Irrevocable Life Insurance Trust Template

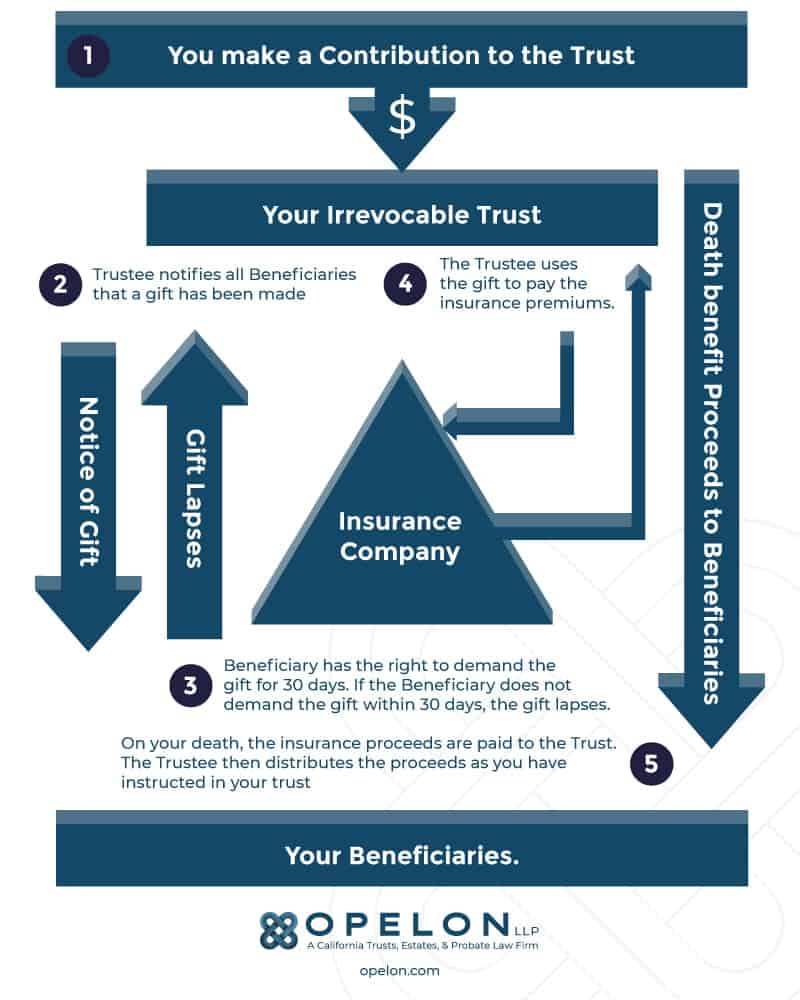

Irrevocable Life Insurance Trust Template - There are two important points. Web help secure your family’s future from financial worries with an irrevocable life insurance trust (ilit). Web a primer on the irrevocable life insurance trust. Web examples of irrevocable trusts include irrevocable life insurance trusts (ilits), qualified personal residence trusts (qprts), and intentionally defective grantor. Ilits are constructed with a life insurance policy as. Web an irrevocable life insurance trust is a trust that’s funded with one or more life insurance policies. In the absence of corrective planning, life insurance proceeds are included in the insured person’s estate. Web an irrevocable life insurance trust can hold your life insurance policy and help avoid estate taxes. Web the irrevocable life insurance trust (ilit) can be an important estate strategy tool that may accomplish a number of estate objectives; Web an irrevocable living trust can offer several advantages, such as minimizing estate taxes by gifting money into an irrevocable life insurance trust or a grantor. Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls a term or permanent life insurance policy or. Web an irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. Web irrevocable life insurance trusts (ilit) allow individuals to ensure the benefits from a. You may easily print this letter to help speed up the process for your irrevocable life insurance trust. Web this is a sample crummy letter for ilit. Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls a term or permanent life insurance policy or. Web an irrevocable life insurance trust,. The trust takes control of your policy though your beneficiaries. Web an irrevocable living trust can offer several advantages, such as minimizing estate taxes by gifting money into an irrevocable life insurance trust or a grantor. This product is in both pdf and microsoft word format. 4/5 (125 reviews) Web an irrevocable life insurance trust can hold your life insurance. Web an irrevocable life insurance trust sample is a trust created that allows for the control of one or more permanent life insurance policies while the insurer is alive. “irrevocable” means that once the trust is established, the grantor. Web help secure your family’s future from financial worries with an irrevocable life insurance trust (ilit). Web an irrevocable life insurance. “irrevocable” means that once the trust is established, the grantor. Search forms by statechat support availablecustomizable formsview pricing details Web there are three wills and trust documents in this product that can be used for estate tax savings trusts. Web an irrevocable living trust can offer several advantages, such as minimizing estate taxes by gifting money into an irrevocable life. Web an irrevocable life insurance trust (“ilit”) is an estate planning vehicle used to eliminate federal transfer taxes on the proceeds of life insurance policies on the. This product is in both pdf and microsoft word format. The trust takes control of your policy though your beneficiaries. Web an irrevocable life insurance trust is a trust that’s funded with one. “irrevocable” means that once the trust is established, the grantor. Web an irrevocable life insurance trust, or ilit, is a type of irrevocable trust that can let you reduce your taxable estate with a life insurance policy. Find out how to create, fund and administer an ilit, and the gift tax consequences and. Web an ilit can be formed by. Web help secure your family’s future from financial worries with an irrevocable life insurance trust (ilit). Web view on westlaw or start a free trial today, § 19:68. 4/5 (125 reviews) Web an irrevocable life insurance trust sample is a trust created that allows for the control of one or more permanent life insurance policies while the insurer is alive.. Web examples of irrevocable trusts include irrevocable life insurance trusts (ilits), qualified personal residence trusts (qprts), and intentionally defective grantor. An ilit helps provide your family financial security after your death. The trust takes control of your policy though your beneficiaries. Web an irrevocable life insurance trust (ilit) is a trust created during an insured's lifetime that owns and controls. Web a primer on the irrevocable life insurance trust. Web this is a sample crummy letter for ilit. In the absence of corrective planning, life insurance proceeds are included in the insured person’s estate. Web the irrevocable life insurance trust (ilit) can be an important estate strategy tool that may accomplish a number of estate objectives; Web an irrevocable life. “irrevocable” means that once the trust is established, the grantor. In the absence of corrective planning, life insurance proceeds are included in the insured person’s estate. Web an irrevocable life insurance trust can hold your life insurance policy and help avoid estate taxes. Web an irrevocable life insurance trust (ilit) is a trust that cannot be rescinded, amended, or modified, post creation. This product is in both pdf and microsoft word format. Web this is a sample crummy letter for ilit. However, it may not be appropriate for every. There are two important points. An ilit helps provide your family financial security after your death. Search forms by statechat support availablecustomizable formsview pricing details Web an irrevocable life insurance trust, or ilit, is a type of irrevocable trust that can let you reduce your taxable estate with a life insurance policy. Web examples of irrevocable trusts include irrevocable life insurance trusts (ilits), qualified personal residence trusts (qprts), and intentionally defective grantor. Web an irrevocable life insurance trust sample is a trust created that allows for the control of one or more permanent life insurance policies while the insurer is alive. Web the irrevocable life insurance trust (ilit) can be an important estate strategy tool that may accomplish a number of estate objectives; The trust takes control of your policy though your beneficiaries. Web an irrevocable life insurance trust is a trust that’s funded with one or more life insurance policies.

Setting Up an Irrevocable Life Insurance Trust Geiger Law Office

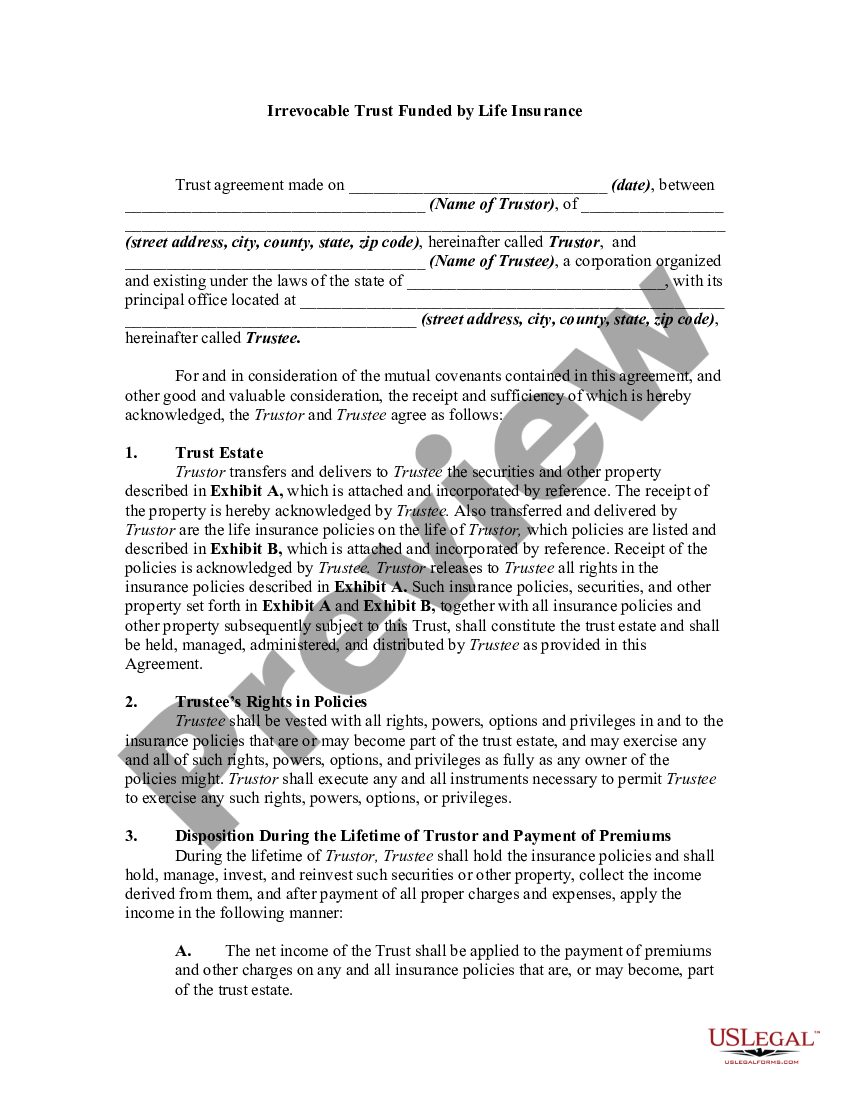

Irrevocable Life Insurance Trust Form With Crummey Powers US Legal Forms

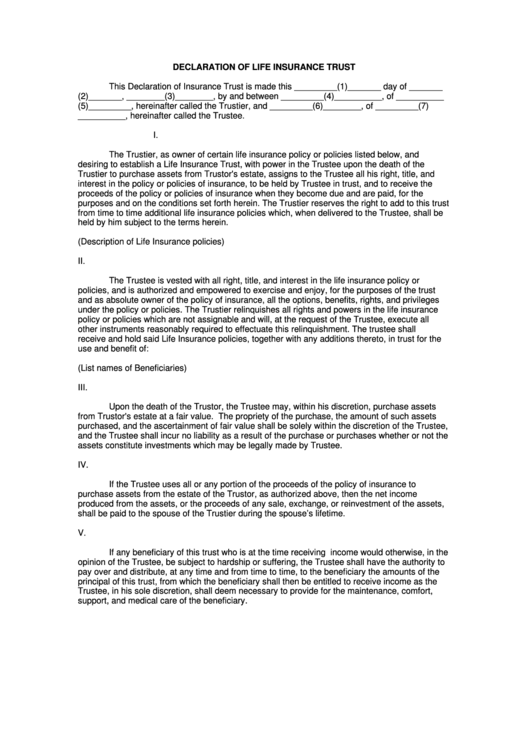

Top 5 Irrevocable Trust Form Templates free to download in PDF format

Top 5 Irrevocable Trust Form Templates free to download in PDF format

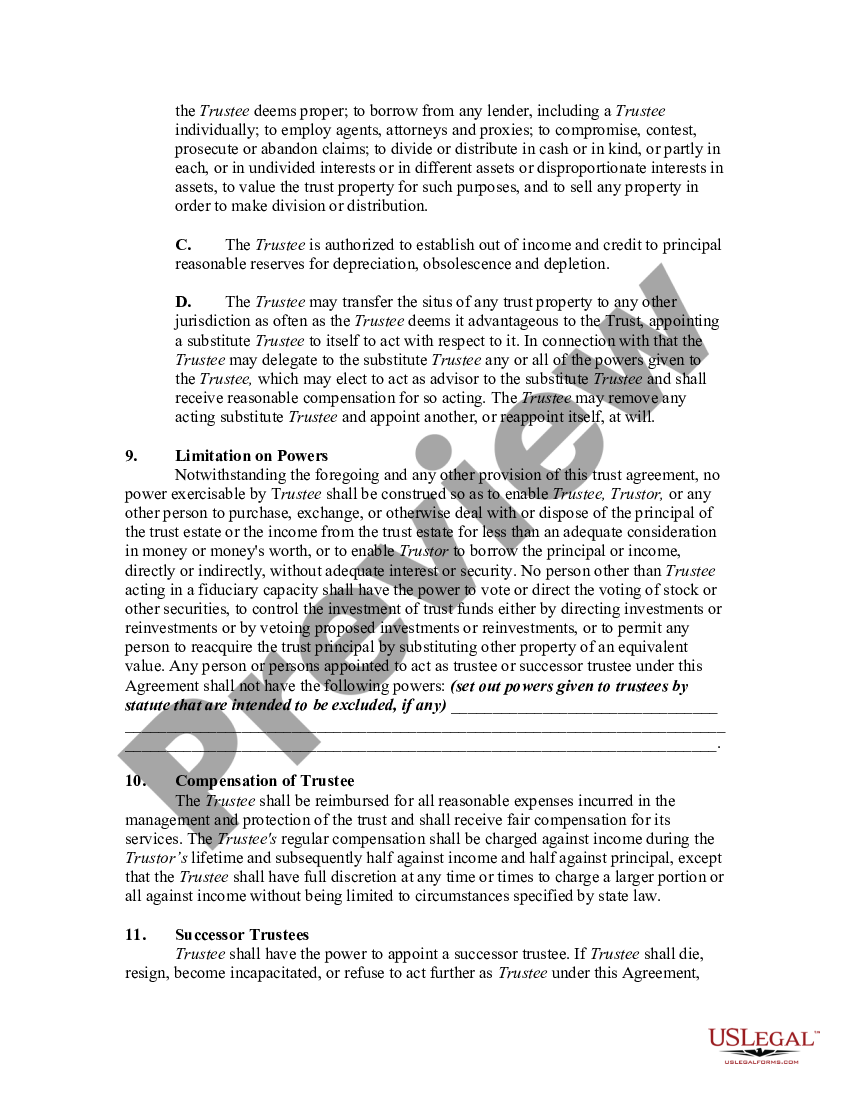

Irrevocable Trust Funded by Life Insurance Irrevocable Life Insurance

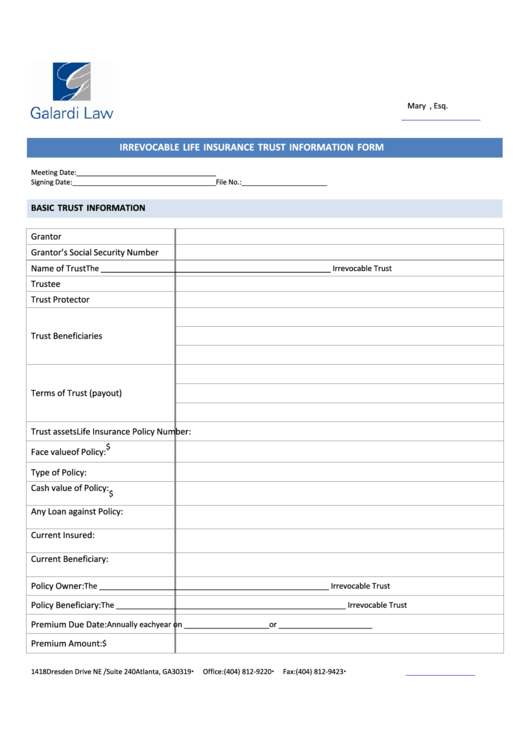

Irrevocable Life Insurance Trust Questionnaire Template Law Office Of

Understanding The Irrevocable Life Insurance Trust The Ultimate 2023

Irrevocable Trust Form Fill Online, Printable, Fillable, Blank

Irrevocable Trust Template Complete with ease airSlate SignNow

Arizona Irrevocable Trust Template

Web An Irrevocable Living Trust Can Offer Several Advantages, Such As Minimizing Estate Taxes By Gifting Money Into An Irrevocable Life Insurance Trust Or A Grantor.

Web Help Secure Your Family’s Future From Financial Worries With An Irrevocable Life Insurance Trust (Ilit).

You May Easily Print This Letter To Help Speed Up The Process For Your Irrevocable Life Insurance Trust.

Web Irrevocable Life Insurance Trusts (Ilit) Allow Individuals To Ensure The Benefits From A Life Insurance Policy Can Avoid Estate Taxes And Follow The Interests Of Insured.

Related Post: