Head And Shoulders Pattern Reverse

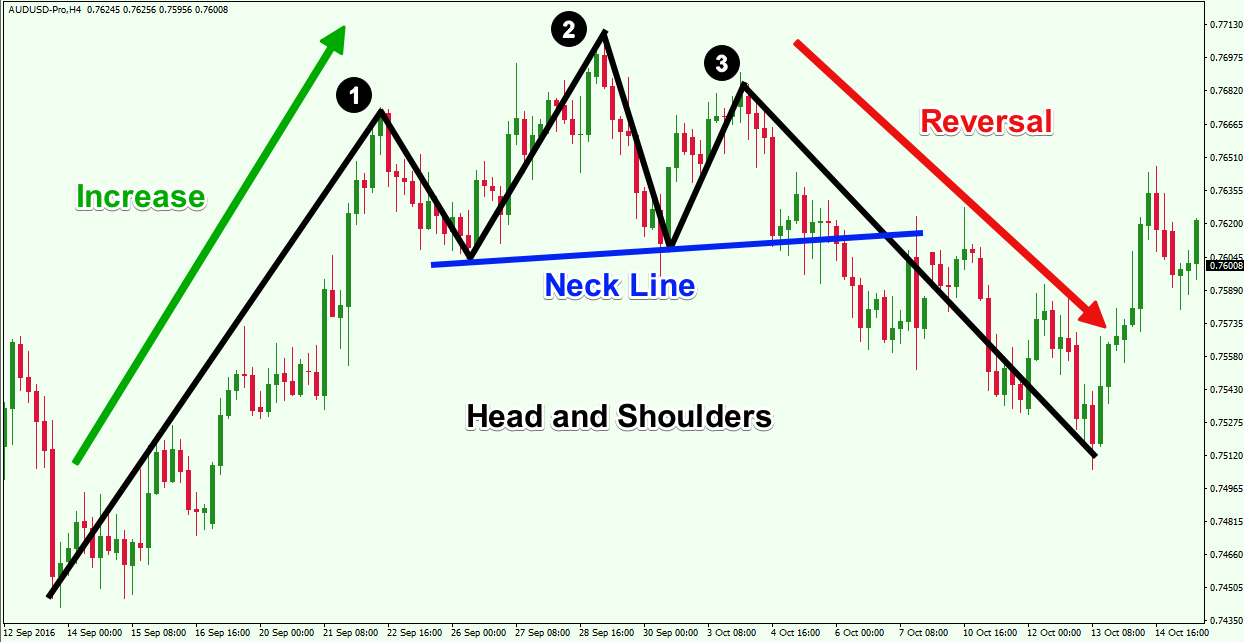

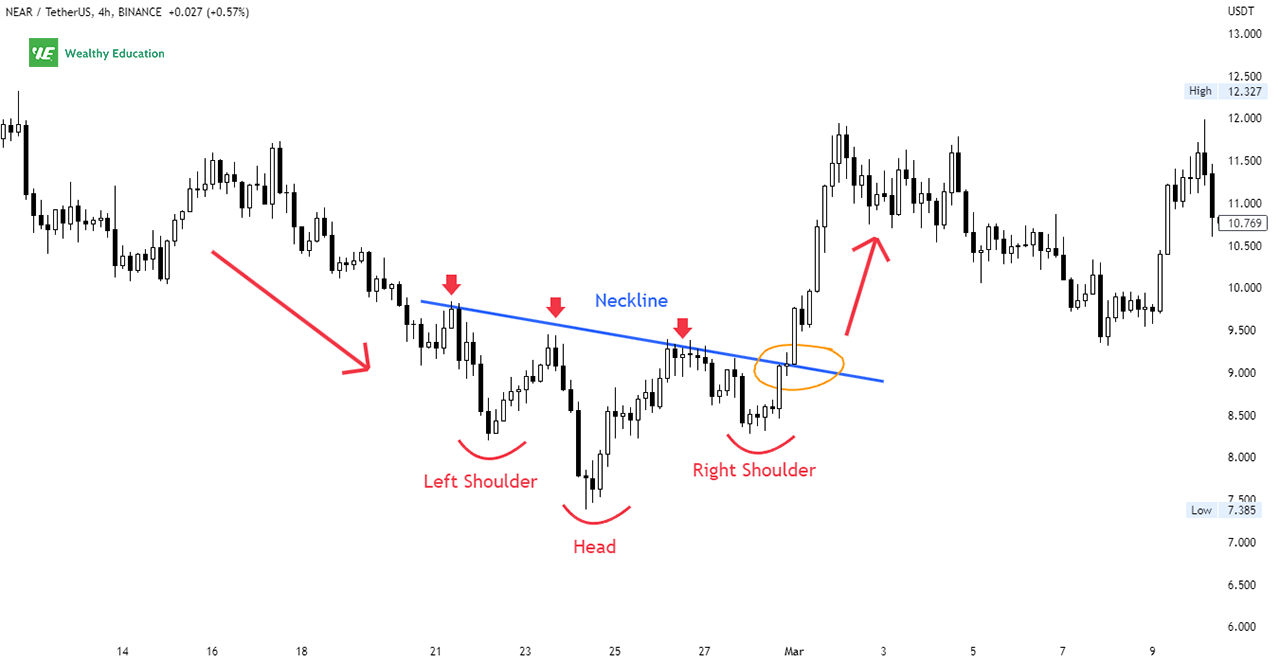

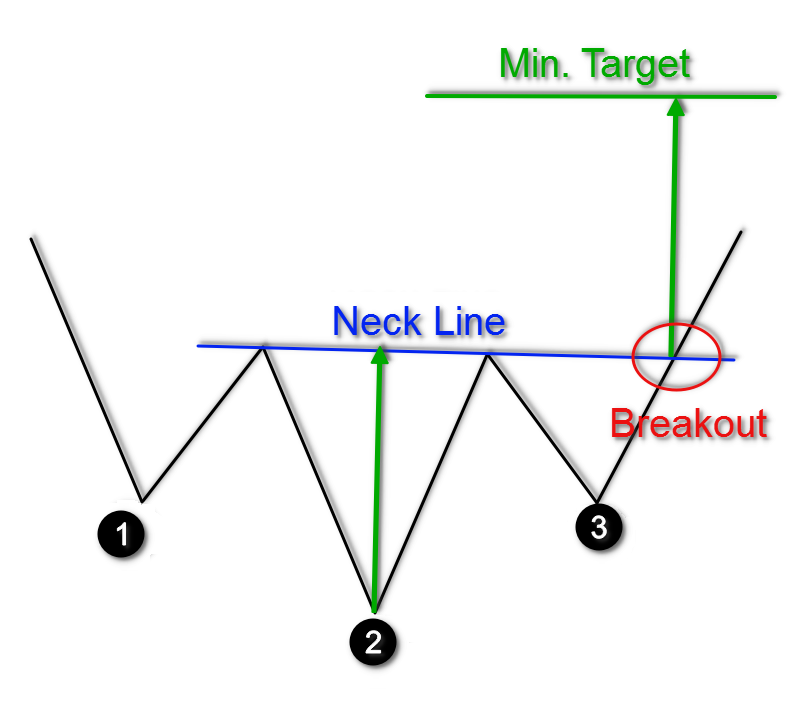

Head And Shoulders Pattern Reverse - Inverse h&s pattern is bullish reversal pattern. The left shoulder forms when investors pushing a stock higher temporarily lose enthusiasm. It enables traders to determine the opportune moment to initiate a trade. Stock passes any of the below filters in nifty 500 segment: The height of the pattern plus the breakout price should be your target price using this indicator. The line connecting the 2 valleys is the neckline. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. The head forms when enthusiasm peaks and then declines to a point at or near the stock's previous low. Web what is an inverse head and shoulders pattern? The pattern is never perfect in shape, as price fluctuations can happen in between the shifts. Stock passes all of the below filters in cash segment: The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web reverse head and shoulder chart pattern. Web the head and shoulders pattern is a reversal trend, indicating price movement is changing from bullish to bearish. Scanner guide scan examples feedback.. The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. The height of the pattern plus the breakout price should be your target price using this indicator. Web a head and shoulders pattern is a. Scanner guide scan examples feedback. The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. The pattern appears on all time frames so it can. Inverse head and shoulders pattern is the mirror image of. Web the head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. This reversal could signal an. The height of the pattern plus the breakout price should be your target price using this indicator. It consists of 3 tops with a higher high in the middle, called the head. Following. Web reverse head and shoulder chart pattern. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher highs (the first and second peak) is broken with the third peak, which is lower than the second. Web what is an inverse head. It enables traders to determine the opportune moment to initiate a trade. This reversal signals the end of. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Inverse h&s pattern is bullish reversal pattern. Read about head and shoulder pattern here: Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. It enables traders to determine the opportune moment to initiate a trade. The height of the pattern plus the breakout price should be your target price using this indicator. Web inverted head and shoulders is a reversal pattern formed. The head forms when enthusiasm peaks and then declines to a point at or near the stock's previous low. Let’s take a look at the four components that make up the. It boasts an impressive success rate of 89%. Read about head and shoulder pattern here: The right shoulder on these patterns typically is higher than the left, but many. This reversal could signal an. The inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). The average price. The head forms when enthusiasm peaks and then declines to a point at or near the stock's previous low. Inverse head and shoulders pattern is the mirror image of head and shoulders pattern. It enables traders to determine the opportune moment to initiate a trade. Scanner guide scan examples feedback. Stock passes all of the below filters in cash segment: Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. This reversal could signal an. The left shoulder forms when investors pushing a stock higher temporarily lose enthusiasm. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. It consists of 3 tops with a higher high in the middle, called the head. The inverse head and shoulders pattern is a reversal pattern in stock trading. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Head & shoulder and inverse head & shoulder. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. The components of a head and shoulders trading pattern. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and.

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Reverse Head And Shoulders Pattern Stocks

Inverse Head and Shoulders Pattern How To Spot It

Head and Shoulders Trading Patterns ThinkMarkets EN

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

headandshouldersreversalchartpattern Forex Training Group

Reverse Head And Shoulders Pattern (Updated 2023)

The Head and Shoulders Pattern A Trader’s Guide

Chart Patterns The Head And Shoulders Pattern Forex Academy

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

The Pattern Is Never Perfect In Shape, As Price Fluctuations Can Happen In Between The Shifts.

It Is The Opposite Of The Head And Shoulders Chart Pattern,.

The Pattern Appears On All Time Frames So It Can.

Inverse H&S Pattern Is Bullish Reversal Pattern.

Related Post: