Ira Rollover Chart

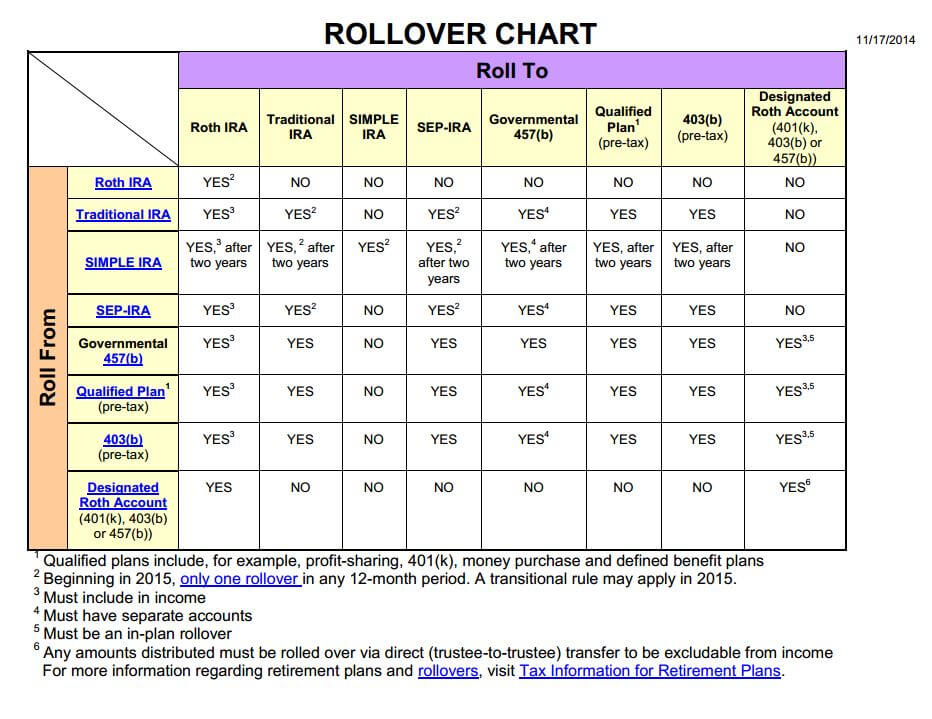

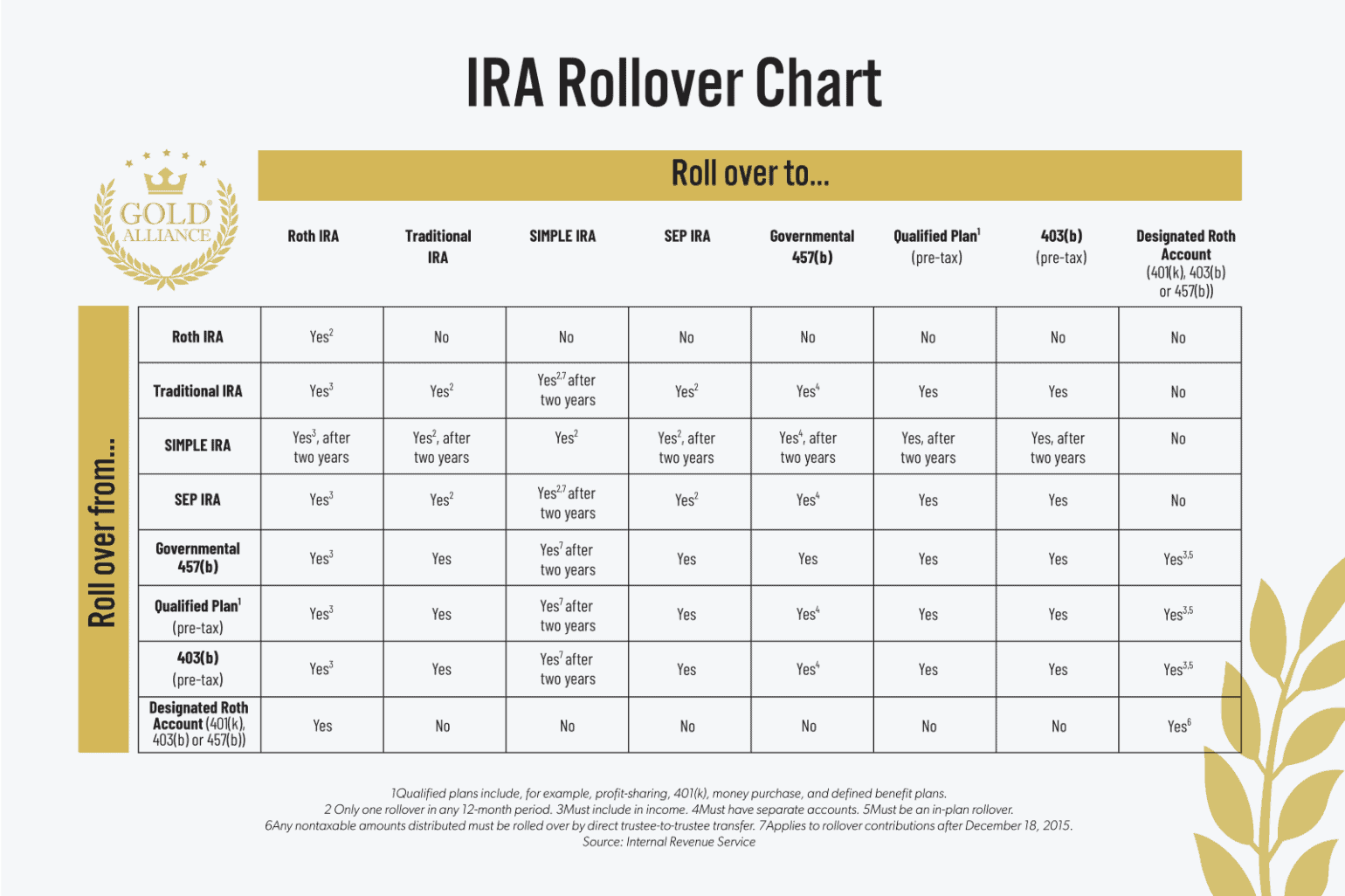

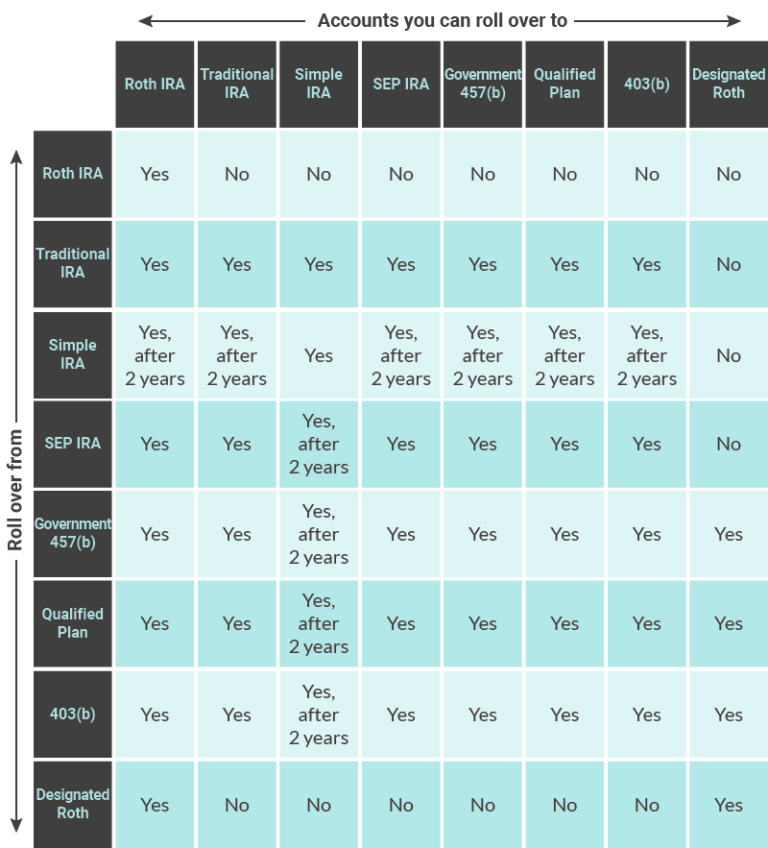

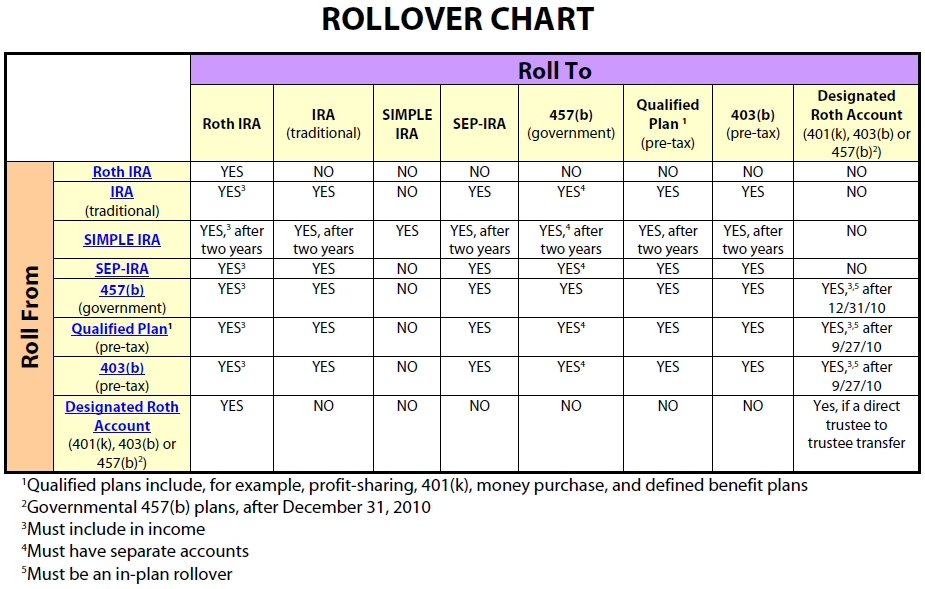

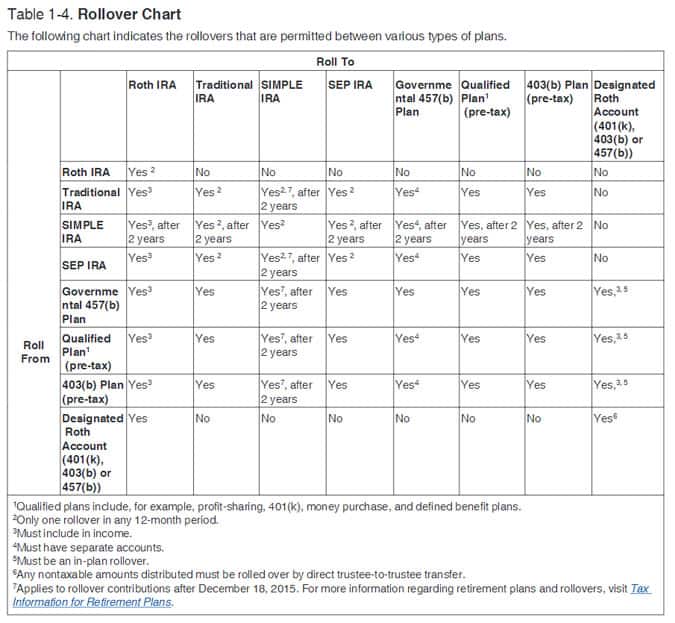

Ira Rollover Chart - The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). What is an ira rollover? Web a rollover is when you move funds from one eligible retirement plan to another, such as from a 401(k) to a traditional ira or roth ira. Benefits of a rollover ira. Web rolling over your 401 (k) to an ira. To postpone including the distribution in your income, you must complete the rollover by august 29, 2023, the 60th day following june 30. Already have a fidelity ira? Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Review a chart of allowable rollover transactions. Web skynesher / getty images. Web rolling over your 401 (k) to an ira. Benefits of a rollover ira. Whether or not you're moving to a new employer and a new 401 (k) plan, you might consider moving the money in your old plan into an ira. What is an ira rollover? Web a rollover is when you move funds from one eligible retirement plan. Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Consider all your choices and learn if a rollover is right for you. Rollover distributions are reported to the irs and may be subject to federal income tax withholding. Web rolling over your 401 (k) to an ira. What is. Rollover distributions are reported to the irs and may be subject to federal income tax withholding. What is an ira rollover? Follow these steps to move your old 401 (k) questions? Web rolling over your 401 (k) to an ira. Benefits of a rollover ira. Follow these steps to move your old 401 (k) questions? Review a chart of allowable rollover transactions. The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). What is an ira rollover? Web explore rolling over your retirement assets at merrill. Web you received an eligible rollover distribution from your traditional ira on june 30, 2023, that you intend to roll over to your 403(b) plan. Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Consider all your choices and learn if a rollover is right for you. Whether or. What is an ira rollover? Web you received an eligible rollover distribution from your traditional ira on june 30, 2023, that you intend to roll over to your 403(b) plan. To postpone including the distribution in your income, you must complete the rollover by august 29, 2023, the 60th day following june 30. Consider all your choices and learn if. What is an ira rollover? Follow these steps to move your old 401 (k) questions? Review a chart of allowable rollover transactions. Rollover distributions are reported to the irs and may be subject to federal income tax withholding. Benefits of a rollover ira. Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira. Web explore rolling over your retirement assets at merrill 1. Already have a fidelity ira? Web a rollover is when you move funds from one eligible retirement plan to another, such as from a 401(k) to a traditional ira or. Web skynesher / getty images. Consider all your choices and learn if a rollover is right for you. Consolidate your assets plus access tools and investment choices available at merrill by rolling over your retirement account. Web a rollover is when you move funds from one eligible retirement plan to another, such as from a 401(k) to a traditional ira. What is an ira rollover? Already have a fidelity ira? Consider all your choices and learn if a rollover is right for you. Whether or not you're moving to a new employer and a new 401 (k) plan, you might consider moving the money in your old plan into an ira. To postpone including the distribution in your income, you. Web explore rolling over your retirement assets at merrill 1. Consolidate your assets plus access tools and investment choices available at merrill by rolling over your retirement account. Already have a fidelity ira? The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Rollover distributions are reported to the irs and may be subject to federal income tax withholding. Web skynesher / getty images. Benefits of a rollover ira. Follow these steps to move your old 401 (k) questions? Web rolling over your 401 (k) to an ira. Web a rollover is when you move funds from one eligible retirement plan to another, such as from a 401(k) to a traditional ira or roth ira. To postpone including the distribution in your income, you must complete the rollover by august 29, 2023, the 60th day following june 30. Web you received an eligible rollover distribution from your traditional ira on june 30, 2023, that you intend to roll over to your 403(b) plan. Web find out how and when to roll over your retirement plan or ira to another retirement plan or ira.

Learn the Rules of IRA Rollover & Transfer of Funds

Ira Types Chart

IRA Rollover Chart Rules Regarding Rollovers and Conversions AAII

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

What Is A Rollover IRA Rollover IRA IRA Rollover NUA

Ira Transfer Chart A Visual Reference of Charts Chart Master

Ira Types Chart

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

The Ultimate Guide To Easily Roll Over Your Retirement Plan Into An IRA

IRA Rollover Chart

Review A Chart Of Allowable Rollover Transactions.

Consider All Your Choices And Learn If A Rollover Is Right For You.

Whether Or Not You're Moving To A New Employer And A New 401 (K) Plan, You Might Consider Moving The Money In Your Old Plan Into An Ira.

What Is An Ira Rollover?

Related Post: