Morningstar Pattern

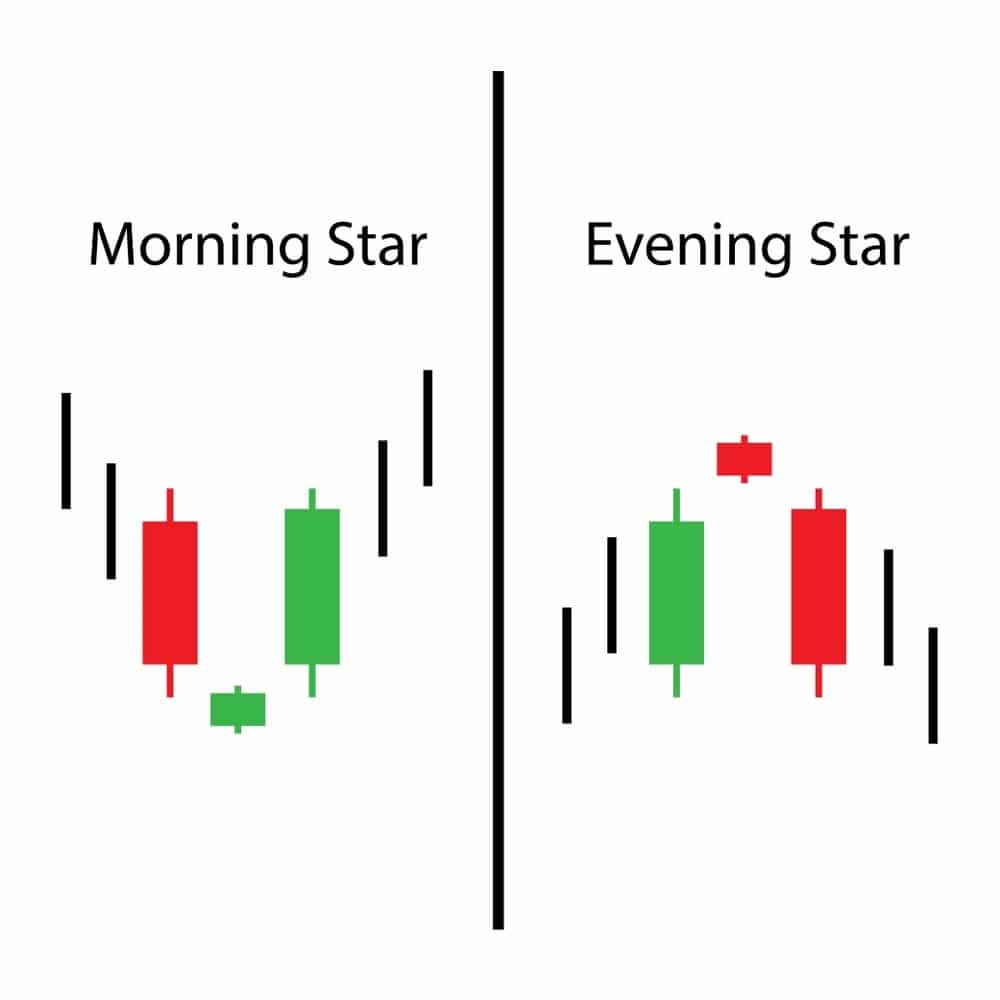

Morningstar Pattern - Web the morning star is a bullish reversal pattern that consists of three candlesticks — a tall bearish candle followed by a small candle that gaps below the first candle, and then a third candle that is bullish and closes above the. A big red candle, a small doji, and a big green candle. It occurs at the base of a downtrend and signals a new uptrend may form. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. Learn what it means and how to maximise trading opportunities using this popular chart pattern. Even if the fed does cut interest rates, payouts on the long end of the yield curve may not decline and could even increase. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Web what is a morning star candlestick? Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web morningstar is an investment research company offering mutual fund, etf, and stock analysis, ratings, and data, and portfolio tools. Web a morning star pattern is a bullish reversal pattern. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Web a 5% allocation to bitcoin or a bitcoin/ether blend contributes over 20% of the portfolio’s total risk and produces a volatility of roughly 10% and. How reliable is the morning star in forex trading? Web the morning star bullish candlestick pattern is a valuable asset for traders seeking to identify potential trend reversals and capitalize on bullish opportunities. Web what is a morning star candlestick? A completed morning star formation indicates a new bullish sentiment in the market. Web a 5% allocation to bitcoin or. Web morningstar is an investment research company offering mutual fund, etf, and stock analysis, ratings, and data, and portfolio tools. Web morning star candlestick is a triple candlestick pattern that indicated bullish reversal. Web what is a morning star candlestick? I'll share examples of recent morning star candlestick formations on real charts, so you can see exactly how to identify. The second candle is short and gaps down from the first one; Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. Web what is the morning star candlestick pattern? It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. It. It consists of three candlesticks: A morning star forms following a downward trend and it. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. The morning star candlestick pattern is recognized if: Even if the fed does cut interest rates, payouts on the long end of the yield curve may not decline and could even increase. It occurs at the base of a downtrend and signals a new uptrend may form. Web what is a morning star candlestick? A morning star forms following a downward trend and it. Web morning star is. Web morning star is a bullish trend reversal candlestick pattern consisting of three candles. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Web morning star candlestick_pattern📈candle analysis | trading strategy #shorts #sharemarket #bankniftyyour queries.trading strategy videointradatrading stra.. Web morning star candlestick_pattern📈candle analysis | trading strategy #shorts #sharemarket #bankniftyyour queries.trading strategy videointradatrading stra. Interest rates on the short end of the yield curve typically move. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. The first candlestick. How to trade the morning star pattern; If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Web a morning star pattern is a. Web a morning star pattern is a bullish reversal pattern. Web the morning star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. Interest rates on the short end of the yield curve. Even if the fed does cut interest rates, payouts on the long end of the yield curve may not decline and could even increase. Interest rates on the short end of the yield curve typically move. How to identify a morning star on forex charts; The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Web the morning star is a candlestick pattern that is comprised of three candles. The morning star candlestick pattern is recognized if: Web what is the morning star candlestick pattern? Web morning star candlestick is a triple candlestick pattern that indicated bullish reversal. Web the morning star bullish candlestick pattern is a valuable asset for traders seeking to identify potential trend reversals and capitalize on bullish opportunities. Web morning star candlestick_pattern📈candle analysis | trading strategy #shorts #sharemarket #bankniftyyour queries.trading strategy videointradatrading stra. How reliable is the morning star in forex trading? It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. I'll share examples of recent morning star candlestick formations on real charts, so you can see exactly how to identify them. How to trade the morning star pattern;

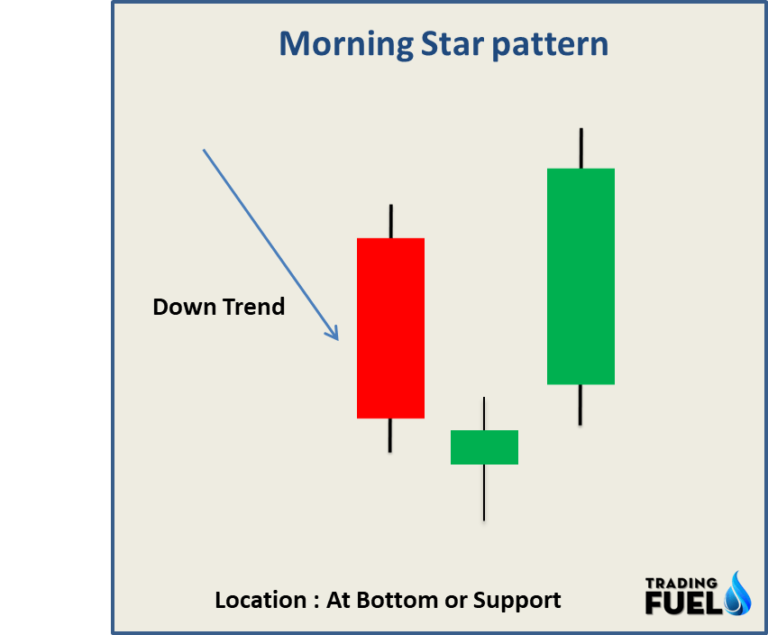

What Is a Morning Star Candlestick Pattern? Trading Fuel

Morning Star Candlestick Pattern

Morning Star Candlestick Pattern definition and guide

Best candlestick patterns morning star candlestick pattern

![]()

Morning Star Candlestick Pattern Trading Strategy Design Talk

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

What Is Morning Star Pattern Design Talk

:max_bytes(150000):strip_icc()/dotdash_Final_Morning_Star_Definition_Jun_2020-01-a6d5241bc649403aa86f394d5a2430a7.jpg)

Morning Star Pattern A Guide to Trading This Bullish Reversal Pattern

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

Morning Star Candlestick Pattern definition and guide

Web The Morning Star Candlestick Pattern Is Easily Recognizable On A Chart Since It Consists Of Three Different Candlesticks.

It Consists Of Three Candlesticks:

Web A 5% Allocation To Bitcoin Or A Bitcoin/Ether Blend Contributes Over 20% Of The Portfolio’s Total Risk And Produces A Volatility Of Roughly 10% And 13%, Respectively, Over The 60/40 Portfolio.

This Pattern Reverses The Downtrend To The Uptrend.

Related Post: