Inverted Head And Shoulders Chart Pattern

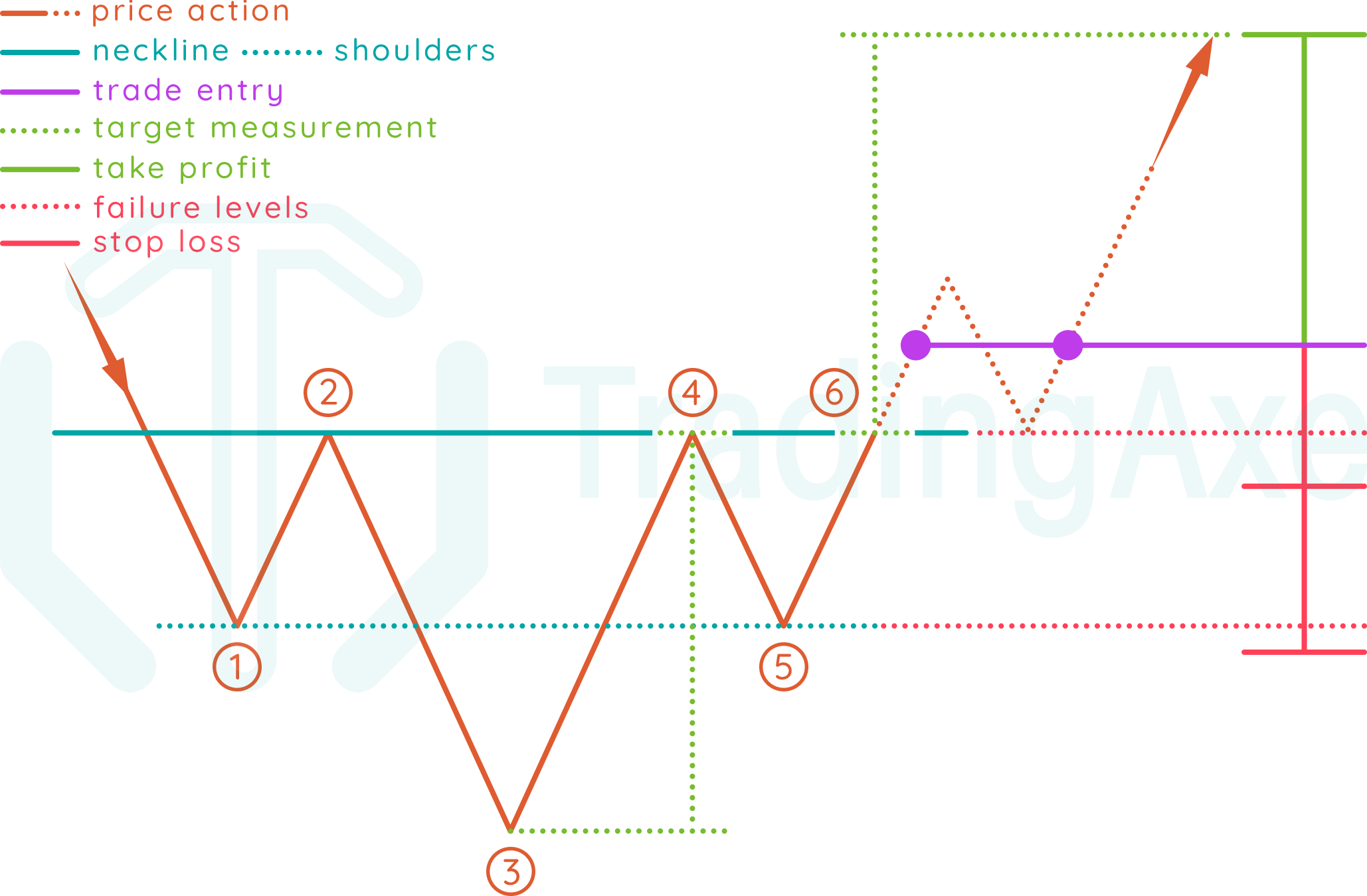

Inverted Head And Shoulders Chart Pattern - Web the inverse head and shoulders pattern resembles the standard head and shoulders pattern but is inverted. Understanding and identifying this pattern can provide traders with profitable trading opportunities. Web this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. Web inverted head and shoulders pattern. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used by intermediate and advanced traders to identify potential reversals in market trends. The middle trough is the lowest among all three. Web the inverse head and shoulders pattern suggests going from a downtrend to an uptrend. It is the opposite of the head and shoulders chart. The left shoulder, a lower middle head, and a second right shoulder roughly at the same level as the left one, all located below a common downward trend. Web the head and shoulders pattern is often considered a reliable indicator of a trend reversal. This chart pattern is the opposite of the traditional head and shoulder (h&s)” pattern. Yes, it has reverted to the prior millennium during the biggest 25 year bull market in history. Web inverted head and shoulders pattern. The first and third lows are called shoulders. Web this indicator automatically draws and sends alerts for all of the chart patterns in. Signals the traders to enter into long position above the neckline. Read about head and shoulder pattern here: Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern.. Web the inverted head and shoulders pattern is a popular and reliable reversal pattern that signals a potential shift from a downtrend to an uptrend. The left trough or the left shoulder. Incredibly, it has returned to its price level of february 1999. An inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal. Diminished volume on the bottoms and an increase in volume on the breaking of the neckline. Inverse h&s pattern is bullish reversal pattern. Volume play a major role in both h&s and inverse h&s patterns. Just to prove i’m totally off my rocker, i. Yes, it has reverted to the prior millennium during the biggest 25 year bull market in. When this pattern forms, it typically signals that the stock’s price may soon reverse its current trend, providing a valuable opportunity to buy or sell. Web this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. The inverse head and shoulders pattern is a reversal pattern in stock trading. Volume. In such cases, one might set a. Traders typically wait for the price to break above the neckline to confirm the pattern before they enter. Market sentiment is shifting from bearish to bullish. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Just to prove. Web inverse head and shoulders pattern,inverse head and shoulders,head and shoulders pattern,head and shoulders,inverse head and shoulders pattern rules,inverse. The left trough or the left shoulder. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web the inverted head and shoulders pattern. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. Traders typically wait for the price to break above the neckline to confirm the pattern before they enter. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal. The middle trough is the lowest among all three. Incredibly, it has returned to its price level of february 1999. It is inverted with the head. It is of two types: Web this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. It is inverted with the head. Diminished volume on the bottoms and an increase in volume on the breaking of the neckline. The formation consists of three distinct lows: Volume play a major role in both h&s and inverse h&s patterns. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from. Illustration of how to trade inverted head and shoulders chart pattern. It represents a bullish signal suggesting a potential reversal of a current downtrend. Web the inverted head and shoulders pattern, also known as the head and shoulders bottom, is a popular chart pattern used in technical analysis to predict trend reversals. Market sentiment is shifting from bearish to bullish. The first and third lows are called shoulders. Incredibly, it has returned to its price level of february 1999. The center trough or the head. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. Diminished volume on the bottoms and an increase in volume on the breaking of the neckline. Read about head and shoulder pattern here: In such cases, one might set a. Web inverted head and shoulders pattern. Web the head and shoulders pattern is often considered a reliable indicator of a trend reversal. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. The formation consists of three distinct lows: The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom.

Inverse Head and Shoulders Pattern How To Spot It

Inverse or Inverted Head and Shoulders Pattern Chart Patterns

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Chart Pattern Inverse Head And Shoulders — TradingView

Inverse Head and Shoulders Pattern Trading Strategy Guide

How To Trade Blog What is Inverse Head and Shoulders Pattern

Inverted Head and Shoulder Chart Pattern Best Analysis

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

Head and Shoulders Trading Patterns ThinkMarkets EN

Chart Patterns The Head And Shoulders Pattern Forex Academy

Yes, It Has Reverted To The Prior Millennium During The Biggest 25 Year Bull Market In History.

Web Inverse Head And Shoulders.

Web The Inverted Head And Shoulders Pattern Is A Popular And Reliable Technical Chart Pattern Used By Intermediate And Advanced Traders To Identify Potential Reversals In Market Trends.

Web The Inverse Head And Shoulders Pattern Suggests Going From A Downtrend To An Uptrend.

Related Post: