Inverted Hammer Candle Pattern

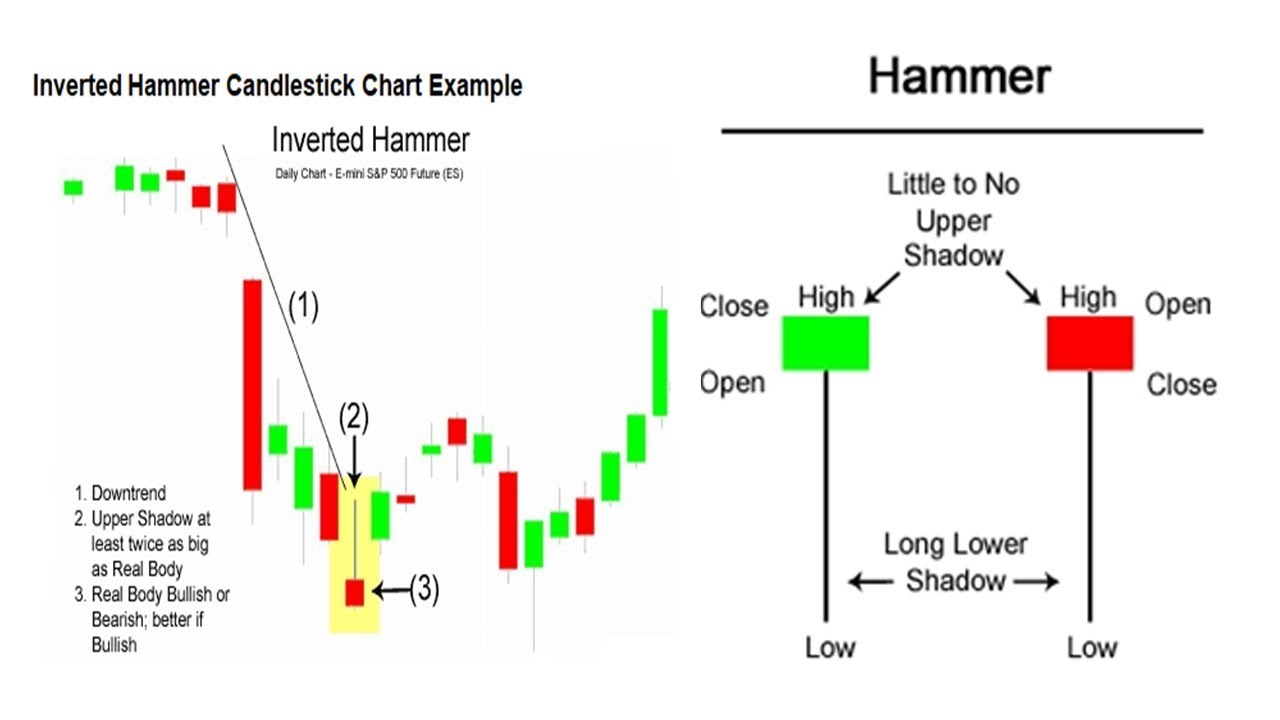

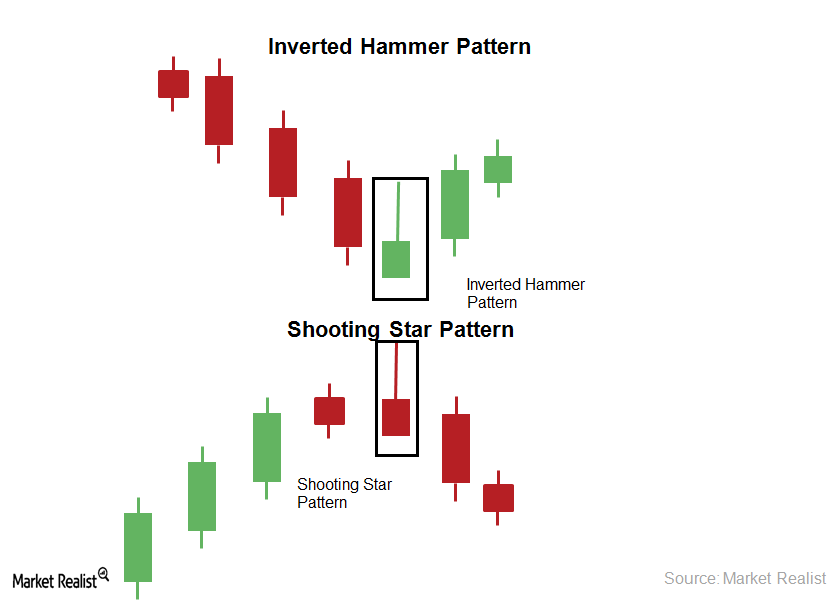

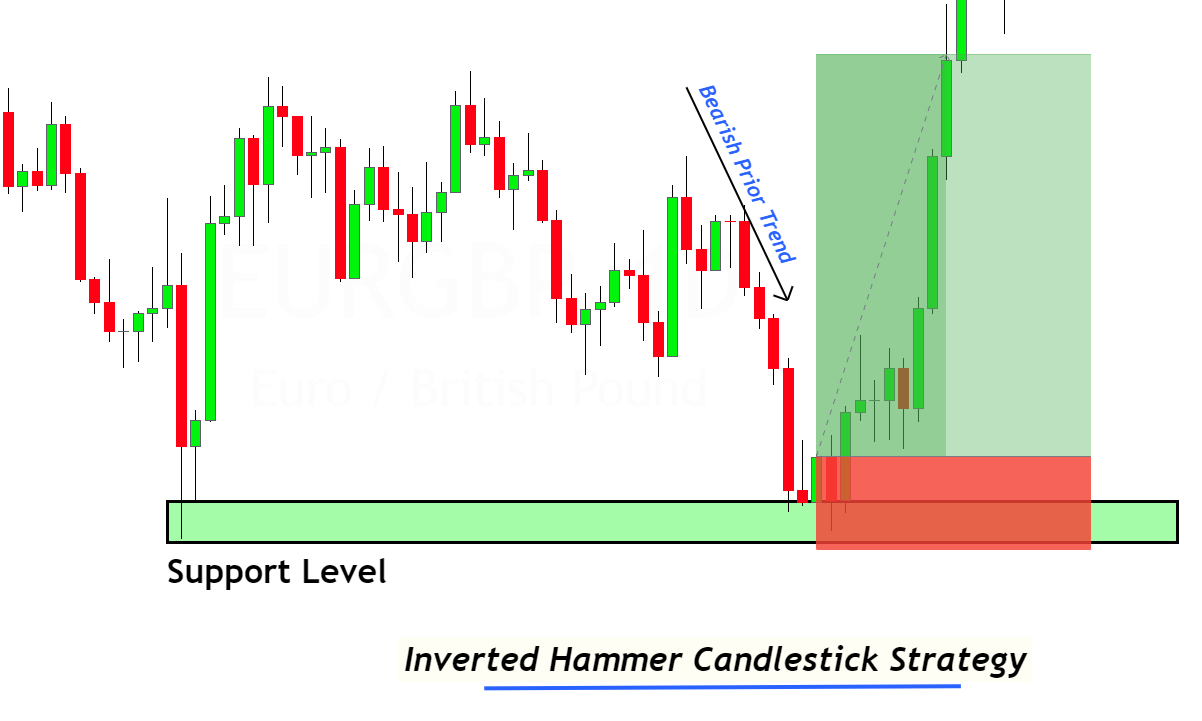

Inverted Hammer Candle Pattern - First, the candle must occur after a downtrend. It signals a potential reversal of price, indicating the initiation of a bullish trend. Web paver patterns, orlando, florida, fl. That means it can be one of the following candles: Web if you’re trying to identify an inverted hammer candlestick pattern, look for the following criteria: Web the inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. Third, the lower shadow should either not exist or be very, very small. It often signals a potential price reversal, where the current trend might be ending or transitioning into a new trend. Web the hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. Second, the upper shadow must be at least two times the size of the real body. Web made entirely by your hands. That is why it is called a ‘bullish reversal’ candlestick pattern. Meanwhile you can send your letters to 824 e eau gallie blvd, indian harbor. Web the inverted hammer candlestick pattern is a crucial tool in technical analysis,. Meanwhile you can send your letters to 824 e eau gallie blvd, indian harbor. Under the friendly guidance of our fragrance and candle experts. The current status of the business is active. This candlestick pattern gets its name from an inverted hammer in. First, the candle must occur after a downtrend. First, the candle must occur after a downtrend. This pattern is typically observed at the end of the downtrend, and hence it signals a bullish reversal. How to use the inverted hammer candlestick pattern in trading? Third, the lower shadow should either not exist or be very, very small. Web the inverted hammer candlestick pattern, also known as the inverse. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web made entirely by your hands. Third, the lower shadow should either not exist or be very, very small. Characterized by its distinctive shape, this pattern provides valuable insights into market sentiment and price action. Orange county pools & pavers provides all. The current status of the business is active. Under the friendly guidance of our fragrance and candle experts. That is why it is called a ‘bullish reversal’ candlestick pattern. Web the inverted hammer candlestick pattern is a crucial tool in technical analysis, heralding potential bullish reversals in bearish markets. Web 5 minute read. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. What is meant by the inverted hammer candlestick? Web the hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal.. Characterized by its distinctive shape, this pattern provides valuable insights into market sentiment and price action. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. Web the inverted hammer candlestick pattern (or. Statistics to prove if the inverted hammer pattern really works. Web the inverted hammer candlestick pattern is commonly observed in the forex market and provides important insight into market momentum. Meanwhile you can send your letters to 824 e eau gallie blvd, indian harbor. Web the inverted hammer pattern is built of two candles. If you’re following traditional inverted hammer. The hammer heads gift & smoke shop, llc principal address is 824 e eau gallie blvd, indian harbor beach, fl, 32937. Are the odds of the inverted hammer pattern in your favor? Second, the upper shadow must be at least two times the size of the real body. Learn how to use it with its significance, benefits, limitations, and more. That is why it is called a ‘bullish reversal’ candlestick pattern. The first candle appears as a long line and has a black body. Second, the upper shadow must be at least two times the size of the real body. Web if you’re trying to identify an inverted hammer candlestick pattern, look for the following criteria: Characterized by its distinctive. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a downtrend and signals a price trend reversal. The hammer heads gift & smoke shop, llc principal address is 824 e eau gallie blvd, indian harbor beach, fl, 32937. How to identify an inverted hammer candlestick pattern? Second, the upper shadow must be at least two times the size of the real body. In particular, the inverted hammer can help to. Under the friendly guidance of our fragrance and candle experts. The current status of the business is active. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. Web the hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal. This candlestick pattern gets its name from an inverted hammer in. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. How does the inverted hammer behave with a 2:1 target r/r ratio? Statistics to prove if the inverted hammer pattern really works. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. What is meant by the inverted hammer candlestick? How to use the inverted hammer candlestick pattern in trading?

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer Candlestick Pattern Quick Trading Guide

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

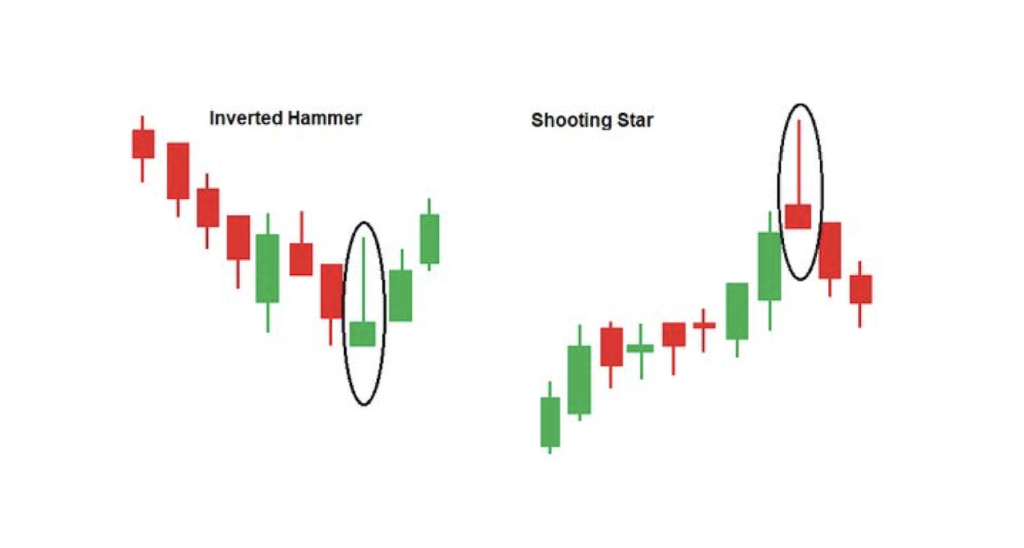

The Inverted Hammer And Shooting Star Candlestick Pattern

Inverted Hammer Candlestick How to Trade it ForexBoat Trading

Inverted Hammer Candlestick Pattern (Bullish Reversal)

Inverted Hammer Candlestick Pattern Forex Trading

Bullish Inverted Hammer Candlestick Pattern ForexBee

Web The Inverted Hammer Pattern Is Built Of Two Candles.

Web The Inverted Hammer Candlestick Pattern Is A Crucial Tool In Technical Analysis, Heralding Potential Bullish Reversals In Bearish Markets.

It Often Appears At The Bottom Of A Downtrend, Signalling Potential Bullish Reversal.

Web Paver Patterns, Orlando, Florida, Fl.

Related Post: