Home Loan Process Flow Chart

Home Loan Process Flow Chart - The documents are being prepared for the final closing disclosure. Your loan processor or mortgage loan originator will provide you with the amount needed for closing (or a. Web getting a home loan may feel like an epic journey at times. It is a valuable tool for loan officers, loan officers, and loan planners. A bank loan is a vital financial lifeline for persons and businesses seeking fiscal assistance. Individuals use the mortgage to get real. Web steps in the mortgage origination process include getting preapproval, applying for the loan, waiting for loan processing and underwriting and attending closing day. Schedule a home inspection as soon as you can. Most people will go through these six steps: Mortgage application is submitted to processing. Best editable templates of mortgage process flow chart. At this stage, your lender will have you fill out a full application and ask you to supply documentation relating to your income, debts and assets. Schedule a home inspection as soon as you can. They offer a gateway to fulfilling life's major goals, such as buying a home or getting higher. Best editable templates of mortgage process flow chart. Now that you’ve found the home you want to buy and a lender to work with, the mortgage process begins. Web there are six distinct phases of the mortgage loan process: Web charter pacific lending corp. This loan origination process flow diagram depicts how a borrower applies for a home loan and. The founder, babak moghaddam has been opening doors to home buyers since 1989. Double click the symbols and type the information, then click any blank area to finish typing. Once you’ve found a home and the seller has accepted your offer, the mortgage loan process truly begins. Best editable templates of mortgage process flow chart. Is a privately owned mortgage. 7 closing contact your title agent/ attorney conducting the closing to schedule a convenient time to close. To help you know what to expect at each step along the way, we’ve laid out a typical timeline for a. After selecting a lender, the next step is to complete a full mortgage loan application. Loan lending management process flow chart. Web. This powerpoint template exhibits the loan debt processing process, including the significant steps from completing the application through completion and financing. Web of course, the time it takes to find a home you love is going to vary, but the average timeline to close a mortgage is just 42 days. After selecting a lender, the next step is to complete. Web getting a home loan may feel like an epic journey at times. Mortgage application is submitted to processing. Figure out what you can afford. This loan origination process flow diagram also includes several steps. After selecting a lender, the next step is to complete a full mortgage loan application. At better mortgage, our modern online process makes it even faster; Your loan is in the final stages before closing. Drag the symbols of flowchart from the left libraries and drop them on the blank page or click the floating button around the symbols to add automatically. This chart shows the action steps that must be completed by the borrower.. You can easily edit this template using creately. Many lenders charge a fee for. Most of this application process was completed during the pre. Our average closing time is just 32 days. After selecting a lender, the next step is to complete a full mortgage loan application. After selecting a lender, the next step is to complete a full mortgage loan application. Individuals use the mortgage to get real. The documents are being prepared for the final closing disclosure. To help you know what to expect at each step along the way, we’ve laid out a typical timeline for a. Thus, such diagrams make the process manageable. Schedule a home inspection as soon as you can. Figure out what you can afford. Now that you’ve found the home you want to buy and a lender to work with, the mortgage process begins. Drag the symbols of flowchart from the left libraries and drop them on the blank page or click the floating button around the symbols to. Web a mortgage flowchart is a visual description of the entire mortgaging procedure. Most of this application process was completed during the pre. This powerpoint template exhibits the loan debt processing process, including the significant steps from completing the application through completion and financing. Web steps in the mortgage origination process include getting preapproval, applying for the loan, waiting for loan processing and underwriting and attending closing day. The mortgage consultant collects and verifies all documents necessary to prepare the loan file for underwriting. You can export it in multiple formats like jpeg, png and svg and easily add it to word documents, powerpoint. The documents are being prepared for the final closing disclosure. Individuals use the mortgage to get real. Thus, such diagrams make the process manageable and less overwhelming. Web what is a mortgage loan process flow chart? This loan origination process flow diagram also includes several steps. They offer a gateway to fulfilling life's major goals, such as buying a home or getting higher education. Double click the symbols and type the information, then click any blank area to finish typing. Web follow these eight steps to get a mortgage loan and become a new homeowner. At better mortgage, our modern online process makes it even faster; At this stage, your lender will have you fill out a full application and ask you to supply documentation relating to your income, debts and assets.

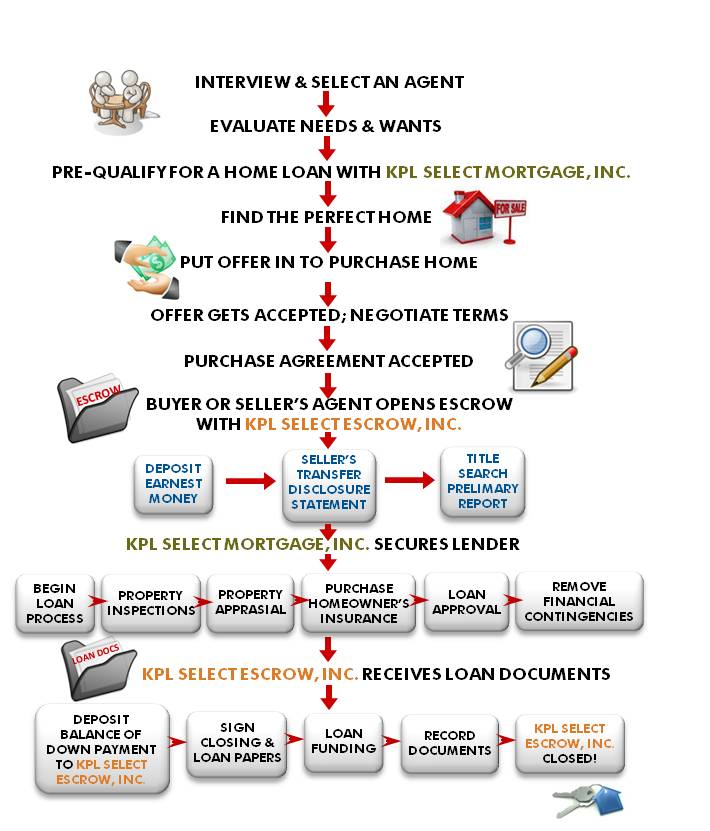

Process Flow Diagram for Home Loan Mortgage Process (Study 1

Home Loan Process Flow Chart A Visual Reference of Charts Chart Master

Loan Process Flow Chart Colorado Mortgage Broker

Home Loan Process Flow Chart

Loan Process Chicago Home Loans

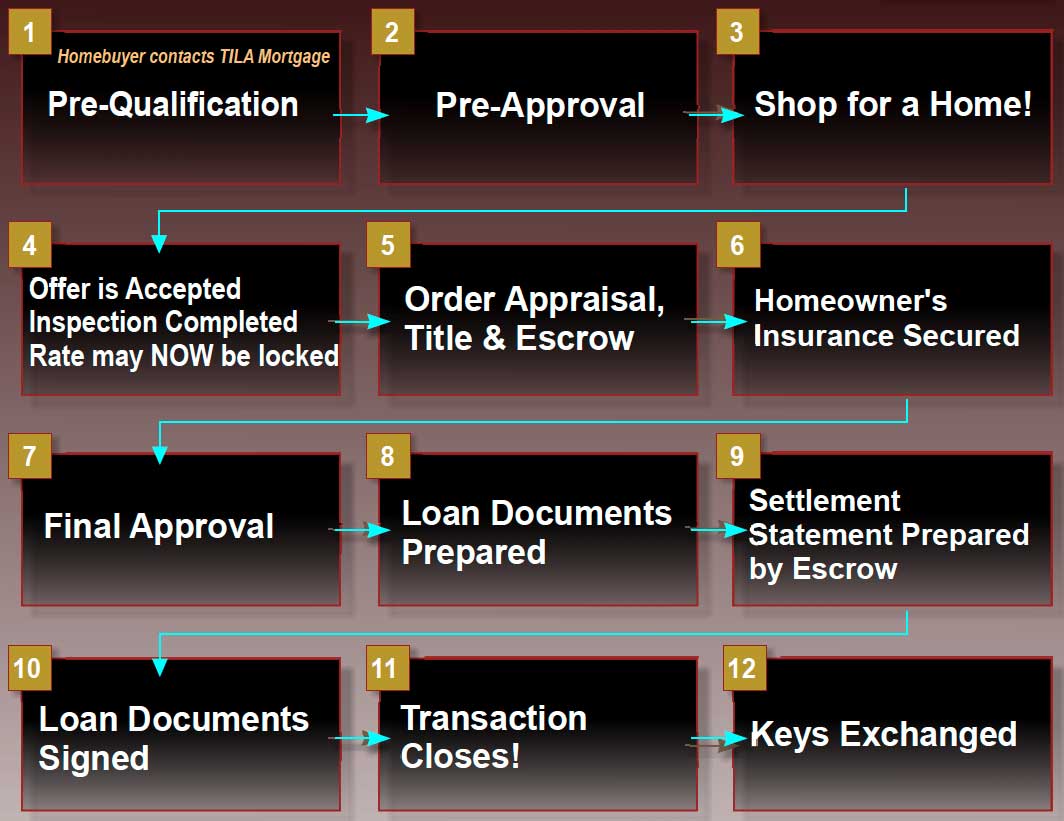

Mortgage Loan Process American Savings Bank Hawaii

The Home Loan Process — TILA Mortgage

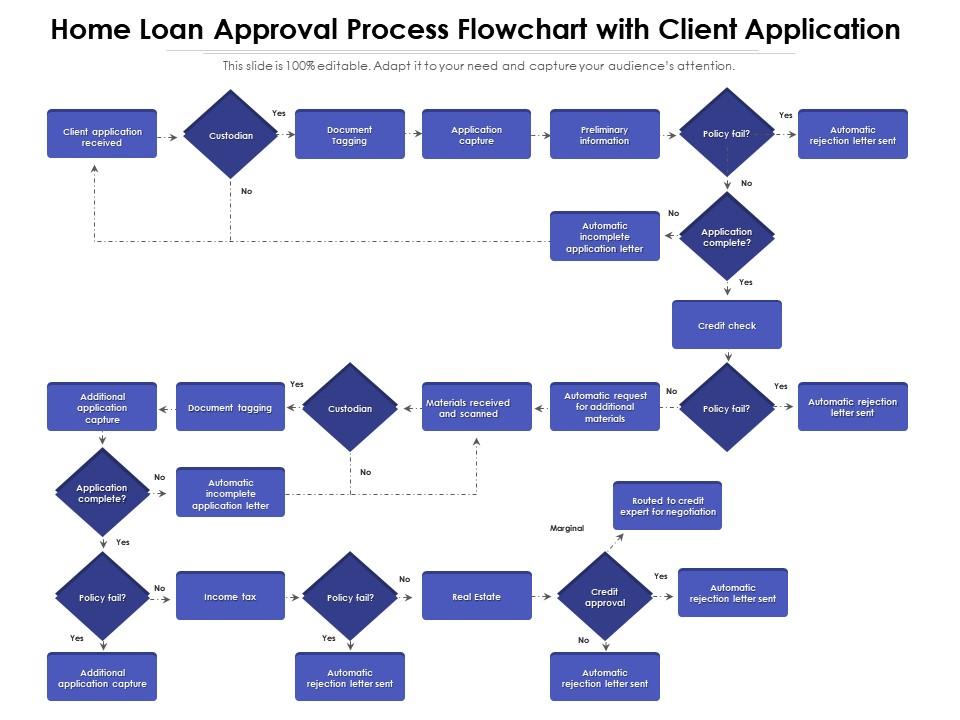

Mortgage Process Flow Charts Uses, Examples, and Creation

Home Loan Approval Process Flowchart With Client Application

The Loan Process Pinnacle Mortgage Corp

Many Lenders Charge A Fee For.

Here's What You Need To Know About Each Step.

Web The Bottom Line.

Your Loan Processor Or Mortgage Loan Originator Will Provide You With The Amount Needed For Closing (Or A.

Related Post: