Macrs Chart

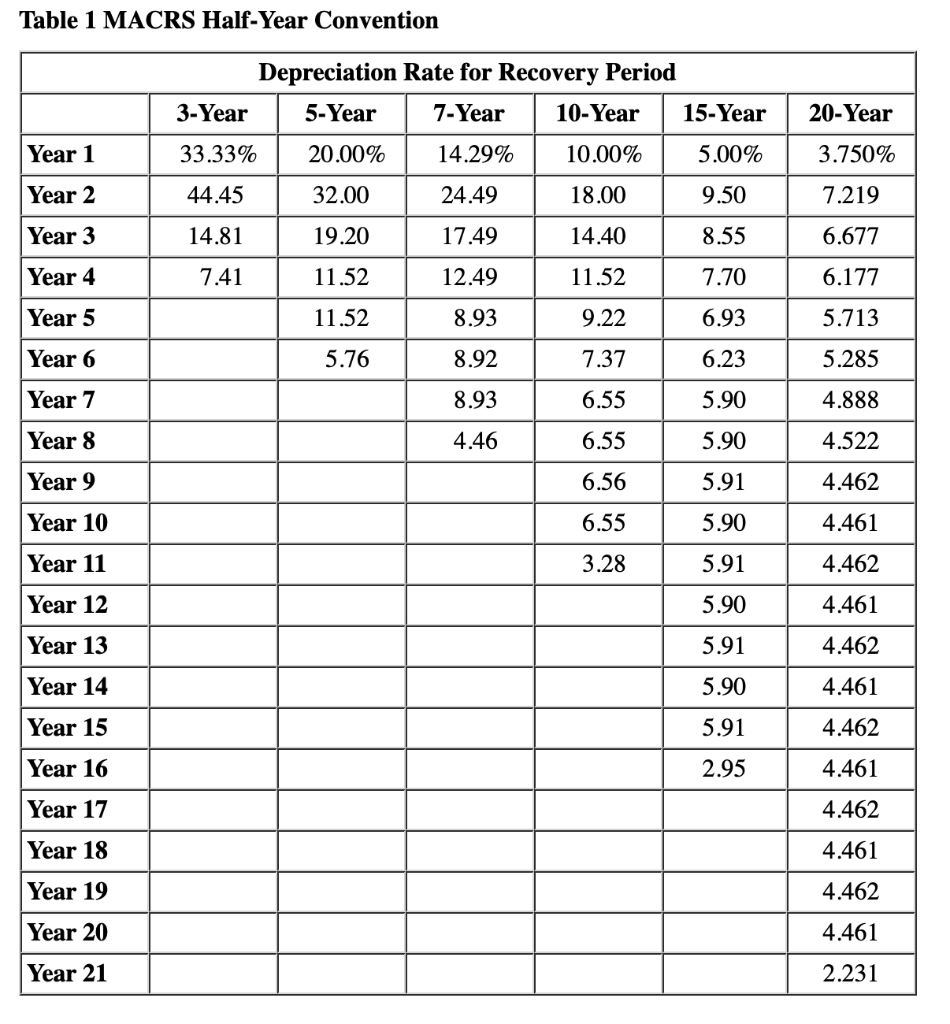

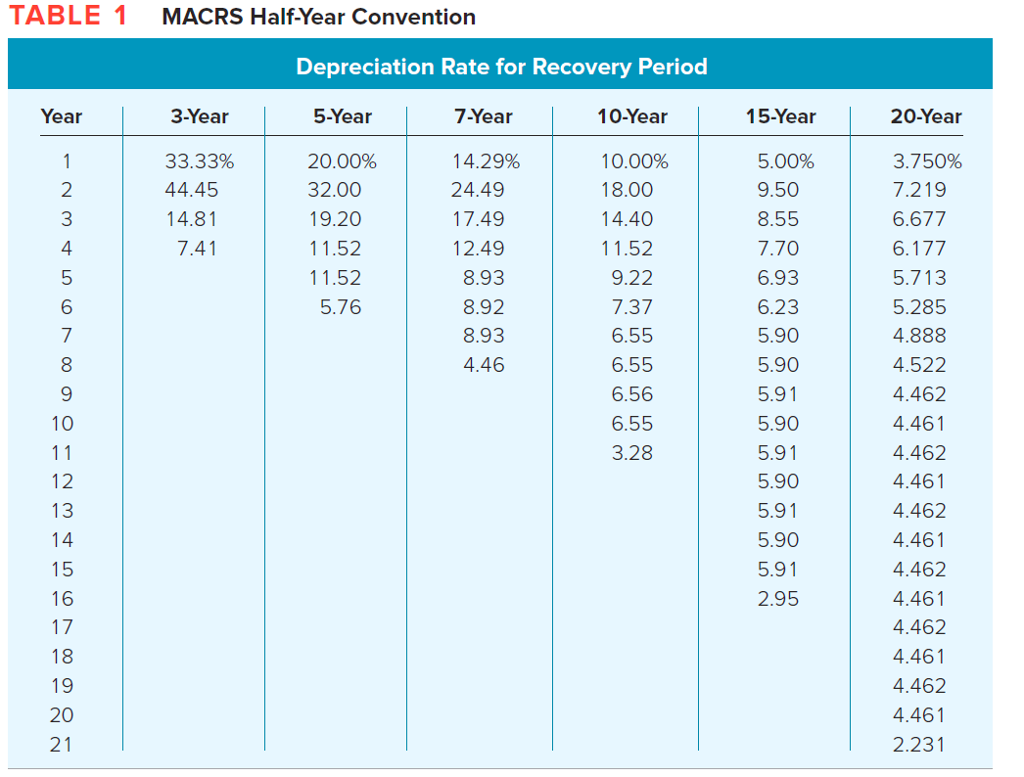

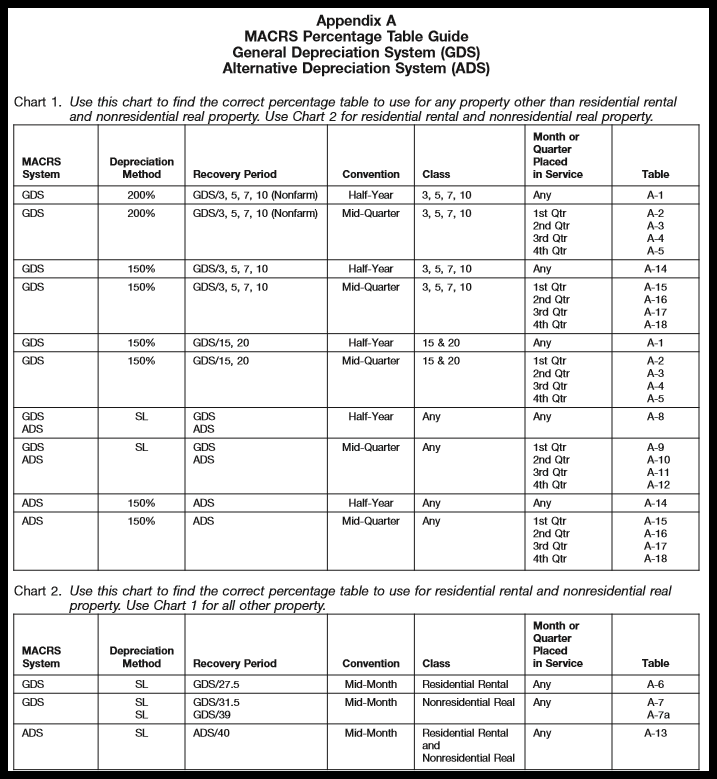

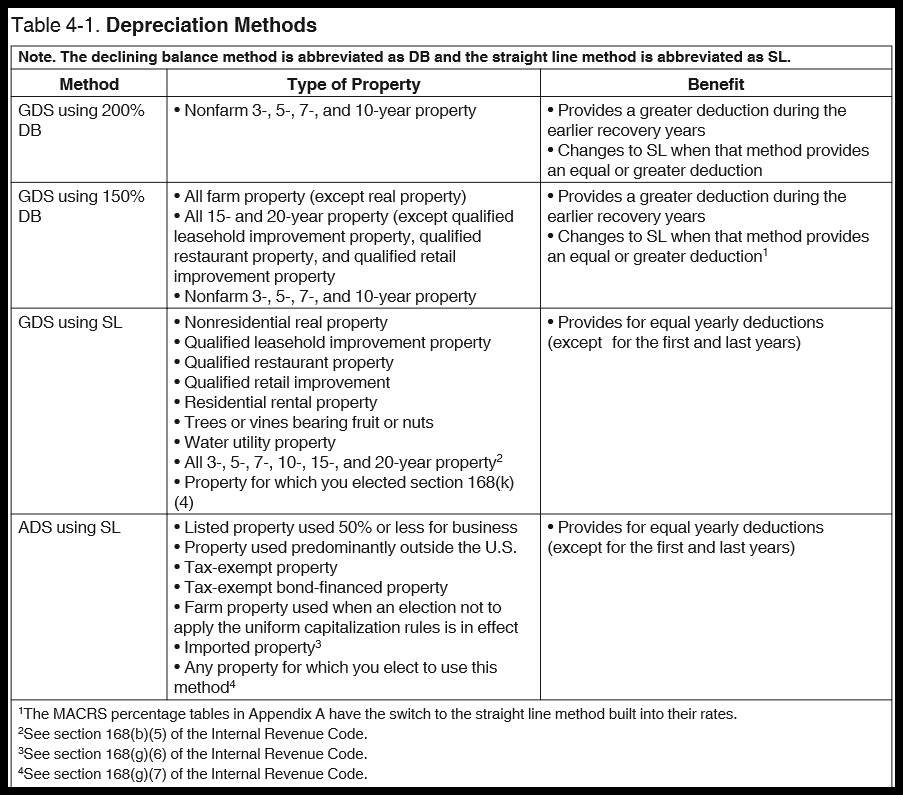

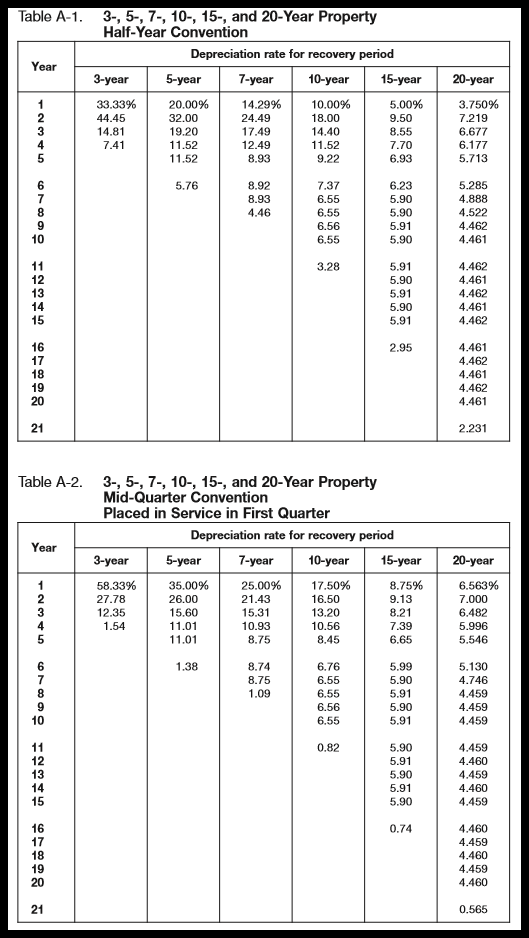

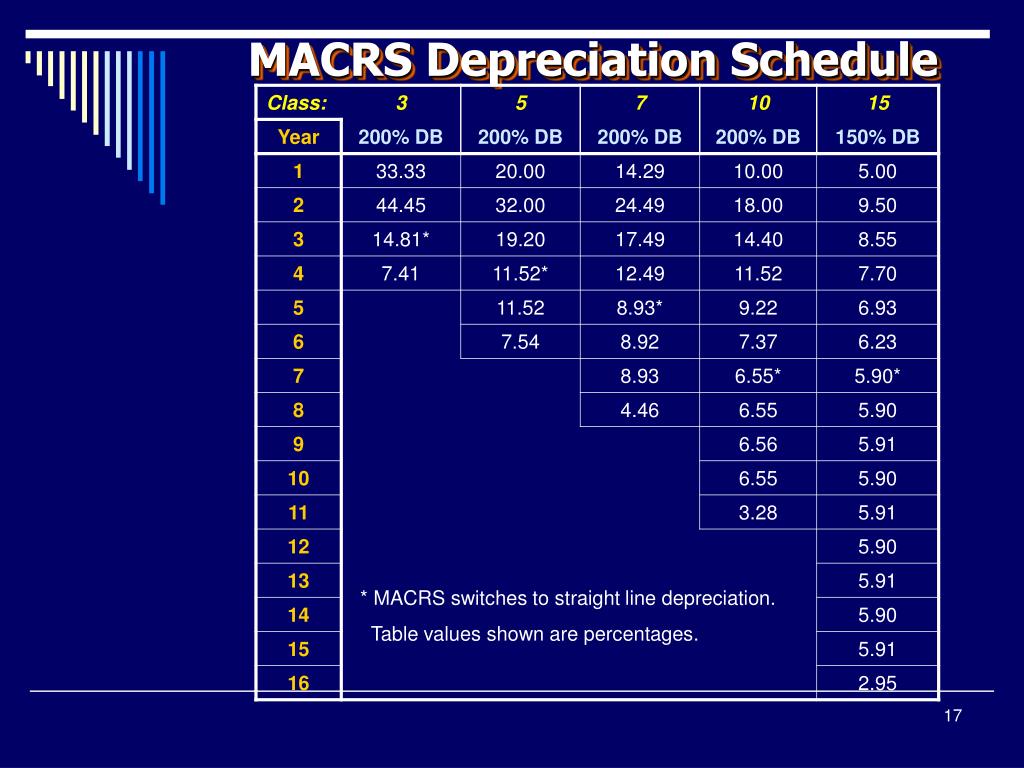

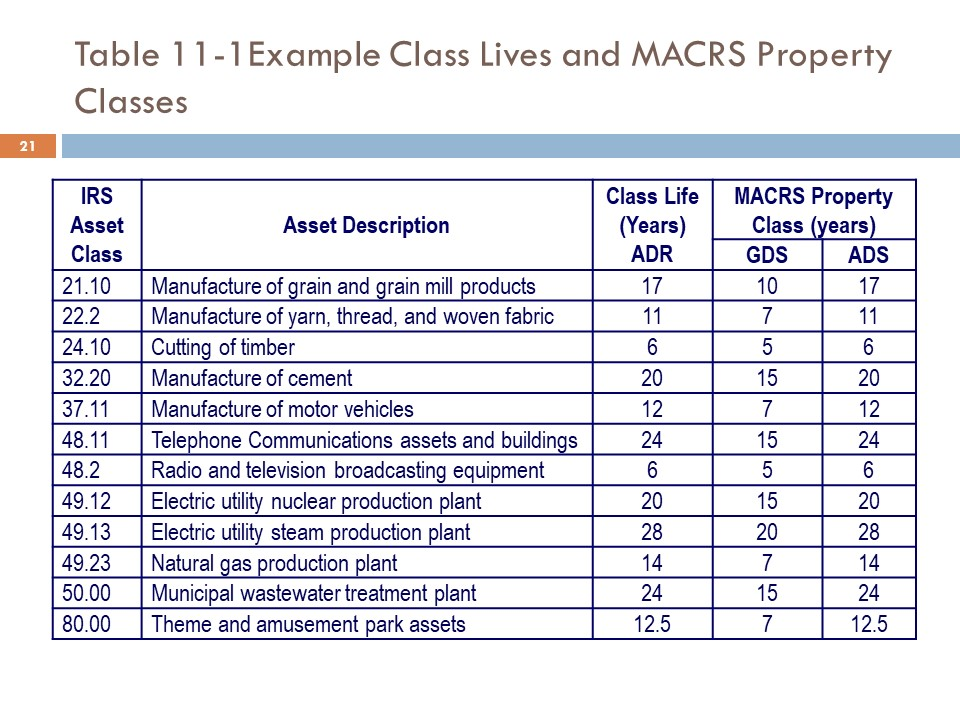

Macrs Chart - Web the explanatory power of the global risk factors differs for the two components of the fxrp. Identify the item of depreciable property (often referred to as the “asset”) determine whether the property is depreciable. What is the basis for depreciation? Adapted from an online discussion. It would phase in a refundable portion of the child tax credit and increase the maximum refundable amount per child to $1,800. Calculate a property's depreciation rate and expense amount using this free online macrs depreciation calculator with printable depreciation schedule. The modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. Web the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs) The bill would have expanded the child tax credit. The general depreciation system (“gds”) and the alternative depreciation system (“ads”). Web the macrs depreciation tables offer a range of options tailoring to different asset classes and purchase timings, ensuring that businesses can accurately spread out the cost of their assets over useful lives. The average explanatory power for the carry risk premium ( chart 1, yellow line) is about 35%, and its evolution over time largely resembles the dynamics of. Identify the item of depreciable property (often referred to as the “asset”) determine whether the property is depreciable. Web macrs consists of two depreciation systems: Our macrs depreciation calculator helps to calculate depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs). The general depreciation system (“gds”) and the alternative depreciation system (“ads”). Macrs consists of two depreciation. The modified accelerated cost recovery system (macrs) is a depreciation method required by the irs. What is the placed in service date? Web macrs consists of two depreciation systems: Web our free macrs depreciation calculator will provide your deduction for each year of the asset’s life. Adapted from an online discussion. Web the macrs depreciation tables offer a range of options tailoring to different asset classes and purchase timings, ensuring that businesses can accurately spread out the cost of their assets over useful lives. Identify the item of depreciable property (often referred to as the “asset”) determine whether the property is depreciable. The modified accelerated recovery system is the standard depreciation. Identify the item of depreciable property (often referred to as the “asset”) determine whether the property is depreciable. Web find out how to calculate the macrs depreciation basis of your assets as well as the different macrs methods of depreciation used to write off different depreciable assets. Web macrs consists of two systems that determine how you depreciate your property—the. Additionally, discover how and when to take. Macrs is the only method allowed by the irs for tax purposes. The average explanatory power for the carry risk premium ( chart 1, yellow line) is about 35%, and its evolution over time largely resembles the dynamics of the fxrp described earlier. The modified accelerated cost recovery system (macrs) allows a business. Web how the system works. Web the macrs depreciation calculator allows you to calculate depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs) Which property class applies under gds? Web the macrs depreciation tables offer a range of options tailoring to different asset classes and purchase timings, ensuring that businesses can accurately spread out the cost of. Select any of the following links for information on macrs/acrs tax assumptions. Web the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes in the united states to recover the cost of tangible assets over a specific period. Web macrs consists of two systems that determine how you depreciate your property—the general depreciation system (gds). Determine who may take depreciation. The following methods are used by this calculator: The modified accelerated recovery system is the standard depreciation method. Web how the system works. Web the macrs depreciation tables offer a range of options tailoring to different asset classes and purchase timings, ensuring that businesses can accurately spread out the cost of their assets over useful. Under macrs, all assets are divided into classes which dictate the number of years over which an asset's cost will be recovered. The modified accelerated recovery system is the standard depreciation method. Our macrs depreciation calculator helps to calculate depreciation schedule for depreciable property using modified accelerated cost recovery system (macrs). Which applies, gds or ads? What is the basis. Web the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by the tax code. Under macrs, all assets are divided into classes which dictate the number of years over which an asset's cost will be recovered. The modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. Identify the item of depreciable property (often referred to as the “asset”) determine whether the property is depreciable. Each macrs class has a predetermined schedule which determines the These two systems depreciate property in different ways, such as by method, recovery period and bonus depreciation. You must use gds unless you are specifically required by. Web find out how to calculate the macrs depreciation basis of your assets as well as the different macrs methods of depreciation used to write off different depreciable assets. Recording depreciation on your books is an important. Which property class applies under gds? Web the explanatory power of the global risk factors differs for the two components of the fxrp. Web start with the macrs depreciation table guide below, which will point you to the proper macrs table (shown in the last column). Web how the system works. Macrs depreciation is the tax depreciation system used in the united states. The chart below shows the main differences between gds and ads. Which applies, gds or ads?

Macrs Depreciation Table Matttroy

The MACRS depreciation schedule for the automated assembly line

A. Using MACRS, what is Javier’s depreciation

MACRS Depreciation Tables & How to Calculate

MACRS Depreciation Tables & How to Calculate

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog

MACRS Depreciation Tables & How to Calculate

MACRS Depreciation, Table & Calculator The Complete Guide

PPT Depreciation PowerPoint Presentation, free download ID1109697

Macrs Ads Depreciation Table Elcho Table

Web The Macrs Depreciation Calculator Allows You To Calculate Depreciation Schedule For Depreciable Property Using Modified Accelerated Cost Recovery System (Macrs)

In Contrast, The Explanatory Power For The Term Premium Differential.

What Is The Placed In Service Date?

It Would Phase In A Refundable Portion Of The Child Tax Credit And Increase The Maximum Refundable Amount Per Child To $1,800.

Related Post: