Market Structure Chart

Market Structure Chart - In this post, we'll delve deep into market structure, presenting insightful examples to enhance your understanding of this concept. Learn to analyze price action, identify trends, and make informed decisions. Market structure helps analyze price movement and identify trading opportunities. Perfect competition, imperfect competition, oligopoly, and monopoly. Web “market structure” is the physics of the stock market, the mechanics. No barriers little to no barriers large barriers very large barriers or impossible. 28 november 2019 by tejvan pettinger. There are high barriers to entry, and firms have significant market power, which enables them to influence prices. Web 1 'magnificent 7' stock with a $46b gem in its portfolio. Barriers to entry and exit. The more competitors in a market, the more likely it is that prices can stay fair and competitive for customers, and in some oligopoly and monopoly markets, government regulations can keep companies from. We disagree, and the history of wall. Learn to analyze price action, identify trends, and make informed decisions. For the audio version of this file click on. It describes the competitive environment in which firms operate and can impact economic outcomes such as pricing, production, and efficiency. Perfect competition, oligopolistic markets, monopolistic markets, and monopolistic competition. None none low to high high, but subject to regulation. Web basic market structures are monopoly, oligopoly, monopolistic competition and perfect competition. Web market structure refers to the way that various. In the vast and dynamic world of financial markets, understanding market structure is paramount for traders and investors seeking to navigate the complexities of buying and selling assets. Web “market structure” is the physics of the stock market, the mechanics. Our web page provides a comprehensive overview of market structure concepts, including perfect competition, monopolistic competition, oligopoly, and monopoly. Perfect. There are high barriers to entry, and firms have significant market power, which enables them to influence prices. 28 november 2019 by tejvan pettinger. Explore practical strategies, trade setups, and the best assets for market structure analysis. Web in this revision video we look through some of the major diagrams that might help you to score high analysis marks in. 28 november 2019 by tejvan pettinger. Explore practical strategies, trade setups, and the best assets for market structure analysis. Web the elements of market structure include the number and size of sellers, entry and exit barriers, nature of product, price, selling costs. In an oligopoly market structure, a few large firms dominate the market and produce either homogenous or differentiated. Web market structure refers to how different industries are classified and differentiated based on their degree and nature of competition for services and goods. The four popular types of market structures include perfect competition, oligopoly market, monopoly market, and monopolistic competition. The oscillator presentation of the detected market structures helps traders. Barriers to entry and exit. The majority of the. Web analysing price swings and understanding whether price is impulsive or corrective helps traders understand the road map, path of least resistance, and overall market structure. Sentiment (demand) and short volume (supply). Market structure helps analyze price movement and identify trading opportunities. In an oligopoly market structure, a few large firms dominate the market and produce either homogenous or differentiated. Yes, firms have the freedom to enter and exit. Web gain a deeper understanding of market structures with our collection of essential diagrams for economics students. The four popular types of market structures include perfect competition, oligopoly market, monopoly market, and monopolistic competition. Market structure encompasses a range of elements that shape how markets function and how prices are determined.. Web there are four basic types of market structure in economics: The majority of the time, the market trends in a sideways motion. It describes the competitive environment in which firms operate and can impact economic outcomes such as pricing, production, and efficiency. For the audio version of this file click on this link: The four popular types of market. Yes, firms have the freedom to enter and exit. Web discover the significance of market structure in trading and gain a competitive edge. Market structure is a framework for comprehending the movements and behaviour of markets. 28 november 2019 by tejvan pettinger. Web analysing price swings and understanding whether price is impulsive or corrective helps traders understand the road map,. In the vast and dynamic world of financial markets, understanding market structure is paramount for traders and investors seeking to navigate the complexities of buying and selling assets. Web market structure refers to how different industries are classified and differentiated based on their degree and nature of competition for services and goods. Web market structure refers to the organizational and other characteristics of a market that influence the nature of competition and pricing. Buy rising demand, falling supply, sell the reverse (or if you short stocks, vice versa). No barriers little to no barriers large barriers very large barriers or impossible. In an oligopoly market structure, a few large firms dominate the market and produce either homogenous or differentiated products. None none low to high high, but subject to regulation. Explore practical strategies, trade setups, and the best assets for market structure analysis. Web market structure refers to the way that various industries are classified and differentiated in accordance with their degree and nature of competition for products and services. Perfect competition, oligopolistic markets, monopolistic markets, and monopolistic competition. 28 november 2019 by tejvan pettinger. There are high barriers to entry, and firms have significant market power, which enables them to influence prices. Web analysing price swings and understanding whether price is impulsive or corrective helps traders understand the road map, path of least resistance, and overall market structure. Web a market structure trading strategy involves analyzing and interpreting various elements that shape price movements, such as swing highs and lows, support and resistance levels, and trendlines. Sentiment (demand) and short volume (supply). For the audio version of this file click on this link:

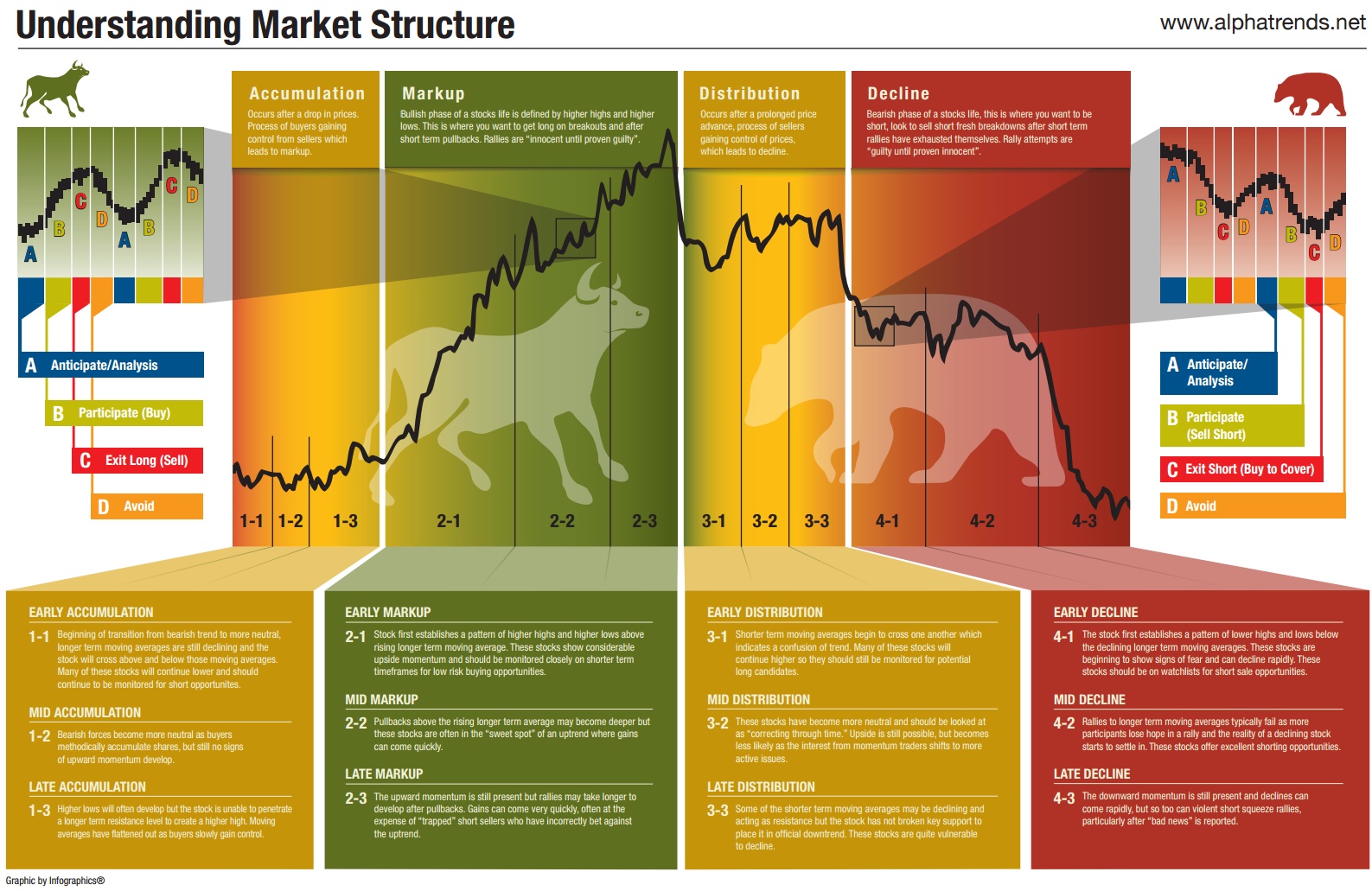

Understanding Market Structure

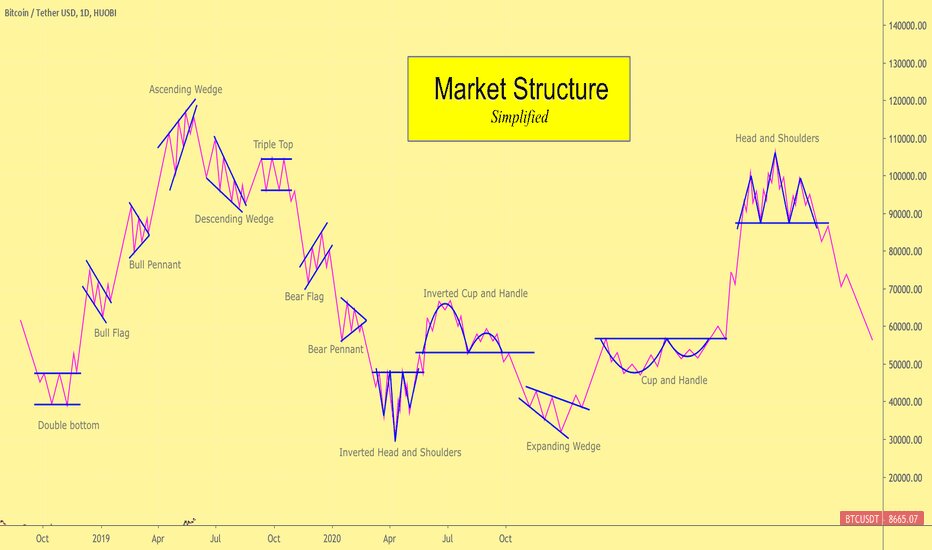

Basic Market Structure and Pattern Behavior for HUOBIBTCUSDT by

Market Structure and Chart Patterns by Elyte Traders Elyte. FX Medium

How To Use Basic Market Structure Forex Traders SMC FX Trading

Market Structure in Trading Dot Net Tutorials

What is Market Structure in Forex Trading ? Forex Trader Profit

Understanding Market Cycles

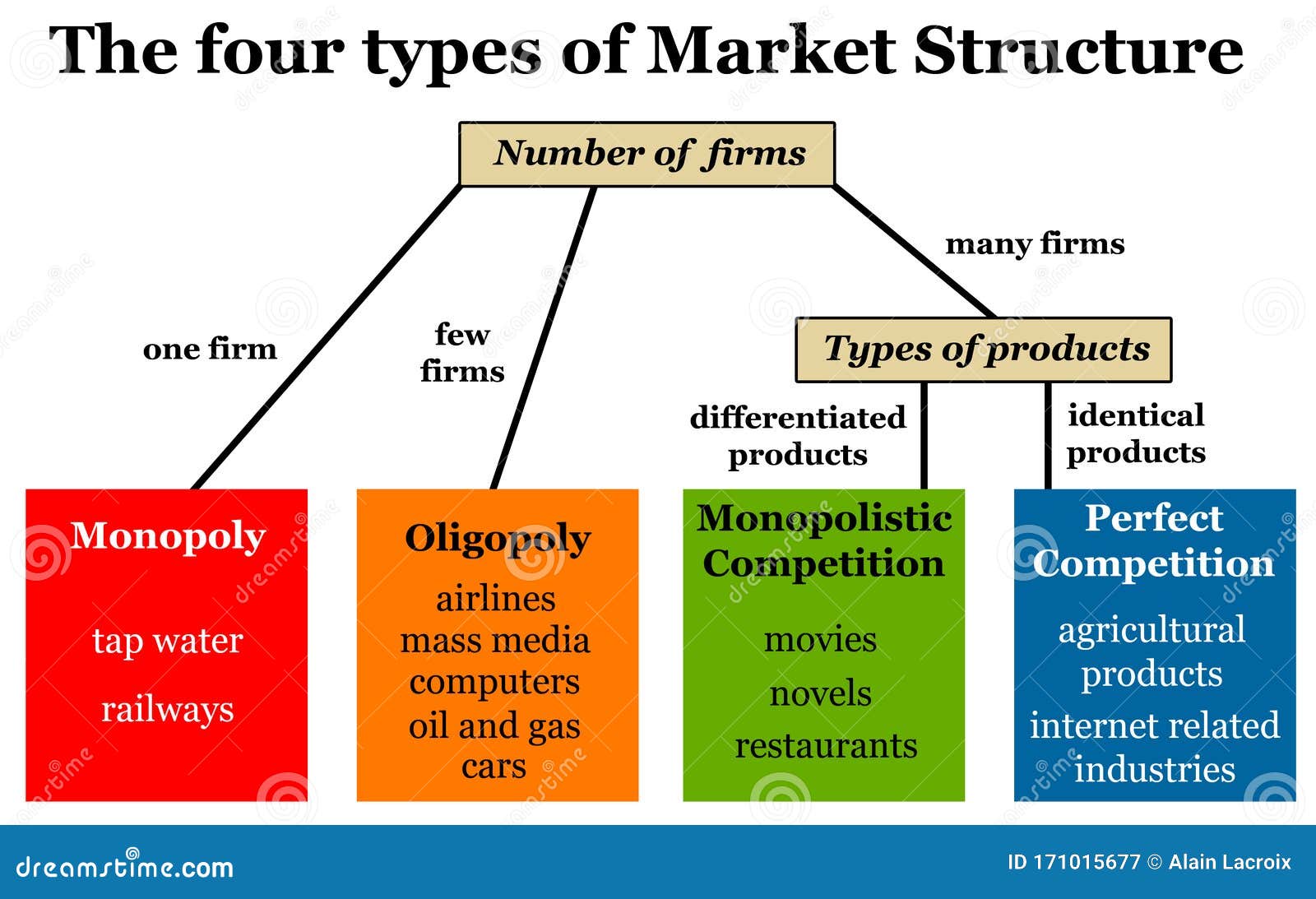

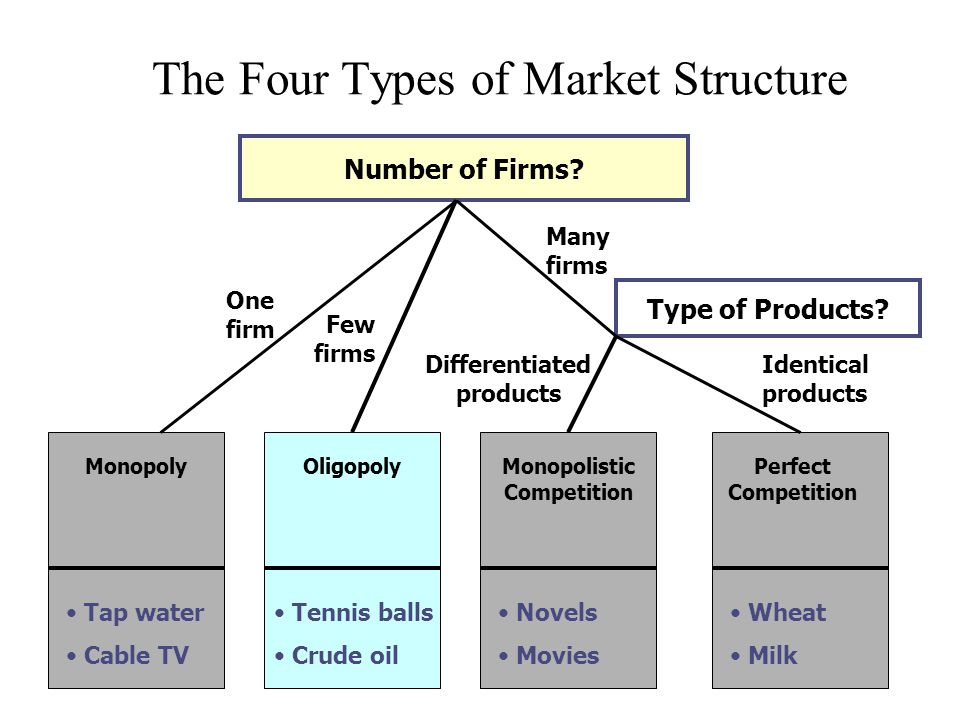

Market structure stock illustration. Illustration of four 171015677

Market Structure in Trading Dot Net Tutorials

The Four Major Types of Market Structure Symphysis

The Majority Of The Time, The Market Trends In A Sideways Motion.

Web There Are Four Basic Types Of Market Structure In Economics:

Web In This Revision Video We Look Through Some Of The Major Diagrams That Might Help You To Score High Analysis Marks In Questions On Market Structures Such As Perfect Competition, Monopolistic Competition, Oligopoly, Monopoly And Contestable Markets

Web The Ultimate Guide To Market Structure With 30+ Charts!

Related Post: