Implied Volatility Chart

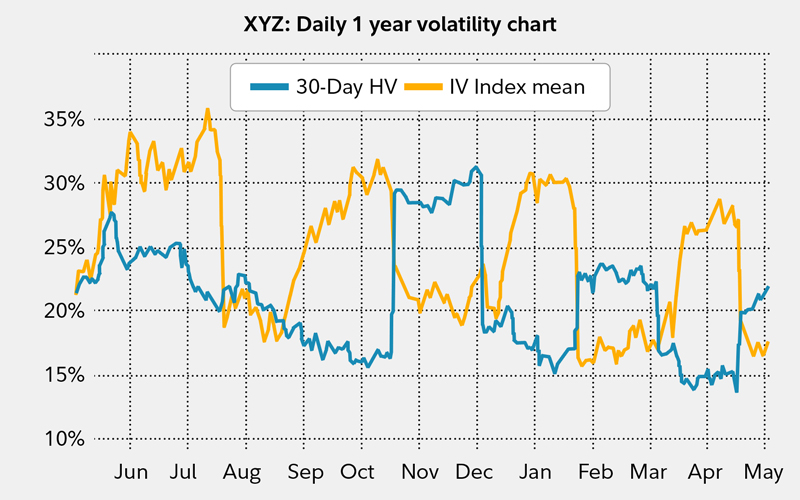

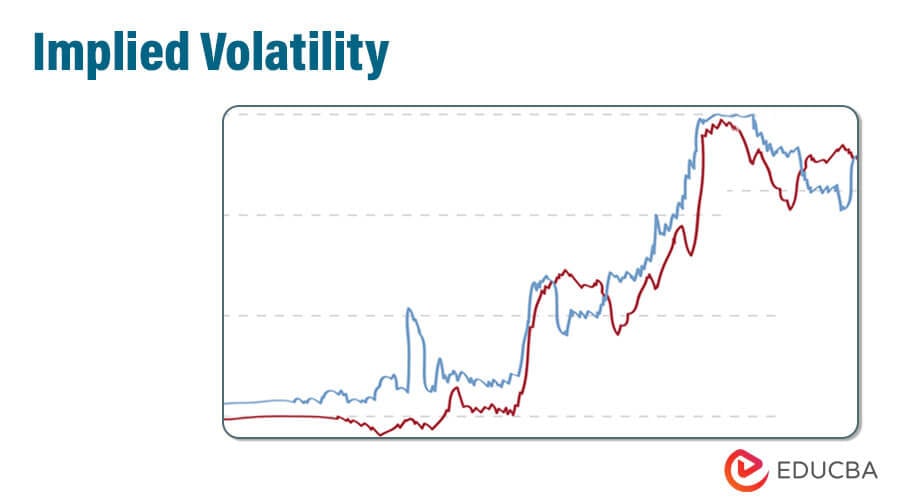

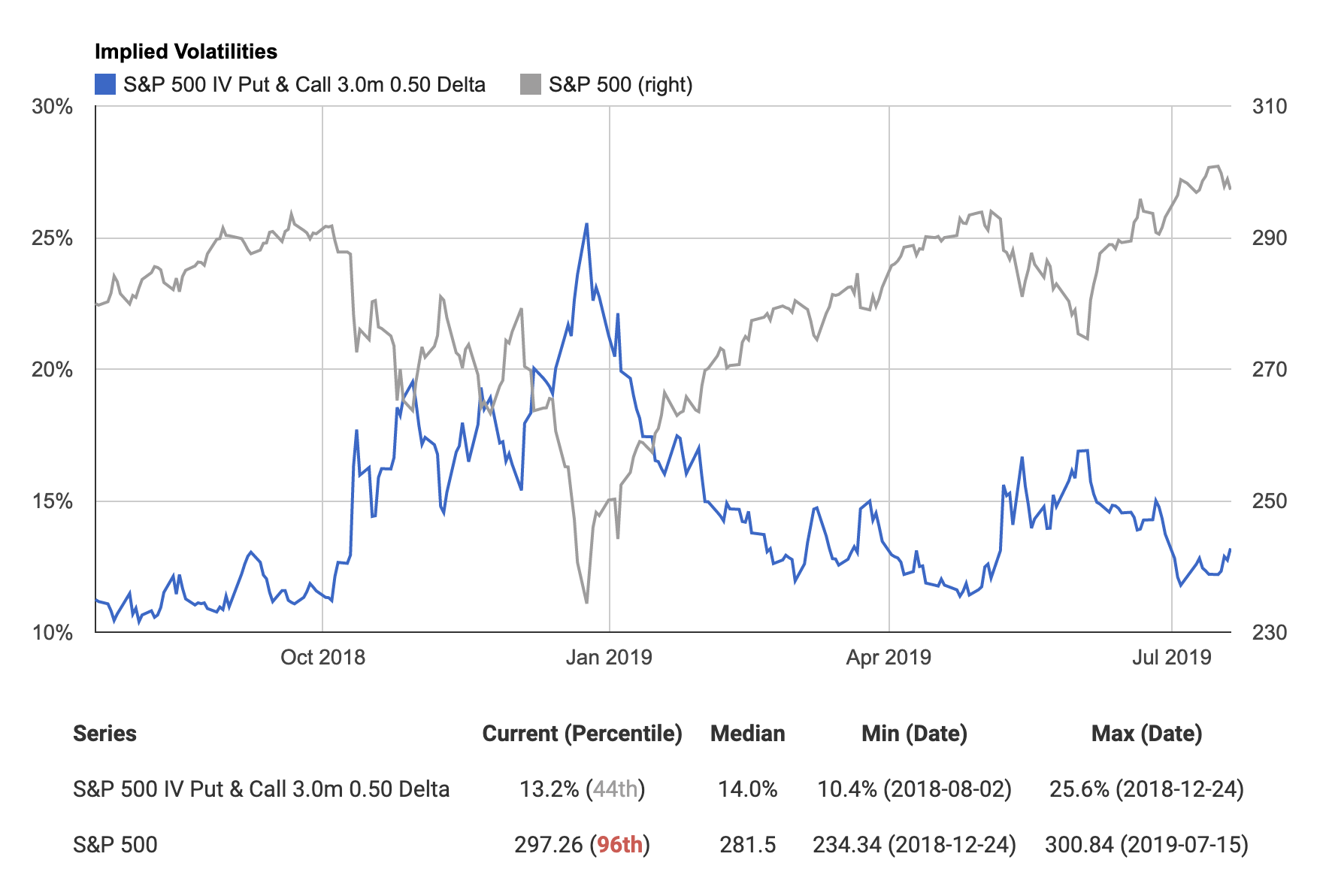

Implied Volatility Chart - Traders and investors can use implied volatility to help gauge the perceived risk or uncertainty in the market and make more informed trading decisions. For the options trader, implied volatility connects standard deviation, the potential price range of a. Our platform allows you to flexibly chart historical implied volatilities, realized volatilities, and skews across global asset classes in seconds. Web implied volatility is a statistical measure of the expected amount of price movements in a given stock or other financial asset over a set future time frame. Markets reflect the economic and geopolitical landscapes, which remain highly turbulent in late july 2024. You can find symbols that have currently elevated option implied volatility, neutral, or subdued. A call option is out of the money (otm) if its strike price is above the price of the underlying stock. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. Nvidia is expected to see more significant price swings than bitcoin and ether. Implied volatility rises and falls, affecting the value and price of. Web implied volatility represents the market consensus of what the price volatility of the underlying instrument will be, so it is very important to understand. Web learn the difference between implied and historical volatility and find out how to align your options trading strategy with the right volatility exposure. Web jul 31, 2024. Web the highest implied volatility options page. Web higher implied volatility generally results in higher option prices, while lower implied volatility generally results in lower option prices. Microsoft is also showing elevated implied volatility with an iv rank of 51.39%. Overlay and compare different stocks and volatility metrics using the interactive features. Web jul 31, 2024. A green implied volatility means it is increasing compared to yesterday,. Web implied volatility represents the expected volatility of a stock over the life of the option. Web our chart tool enables users to visualize options surfaces and compare relative volatilities between stocks by creating simple and more complex spreads or ratios. Overlay and compare different stocks and volatility metrics using the interactive features. Web the vix index measures the implied. Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as demand changes. A call option is out of the money (otm) if its strike price is above the price of the underlying stock. Web implied volatility is a statistical measure of. You can't directly observe it, but you know it's there, and it's measurable. Microsoft is also showing elevated implied volatility with an iv rank of 51.39%. Web implied volatility, synonymous with expected volatility, is a variable that shows the degree of movement expected for a given market or security. Implied volatility shows how the. Create your own screens with over. Web jul 31, 2024. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. Implied volatility (iv) is like gravity. Web implied volatility represents the expected volatility of a stock over the life of the option. Overlay and compare different stocks and volatility metrics using the interactive features. As expectations change, option premiums react appropriately. Markets reflect the economic and geopolitical landscapes, which remain highly turbulent in late july 2024. Web implied volatility (iv) is essentially a measure of how much the market believes the price of a stock or other underlying asset will move in the future, and is a key factor in determining the. Overlay and. Web implied volatility is a statistical measure of the expected amount of price movements in a given stock or other financial asset over a set future time frame. Web shows stocks, etfs and indices with the most option activity on the day, with the atm average iv rank and iv percentile. Our charting tools contain over 10 years of historical. Markets reflect the economic and geopolitical landscapes, which remain highly turbulent in late july 2024. Web implied volatility (iv) is essentially a measure of how much the market believes the price of a stock or other underlying asset will move in the future, and is a key factor in determining the. Implied volatility (iv) is like gravity. Web market chameleon's. Overlay and compare different stocks and volatility metrics using the interactive features. As expectations change, option premiums react appropriately. Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as demand changes. Web the vix index measures the implied volatility of put. You see, an option’s market value is determined in part. Web learn the difference between implied and historical volatility and find out how to align your options trading strategy with the right volatility exposure. An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range. Web our chart tool enables users to visualize options surfaces and compare relative volatilities between stocks by creating simple and more complex spreads or ratios. Web view volatility charts for apple (aapl) including implied volatility and realized volatility. You can find symbols that have currently elevated option implied volatility, neutral, or subdued. 3 describes an option with no intrinsic value. Web implied volatility, synonymous with expected volatility, is a variable that shows the degree of movement expected for a given market or security. A green implied volatility means it is increasing compared to yesterday, and a red implied volatility means it is decreasing compared to yesterday. Nvidia is expected to see more significant price swings than bitcoin and ether. Our platform allows you to flexibly chart historical implied volatilities, realized volatilities, and skews across global asset classes in seconds. As expectations change, option premiums react appropriately. You can't directly observe it, but you know it's there, and it's measurable. Web the vix index measures the implied volatility of put and call options on the s&p 500, the most diversified u.s. Implied volatility rises and falls, affecting the value and price of. Web jul 31, 2024.

Implied Volatility Chart Thinkorswim

How to View Implied Volatility and IV Rank/Percentile on TradingView

Implied Volatility Options Chart

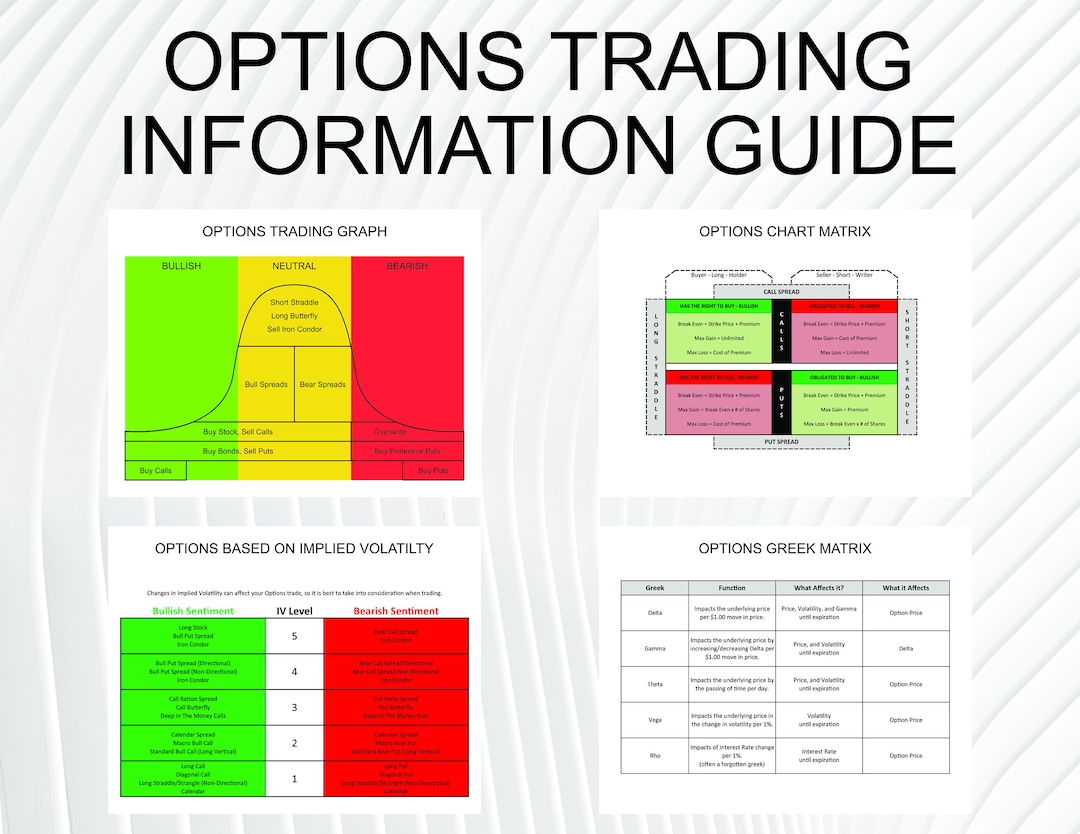

Options Trading Implied Volatility, Chart Matrix, and Options Greek

Implied volatility Fidelity

Implied Volatility Basics, Factors & Importance Chart & Example

Complete Guide to Options Pricing Option Alpha

Implied Volatility Charting · Volatility User Guide

Implied Volatility What is it & Why Should Traders Care?

Implied Volatility What is it & Why Should Traders Care?

Iv Is Constantly Changing With Market Conditions.

Often Labeled As Iv For Short, Implied.

Overlay And Compare Different Stocks And Volatility Metrics Using The Interactive Features.

Web View Volatility Charts For Spdr Dow Jones Industrial Average Etf Trust (Dia) Including Implied Volatility And Realized Volatility.

Related Post: