Homestead Designation Texas

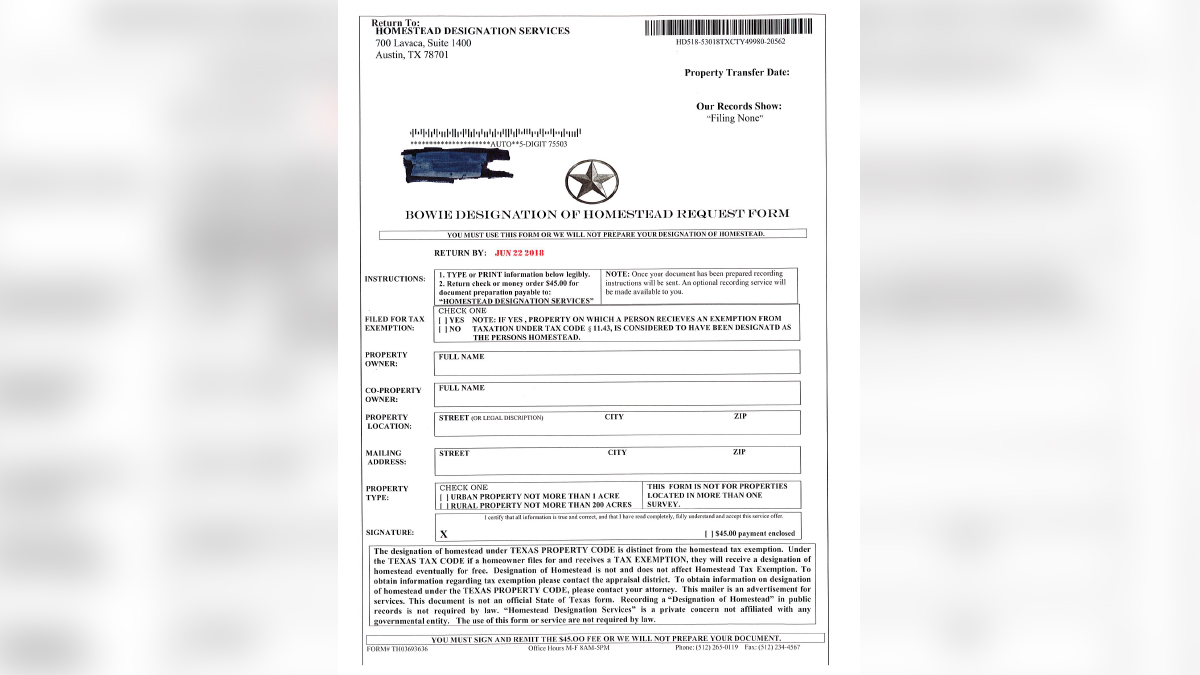

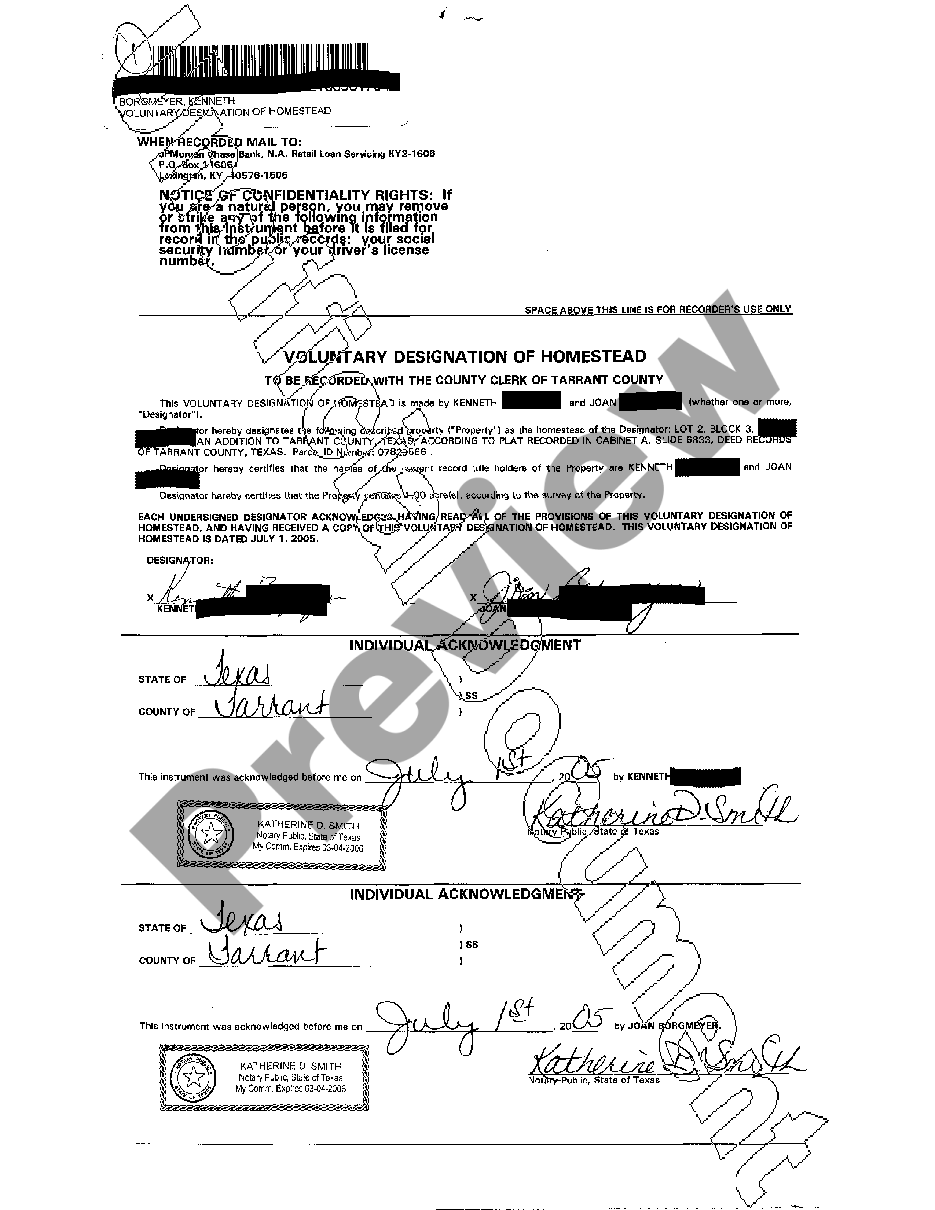

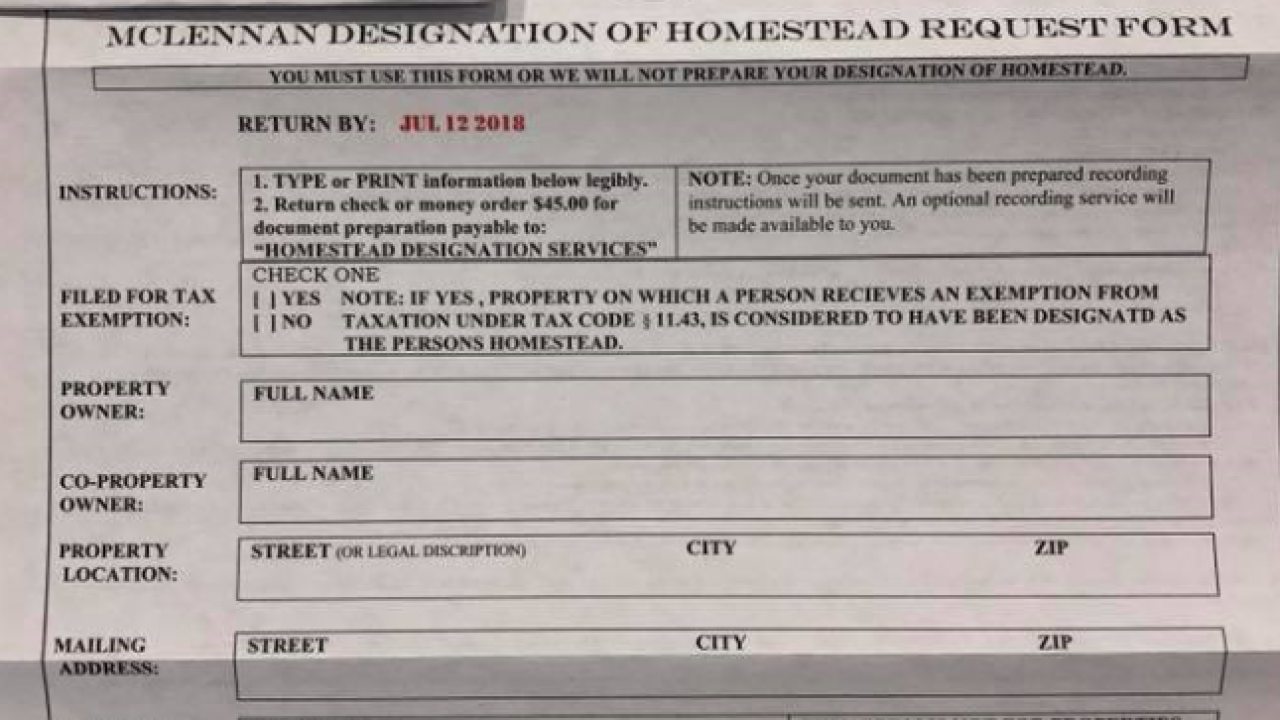

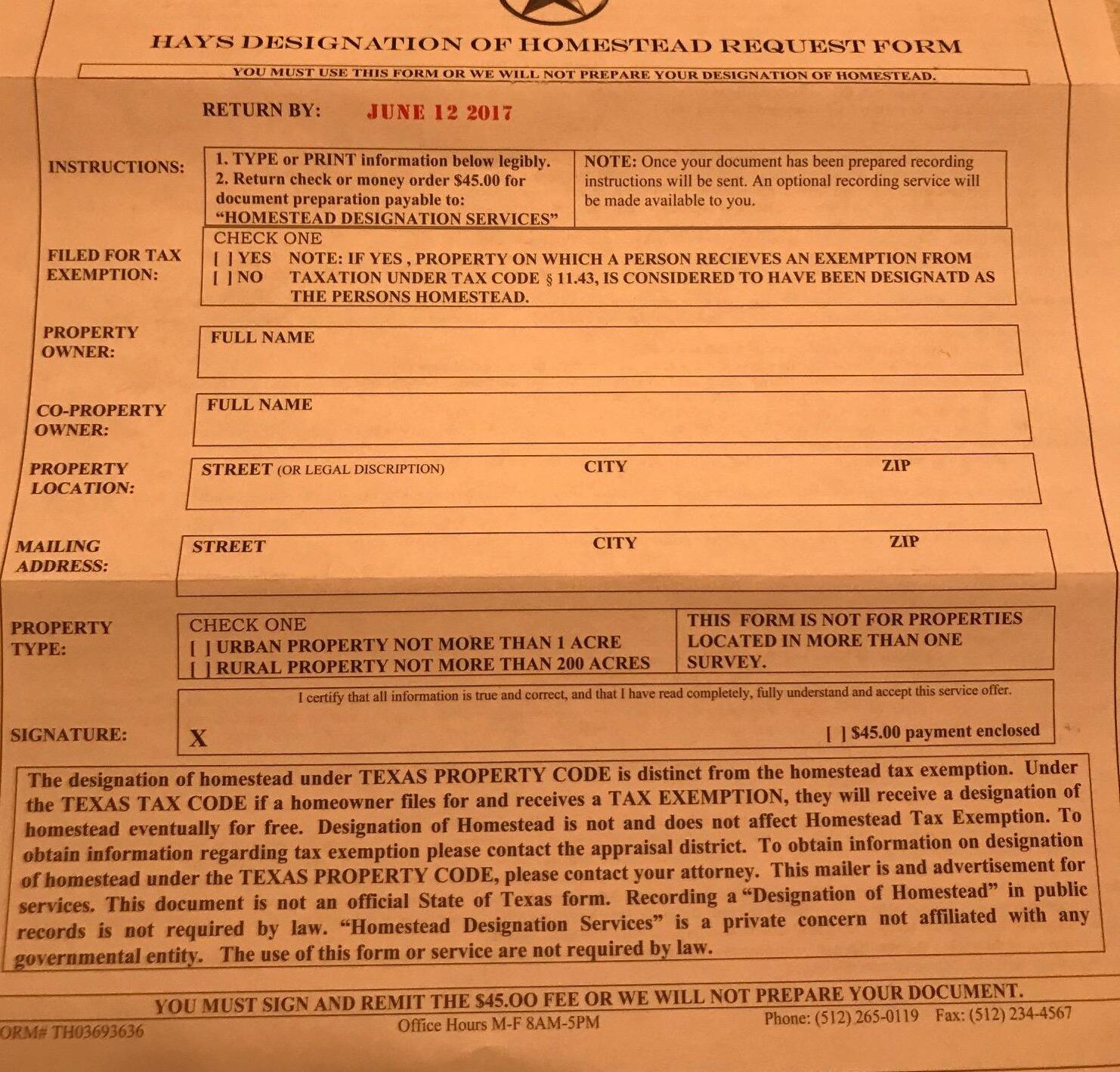

Homestead Designation Texas - I have bought a single person homestead designation form. Web the texas property code designation of homestead provides equity protection for homeowners and is free to file at the bowie county appraisal office in texarkana, texas, at your convenience. Web a homestead is considered to be urban if, at the time the designation is made, the property is: Web harris county, texas — with property taxes in the news, a khou 11 news viewer reached out to share a letter that she got in the mail that raised a red flag. I am single and he is obviously married to my mom whose name is not on title. The letter claims to offer. Web this article outlines unique protections available to an individual’s residence and personal property by what are broadly referred to as texas homestead laws. Web under texas law, a resident is eligible to apply for a residence homestead exemption for their principal residence, the home where they live. Web a general homestead exemption in texas can save you money on property taxes by lowering the taxable value of your home by up to $100,000 for school taxes. Web designation is different. To file a designation of homestead, you are not required to use this form or this service. To see if you qualify or to apply, contact the (name) county appraisal district office today. Web the texas property code designation of homestead provides equity protection for homeowners and is free to file at the bowie county appraisal office in texarkana, texas,. Web voluntary designation of homestead. Web a practice note explaining the protections provided for residential real estate that is or may qualify to be designated as a homestead in texas. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if married, that person's spouse may voluntarily designate not more than 200 acres of the property as the homestead. This will allow for a qualifying new home to be eligible for. The letter claims to offer. Web homestead exemptions reduce the appraised value of your home and lower your property taxes. A homestead can be a separate structure, a condominium or a manufactured home on owned or leased land. If a homeowner files for and receive a tax exemption, they will receive a designation of. Web homestead property is protected under. Web a practice note explaining the protections provided for residential real estate that is or may qualify to be designated as a homestead in texas. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if married, that person's spouse may. Under the texas tax code if a homeowner files for and receives a tax exemption, they will receive a designation of. Under texas law, separate from the discount, you can fill out a form and give it to your county clerk designating your residence as your homestead. Web a general homestead exemption in texas can save you money on property. Under texas law, separate from the discount, you can fill out a form and give it to your county clerk designating your residence as your homestead. Web the texas property code designation of homestead provides equity protection for homeowners and is free to file at the bowie county appraisal office in texarkana, texas, at your convenience. Web i would like. You might be able to claim a homestead exemption based on whether you are 65 or older, have. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. Web homestead exemptions reduce the appraised value of your home and lower your property taxes. The letter claims to offer. A standard document that a property. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. Several homestead exemptions are available such as those for disabled veterans or residents age 65 or older. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the. Web a practice note explaining the protections provided for residential real estate that is or may qualify to be designated as a homestead in texas. I have bought a single person homestead designation form. If a homeowner files for and receive a tax exemption, they will receive a designation of. Web the designation of homestead under texas property code is. Exemptions are also available for disabled veterans, seniors over the age of 65, people with qualifying disabilities, and some surviving spouses. Web a general homestead exemption in texas can save you money on property taxes by lowering the taxable value of your home by up to $100,000 for school taxes. Web if you own and occupy your home, you may be eligible for the general residential homestead exemption. Recording a “designation of homestead” in the public records is optional. Web attorney general ken paxton today warned consumers to beware of businesses that are sending misleading letters to texans offering a “designation of homestead” if they pay a fee. (a) if a rural homestead of a family is part of one or more parcels containing a total of more than 200 acres, the head of the family and, if married, that person’s spouse may voluntarily designate not more than 200 acres of the property as the homestead. A homestead can be a separate structure, a condominium or a manufactured home on owned or leased land. Web designation is different. Web the texas property code designation of homestead provides equity protection for homeowners and is free to file at the bowie county appraisal office in texarkana, texas, at your convenience. (1) located within the limits of a municipality or its extraterritorial jurisdiction or a platted subdivision; Several homestead exemptions are available such as those for disabled veterans or residents age 65 or older. Web this article outlines unique protections available to an individual’s residence and personal property by what are broadly referred to as texas homestead laws. Here, learn how to claim a homestead exemption. Web the texas legislature has passed a new law effective january 1, 2022, permitting buyers to file for homestead exemption in the same year they purchase their new home. I am single and he is obviously married to my mom whose name is not on title. To file a designation of homestead, you are not required to use this form or this service.

Designation Of Homestead Request Form Texas My Bios

Consumer Alert! Homestead Designation Services Fort Bend Central

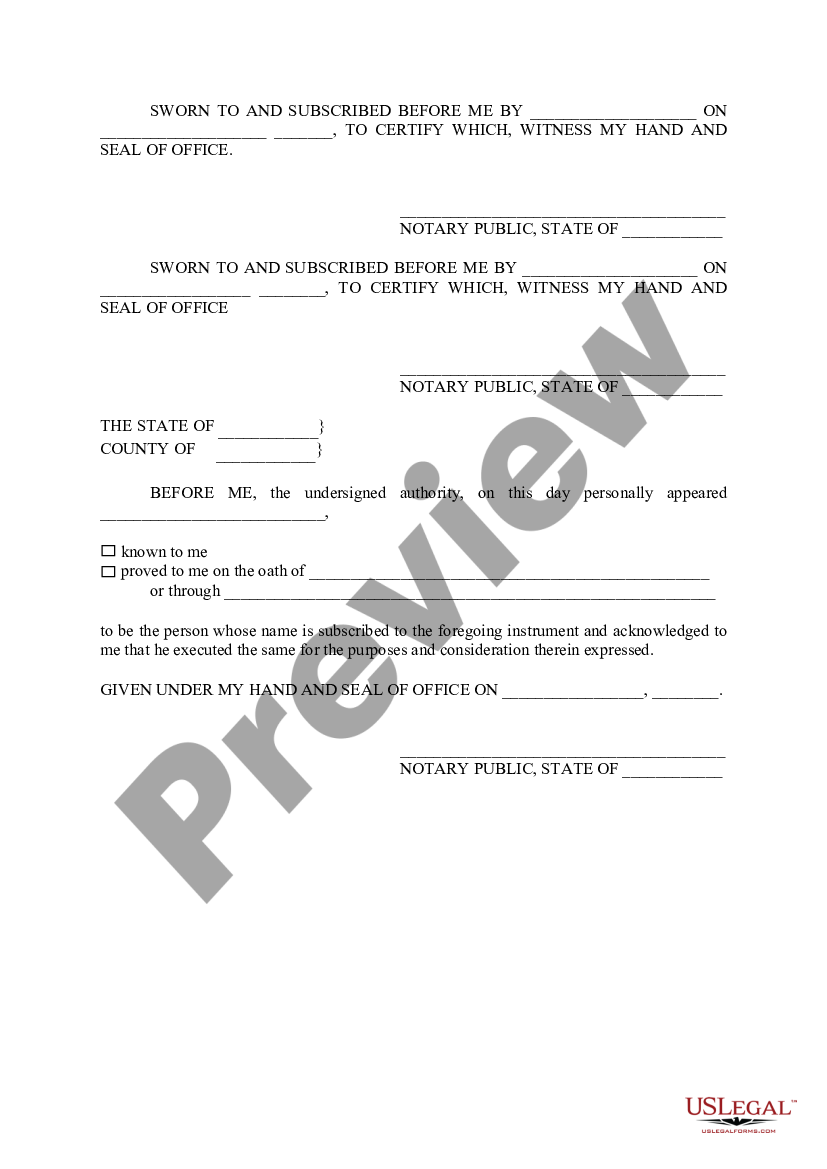

Austin Texas Voluntary Designation of Homestead Voluntary Designation

/cloudfront-us-east-1.images.arcpublishing.com/gray/RE3WPYCAXVKO5DWJNFERVCQ2NE.jpg)

Beware of ‘designation of homestead’ offers, Texas AG warns

/cloudfront-us-east-1.images.arcpublishing.com/gray/XKIYHYWEZZA4HE5ELAFZICBYIU.png)

Designation Of Homestead Request Form Texas Bios Pics

Designation Of Homestead Request Form Texas

Hays County Homestead Exemption Form 2023

Designation Of Homestead Request Form Texas

Homestead Designation Form Texas Awesome Home

Harris Texas Non Homestead Affidavit and Designation of Homestead

Web Homestead Exemptions Reduce The Appraised Value Of Your Home And Lower Your Property Taxes.

(A) If A Rural Homestead Of A Family Is Part Of One Or More Parcels Containing A Total Of More Than 200 Acres, The Head Of The Family And, If Married, That Person's Spouse May Voluntarily Designate Not More Than 200 Acres Of The Property As The Homestead.

Web I Would Like To File A Designation Of Homestead In Texas To Protect My Property From Creditors When They Sue.

Under The Texas Tax Code If A Homeowner Files For And Receives A Tax Exemption, They Will Receive A Designation Of.

Related Post: