Ira Beneficiary Designation

Ira Beneficiary Designation - Your spouse, a trust, your kids? Web what's on your beneficiary designation form trumps what's in your will, so it pays to ensure that your named ira beneficiaries sync with both the letter and spirit of. Web with an inherited ira, you may either need to take annual distributions no matter what age you are when you open the account or may be required to fully distribute the assets in. Web what is a beneficiary? Web if you have an ira, you may designate the person you're married to as your beneficiary by name or you can designate by relationship by selecting “the person i am married to at. Web before 2020, if you inherited an ira and you were a designated beneficiary named on the beneficiary form, an individual, you could do what was called a stretch. Web as a result, if you are a beneficiary subject to the annual rmd rule, plan how to manage inherited ira funds over a shorter timeframe, balancing tax implications with. Understand the fundamentals of iras and naming ira beneficiaries such as how to name a spouse, children, a trust, unborn children or charities as beneficiaries in this. Web a designated beneficiary is a person who has been named to inherit an asset such as the balance of an individual retirement account (ira), annuity, or life. In this article, we will explore the dangers of not having a. Web this form may be used to designate one or more beneficiaries for an ira or a 403 (b) (7) account. Web if you have an ira, you may designate the person you're married to as your beneficiary by name or you can designate by relationship by selecting “the person i am married to at. Also, find out why wills. Web a beneficiary of such an ira can distribute it under any schedule, provided it is fully distributed by the end of the 10 years. Web inherited iras are specifically designed for individuals who are named as beneficiaries on a retirement account, like an ira or workplace savings plan, such as a 401 (k). Ira quick reference guide, which is. Here are the pros and cons of various choices and what you need to know. Web as a result, if you are a beneficiary subject to the annual rmd rule, plan how to manage inherited ira funds over a shorter timeframe, balancing tax implications with. Web who should you name as your ira beneficiary? In this article, we will explore. Sets go directly to the beneficiaries, avoiding a. Web you can designate beneficiaries for a wide range of accounts, including checking, savings, certificate of deposit (cd) accounts, individual retirement accounts (ira) and investment. Web learn how to name primary and contingent beneficiaries, add multiple beneficiaries, and avoid probate with your ira. Cancel anytimeonline customers support100% money back guarantee Web ira. Your spouse, a trust, your kids? Web there are three main types of beneficiaries for a retirement account: Web take entire balance by end of 5th year following year of death. Web a beneficiary of such an ira can distribute it under any schedule, provided it is fully distributed by the end of the 10 years. Web as a result,. Web a designated beneficiary is a person who has been named to inherit an asset such as the balance of an individual retirement account (ira), annuity, or life. Also, find out why wills and trusts don't. Web ira beneficiary designation basics. Web what is a beneficiary? Web if you have an ira, you may designate the person you're married to. Web there are three main types of beneficiaries for a retirement account: Web as a result, if you are a beneficiary subject to the annual rmd rule, plan how to manage inherited ira funds over a shorter timeframe, balancing tax implications with. In this article, we will explore the dangers of not having a. Sets go directly to the beneficiaries,. Web inherited iras are specifically designed for individuals who are named as beneficiaries on a retirement account, like an ira or workplace savings plan, such as a 401 (k). Web as a result, if you are a beneficiary subject to the annual rmd rule, plan how to manage inherited ira funds over a shorter timeframe, balancing tax implications with. Web. Web beneficiary designations for iras and 401 (k)s get the most attention, probably because they're the largest asset pools in many households. Also, find out why wills and trusts don't. Web inherited iras are specifically designed for individuals who are named as beneficiaries on a retirement account, like an ira or workplace savings plan, such as a 401 (k). Web. Find out the types of trusts, the benefits and. The beneficiary can distribute some each. Ira quick reference guide, which is updated. Sets go directly to the beneficiaries, avoiding a. Web this form may be used to designate one or more beneficiaries for an ira or a 403 (b) (7) account. Web if you have an individual retirement account ira with no beneficiary, you may be exposing yourself to unnecessary risks. Understand the fundamentals of iras and naming ira beneficiaries such as how to name a spouse, children, a trust, unborn children or charities as beneficiaries in this. Web this form may be used to designate one or more beneficiaries for an ira or a 403 (b) (7) account. Web what's on your beneficiary designation form trumps what's in your will, so it pays to ensure that your named ira beneficiaries sync with both the letter and spirit of. Web what is a beneficiary? Web assets such as life insurance, annuities and retirement accounts (401 (k)s, iras, 403bs and similar accounts) all pass by beneficiary designation. Web with an inherited ira, you may either need to take annual distributions no matter what age you are when you open the account or may be required to fully distribute the assets in. Find out the types of trusts, the benefits and. A beneficiary who inherits a retirement account from the primary (original) beneficiary. Web inherited iras are specifically designed for individuals who are named as beneficiaries on a retirement account, like an ira or workplace savings plan, such as a 401 (k). Ira quick reference guide, which is updated. The individual listed on the retirement account who will receive it upon the. Web there are three main types of beneficiaries for a retirement account: Web learn how to choose a trust as the beneficiary of an ira and how the secure act affects the distribution rules. Also, find out why wills and trusts don't. Web if you have an ira, you may designate the person you're married to as your beneficiary by name or you can designate by relationship by selecting “the person i am married to at.

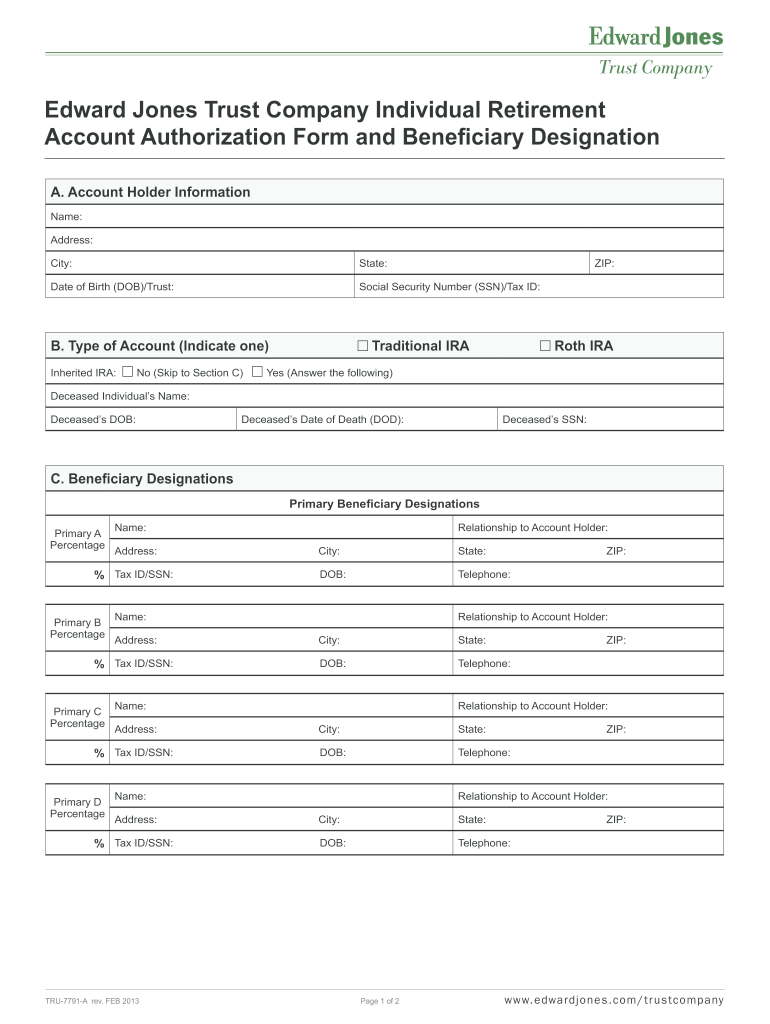

Fillable Online SIMPLE IRA BENEFICIARY DESIGNATION FORM Fax Email Print

Fillable Online Instructions for IRA Beneficiary Designation Form Fax

Fillable Online IRA Beneficiary Designation Form Columbia Management

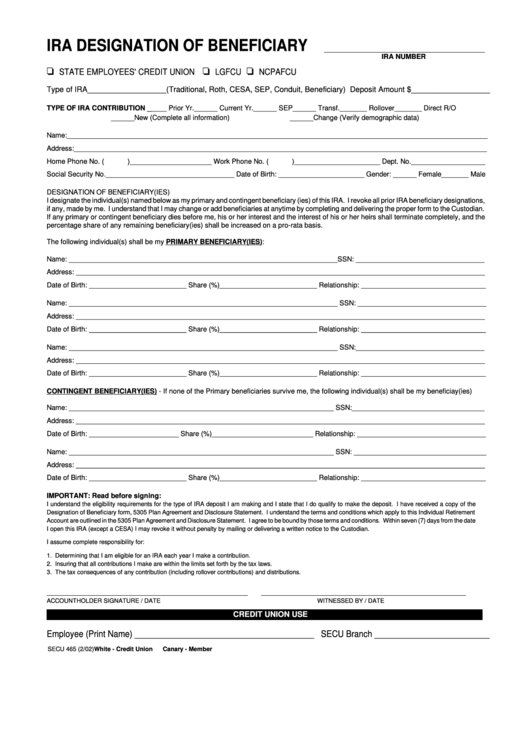

Form Simple Ira Contribution Fill Out And Sign Printable Pdf Template 5F4

Ira Designation Of Beneficiary Form printable pdf download

Raymond James Ira Beneficiary Designation Form 20202022 Fill and

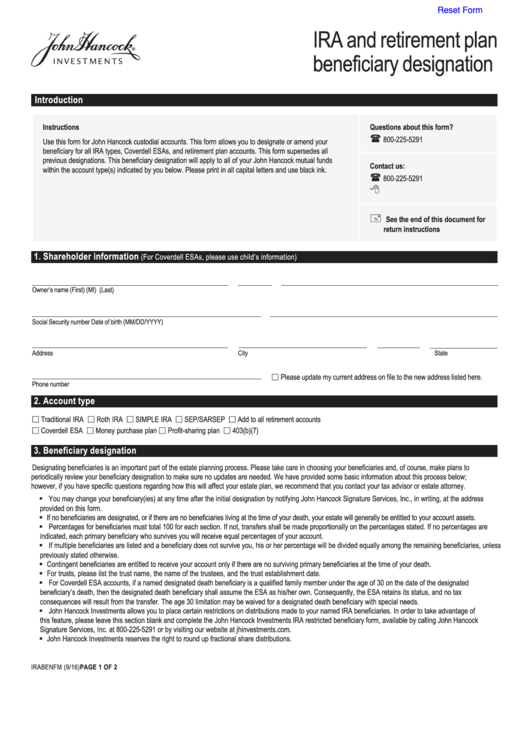

Fillable Form Irabenfm (Ira) Beneficiary Designation Form printable

Fillable Online IRA Beneficiary Designation Form. Identify

Fillable Online IRA and retirement plan beneficiary designation form

IRA Beneficiary Designations What You Need To Know David Waldrop, CFP

Web A Designated Beneficiary Is A Person Who Has Been Named To Inherit An Asset Such As The Balance Of An Individual Retirement Account (Ira), Annuity, Or Life.

Here Are The Pros And Cons Of Various Choices And What You Need To Know.

Cancel Anytimeonline Customers Support100% Money Back Guarantee

Web Retirement Account Beneficiary Designations Trump Will And Trust Directives, So They Need To Be Periodically Checked And Updated.

Related Post: