Nonprofit Receipt Template

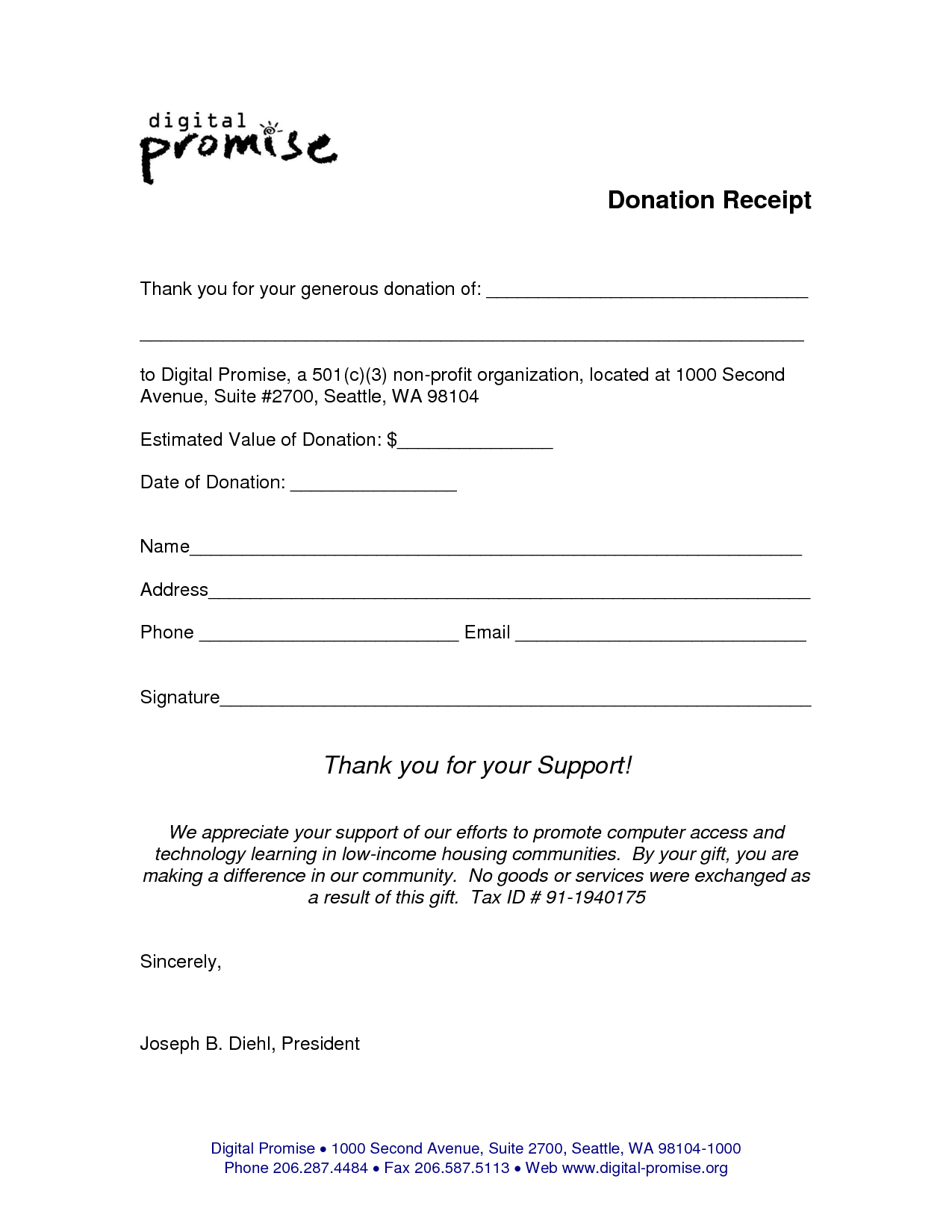

Nonprofit Receipt Template - Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web below we have listed some of the best nonprofit donation receipt templates we could find. Made to meet us & canada requirements. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. It contains the details of the donor’s contributions. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: No matter what type of charity you are responsible for managing, your donation receipt needs to include some basic information. Web charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. Web here is what should generally be included in a nonprofit donation receipt: When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs form 1023 to become a 501 (c) (3) nonprofit. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. No matter what type of charity you are responsible for managing, your donation receipt needs to include some basic information. Web a donation receipt is an official document that provides evidence of donations or. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. Web nonprofit donation receipt template is required by an organization that accepts donation. Web what are. What should diy donation receipts include? Web donation receipts, also called donation tax receipts, are a form of written proof that provide official documentation of a contribution made by a donor. Web below we have listed some of the best nonprofit donation receipt templates we could find. How can a nonprofit use them + sample donation letter & receipt template.. Web here is what should generally be included in a nonprofit donation receipt: Web organizations that accept donations must have receipts. This article will serve as a thorough guide to nonprofit donations and show you what kinds of expenses donations can—and cannot—be used to cover. No matter what type of charity you are responsible for managing, your donation receipt needs. Web nonprofit donation receipt template is required by an organization that accepts donation. Made to meet us & canada requirements. What does 501 (c) (3) mean? Donation receipts are often written in the form of an acknowledgment letter that proves the fact that a certain donation has been received. Web this article covers everything you need to know about creating. These are given when a donor donates to a nonprofit organization. We will populate it automatically with all the necessary donation details and organization info. The amount of gifts received. Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary.. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Web you can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Web by following these best practices, you can create a donation receipt template and donation. Instead of creating from scratch, you can get and use these donation receipt templates for free. You may need donations to run your nonprofit, but how can you use them? Web what are the best donation receipt templates for nonprofits? These are given when a donor donates to a nonprofit organization. Web a donation receipt is an official document that. What to include on a nonprofit donation receipt? Statement that no goods or services were provided by the organization, if. When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs form 1023 to become a 501 (c) (3) nonprofit. Web by following these best practices, you can create. How can a nonprofit use them + sample donation letter & receipt template. Web charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. The amount of gifts received. Web here is what should generally be included in a nonprofit donation receipt: Web below we have listed some of the best. Web by following these best practices, you can create a donation receipt template and donation receipt letter template that is clear, accurate, professional, and compliant with legal requirements, making it easier to acknowledge and thank donors for their contributions. Web here is what should generally be included in a nonprofit donation receipt: It allows you to create and customize the draft of your receipt contents. __________________ (find on the irs website) donor information. What does 501 (c) (3) mean? When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs form 1023 to become a 501 (c) (3) nonprofit. How can a nonprofit use. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. Statement that no goods or services were provided by the organization, if. This article will serve as a thorough guide to nonprofit donations and show you what kinds of expenses donations can—and cannot—be used to cover. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. A donation can be in the form of cash or property. How can a nonprofit use them + sample donation letter & receipt template. Web nonprofit donation receipt template is required by an organization that accepts donation. Web get a free nonprofit donation receipt template for every giving scenario.![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)

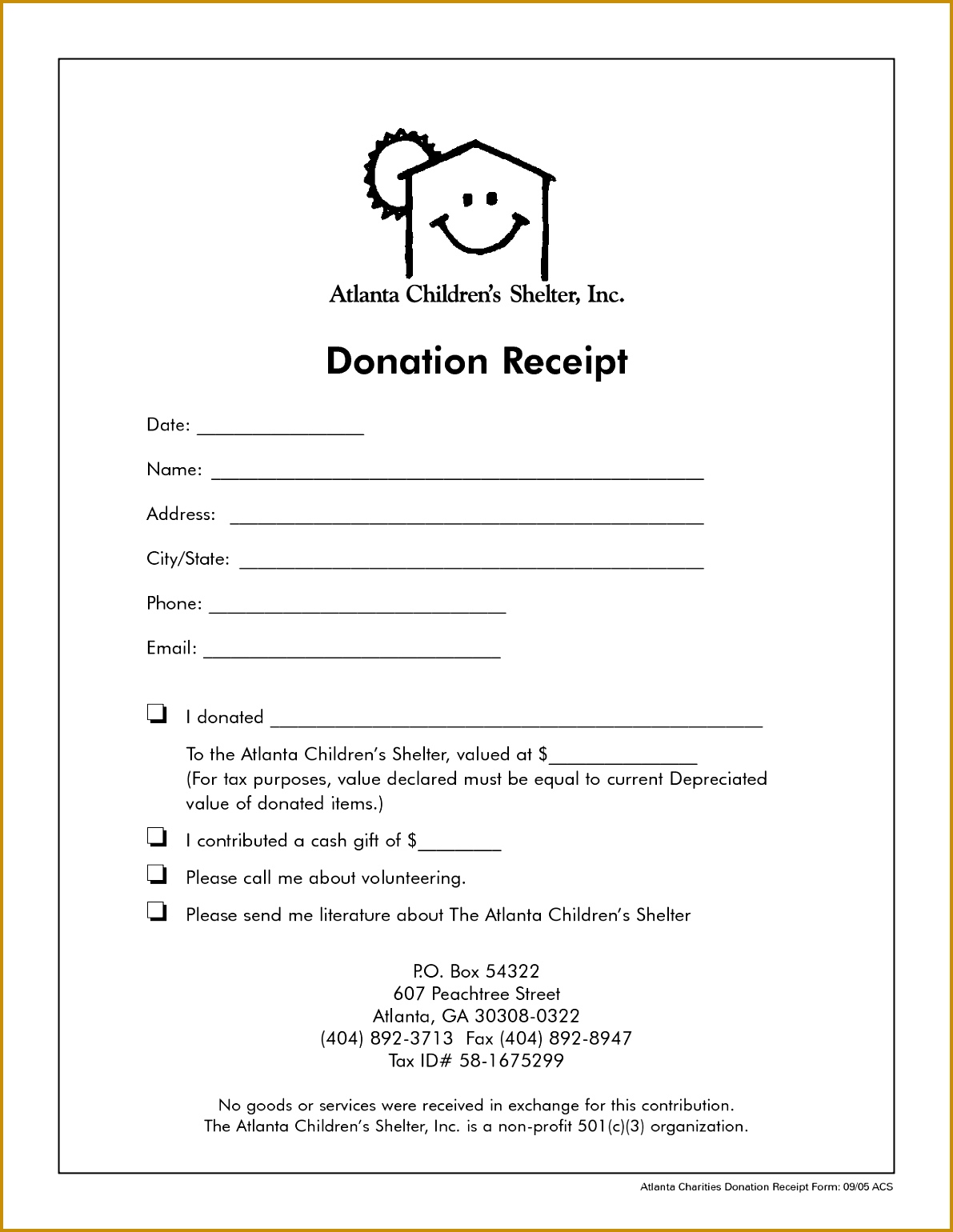

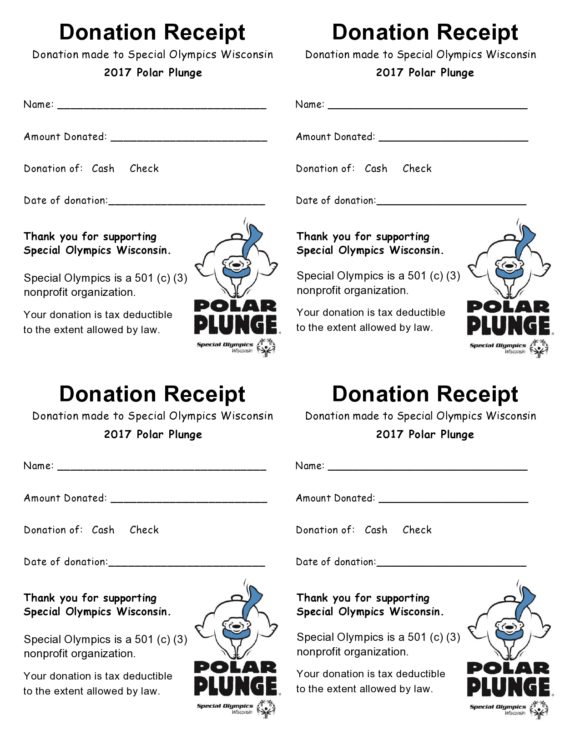

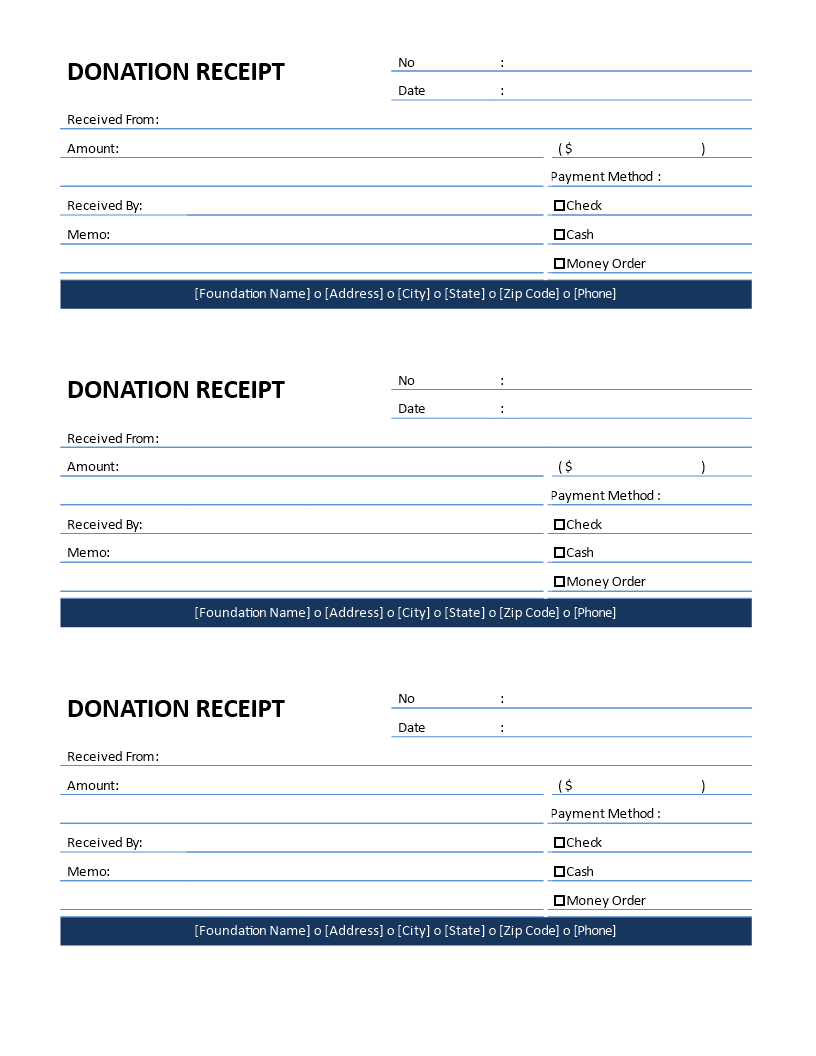

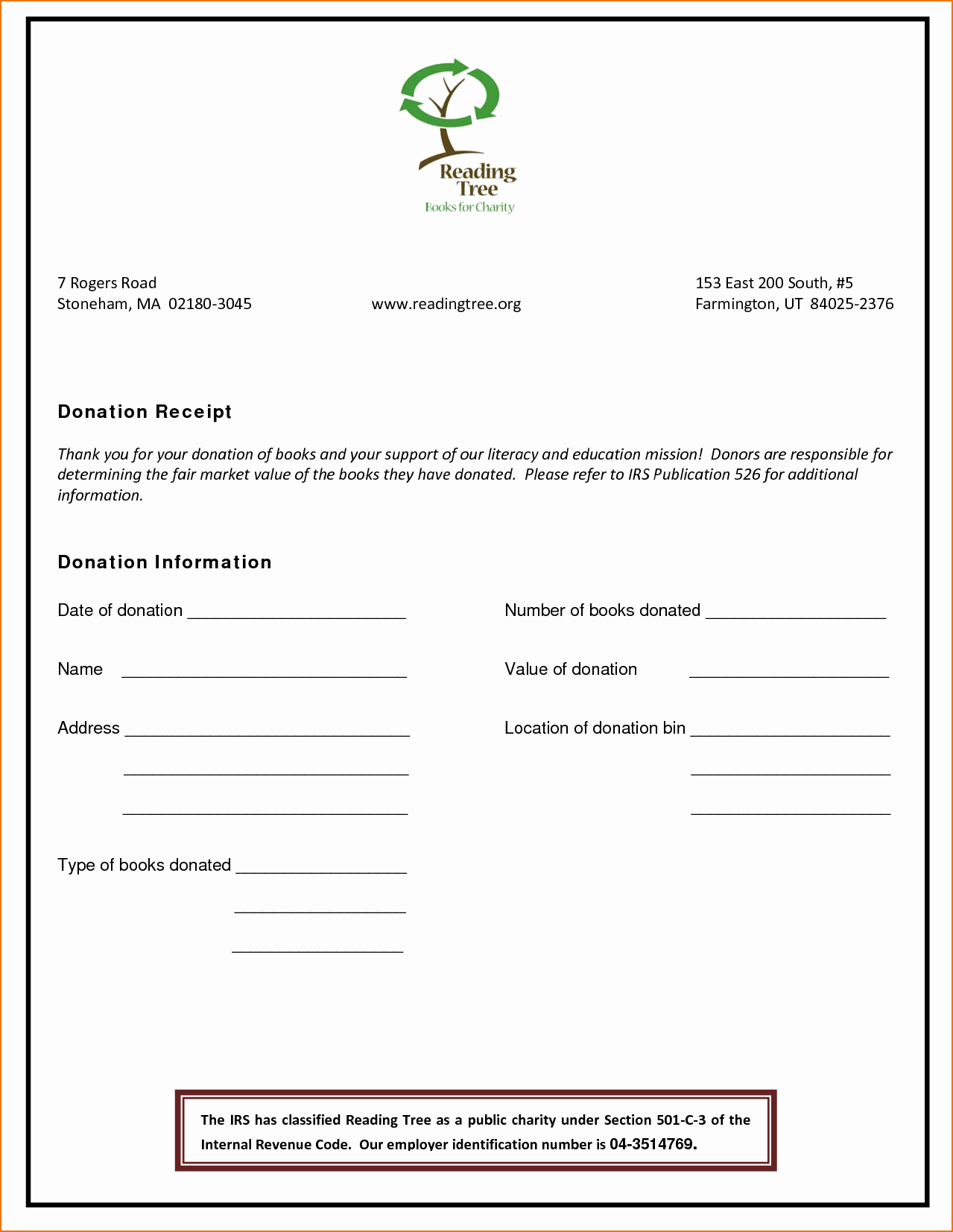

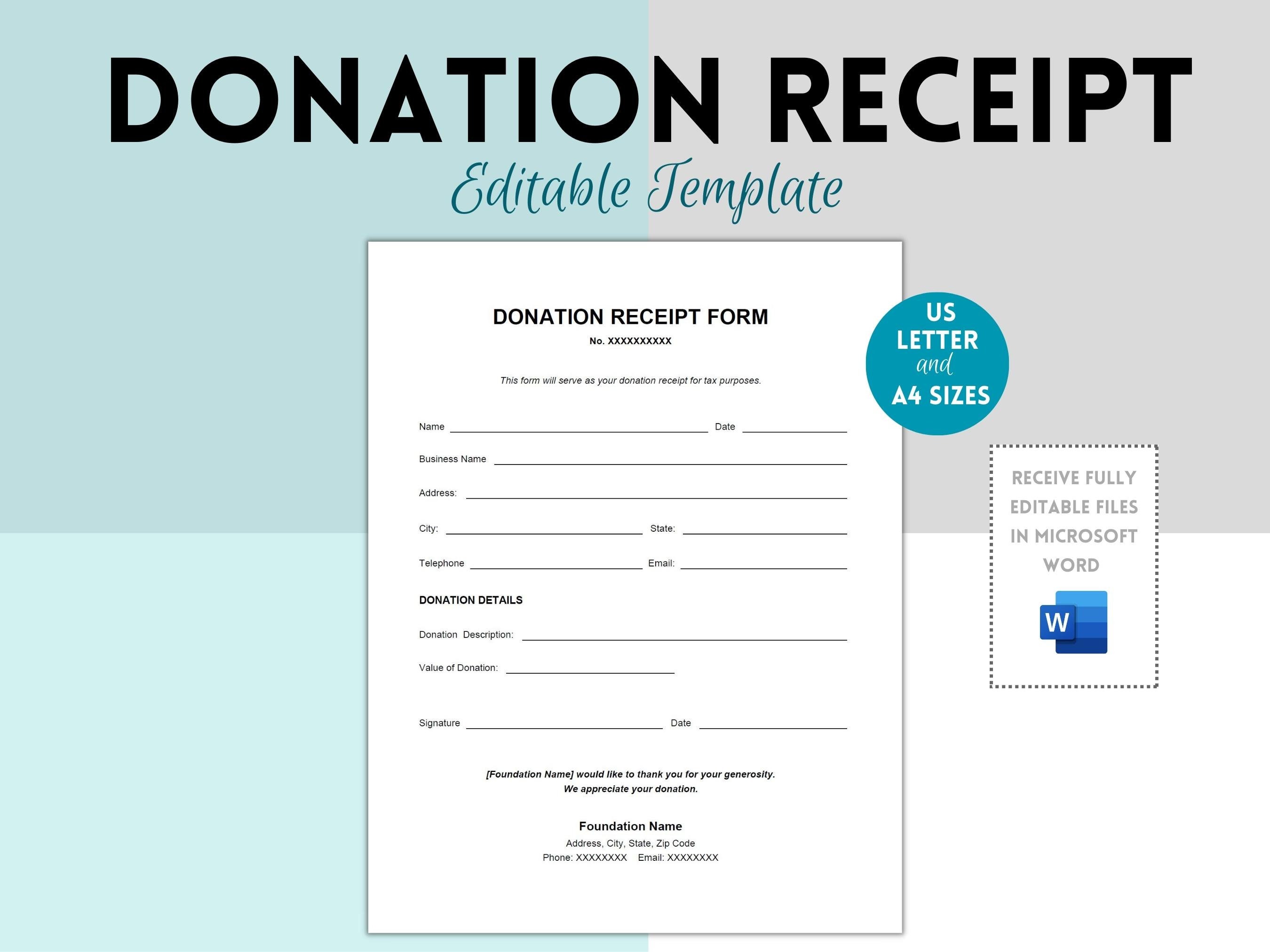

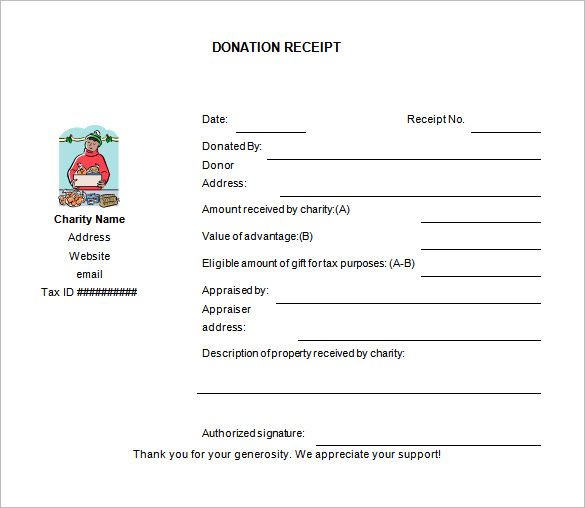

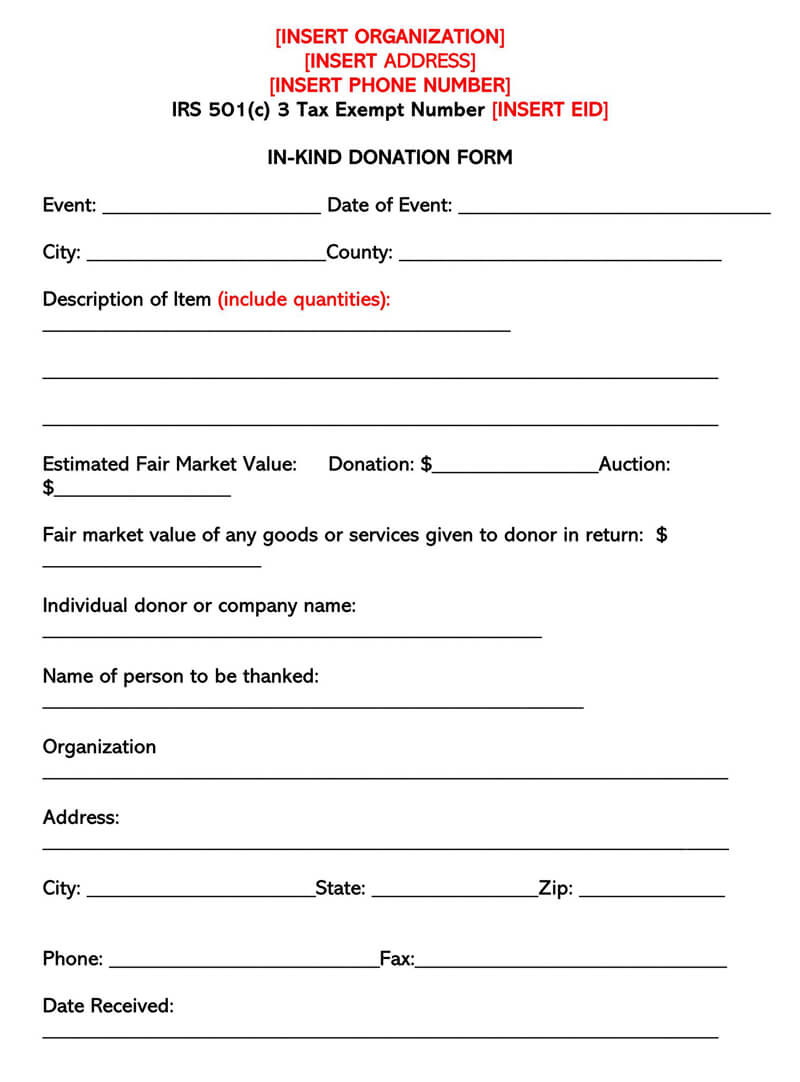

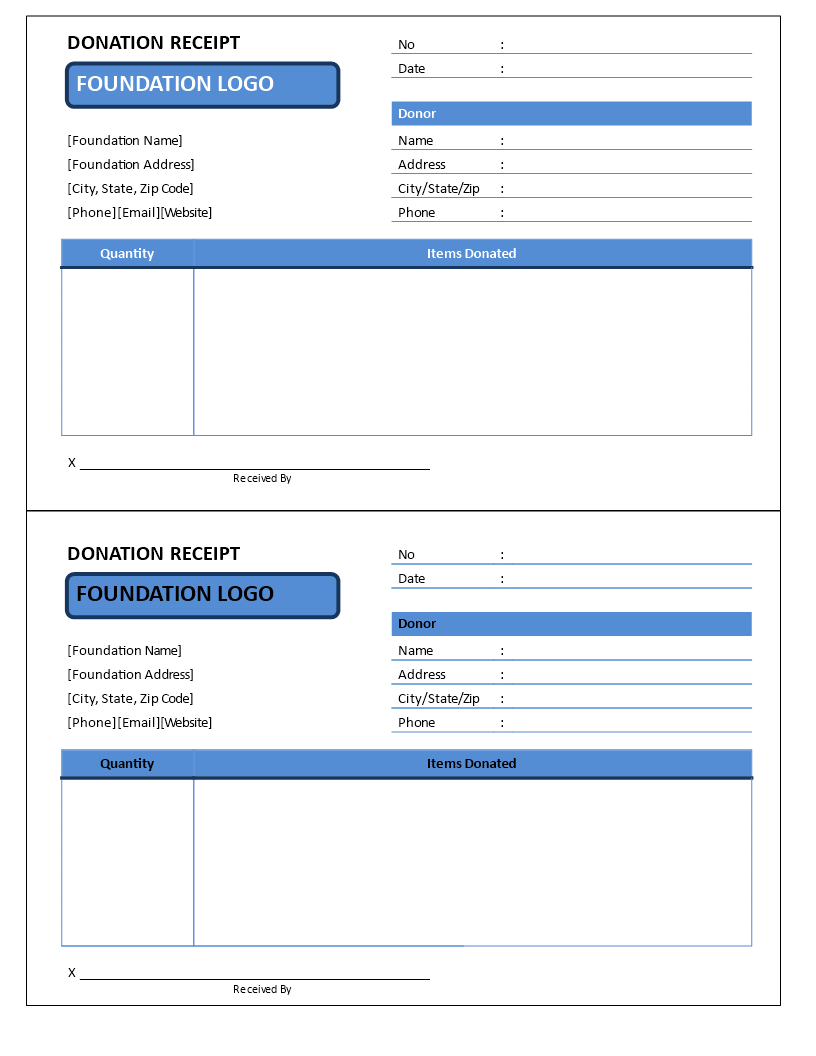

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Trending Nonprofit Contribution Receipt Template Simple Receipt Templates

30 Non Profit Donation Receipt Templates (PDF, Word) PrintableTemplates

Nonprofit Donation Receipt for Cash Donation Templates at

Non Profit Donation Receipt Template Excel Templates

50 Non Profit Donation Receipt Form

Nonprofit Donation Receipt, Donation Receipt Forms, Donation Receipt

Nonprofit Receipt 6+ Examples, Format, Pdf

Free Nonprofit (Donation) Receipt Templates (Forms)

Non profit donation receipt template Templates at

Lovetoknow Editable Donation Receipt Template.

Both Parties Are Required To Use Donation Receipts To Prove That They’ve Either Donated Cash Or.

Made To Meet Us & Canada Requirements.

What Should Diy Donation Receipts Include?

Related Post: