Ibbotson Charts

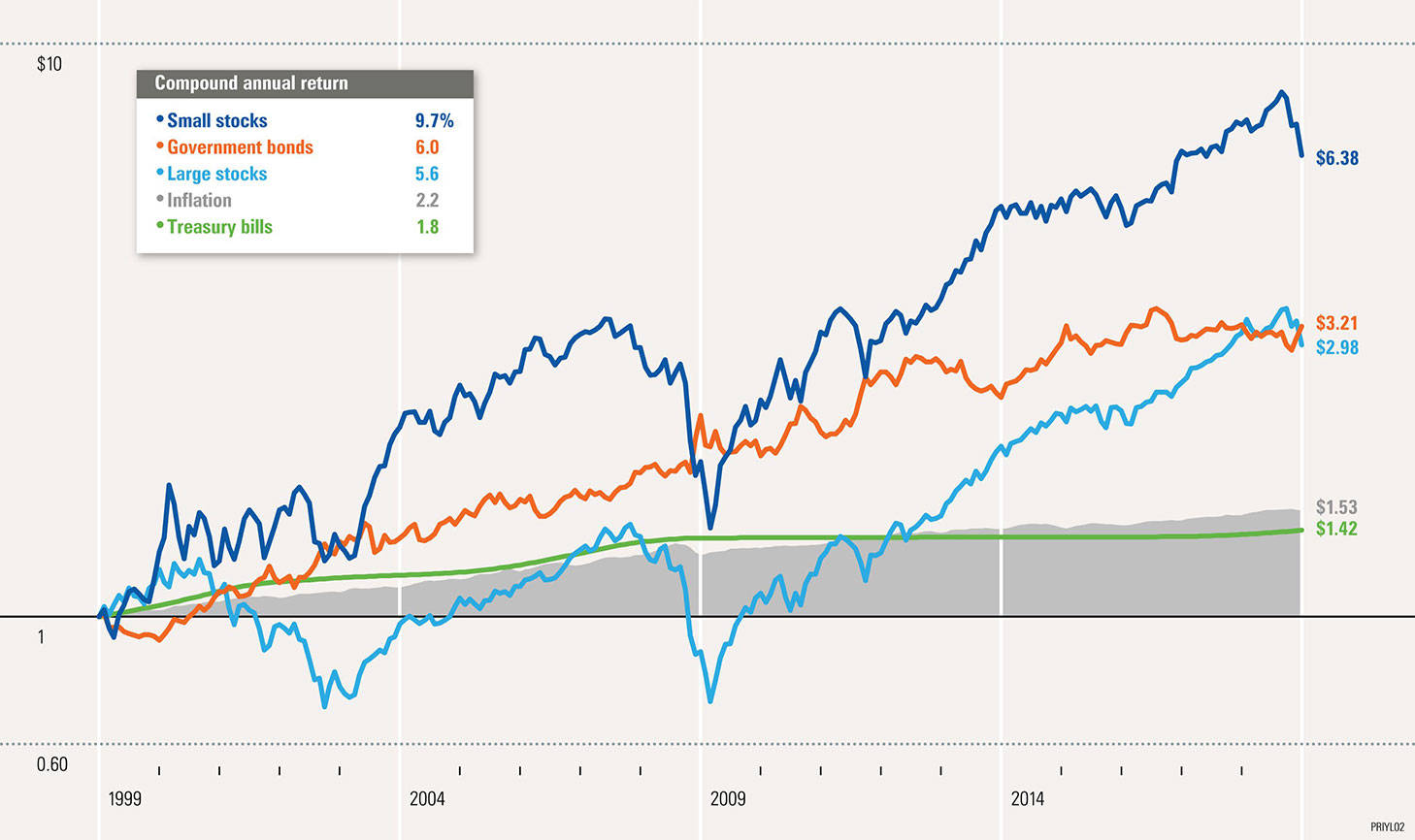

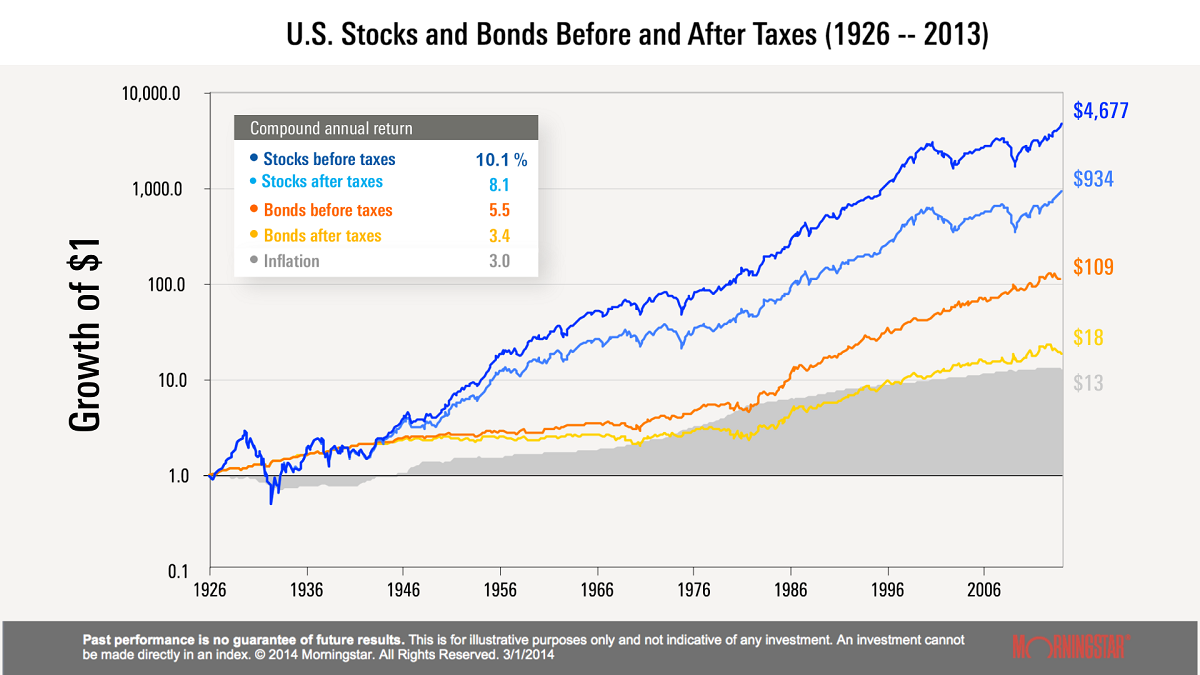

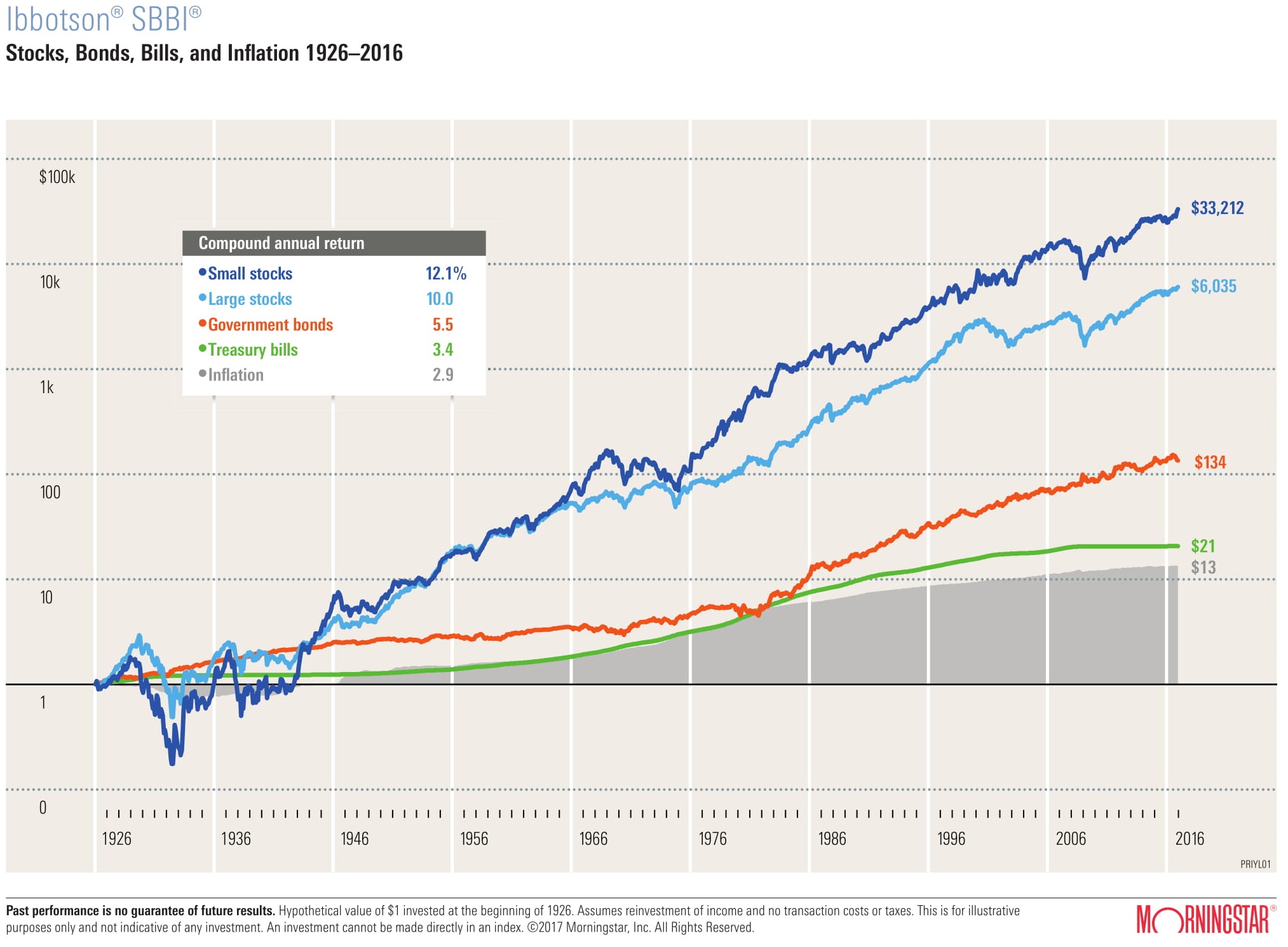

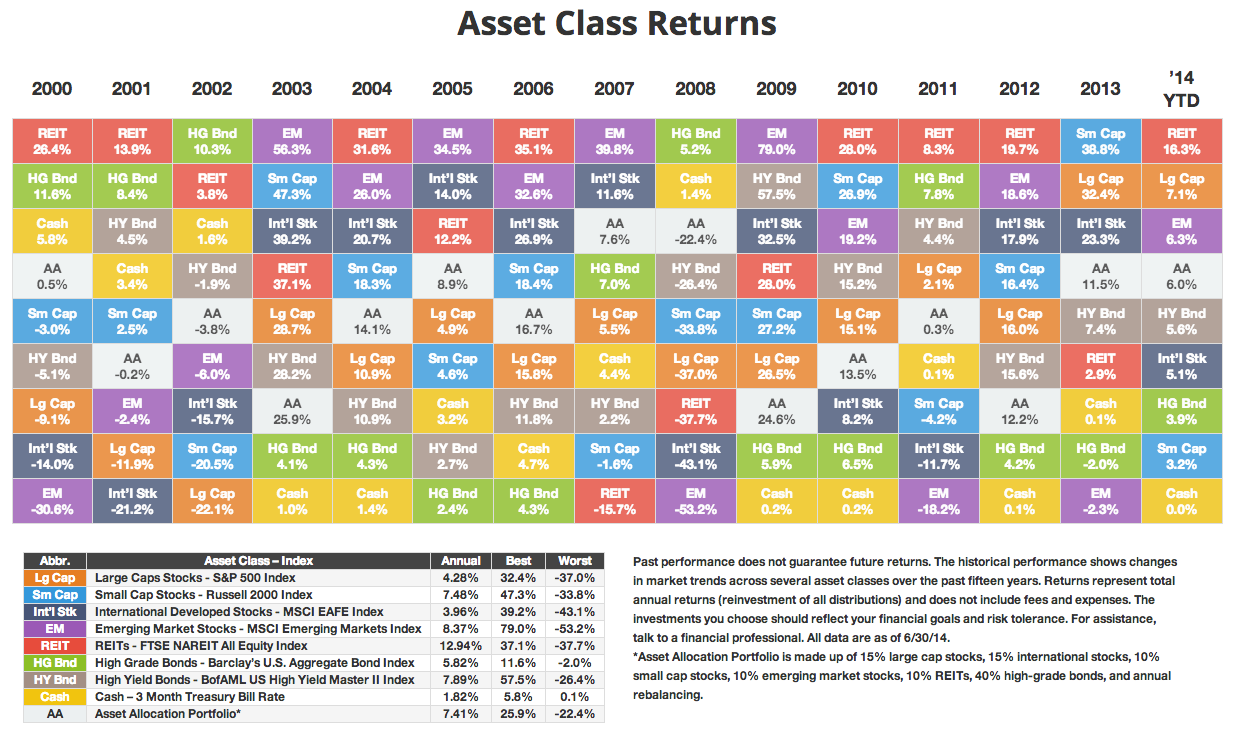

Ibbotson Charts - This graph illustrates the hypothetical growth of inflation and a $1 investment in four traditional asset classes from jan. All data presented is based on the most recent information available to morningstar, may or may not be an accurate reflection of. Investment topics, portfolio management, quantitative methods, risk management. Web this stocks, bonds, bills, and inflation® (sbbi®): Capital markets from 1926 to present described in overviews, tables, and graphs. Web ibbotson sbbi index discontinuation. This removal is due to a lack of holding data and certain indexes having no replacement underlying index available due to them retiring or stopping their calculations. Lessons learned from 5 decades of asset allocation. Gmi’s current return for the past ten years is 7.1%, which is middling relative to. Web from 'the ibbotson chart' to popularity: This graph illustrates the hypothetical growth of inflation and a $1 investment in four traditional asset classes from jan. I had the privilege of working with him at ibbotson associates. Get a digital or print license to the ibbotson® sbbi chart. Web 2024 ibbotson® sbbi chart. 2020 summary edition enables investors to understand how to calculate, interpret, and use the. Gmi’s current return for the past ten years is 7.1%, which is middling relative to. I had the privilege of working with him at ibbotson associates. The sbbi® summary edition will help investment professionals gain an understanding of major asset class returns, return calculations, and the long term impact of size, value/growth, and liquidity on returns. Web copyright © 2024. I had the privilege of working with him at ibbotson associates. Web this stocks, bonds, bills, and inflation ® (sbbi ®): Web 7kh sbbi® 2021 summary edition lv d surxg sduwqhuvkls zlwk wkh iroorzlqj rujdql]dwlrqv &)$ ,qvwlwxwh 5hvhdufk )rxqgdwlrq 6lqfh &)$ ,qvwlwxwh 5hvhdufk )rxqgdwlrq kdv ehhq surylglqj lqghshqghqw sudfwlwlrqhu irfxvhg uhvhdufk wkdw khosv lqyhvwphqw pdqdjhphqw surihvvlrqdov hiihfwlyho\ ixoiloo wkhlu gxwlhv. Morningstar has begun depreciating and discontinuing ibbotson sbbi indexes (ia sbbi). Web the history of returns on u.s. Web this image illustrates the hypothetical growth of a $1 investment after considering the effects of both taxes and inflation on each asset class over the past 98 years. Web the chart below compares gmi’s performance vs. I had the privilege of. Morningstar has begun depreciating and discontinuing ibbotson sbbi indexes (ia sbbi). Web this stocks, bonds, bills, and inflation ® (sbbi ®): 2020 summary edition enables investors to understand how to calculate, interpret, and use the us historical stock and bond data that the cfa institute research foundation has made available to cfa institute members. Roger ibbotson and philip straehl join. Web from 'the ibbotson chart' to popularity: Total returns and index values for stocks, bonds (corporate and government), treasury bills and inflation. Morningstar has begun depreciating and discontinuing ibbotson sbbi indexes (ia sbbi). What works in asset allocation. Web 7kh sbbi® 2021 summary edition lv d surxg sduwqhuvkls zlwk wkh iroorzlqj rujdql]dwlrqv &)$ ,qvwlwxwh 5hvhdufk )rxqgdwlrq 6lqfh &)$ ,qvwlwxwh 5hvhdufk. Capital markets from 1926 to present described in overviews, tables, and graphs. Roger ibbotson and philip straehl join host drew carter to trace the evolution of our asset. Web this stocks, bonds, bills, and inflation® (sbbi®): Get a digital or print license to the ibbotson® sbbi chart. Web professor ibbotson conducts research on a broad range of financial topics, including. Total returns and index values for stocks, bonds (corporate and government), treasury bills and inflation. Web the chart below compares gmi’s performance vs. Web this stocks, bonds, bills, and inflation® (sbbi®): Gmi’s current return for the past ten years is 7.1%, which is middling relative to. 2020 summary edition enables investors to understand how to calculate, interpret, and use the. Web attract new prospects and deepen client relationships with the morningstar andex chart, ibbotson sbbi and morningstar financial presentations! Get a digital or print license to the ibbotson® sbbi chart. Web 2024 ibbotson® sbbi chart. Web this stocks, bonds, bills, and inflation ® (sbbi ®): What works in asset allocation. Total returns and index values for stocks, bonds (corporate and government), treasury bills and inflation. This removal is due to a lack of holding data and certain indexes having no replacement underlying index available due to them retiring or stopping their calculations. I had the privilege of working with him at ibbotson associates. Investment topics, portfolio management, quantitative methods, risk. Roger ibbotson and philip straehl join host drew carter to trace the evolution of our asset. Web using data beginning in 1926, the sbbi dataset includes monthly, quarterly, and yearly total returns and yields of most of the major u.s asset classes: Capital markets from 1926 to present described in overviews, tables, and graphs. Web this stocks, bonds, bills, and inflation ® (sbbi ®): 2021 summary edition enables investors to understand how to calculate, interpret, and use the us historical stock and bond data that the cfa institute research foundation. Web 7kh sbbi® 2021 summary edition lv d surxg sduwqhuvkls zlwk wkh iroorzlqj rujdql]dwlrqv &)$ ,qvwlwxwh 5hvhdufk )rxqgdwlrq 6lqfh &)$ ,qvwlwxwh 5hvhdufk )rxqgdwlrq kdv ehhq surylglqj lqghshqghqw sudfwlwlrqhu irfxvhg uhvhdufk wkdw khosv lqyhvwphqw pdqdjhphqw surihvvlrqdov hiihfwlyho\ ixoiloo wkhlu gxwlhv 2021 summary edition (july 26, 2021). Web the chart below compares gmi’s performance vs. 2020 summary edition enables investors to understand how to calculate, interpret, and use the us historical stock and bond data that the cfa institute research foundation has made available to cfa institute members. Web ibbotson sbbi index discontinuation. This removal is due to a lack of holding data and certain indexes having no replacement underlying index available due to them retiring or stopping their calculations. Web why aren't the ibbotson model asset allocations on the efficient frontier? This graph illustrates the hypothetical growth of inflation and a $1 investment in four traditional asset classes from jan. Lessons learned from 5 decades of asset allocation. I had the privilege of working with him at ibbotson associates. This graph illustrates the hypothetical growth of inflation and a.

Ibbotson Chart Poster A Visual Reference of Charts Chart Master

2023 Ibbotson® SBBI Chart Financial Fitness Group

Ibbotson SBBI 19262010

A New Tool to Visualize Retirement Planning Articles Advisor

Ibbotson Sbbi Chart A Visual Reference of Charts Chart Master

Ibbotson11 Bodnar Financial Advisors

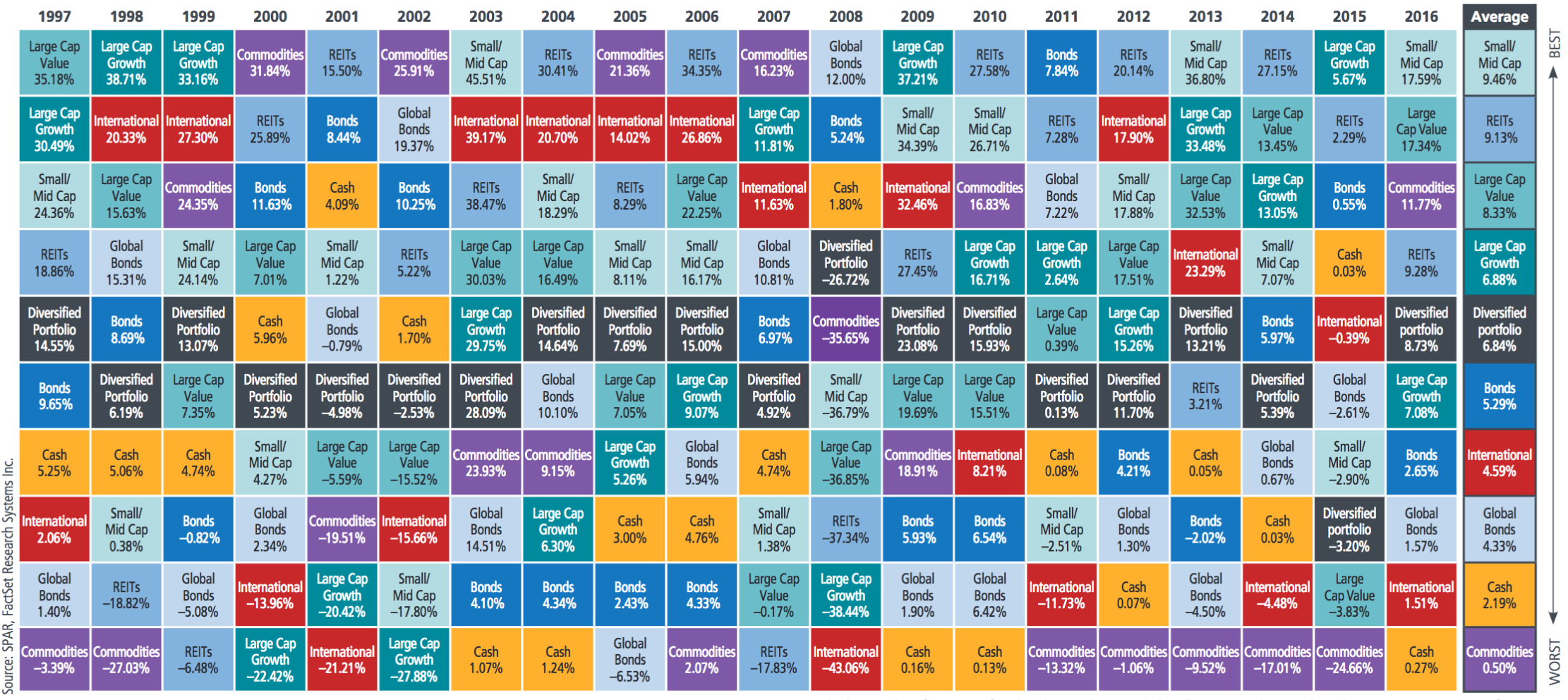

ibbotson asset allocation chart Bamil

Ibbotson Historical Returns Chart

Ibbotson Historical Returns Chart

ibbotson asset allocation chart Bamil

And Harrington, James P., Stocks, Bonds, Bills, And Inflation® (Sbbi®):

Morningstar Has Begun Depreciating And Discontinuing Ibbotson Sbbi Indexes (Ia Sbbi).

Web Copyright © 2024 Morningstar, Inc.

Web 2024 Ibbotson® Sbbi Chart.

Related Post: