Non Profit Organization Receipt Template

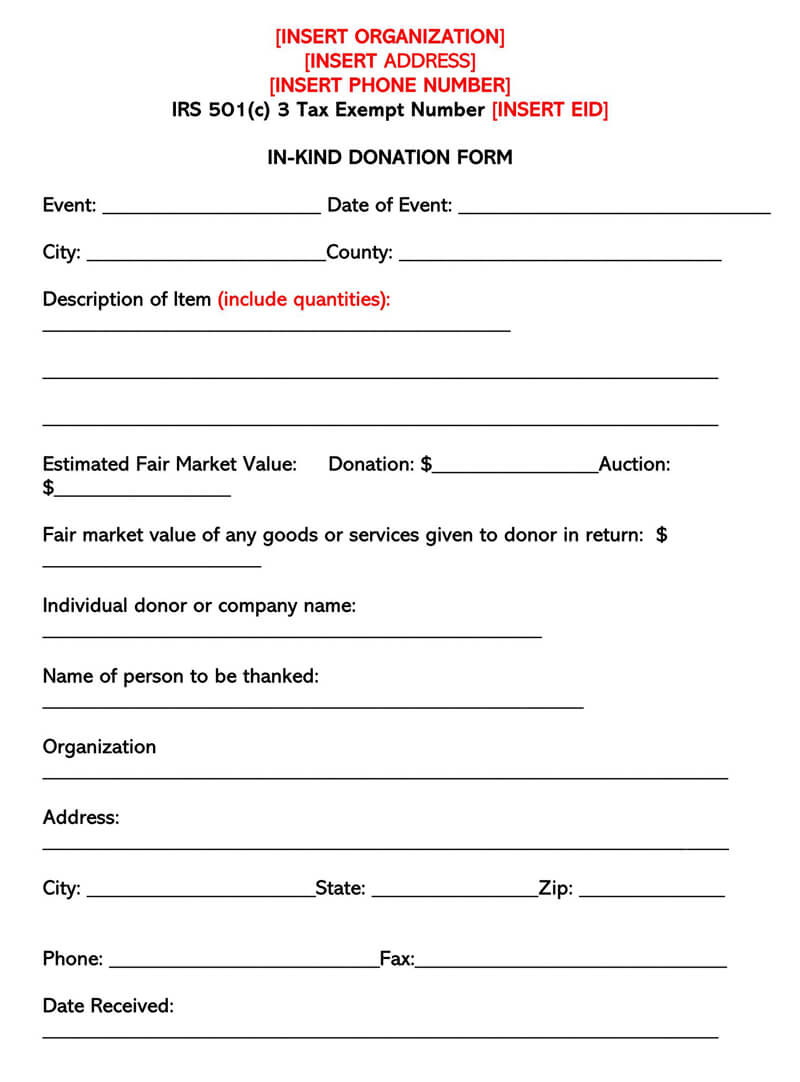

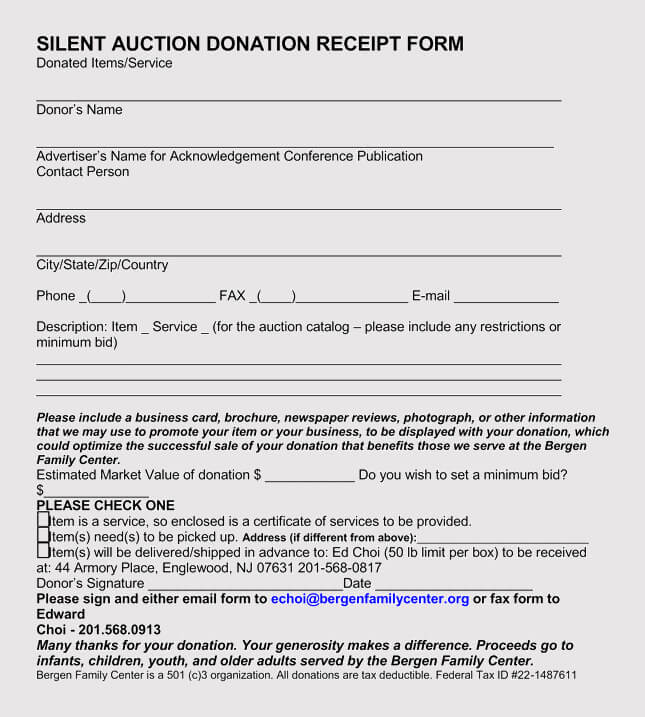

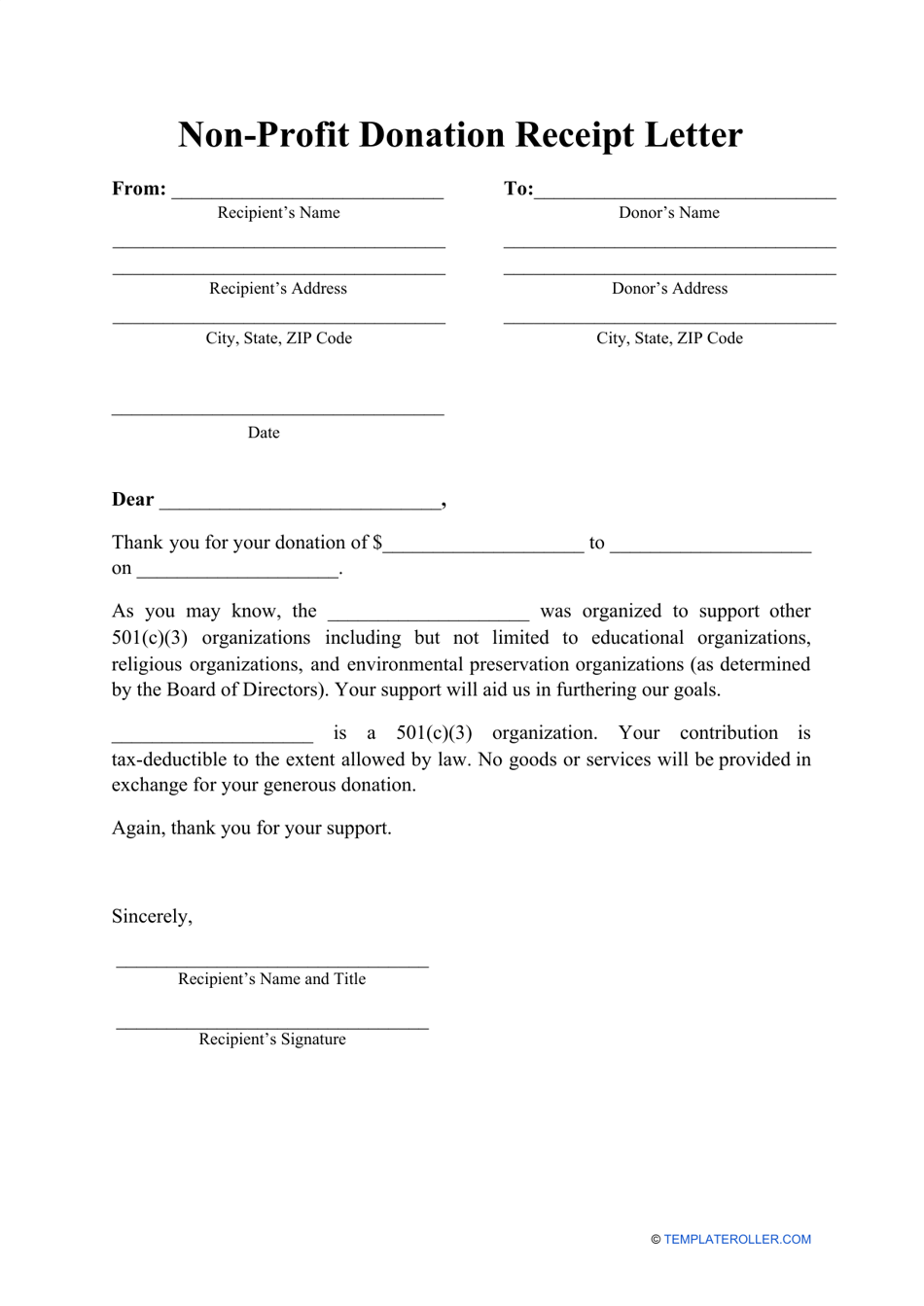

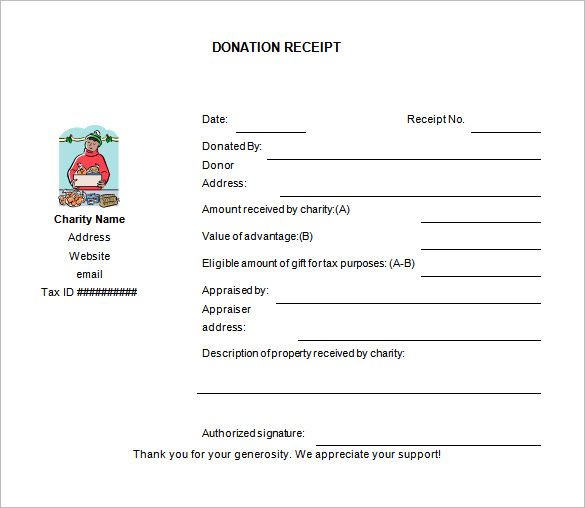

Non Profit Organization Receipt Template - Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: It contains the details of the donor’s contributions. What to include in a donation receipt. This article will serve as a thorough guide to nonprofit donations and show you what kinds of expenses donations can—and cannot—be used to cover. Jonathan mayfield • november 19, 2020. Web organizations that accept donations must have receipts. One of the most important parts of running a nonprofit is making sure you’re staying compliant with government regulations. Charities use them to track where donations come from and how they are spent, and donors can feel confident that their contribution is going towards a worthwhile cause. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Both parties are required to use donation receipts to prove that they’ve either donated cash or. This article will serve as a thorough guide to nonprofit donations and show you what kinds of expenses donations can—and cannot—be used to cover. One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). We will populate it automatically with all the necessary donation details and organization info. Web donation receipt email &. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. We will populate it automatically with all the. Here’s what’s included in this article: Web donation receipt email & letter templates for your nonprofit. Both parties are required to use donation receipts to prove that they’ve either donated cash or. Charities use them to track where donations come from and how they are spent, and donors can feel confident that their contribution is going towards a worthwhile cause.. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web a charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. What to include in a donation receipt. Web the written acknowledgment required to substantiate a. What to include in a donation receipt. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. Both parties are required to use donation receipts to prove that they’ve either donated cash or. Web a charitable donation. Both parties are required to use donation receipts to prove that they’ve either donated cash or. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. You may need donations to run your nonprofit, but how can you use them? This article will serve as a thorough guide to. How can a nonprofit use them + sample donation letter & receipt template. Jonathan mayfield • november 19, 2020. Charities use them to track where donations come from and how they are spent, and donors can feel confident that their contribution is going towards a worthwhile cause. Instead of creating from scratch, you can get and use these donation receipt. This document often plays a pivotal role during tax filings, allowing donors. No matter what type of charity you are responsible for managing, your donation receipt needs to include some basic information. Web in this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt. Instead of creating from scratch, you can get and use these donation receipt templates for free. Why do you need a donation receipt? Charities use them to track where donations come from and how they are spent, and donors can feel confident that their contribution is going towards a worthwhile cause. How can a nonprofit use them + sample donation. The last thing you want is to spend your time dealing with legal trouble. Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Web nonprofit donation receipt template is required by an organization that accepts donation. Web in this. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Why do you need a donation receipt? Made to meet us & canada requirements. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. Web in this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! The last thing you want is to spend your time dealing with legal trouble. Jonathan mayfield • november 19, 2020. Charities use them to track where donations come from and how they are spent, and donors can feel confident that their contribution is going towards a worthwhile cause. It allows you to create and customize the draft of your receipt contents. What is a donation receipt? These are given when a donor donates to a nonprofit organization. It contains the details of the donor’s contributions. Web free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Both parties are required to use donation receipts to prove that they’ve either donated cash or. What to include in a donation receipt.

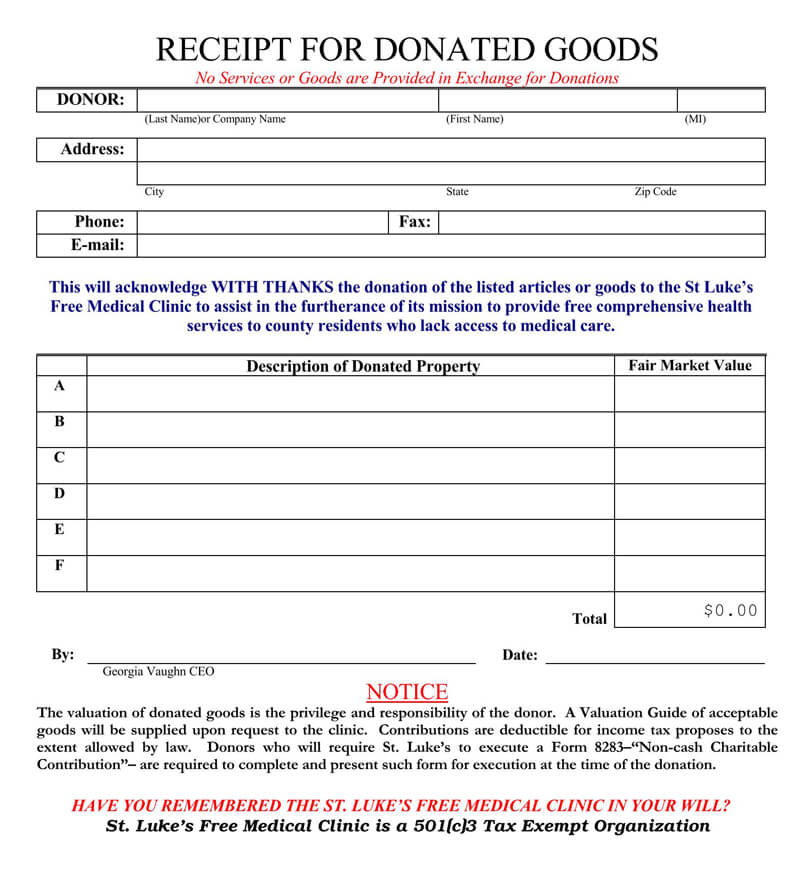

Free Nonprofit (Donation) Receipt Templates (Forms)

46 Free Donation Receipt Templates (501c3, NonProfit)

Non Profit Donation form Template New Non Profit Donation Receipt in

Non Profit Organization Donation Donation Receipt Template Google Docs

45+ Free Donation Receipt Templates (NonProfit) Word, PDF Receipt

Nonprofit Donation Receipt Letter Template Download Printable PDF

Non Profit Tax Receipt Template Excel Templates

Nonprofit Receipt 6+ Examples, Format, Pdf

Free Printable Donation Receipt Template Printable Templates

Free Nonprofit (Donation) Receipt Templates (Forms)

Web Get A Free Nonprofit Donation Receipt Template For Every Giving Scenario.

This Article Will Serve As A Thorough Guide To Nonprofit Donations And Show You What Kinds Of Expenses Donations Can—And Cannot—Be Used To Cover.

This Document Often Plays A Pivotal Role During Tax Filings, Allowing Donors.

Web Organizations That Accept Donations Must Have Receipts.

Related Post: