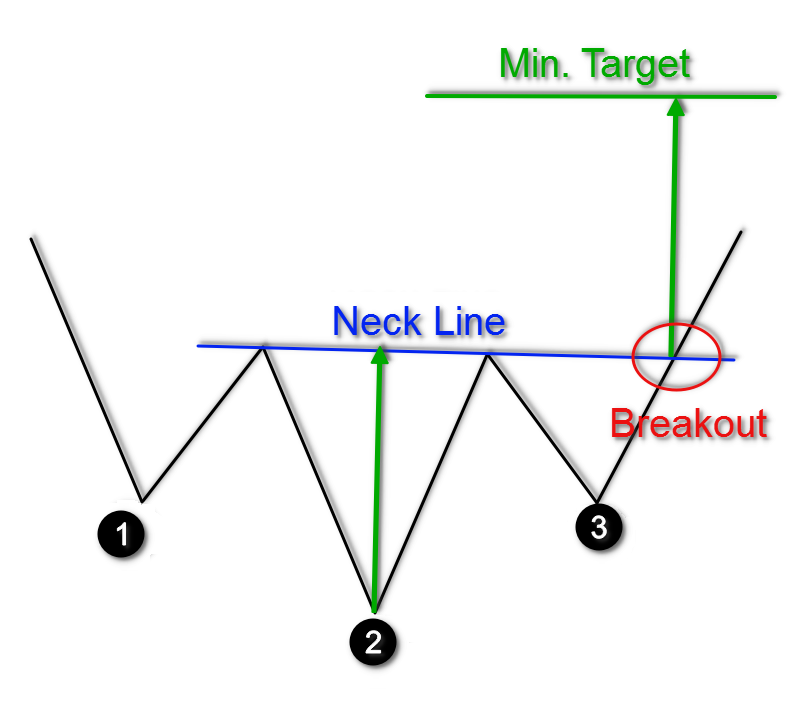

Inverted Head And Shoulder Pattern

Inverted Head And Shoulder Pattern - This chart pattern has three consecutive. Web learn how to identify and trade the inverse head and shoulders pattern, a bullish reversal formation in a downtrend. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading that indicates a bullish trend. It is characterized by three bottoms (troughs), where. Price declines followed by a. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web learn how to identify and use the inverse head and shoulders pattern, a bullish signal of a potential trend reversal in technical analysis. Following this, the price generally goes to. This pattern indicates a bullish reversal from a downtrend and has. Web an inverted head and shoulders pattern is similar to the head and shoulders pattern but is inverted in shape. This pattern indicates a bullish reversal from a downtrend and has. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web inverse head and shoulders pattern. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used by intermediate and advanced traders to identify potential. The indicator shows the pattern status, the. Web if you're looking to add a position, the formation of an inverse head and shoulders, with a stock price breaking above the neckline, often indicates a bearish trend. Web learn how to identify and trade the inverse head and shoulders pattern, a bullish chart pattern that signals the buyers are in control. The indicator shows the pattern status, the. Web if you're looking to add a position, the formation of an inverse head and shoulders, with a stock price breaking above the neckline, often indicates a bearish trend. Price declines followed by a. This chart pattern has three consecutive. Web learn how to identify and use the inverse head and shoulders pattern, a bullish candlestick formation that occurs at the end of a downward trend. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading that indicates a bullish. Web learn how to identify and trade the inverse head and shoulders pattern, a bullish reversal formation in a downtrend. See examples, videos, and statistics of this chart pattern on. Web the inverse head and shoulders pattern resembles the standard head and shoulders pattern but is inverted. The indicator shows the pattern status, the. Web learn how to identify and. Web inverse head and shoulders pattern. See examples, videos, and statistics of this chart pattern on. Web inverse head and shoulders. Often seen at the bottom of the. Formation of the inverse head and shoulders pattern seen at market bottoms: Web learn how to identify and trade the inverse head and shoulders pattern, a bullish reversal formation in a downtrend. Web inverse head and shoulders. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web learn how to identify and trade the inverse head and shoulders pattern, a. Following this, the price generally goes to. Discover the key factors to. Web learn how to identify and trade the inverse head and shoulders pattern, a bullish chart pattern that signals the buyers are in control. Web the inverted head and shoulders pattern is a popular and reliable reversal pattern that signals a potential shift from a downtrend to an. Often seen at the bottom of the. Web inverse head and shoulders. Web learn how to identify and use the inverse head and shoulders pattern, a bullish candlestick formation that occurs at the end of a downward trend. This pattern indicates a bullish reversal from a downtrend and has. Discover the key factors to. Following this, the price generally goes to. Web learn how to identify and trade the inverse head and shoulders pattern, a bullish reversal formation that signals a breakout above the neckline. Web if you're looking to add a position, the formation of an inverse head and shoulders, with a stock price breaking above the neckline, often indicates a bearish trend. See examples, videos, and statistics of this chart pattern on. Web learn how to identify and use the inverse head and shoulders pattern, a bullish candlestick formation that occurs at the end of a downward trend. The indicator shows the pattern status, the. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web the inverted head and shoulders pattern is a popular and reliable reversal pattern that signals a potential shift from a downtrend to an uptrend. Web learn how to identify and use the inverse head and shoulders pattern, a bullish signal of a potential trend reversal in technical analysis. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used by intermediate and advanced traders to identify potential. Often seen at the bottom of the. Web learn how to identify and use the inverted head and shoulders pattern, a classic chart pattern that signals a reversal from a downtrend to an uptrend. Web learn how to identify and use the inverted head and shoulders pattern, a reversal pattern formed by three lows and two highs. Web learn how to identify and trade the inverse head and shoulders pattern, a bullish reversal formation in a downtrend. Web the inverse head and shoulders pattern resembles the standard head and shoulders pattern but is inverted. It is characterized by three bottoms (troughs), where. Formation of the inverse head and shoulders pattern seen at market bottoms: Web inverse head and shoulders. This chart pattern has three consecutive.

Inverted Head and Shoulder Chart Pattern Best Analysis

Chart Patterns The Head And Shoulders Pattern Forex Academy

Inverse Head and Shoulders Pattern How To Spot It

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

Inverse Head and Shoulders Pattern The Complete Guide

Inverted Head and Shoulders Chart Patterns (1) Forex4live Platinum 2023

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

:max_bytes(150000):strip_icc()/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)

Inverse Head and Shoulders What the Pattern Means in Trading

Head and Shoulders Trading Patterns ThinkMarkets EN

Web An Inverse Head And Shoulders Is An Upside Down Head And Shoulders Pattern And Consists Of A Low, Which Makes Up The Head, And Two Higher Low Peaks That.

This Pattern Indicates A Bullish Reversal From A Downtrend And Has.

Web Learn How To Identify And Trade The Inverse Head And Shoulders Pattern, A Technical Analysis Pattern That Signals A Potential Trend Reversal In A Downtrend.

Web Learn How To Identify And Trade The Inverse Head And Shoulders Pattern, A Reversal Pattern In Stock Trading That Indicates A Bullish Trend.

Related Post: