Inverted Head And Shoulders Pattern

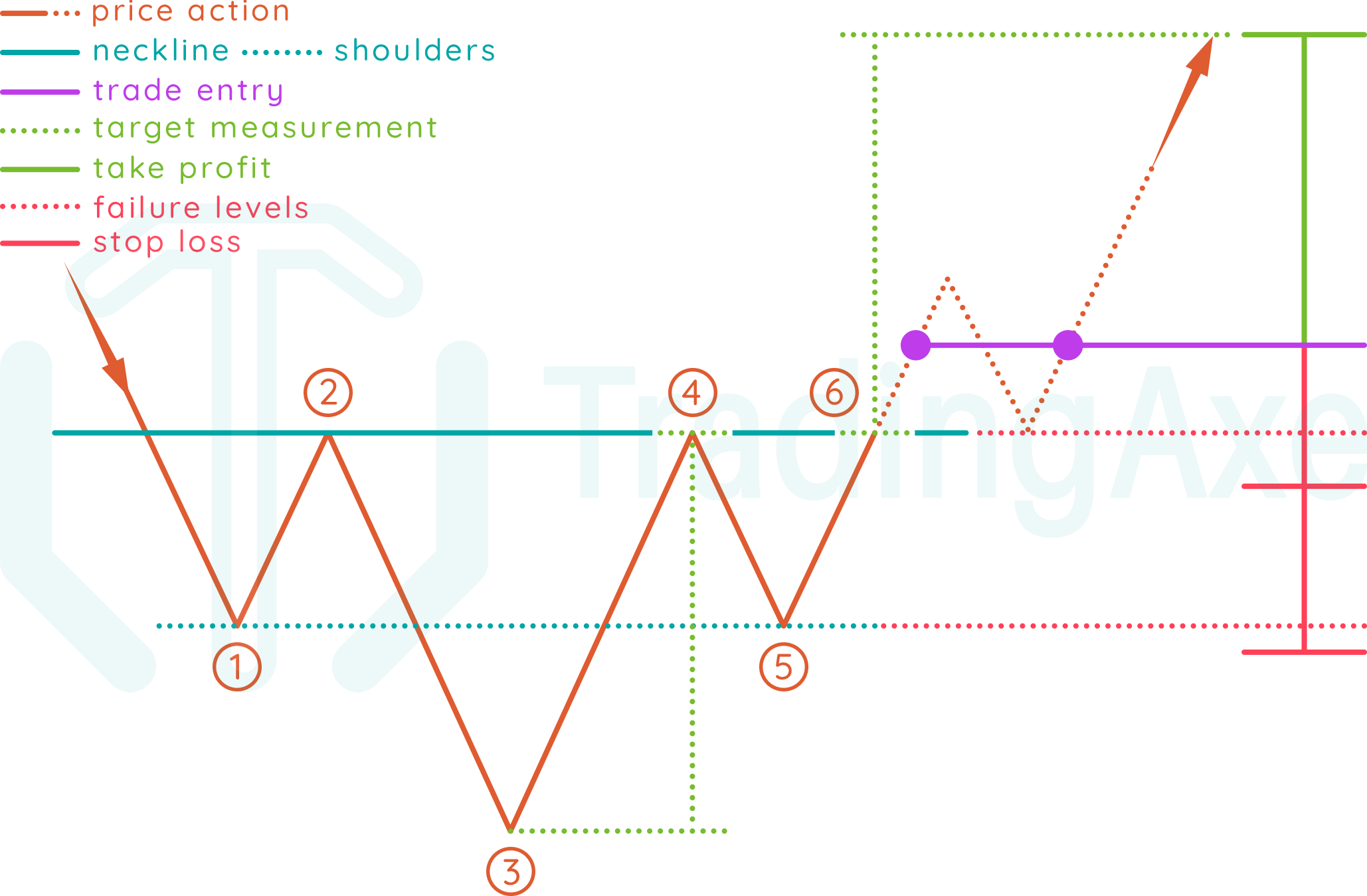

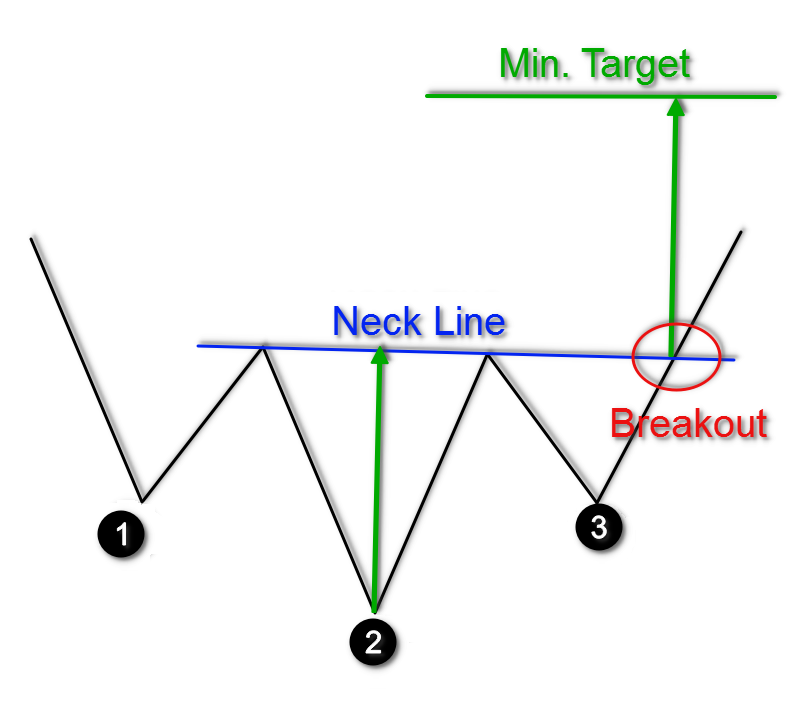

Inverted Head And Shoulders Pattern - It is the opposite version of the head and shoulders pattern (which is a. It is considered a reliable indicator that the asset’s price, which could be a stock, cryptocurrency, or future, is about to change direction and potentially embark on an upward trend. Web inverse head and shoulders: Web the inverse head and shoulders pattern is a bullish trend reversal chart pattern. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Head and shoulders bottoms go to the upside as a successful breakout about 75% of the time. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart pattern, used in technical analysis to predict the reversal of a current. Web the inverted head and shoulders pattern is a classic chart pattern used in technical analysis to predict a reversal in a downward trend. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. The second component is the inverse head and shoulders formation, which is formed when the asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Web inverse head and shoulders formation. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart. It is considered a reliable indicator that the asset’s price, which could be a stock, cryptocurrency, or future, is about to change direction and potentially embark on an upward trend. It is the opposite version of the head and shoulders pattern (which is a. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used. In fact, it has the probability to give you impressive gains when you trade this. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Web the inverted head and shoulders pattern is. It is the opposite version of the head and shoulders pattern (which is a. The second component is the inverse head and shoulders formation, which is formed when the asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). It is identified by three successive troughs, with. The inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart pattern, used in technical analysis to predict. It is identified by three successive troughs, with the middle being the deepest (the head) and the other approximately equal in depth (the shoulders). The inverse head and shoulders pattern is a bullish candlestick formation that occurs at the end of a downward trend and potentially signals the end of a trend and the beginning of a new upward trend.. It is identified by three successive troughs, with the middle being the deepest (the head) and the other approximately equal in depth (the shoulders). Web the inverted head and shoulders pattern is a classic chart pattern used in technical analysis to predict a reversal in a downward trend. Web what is the inverse head and shoulders candlestick pattern? It is. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web the inverted head and shoulders pattern is a classic chart pattern used in technical analysis to predict a reversal in a downward trend. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low,. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web inverse head and shoulders: Head and shoulders bottoms go to the upside as a successful breakout about 75% of the time. The second component is the inverse head and shoulders formation, which is formed when the asset’s price creates a low (the. Among the myriad of chart formations, the inverted head and shoulders, also known as the upside down head and shoulders, is a critical beacon, indicating a significant shift in market trends.this. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart pattern, used in technical analysis to predict the reversal of a current.. Web the inverted head and shoulders pattern is a classic chart pattern used in technical analysis to predict a reversal in a downward trend. It is considered a reliable indicator that the asset’s price, which could be a stock, cryptocurrency, or future, is about to change direction and potentially embark on an upward trend. Sometimes, there is a fake out, which. An inverse head and shoulders, often referred to as a head and shoulders bottom, is a chart pattern, used in technical analysis to predict the reversal of a current. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used by intermediate and advanced traders to identify potential reversals in market trends. Web inverse head and shoulders formation. In fact, it has the probability to give you impressive gains when you trade this. It is identified by three successive troughs, with the middle being the deepest (the head) and the other approximately equal in depth (the shoulders). It is the opposite version of the head and shoulders pattern (which is a. The second component is the inverse head and shoulders formation, which is formed when the asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Among the myriad of chart formations, the inverted head and shoulders, also known as the upside down head and shoulders, is a critical beacon, indicating a significant shift in market trends.this. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Web what is the inverse head and shoulders candlestick pattern? Web the inverse head and shoulders pattern is a bullish trend reversal chart pattern.

Inverse Head and Shoulders Pattern Trading Strategy Guide

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

Head and Shoulders Trading Patterns ThinkMarkets EN

Inverted Head And Shoulder Pattern Finschool

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

How To Trade Blog What is Inverse Head and Shoulders Pattern

Inverted Head and Shoulder Chart Pattern YouTube

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

Inverse or Inverted Head and Shoulders Pattern Chart Patterns

Inverse Head and Shoulders Pattern How To Spot It

Web Inverse Head And Shoulders:

The Inverse Head And Shoulders Pattern Is A Bullish Candlestick Formation That Occurs At The End Of A Downward Trend And Potentially Signals The End Of A Trend And The Beginning Of A New Upward Trend.

Head And Shoulders Bottoms Go To The Upside As A Successful Breakout About 75% Of The Time.

Web For Many Investors And Technical Analysts, Recognizing Patterns In Price Charts Serves As A Compass In The Often Tumultuous Seas Of Trading.

Related Post: