track buyers and sellers tick by tick giving you a comprehensive view of the activity for order flow trading. Analyzing the order flow helps you recognize the final details of the buying and selling. Learn how to interpret total volume, absorption and defense for precise market insights. Since 2016, our team of professional traders and engineers has been at the forefront of innovation in the crypto markets. Web an order flow chart will show you exactly how many buy and sell market orders were executed at each price level. Order flow traders look to. Learn how to interpret total volume, absorption and defense for precise market insights. A video explaining orderflow setup in gocharting # What is footprint aka cluster charts. The blue ones = bid limit orders. A great tool improves the way you think.” for questions or comments please send emails to: Identify volume clusters, absorption, exhaustion and unfinished auction patterns. Order flow trading is just like having an offstage ticket to view all the bids and submissions that people are making. Discover a wide range of tools including orderflow charts, market profile, and volume profile for accurate trading decisions. Web discover the best order flow indicators i've used over my 20. Web unlock the power of order flow charts in day trading. Web gocharting trading platform provides orderflow analysis, an advanced analytical functionality, which allows you to see the traded volume at each price level, assess the balance between buyers and sellers and understand the intentions of traders regarding the future price. Red ones = ask limit orders. It helps traders. How much desktop pro costs? Volgraph™3 professional is a premium order flow trading and analysis platform. Web unlock the power of order flow charts in day trading. See the order flow chart below: Plus vat of payers country. Orderflowsolutions at gmail dot com. Web unlock the power of order flow charts in day trading. Web orderflow charts can show you in real time the actual demand and supply at the exchange by simulating the transactions occurring at the exchange on your chart. Web an order flow chart will show you exactly how many buy and sell market orders. A video explaining orderflow setup in gocharting # Since 2016, our team of professional traders and engineers has been at the forefront of innovation in the crypto markets. See the order flow chart below: Web this innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Web what is order flow. Web volumetric bars track buyers and sellers tick by tick giving you a comprehensive view of the activity for order flow trading. What is footprint aka cluster charts. A great tool improves the way you think.” for questions or comments please send emails to: Volgraph™3 professional is a premium order flow trading and analysis platform. Market sentiment refers to the. Web order flow trading is a strategy that involves analyzing the flow of buy and sell orders in the market to gain insights into market dynamics. Order flow traders look to profit by capitalizing on market imbalances. Orderflowsolutions at gmail dot com. For $36 a month you will hardly find a better offer. Web an order flow chart will show. Web it’s the largest such swap since the cold war. Web order flow trading is a type of trading strategy where trading edges are defined through the analysis of advertised orders and/or executed orders. Web these tpo (time price opportunities) or market profile charts do not need tick data, meaning they do not need information about volume executed at each bid and ask price point, they can work with normal price volume data, and hence its easy to implement. Web this innovative tool is designed to enhance your trading strategy by providing a detailed analysis of order flow and velocity. Web an order flow chart will show you exactly how many buy and sell market orders were executed at each price level. Web it offers footprint charts, orderflow indicators, market profile, and a variety of volume profile charts as well. Learn to spot when buy or sell imbalances are forming. Market sentiment refers to the general opinion of investors towards a certain security or financial market. Order flow trading is just like having an offstage ticket to view all the bids and submissions that people are making. The blue ones = bid limit orders. Orderflowsolutions at gmail dot com. Web volumetric bars track buyers and sellers tick by tick giving you a comprehensive view of the activity for order flow trading. Evan gershkovich, the wall street journal reporter who had been detained in russia since last year, was brought home to the u.s. Volgraph™3 professional is a premium order flow trading and analysis platform. Exocharts is a multiplatform charting software that runs on desktop and web. It requires predicting fellow traders’ moves.

Orderflows Turns All In One Order Flow Analysis Tool

What is an order flow chart? Stocks On Fire

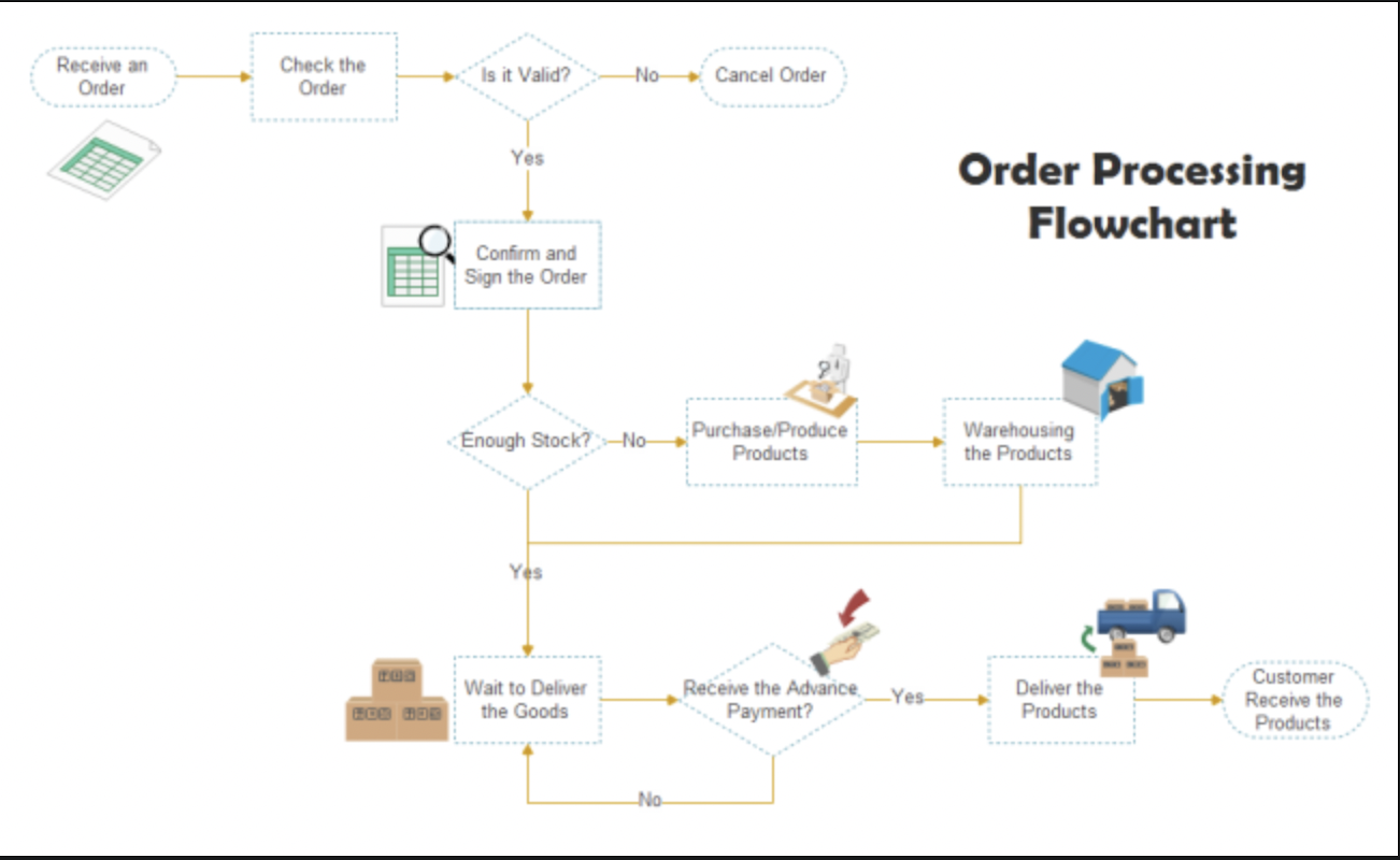

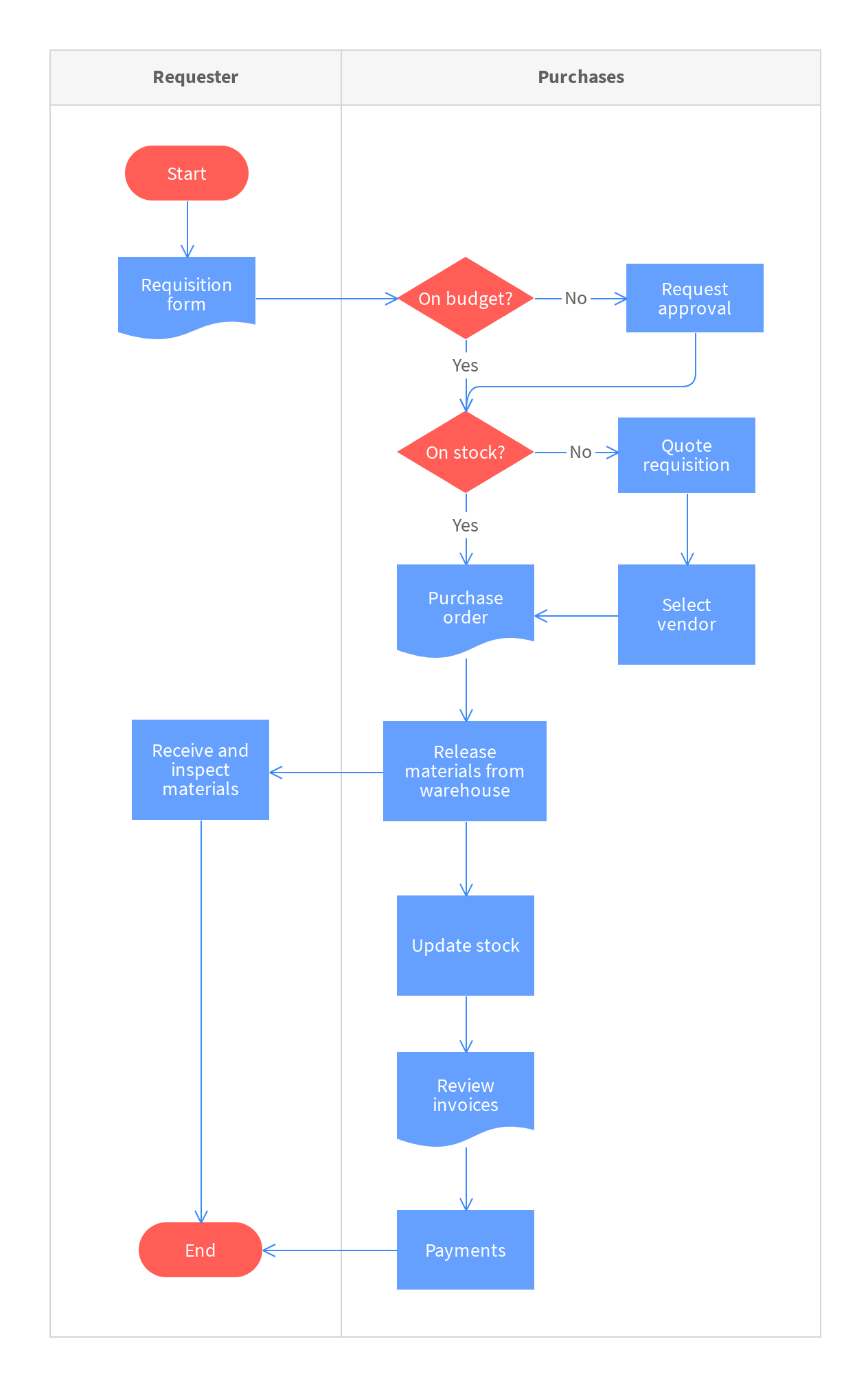

How Order Management Process Workflows and Flow Charts Work

How to Enable Tick Replay Option in NinjaTrader 8 to get OrderFlow Charts?

Manufacturing Order Process Flowchart Template Moqups

Veritas OrderFlow Chart Template MZpack for NinjaTrader

OrderFlow charts dated 21st August Vtrender

Beginners Guide to Order Flow PART 1 What Is Order Flow?

Footprint indicator, order flow indicator for professionals traders

Live Orderflow and Market Profile Charts How do you get them

Discover A Wide Range Of Tools Including Orderflow Charts, Market Profile, And Volume Profile For Accurate Trading Decisions.

Web Order Flow Trading, At Its Heart, Is A Strategic Mind Game, Akin To Poker Or Chess.

It’s A Microscopic Look Into The Price Movement That Is Represented On The Price Bar Or Candlestick.

Analyzing The Order Flow Helps You Recognize The Final Details Of The Buying And Selling Volume.

Related Post: