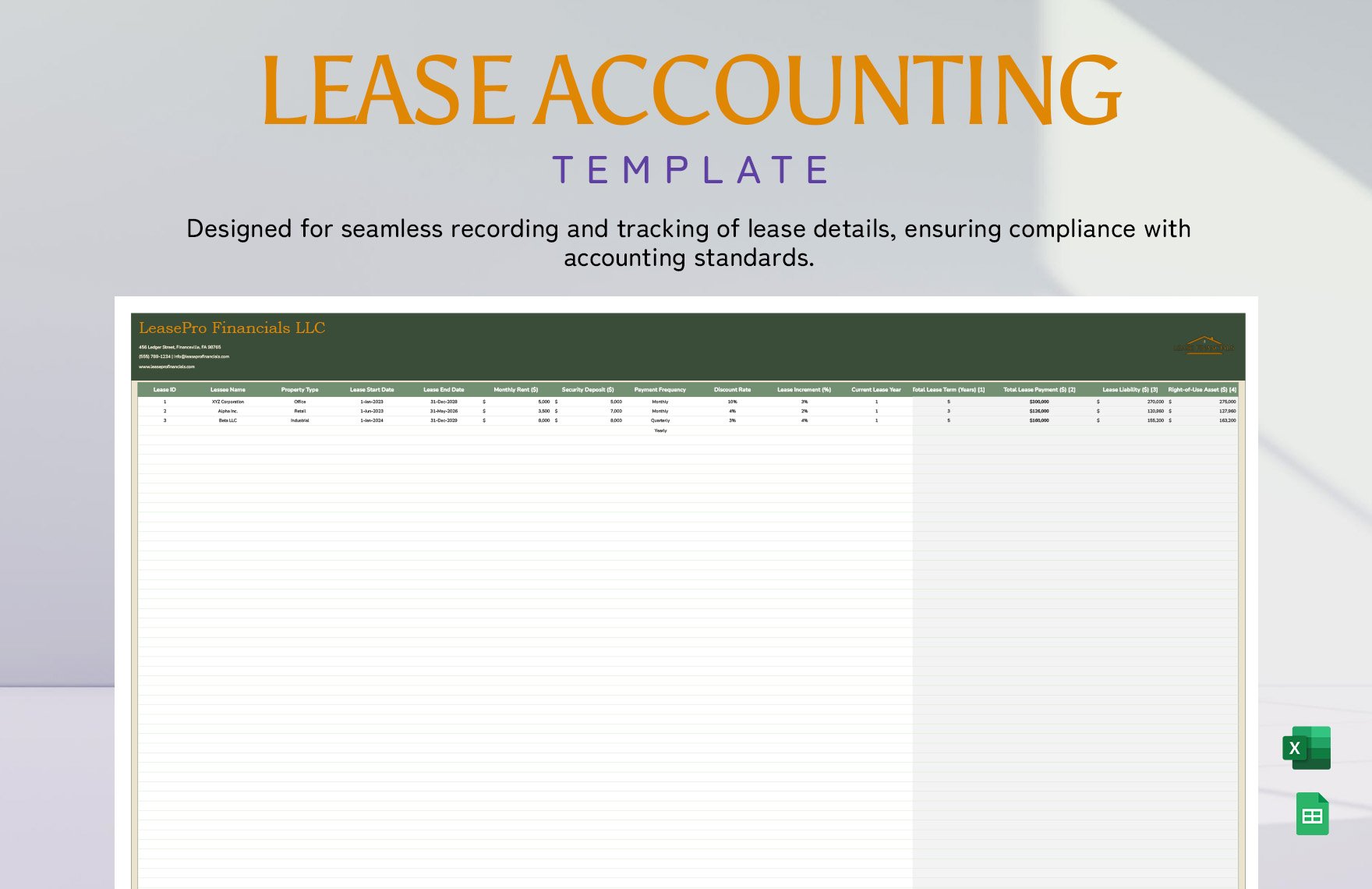

Lease Accounting Template

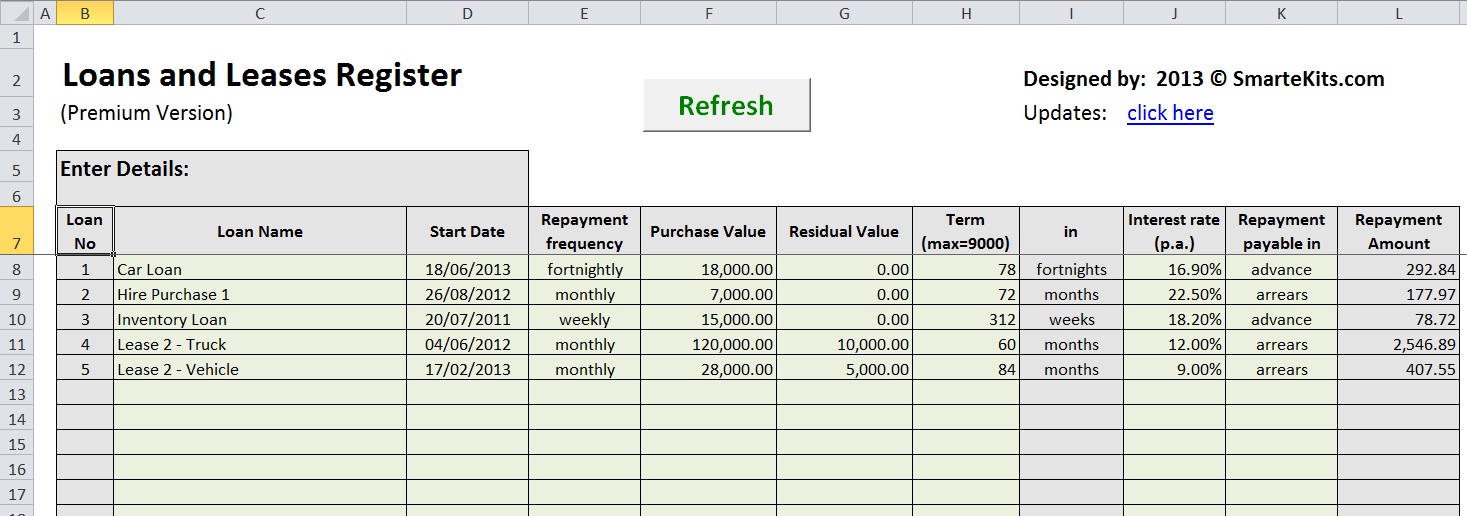

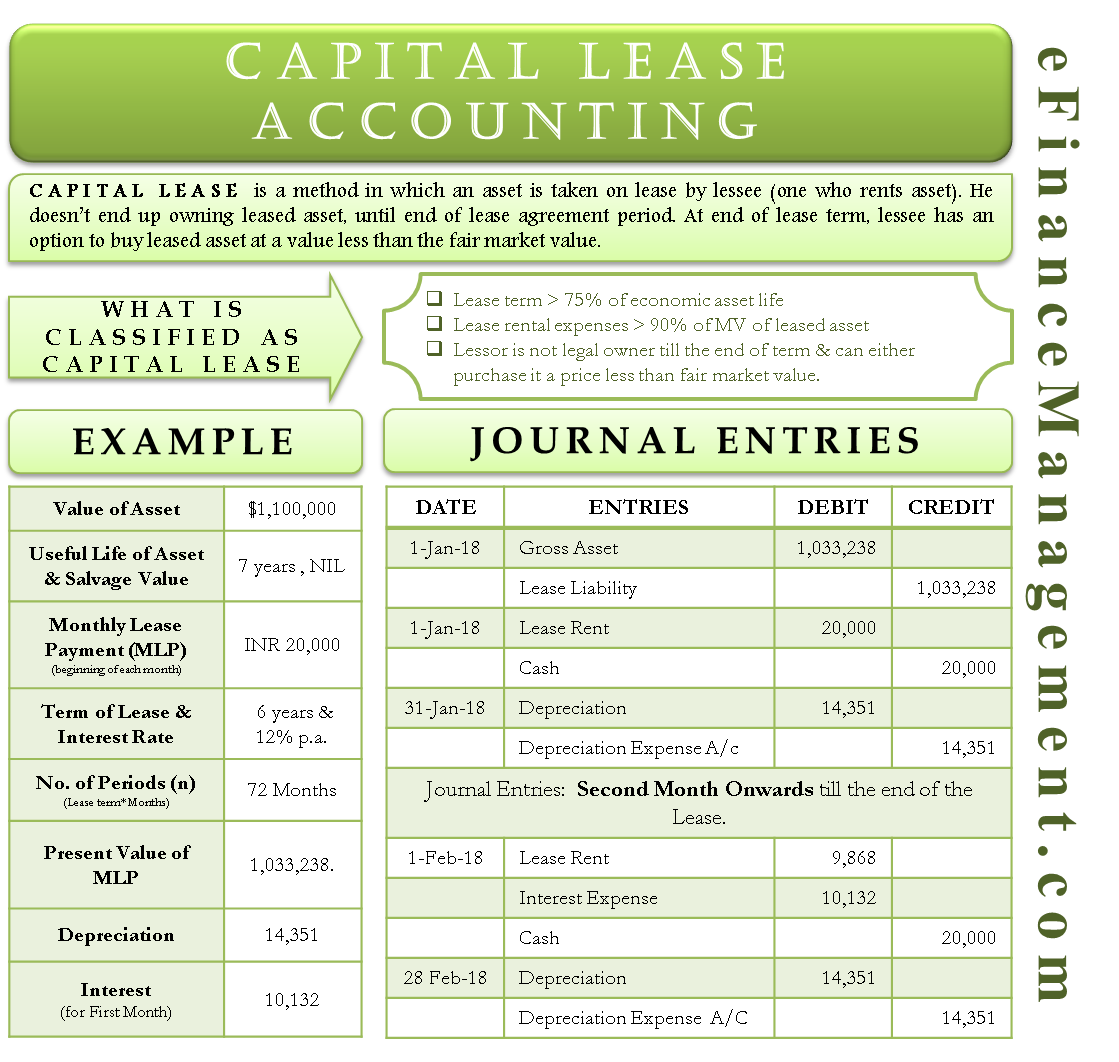

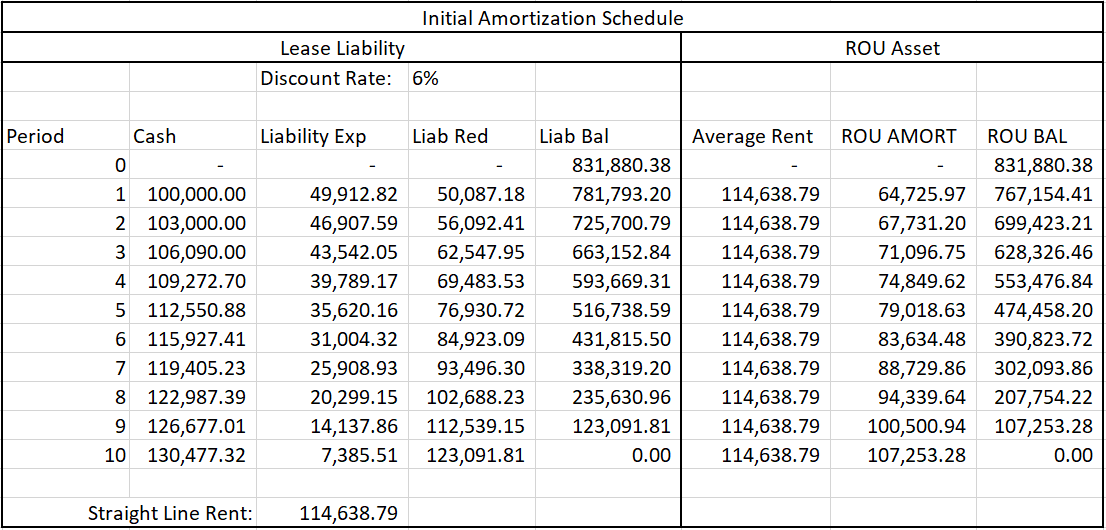

Lease Accounting Template - Web an excel calculation model to calculate accounting movements and balances for up to 15 lease agreements based on ifrs 16 requirements from a lessee perspective. We figure you probably don’t do lease accounting every day. Web so what does this mean? The lessee's right to use the leased asset. On february 25, 2016, fasb issued accounting standards update (asu) no. The examples below are identical leases in terms, payments, and discount rates. This program prompts you to record relevant lease data, then generates complex calculations for pv calculations and journal entries, and runs reports that help you meet accounting and disclosure requirements. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or Web learn from free lease accounting examples. The objective of this asu is to increase transparency and comparability in financial reporting by requiring balance sheet recognition of leases and note disclosure of certain information about lease arrangements. The lessee's right to use the leased asset. The calculation is done monthly. Web download our asc 842 lease accounting spreadsheet template & easily create an operating lease schedule that complies with asc 842 requirements. Larson lease accounting template asc 842. Web looking for a lease accounting ifrs 16 excel template? Web looking for asc 842 lease accounting excel templates? The remaining lease liability must also include the interest expense. We figure you probably don’t do lease accounting every day. Larson lease accounting template asc 842. Lease accounting hot topics for entities that have adopted asc 842. If you are recording an operating lease, the lessee is responsible for making periodic payments in exchange for using the leased asset. Acts as a lease register and a financial impact calculator. Isolating this variable can help you better understand the impact of asc 842. Web the two most common types of leases in accounting are operating and finance (or. Web with our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Web learn from free lease accounting examples. Web pwc is pleased to offer our updated leases guide. The present value of all known future lease payments. The fasb’s new standard on leases, asc 842, is effective for all entities. Web what are the asc 842 journal entries? The only difference is lease classification. Web an excel calculation model to calculate accounting movements and balances for up to 15 lease agreements based on ifrs 16 requirements from a lessee perspective. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or Web asc 842 leases. Web looking for asc 842 lease accounting excel templates? This guide discusses lessee and lessor accounting under asc 842. Excel based, macro driven tool. The free excel template from contavio helps you understand the leases standard and shows you how to calculate contracts. Web asc 842 leases calculation template. Web about the leases guide pwc is pleased to offer our updated leases guide. Uses the npv function in excel. The fasb’s new standard on leases, asc 842, is effective for all entities. The calculation is done monthly. The only difference is lease classification. The present value of all known future lease payments. Click the link to download a template for asc 842. The free excel template from contavio helps you understand the leases standard and shows you how to calculate contracts. Lease accounting hot topics for entities that have adopted asc 842. Isolating this variable can help you better understand the impact of. The present value of all known future lease payments. Web about the leases guide pwc is pleased to offer our updated leases guide. The fasb’s new standard on leases, asc 842, is effective for all entities. Web this method shown is one of many ways of how to calculate a lease amortization schedule. Web an excel calculation model to calculate. Isolating this variable can help you better understand the impact of asc 842. On february 25, 2016, fasb issued accounting standards update (asu) no. To make your job easier, we’ve built a few simple examples that show how the lease accounting works under the current and previous standards for capital/finance leases and operating leases. The fasb’s new standard on leases,. The present value of all known future lease payments. One of the most common schedules you’ll see companies apply. The free excel template from contavio helps you understand the leases rules and shows you how to calculate contracts. Posted by larson and company. Asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. The lessee's right to use the leased asset. Web an excel calculation model to calculate accounting movements and balances for up to 15 lease agreements based on ifrs 16 requirements from a lessee perspective. The key attributes of this lease liability monthly amortization schedule are: Web our ifrs 16 lease accounting tool provides an accurate, reliable and cost effective solution. To make your job easier, we’ve built a few simple examples that show how the lease accounting works under the current and previous standards for capital/finance leases and operating leases. Larson lease accounting template asc 842. The fasb’s new standard on leases, asc 842, is effective for all entities. Web download our asc 842 lease accounting spreadsheet template & easily create an operating lease schedule that complies with asc 842 requirements. Learn more about the challenges of using excel templates for asc 842 compliance and our solutions. It's essentially like accounting for all your leases as if they were capital leases under asc 840. Acts as a lease register and a financial impact calculator.

Retail lease administration software Energy FM MRI Software

Lease Accounting Template Excel

How to Implement ASC 842 Lease Accounting Standard in Your Organization

What is Lease Accounting?

Lease Accounting Template

How lease accounting may look under FRS 102 Interface Accountants

accounting entries for acquisition

Thank you Lease Accounting Guide Occupier

Asc 842 Lease Accounting Excel Template

Accounting Templates in Google Sheets Download in Word, Google Docs

The Only Difference Is Lease Classification.

Web So What Does This Mean?

The Objective Of This Asu Is To Increase Transparency And Comparability In Financial Reporting By Requiring Balance Sheet Recognition Of Leases And Note Disclosure Of Certain Information About Lease Arrangements.

Web Looking For Asc 842 Lease Accounting Excel Templates?

Related Post: