Letter To Insurance Company Template

Letter To Insurance Company Template - The goal of the letter is to inform the insurance company that you demand monetary compensation for damages after something like a car accident. Web use our template, samples, and helpful hints to write an effective notification letter. This introduction should be brief and to the point, but should provide enough context for the reader to understand why you are contacting the insurance company. If you are chasing compensation for either of these factors, then demand letters are a dependable way to ensure a fair settlement. It provides details of a calamity or accident, as provided in your policy. Begin by stating the subject of your letter in a clear and concise manner. Utilize the provided templates for different scenarios. Web if you're making a personal injury claim after any kind of accident, looking at a sample demand letter is a great way to put together your opening settlement demand to the other party (or that party's insurance company), or to frame your best case when making a counteroffer as part of settlement negotiations. Here are a few sample insurance letters to help you write the perfect letter in minutes. Web start your injury claim negotiations with an effective compensation demand to the insurance company. Whether you’re looking to file a claim, dispute a denial, or request a change in coverage, our guide is designed to help you get the results you want. Here are a few sample insurance letters to help you write the perfect letter in minutes. Web in this article, we’ll provide you with examples of letters to insurance companies and show. Start with a clear introduction. Starting an insurance appeal begins with drafting the letter and submitting it to your insurance company. Web utilize the following appeal letter sample as a resource to construct formal correspondence with your insurance company, articulating your concerns with precision and courtesy. Settlement negotiations begin with a written demand for compensation. Typically, the human resources (hr). Here’s a sample demand letter with tips you can use for your letter to the auto insurance company. Get specialized insurance letter templates from template.net that you can edit, download, and print conveniently in minutes. Dear insurance company, i am writing to appeal the recent decision regarding my insurance claim (claim number: Web dear [name], thank you for assisting me. These letters were developed and used by families who encountered these situations. The individual or attorney writing the letter, the ‘claimant’, informs the insurance company that they intend to seek monetary repayment to satisfy their claimed damages. A demand letter to an insurance company is a document used by an insurance holder to demand action by an insurance company. Web. Web create a demand letter to an insurance company. Web utilize the following appeal letter sample as a resource to construct formal correspondence with your insurance company, articulating your concerns with precision and courtesy. The individual or attorney writing the letter, the ‘claimant’, informs the insurance company that they intend to seek monetary repayment to satisfy their claimed damages. Start. The goal of the letter is to inform the insurance company that you demand monetary compensation for damages after something like a car accident. The first thing in your letter is all the necessary details the insurance company needs to identify your case. Include all relevant medical bills, receipts, and notes. Begin by stating the subject of your letter in. This introduction should be brief and to the point, but should provide enough context for the reader to understand why you are contacting the insurance company. Web create a demand letter to an insurance company. Get specialized insurance letter templates from template.net that you can edit, download, and print conveniently in minutes. Sound like a pro with our letter template. Web sample car accident demand letter to an auto insurance company. Speed up your paperwork with jotform sign. This introduction should be brief and to the point, but should provide enough context for the reader to understand why you are contacting the insurance company. Typically, the human resources (hr) department, a direct supervisor, or an authorized company. These letters were. Web an insurance company demand letter is a letter written to an insurance company seeking money for a claim related to personal injury or property damage. Here are a few sample insurance letters to help you write the perfect letter in minutes. Web this section provides seven sample letters to use for various circumstances you may encounter that require you. This could be something like “claim for damaged property” or “request for policy cancellation.” a clear heading can help the recipient identify the purpose of the letter without having to read the entire document. Typically, the human resources (hr) department, a direct supervisor, or an authorized company. Use the following guidelines to create your appeal request: Web if you're making. It provides details of a calamity or accident, as provided in your policy. Start with a clear introduction. Whether you’re looking to file a claim, dispute a denial, or request a change in coverage, our guide is designed to help you get the results you want. The goal of the letter is to inform the insurance company that you demand monetary compensation for damages after something like a car accident. Settlement negotiations begin with a written demand for compensation. Use the following guidelines to create your appeal request: A demand letter to an insurance company is a document used by an insurance holder to demand action by an insurance company. Web dear [name], thank you for assisting me with [my/my loved one’s] medical care. Web utilize the following appeal letter sample as a resource to construct formal correspondence with your insurance company, articulating your concerns with precision and courtesy. These letters were developed and used by families who encountered these situations. Web this past employment verification letter confirms the job titles, dates of employment, and sometimes the reasons for leaving previous positions. However, the cooperation of the fine staff at [insurance company name] makes it a little easier. From gathering the necessary information to addressing the letter and stating your purpose, we will cover all the essential aspects to ensure that your message is conveyed effectively. Additionally, it acts as a formal request for benefits. Begin by stating the subject of your letter in a clear and concise manner. This introduction should be brief and to the point, but should provide enough context for the reader to understand why you are contacting the insurance company.

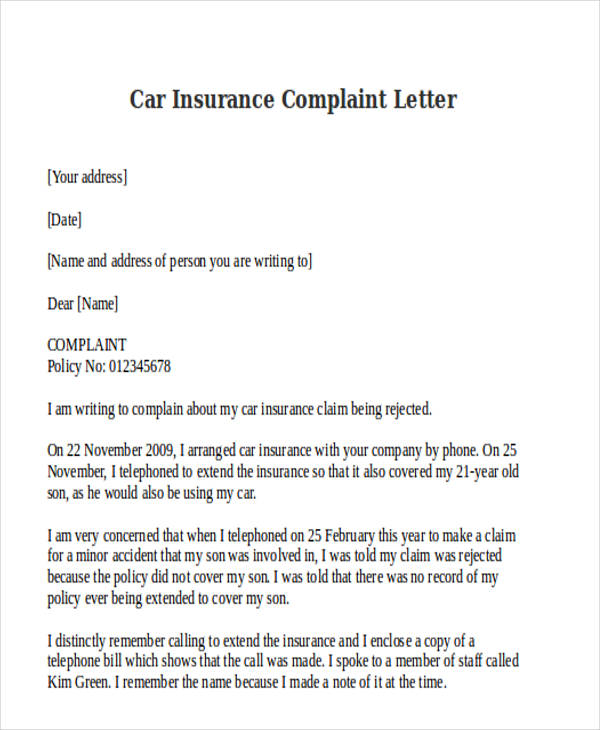

Car Insurance Dispute Letter Template, Car Insurance Dispute Letter

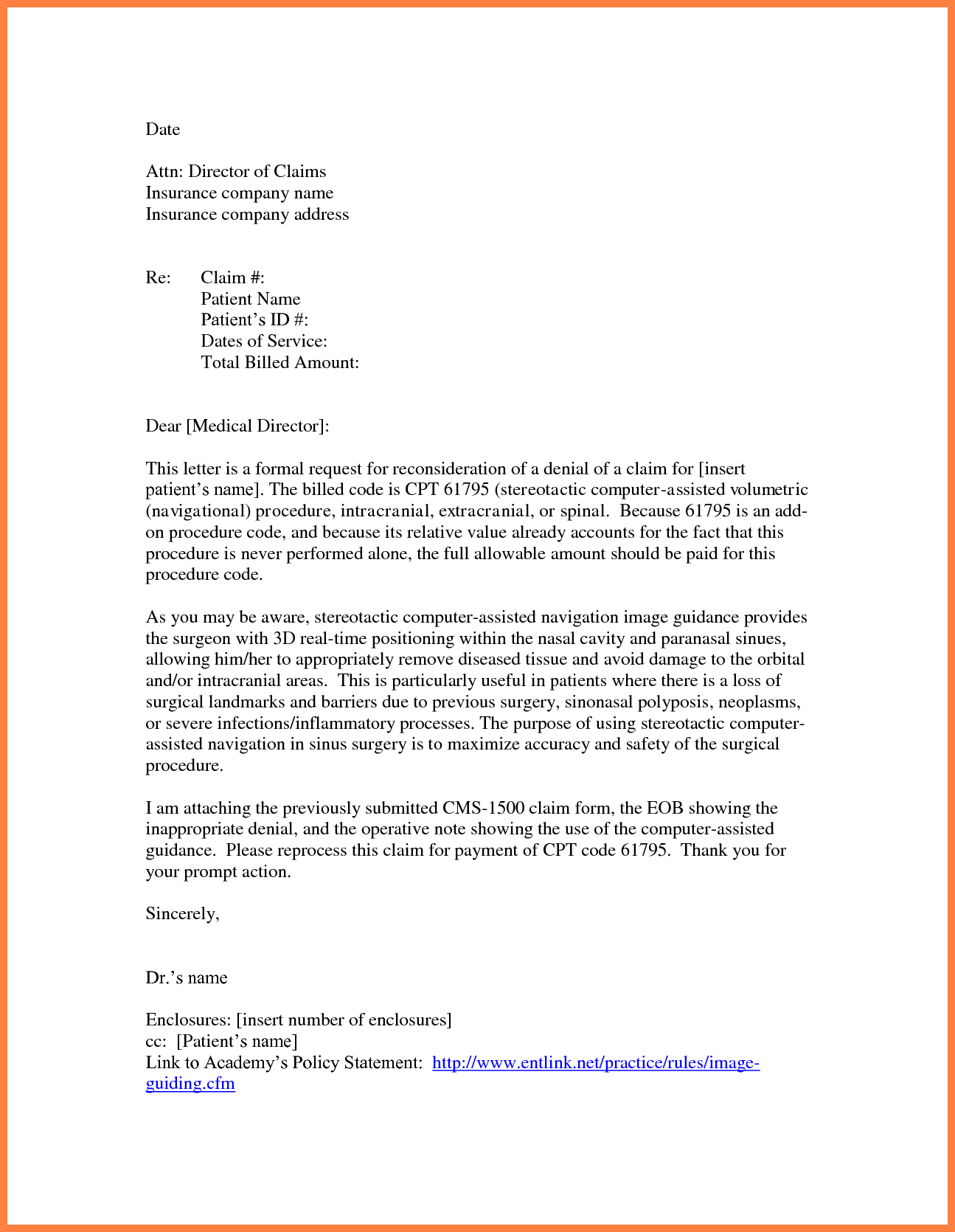

template of insurance claim letter 11 Facts About Template

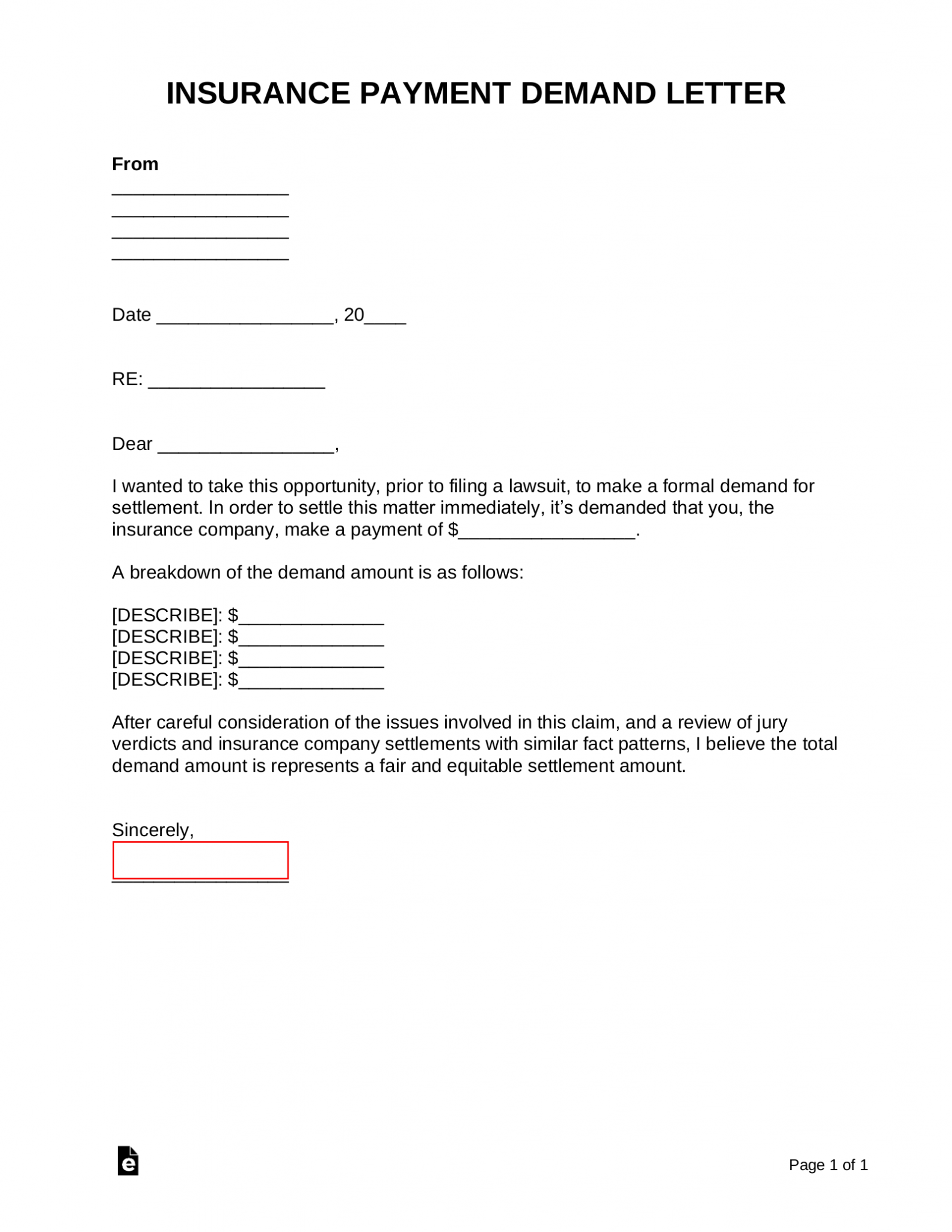

Free Insurance Company Demand Letter PDF Word eForms

Insurance Claim Letter Examples How to Write an Insurance Claim?

insurance complaint template letter Ten Quick Tips

Letter Insurance Template Mt Home Arts

Letter to Insurance Company Template Samples Letter Template

Letter To An Insurance Company For Claim Settlement 2024 (guide + Free

Organize Your Health Insurance Card Letter

Writing An Appeal Letter To Health Insurance Company SampleTemplatess

Web Use Our Template, Samples, And Helpful Hints To Write An Effective Notification Letter.

Web A Demand Letter To An Insurance Company Is A Letter Written To An Insurance Company Seeking Money For A Claim Normally Related To Personal Injury Or Property Damage.

The First Thing In Your Letter Is All The Necessary Details The Insurance Company Needs To Identify Your Case.

The Individual Or Attorney Writing The Letter, The ‘Claimant’, Informs The Insurance Company That They Intend To Seek Monetary Repayment To Satisfy Their Claimed Damages.

Related Post: