Inverted Hammer Pattern

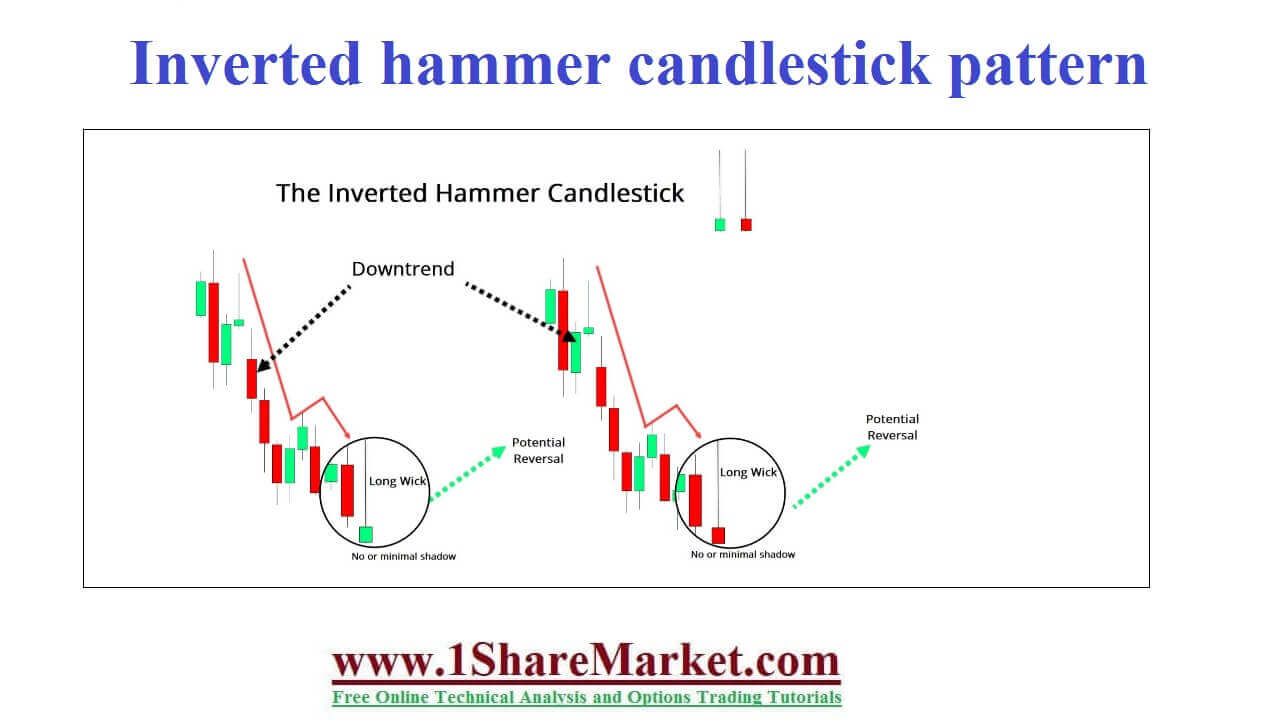

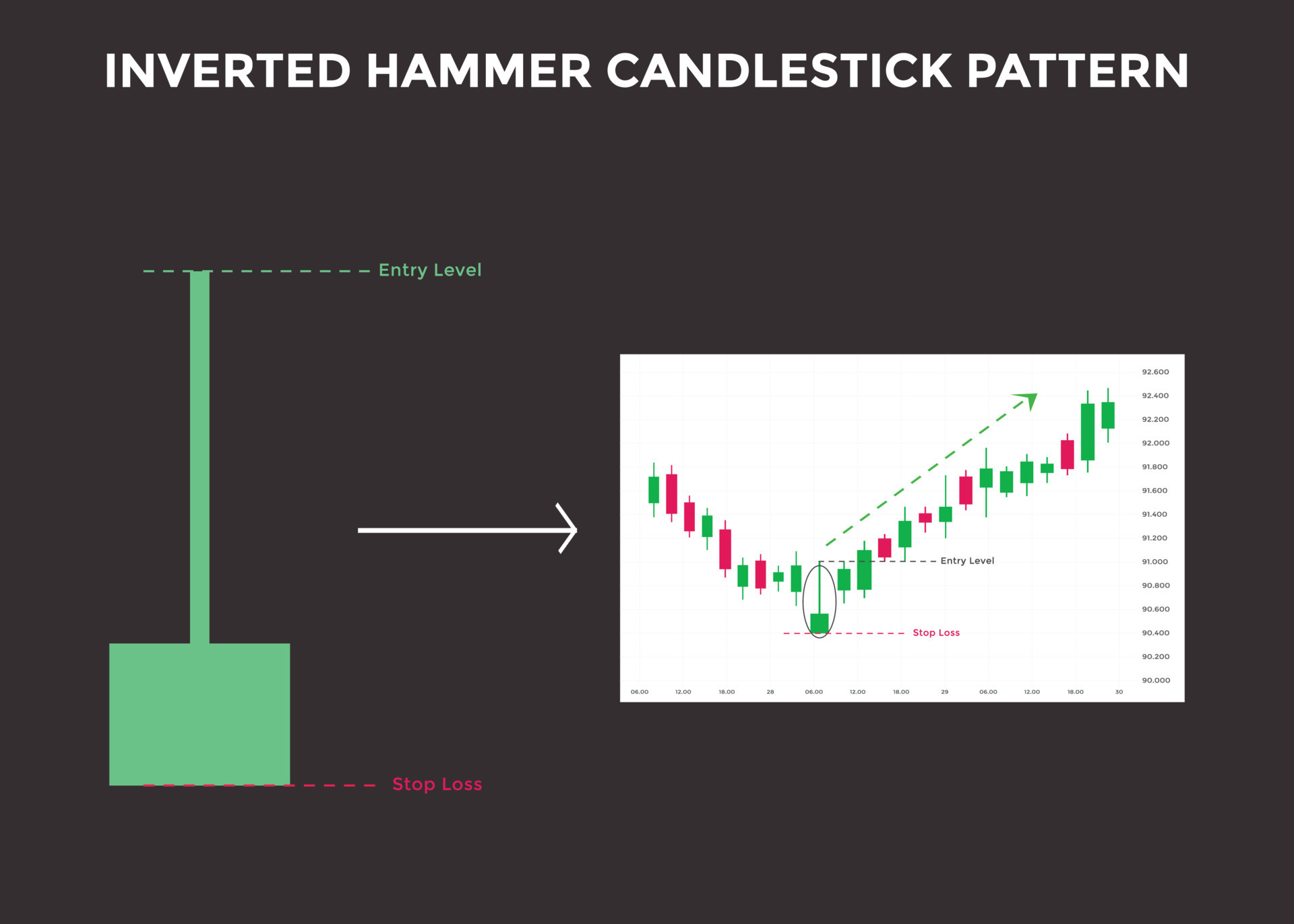

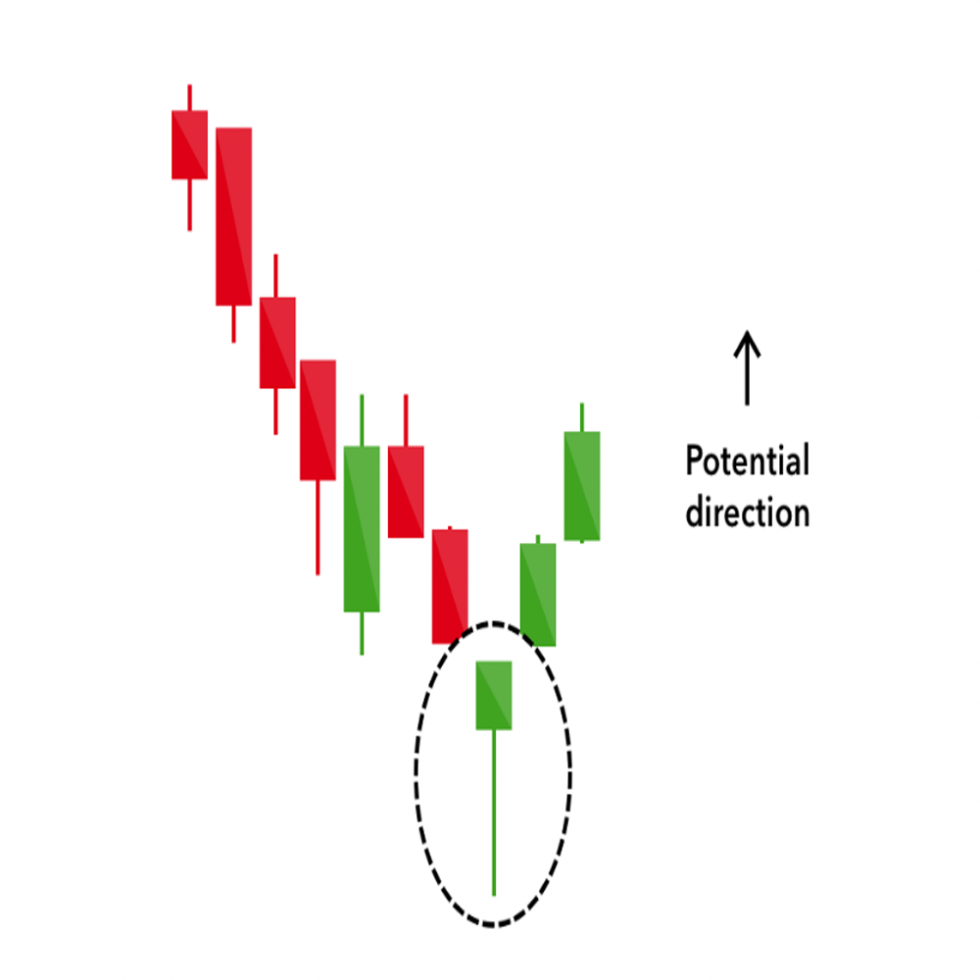

Inverted Hammer Pattern - Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a downtrend and signals a price trend reversal. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. That is why it is called a ‘bullish reversal’ candlestick pattern. This pattern is typically observed at the end of the downtrend, and hence it signals a bullish reversal. Web what is an inverted hammer pattern in candlestick analysis? If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web inverted hammer is a single candle which appears when a stock is in a downtrend. That is why it is called a ‘bullish reversal’ candlestick pattern. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. Web inverted hammer is a single candle which appears when a stock. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a downtrend and signals a price. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web inverted hammer is a single candle which appears when a stock is in a downtrend. That is why it is called a ‘bullish reversal’ candlestick pattern. Web what is an inverted hammer pattern in candlestick analysis? Web the inverted hammer candlestick pattern is formed on. Web what is an inverted hammer pattern in candlestick analysis? Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. That is why it is called a ‘bullish reversal’ candlestick pattern. It signals a potential reversal of price, indicating the initiation of a. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs. This pattern is typically observed at the end of the downtrend, and hence it signals a bullish reversal. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web. That is why it is called a ‘bullish reversal’ candlestick pattern. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example,. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web what is an inverted hammer pattern in candlestick analysis? That is why it is called a. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a downtrend and signals a price trend reversal. That is why it is called a ‘bullish reversal’ candlestick pattern. This pattern is typically observed at the end of the downtrend, and hence it signals a bullish reversal. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web inverted hammer is a single candle which appears when a stock is in a downtrend. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher.

Inverted Hammer Candlestick Pattern Quick Trading Guide

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

prendere un raffreddore Giudizio sigaretta hammer and inverted hammer

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

How to Use the Inverted Hammer Pattern Market Pulse

How to Trade with Inverted Hammer Candlestick Pattern

16 candlestick patterns every trader should know Decision Maker Blog

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

Inverted Hammer Candlestick Pattern (Hindi/Urdu) Inverted Hammer

Web In This Guide To Understanding The Inverted Hammer Candlestick Pattern, We’ll Show You What This Chart Looks Like, Explain Its Components, Teach You How To Interpret It With An Example, And How To Trade On It.

Web What Is An Inverted Hammer Pattern In Candlestick Analysis?

Related Post: