Nonprofit Bookkeeping Template

Nonprofit Bookkeeping Template - Web nonprofit bookkeeping is the process of systematically recording, organizing, and tracking a nonprofit’s financial activities. Web this free nonprofit chart of accounts template can be used to create a chart of accounts for a start up non profit organization. Web when choosing a bookkeeper, updating financial information, and developing reports, you’ll want to keep in mind your organization’s mission and goals. Web nonprofit accounting is the practice of tracking and accounting for funds received or disbursed by a nonprofit organization. Web l uderstanding and setting up your nonprofit bookkeeping and accounting l addressing financial controls and risk management l activities in the yearly accounting cycle Web if your church or nonprofit organization needs to track assets and liabilities, double entry software such as aplos or qbo would the best for your accounting needs. Web documenting cash and preparing cash receipts. Beginner’s guide to nonprofit accounting, budget template, chart of accounts template, month close calendar, and more! From internal, grant, and board reporting, to forecasting, budgeting, and cash flow management, to creating financial statements and customized dashboards. Web running a nonprofit requires that you annually prepare and submit paperwork to your employees, the board of directors, the social security administration, and the irs. Most nonprofits elect some kind of treasurer or financial officer to manage all of the organization’s finances. And that treasurer needs certain tools to. Web the 100 companies that made the cut in our sixteenth annual best companies to work for rankings Navigating the landscape of standardized accounting principles: There are six key processes to concentrate on: With a solid bookkeeping system, your nonprofit can ensure financial transparency, comply with federal and state regulations, and have a detailed record of your finances to help in the accounting process. Beginner’s guide to nonprofit accounting, budget template, chart of accounts template, month close calendar, and more! And that treasurer needs certain tools to. How will transactions be recorded. Web. From internal, grant, and board reporting, to forecasting, budgeting, and cash flow management, to creating financial statements and customized dashboards. Navigating the landscape of standardized accounting principles: Web free downloadable template files such as: How can nonprofits simplify their bookkeeping? It allows your organization to monitor its spending, fundraising, assets, receivables, payables, and other transactions essential to. Borrowing funds and establishing lines of credit. It allows your organization to monitor its spending, fundraising, assets, receivables, payables, and other transactions essential to. Web yptc assists with each of our nonprofit clients’ unique accounting and bookkeeping needs: Web l uderstanding and setting up your nonprofit bookkeeping and accounting l addressing financial controls and risk management l activities in the. Web complete small business solutions offers the following services to not for profits: However, if you are a start up or small church or nonprofit, my free accounting software downloads may be just what you are looking for. Now, let’s put each of those 5 required categories together to get a full look at a nonprofit chart of accounts. Web. If you’re ready to create a chart of accounts for your nonprofit, you can start with this template, made for you to customize by the charity cfo. Web if your church or nonprofit organization needs to track assets and liabilities, double entry software such as aplos or qbo would the best for your accounting needs. With a solid bookkeeping system,. However, if you are a start up or small church or nonprofit, my free accounting software downloads may be just what you are looking for. Web documenting cash and preparing cash receipts. How can nonprofits simplify their bookkeeping? From internal, grant, and board reporting, to forecasting, budgeting, and cash flow management, to creating financial statements and customized dashboards. Web yptc. It includes recording nonprofit growth in revenues and expenditures, tracking expenses, preparing financial statements and analysis reports, budgeting, and ensuring compliance with relevant laws and regulations. In this article, we’ll discuss key bookkeeping responsibilities and steps to efficient bookkeeping and provide 3 software options that can help. Web running a nonprofit requires that you annually prepare and submit paperwork to. Nonprofit accounting and bookkeeping revolve around representing an organization’s financial records in compliance with generally accepted accounting principles (gaap). Web honing successful nonprofit bookkeeping requires a thorough understanding of unique accounting procedures specific to the sector. Web download the nonprofit chart of accounts template! Web the 100 companies that made the cut in our sixteenth annual best companies to work. From internal, grant, and board reporting, to forecasting, budgeting, and cash flow management, to creating financial statements and customized dashboards. Web nonprofit bookkeeping is the process of systematically recording, organizing, and tracking a nonprofit’s financial activities. Web bookkeeping for nonprofits is recording and analyzing financial transactions to ensure compliance with state and federal accounting rules. Web nonprofit accounting is the. Web running a nonprofit requires that you annually prepare and submit paperwork to your employees, the board of directors, the social security administration, and the irs. Web ensure financial clarity and integrity in your nonprofit with our comprehensive income recognition policy template. Navigating the landscape of standardized accounting principles: Learn how to create and analyze financial statements. Web honing successful nonprofit bookkeeping requires a thorough understanding of unique accounting procedures specific to the sector. Borrowing funds and establishing lines of credit. Authorizing people to open accounts, sign checks, etc. Storing deposit and withdrawal slips. How will transactions be recorded. However, if you are a start up or small church or nonprofit, my free accounting software downloads may be just what you are looking for. Web nonprofit accounting is the practice of tracking and accounting for funds received or disbursed by a nonprofit organization. It includes recording nonprofit growth in revenues and expenditures, tracking expenses, preparing financial statements and analysis reports, budgeting, and ensuring compliance with relevant laws and regulations. Web bookkeeping for a nonprofit is the process of entering, recording, and classifying an organization’s finances. Web if your church or nonprofit organization needs to track assets and liabilities, double entry software such as aplos or qbo would the best for your accounting needs. Web when choosing a bookkeeper, updating financial information, and developing reports, you’ll want to keep in mind your organization’s mission and goals. How can nonprofits simplify their bookkeeping?

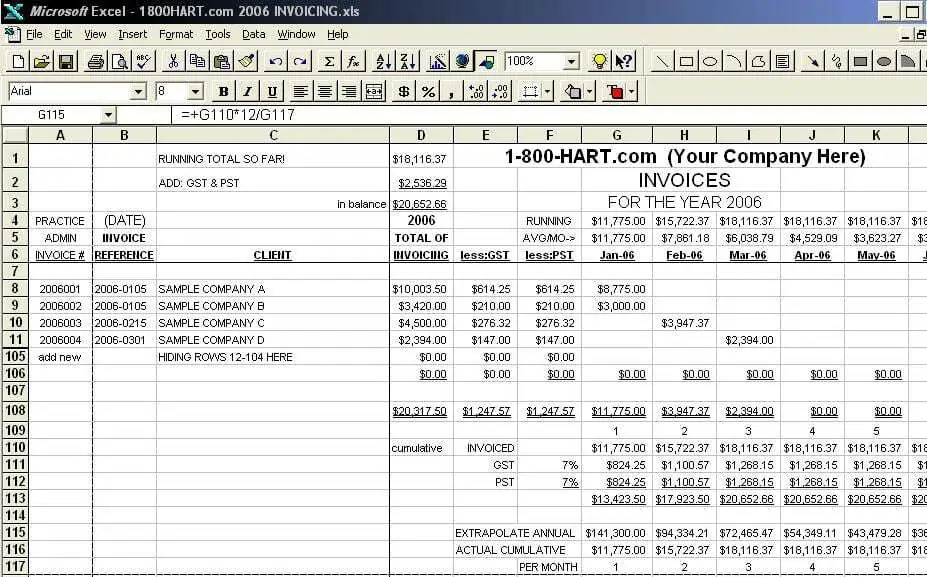

Excel Farm Accounting Templates

Nonprofit Bookkeeping and Accounting Services Terms

![Bookkeeping Proposal Template [Free Sample] Proposable](https://proposable.com/wp-content/uploads/2020/05/Bookkeeping-Thumb.jpg)

Bookkeeping Proposal Template [Free Sample] Proposable

Spreadsheet Clothing Google Spreadshee spreadsheet for clothing store

8 Best Practices for Nonprofit Bookkeeping in Boston & New England

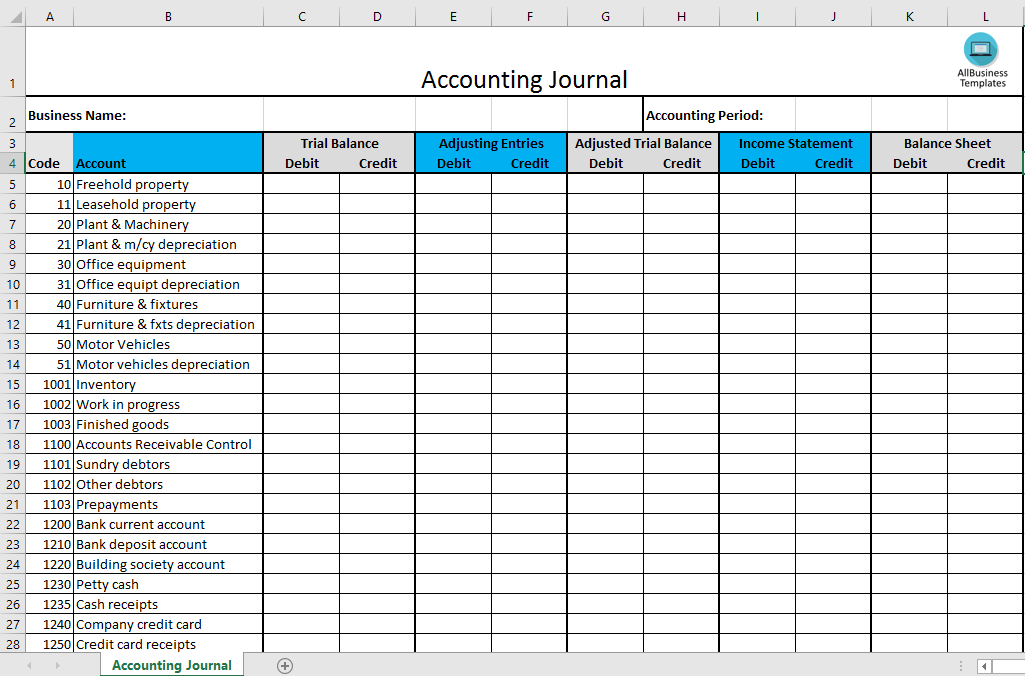

8+ Excel Bookkeeping Templates Excel Templates

free basic bookkeeping spreadsheet template1 —

Small Business Bookkeeping Template —

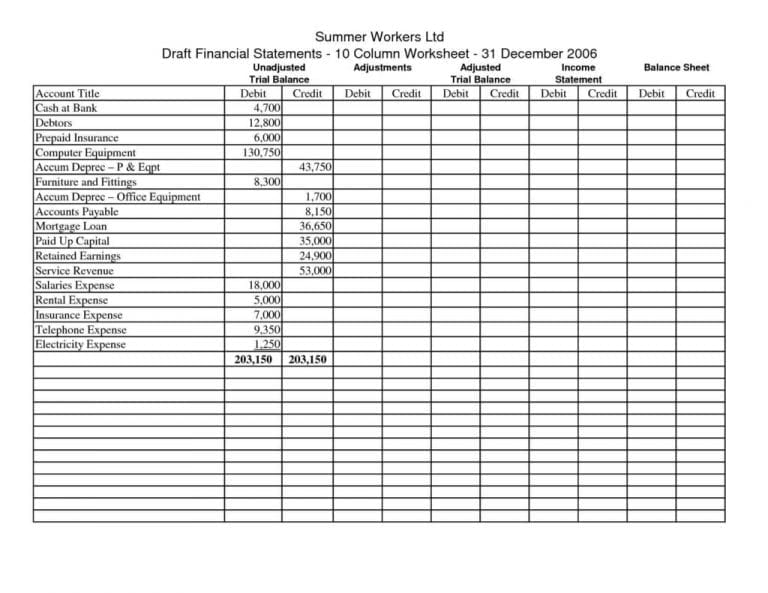

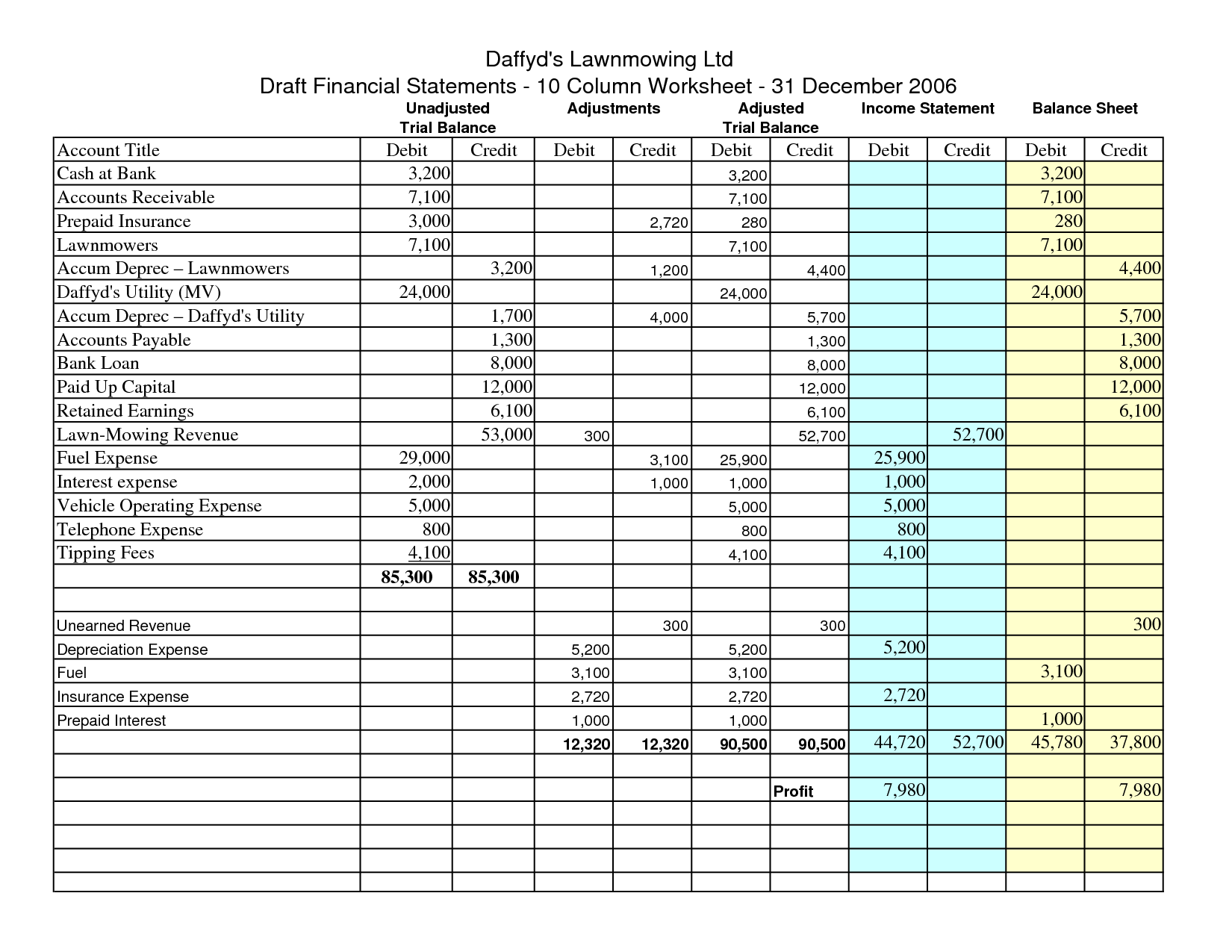

Bookkeeping for Nonprofits A Basic Guide & Best Practices

Excel Templates For Nonprofit Organizations

And That Treasurer Needs Certain Tools To.

Web Documenting Cash And Preparing Cash Receipts.

Web L Uderstanding And Setting Up Your Nonprofit Bookkeeping And Accounting L Addressing Financial Controls And Risk Management L Activities In The Yearly Accounting Cycle

Now, Let’s Put Each Of Those 5 Required Categories Together To Get A Full Look At A Nonprofit Chart Of Accounts.

Related Post: