Macrs Depreciation Chart

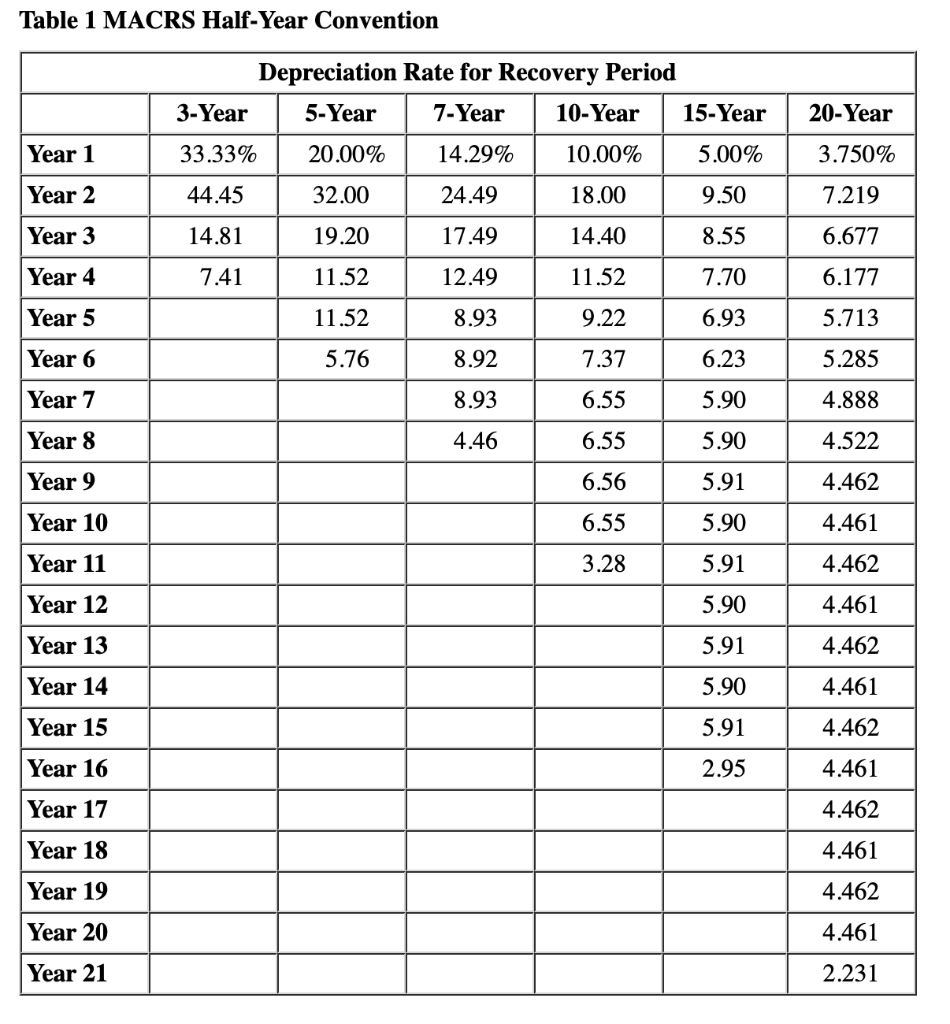

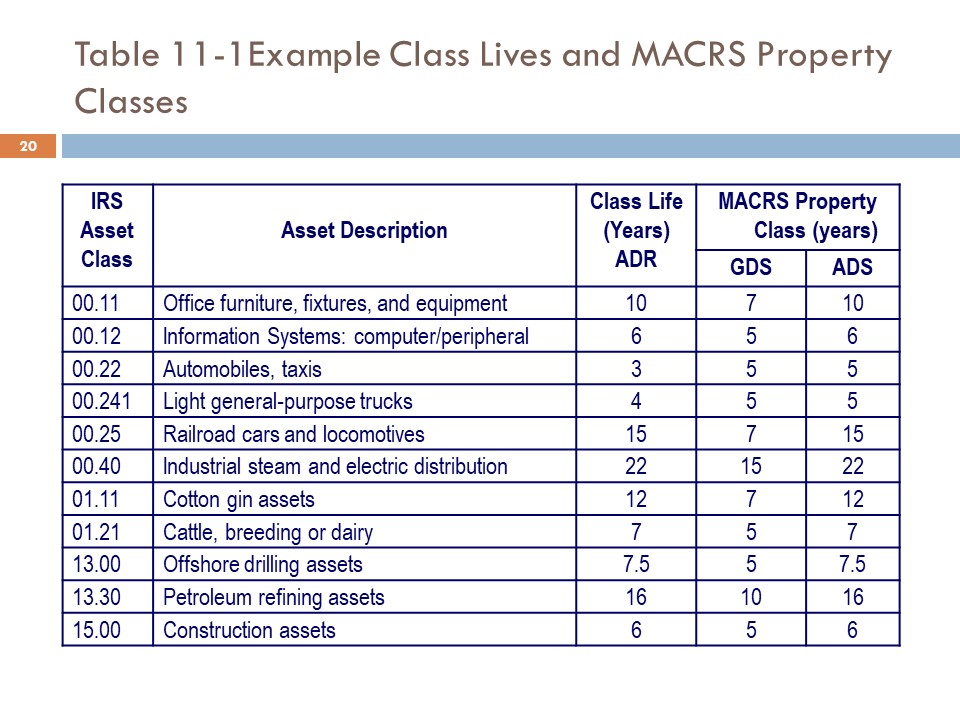

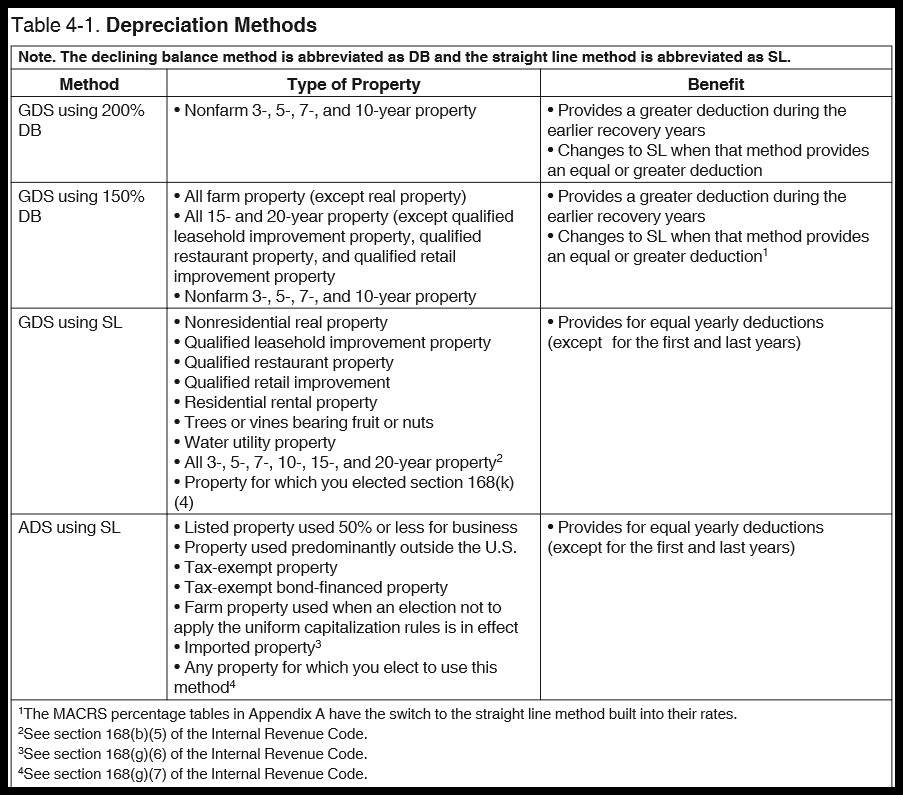

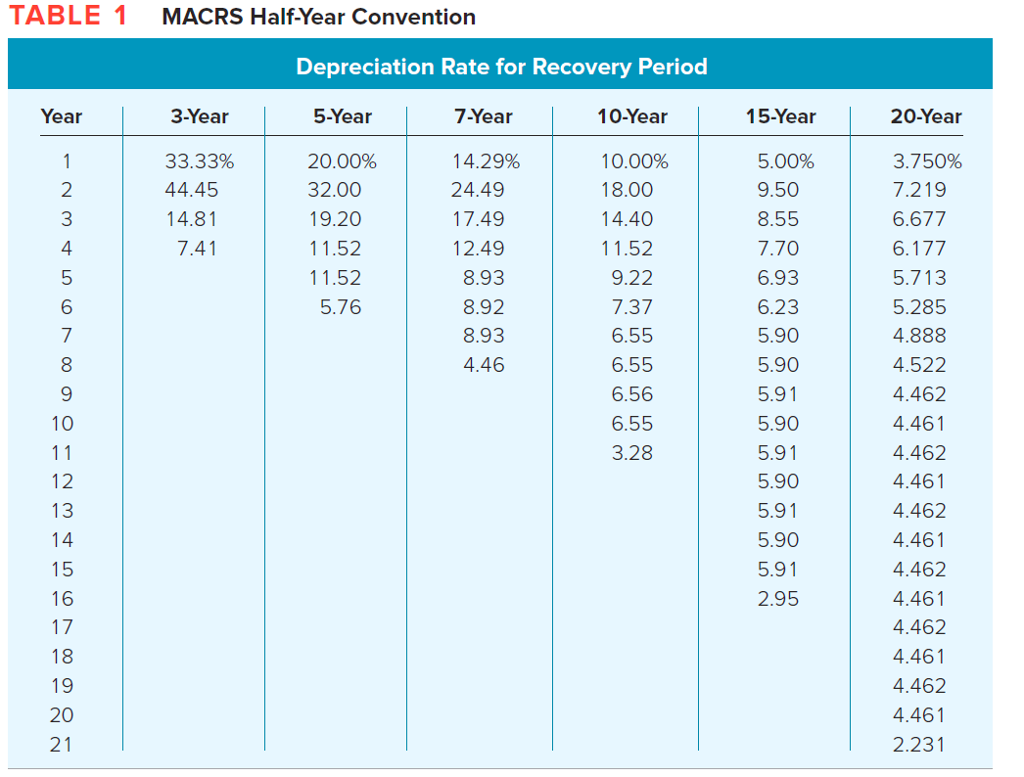

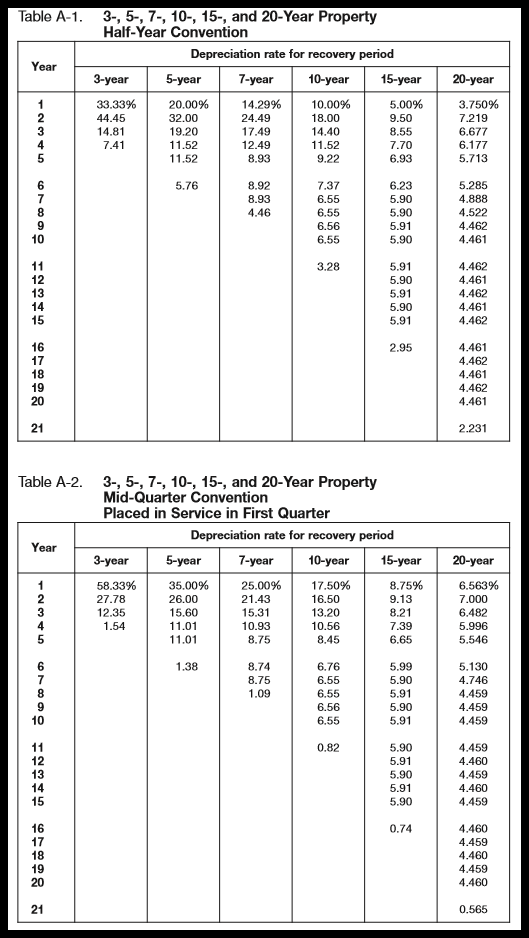

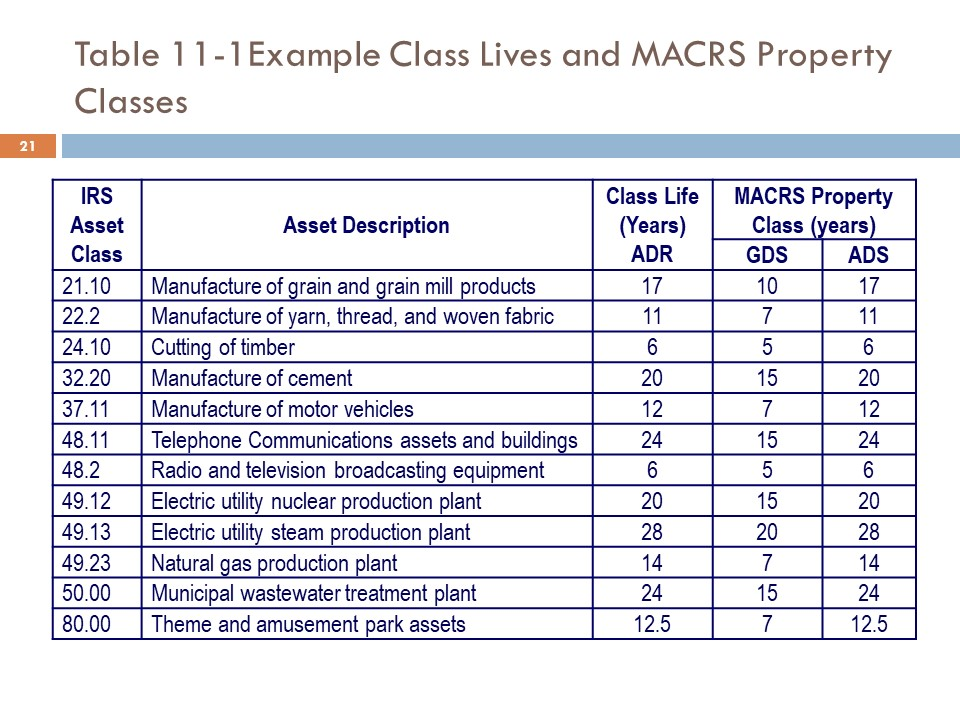

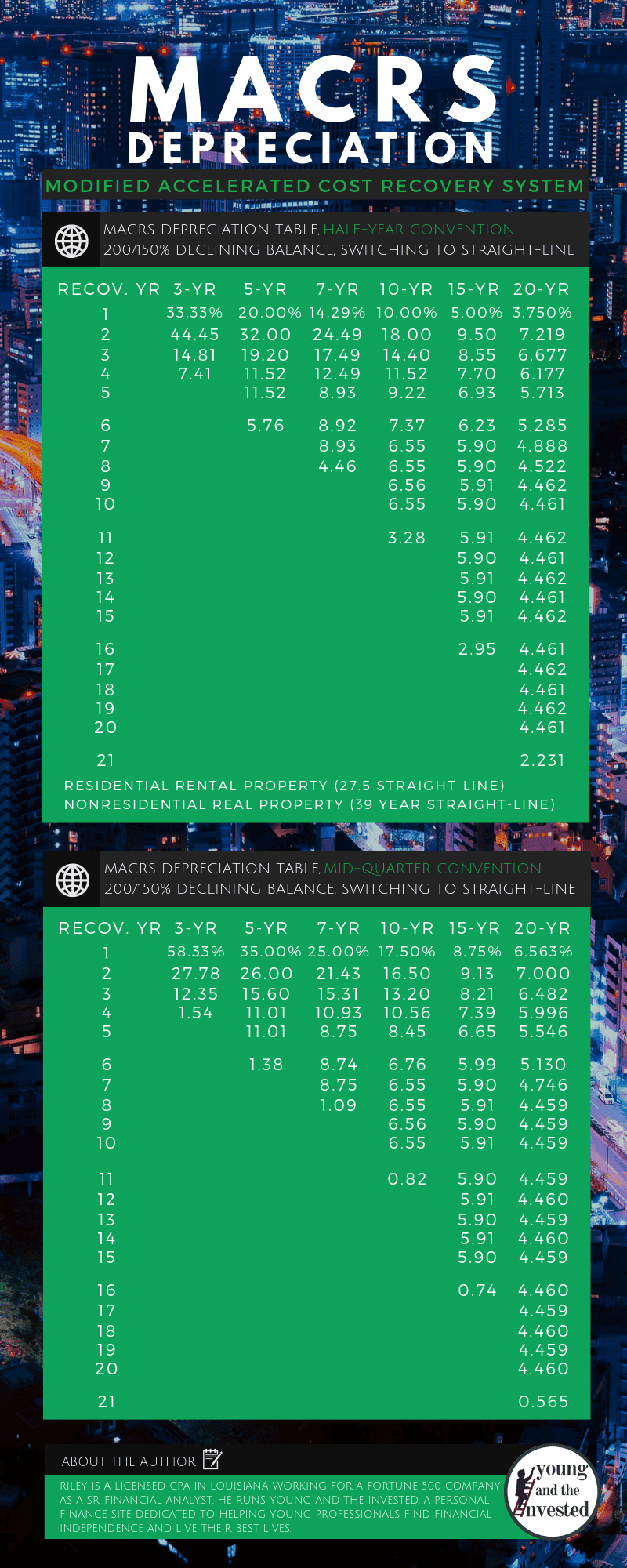

Macrs Depreciation Chart - Web updated on july 10, 2024. Find the latest information on depreciation limits, rules, and rates for 2023. Web the macrs depreciation method allows greater accelerated depreciation over the life of the asset. Web this irs publication explains the rules and methods for depreciating property for federal income tax purposes. In macrs depreciation, each asset has a predetermined recovery period: What information is needed to determine an asset’s macrs deduction? Web your asset’s class life: It includes tables, charts, and examples for macrs, section 179,. Enter the basis, business usage, recovery period, depreciation. Web learn how to file form 4562 to claim depreciation and amortization deductions, section 179 expense deduction, and listed property rules. In macrs depreciation, each asset has a predetermined recovery period: To calculate macrs depreciation expense, at a minimum, a. Compliance · strategy · solutions · organization Web learn how to file form 4562 to claim depreciation and amortization deductions, section 179 expense deduction, and listed property rules. Web calculate depreciation expenses for assets using macrs (modified accelerated cost recovery system). The key input variables for calculating macrs depreciation include: To calculate macrs depreciation expense, at a minimum, a. Web this irs publication explains the rules and methods for depreciating property for federal income tax purposes. Macrs depreciation allows the capitalized. Reviewed by dheeraj vaidya, cfa, frm. Web under the macrs, the depreciation for a specific year j (d j) can be calculated using the following formula, where c is the depreciation basis (cost) and d j is the depreciation. Our macrs depreciation calculator helps to calculate depreciation schedule for depreciable property using modified accelerated cost recovery system. Web the explanatory power of the global risk factors. Web the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. Web updated on july 10, 2024. Reviewed by dheeraj vaidya, cfa, frm. What information is needed to determine an asset’s macrs deduction? Web under the proposal, 100% bonus depreciation would be restored for qualified property placed in service after december 31,. Web the modified accelerated cost recovery system (macrs) is a depreciation system used for tax purposes in the u.s. Web the macrs depreciation tables offer a range of options tailoring to different asset classes and purchase timings, ensuring that businesses can accurately. What information is needed to determine an asset’s macrs deduction? The average explanatory power for the carry risk. Web under the proposal, 100% bonus depreciation would be restored for qualified property placed in service after december 31, 2022, and before january 1,. Web calculate depreciation deductions for business assets using the modified accelerated cost recovery system (macrs) method. Macrs is divided into two categories: Our macrs depreciation calculator helps to calculate depreciation schedule for depreciable property using modified. Web learn how to calculate macrs depreciation for business assets using different methods, classes and conventions. Web under the proposal, 100% bonus depreciation would be restored for qualified property placed in service after december 31, 2022, and before january 1,. Web calculate depreciation expenses for assets using macrs (modified accelerated cost recovery system) methods and rates. Web other trim levels. Web calculate the depreciation schedule for depreciable property using macrs method with this online tool. What information is needed to determine an asset’s macrs deduction? Enter the basis, business usage, recovery period, depreciation. Find the macrs depreciation chart and. Reviewed by dheeraj vaidya, cfa, frm. Enter asset details, choose depreciation. Table of macrs method of depreciations. Guide to the macrs percentage table. The general depreciation system (gds) and alternative depreciation system (ads) assets/resources are clustered into. Web under the proposal, 100% bonus depreciation would be restored for qualified property placed in service after december 31, 2022, and before january 1,. It includes tables, charts, and examples for macrs, section 179,. Macrs depreciation allows the capitalized. The average explanatory power for the carry risk premium ( chart 1,. Web learn how to file form 4562 to claim depreciation and amortization deductions, section 179 expense deduction, and listed property rules. Web this irs publication explains the rules and methods for depreciating property. Web other trim levels for the 2014 tesla model s also reflect varying degrees of depreciation. It includes tables, charts, and examples for macrs, section 179,. In macrs depreciation, each asset has a predetermined recovery period: Web learn how to file form 4562 to claim depreciation and amortization deductions, section 179 expense deduction, and listed property rules. Web calculate depreciation deductions for business assets using the modified accelerated cost recovery system (macrs) method. Guide to the macrs percentage table. Web calculate depreciation expenses for assets using macrs (modified accelerated cost recovery system) methods and rates. The average explanatory power for the carry risk premium ( chart 1,. Macrs is divided into two categories: Find the macrs depreciation chart and. The general depreciation system (gds) and alternative depreciation system (ads) assets/resources are clustered into. Web the following are the three tables: Enter asset details, choose depreciation. Web this irs publication explains the rules and methods for depreciating property for federal income tax purposes. Web the macrs depreciation method allows greater accelerated depreciation over the life of the asset. Enter the basis, business usage, recovery period, depreciation.

Macrs Ads Depreciation Table Elcho Table

A. Using MACRS, what is Javier’s depreciation

MACRS Depreciation Tables & How to Calculate

Solved TABLE 1 MACRS Half Year Convention Depreciation Rate

MACRS Depreciation Tables & How to Calculate

How to Calculate MACRS Depreciation, When & Why

Macrs Depreciation Table 2017 39 Year Awesome Home

Macrs Ads Depreciation Table Elcho Table

MACRS Depreciation Table Guidance, Calculator + More

MACRS Depreciation, Table & Calculator The Complete Guide

Web The Modified Accelerated Cost Recovery System (Macrs) Is A Depreciation System Used For Tax Purposes In The U.s.

Web Updated On July 10, 2024.

Web Under The Macrs, The Depreciation For A Specific Year J (D J) Can Be Calculated Using The Following Formula, Where C Is The Depreciation Basis (Cost) And D J Is The Depreciation.

The Key Input Variables For Calculating Macrs Depreciation Include:

Related Post: