Head And Shoulders Pattern Inverse

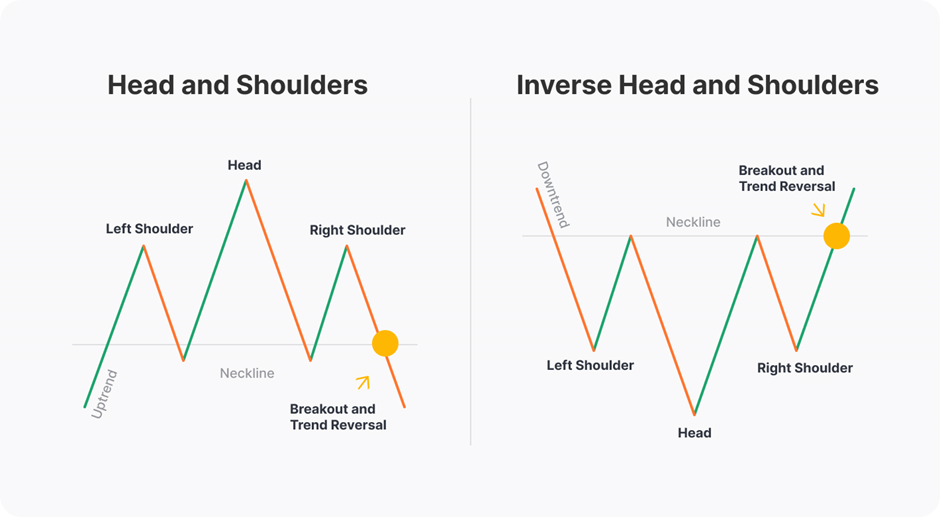

Head And Shoulders Pattern Inverse - Web the head and shoulders chart pattern is popular and easy to spot when traders know what they're watching for. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading that indicates a bullish trend. You can enter a long position when the price moves above the neck,. Web the s&p 500 topped out last thursday at 5,490 and has tested that level four times. Web learn how to identify and trade the inverse head and shoulders pattern, a technical analysis pattern that signals a potential trend reversal in a downtrend. The first and third lows are called shoulders. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. It's one of the most reliable trend reversal patterns. Web learn how to identify and use the inverse head and shoulders pattern, a bullish candlestick formation that occurs at the end of a downward trend. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Web all chart patterns [theeccentrictrader] this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. Web inverted head and shoulders is a reversal pattern formed by three. Web learn how to identify and use the inverse head and shoulders pattern, a bullish reversal formation that signals a potential uptrend in stock prices. On the positive side, bitcoin has formed an inverse head and shoulders. Web inverse head and shoulders pattern,inverse head and shoulders,head and shoulders pattern,head and shoulders,inverse head and shoulders pattern rules,inverse. Web if you're looking. You can enter a long position when the price moves above the neck,. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading that indicates a bullish trend. You can enter a long position when the price moves above the neck,. With the zero gamma level around the 5,520 region and liquidity thinning out,. Web learn how to identify and trade the inverse head. You can enter a long position when the price moves above the neck,. Web the pair has formed a shooting star candlestick pattern, a popular bearish reversal sign. Web learn how to identify and use the inverse head and shoulders pattern, a bullish reversal formation that signals a potential uptrend in stock prices. Web if you're looking to add a. The pattern is similar to the shape of a. Web learn how to identify and trade the inverse head and shoulders pattern, a technical analysis pattern that signals a potential trend reversal in a downtrend. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. The first. Web the pair has formed a shooting star candlestick pattern, a popular bearish reversal sign. Web learn how to identify and trade the inverse head and shoulders pattern, a technical analysis pattern that signals a potential trend reversal in a downtrend. Web inverse head and shoulders pattern,inverse head and shoulders,head and shoulders pattern,head and shoulders,inverse head and shoulders pattern rules,inverse.. The first and third lows are called shoulders. On the positive side, bitcoin has formed an inverse head and shoulders. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading that indicates a bullish trend. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. The pattern appears as a. Web learn how to identify and use the inverse head and shoulders pattern, a bullish reversal formation that signals a potential uptrend in stock prices. Web inverse head and shoulders is a. On the positive side, bitcoin has formed an inverse head and shoulders. Web the pair has formed a shooting star candlestick pattern, a popular bearish reversal sign. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Web inverse head and shoulders is a price pattern in technical analysis that signals a. Web learn how to identify and use the inverse head and shoulders pattern, a bullish candlestick formation that occurs at the end of a downward trend. Inverse head and shoulders pattern points to potential 5,500 breakout 7/30/2024 12:56 am investingcom; The middle dip resembles a head, while the right and left dips on the. Web the s&p 500 topped out last thursday at 5,490 and has tested that level four times. On the positive side, bitcoin has formed an inverse head and shoulders. It's one of the most reliable trend reversal patterns. The pattern appears as a. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. Web all chart patterns [theeccentrictrader] this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. You can enter a long position when the price moves above the neck,. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web if you're looking to add a position, the formation of an inverse head and shoulders, with a stock price breaking above the neckline, often indicates a bearish trend has ended and. The pattern is similar to the shape of a. The first and third lows are called shoulders. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Web learn how to identify and trade the inverse head and shoulders pattern, a reversal pattern in stock trading that indicates a bullish trend.

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

How to Trade with the Inverse Head and Shoulders Pattern Market Pulse

Inverse Head and Shoulders Pattern How To Spot It

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Chart Patterns The Head And Shoulders Pattern Forex Academy

How To Trade Blog What is Inverse Head and Shoulders Pattern

Head And Shoulders Chart Meaning

Inverse Head and Shoulders Pattern Trading Strategy Guide

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

Head and Shoulders Trading Patterns ThinkMarkets EN

Web Inverse Head And Shoulders Is A Price Pattern In Technical Analysis That Signals A Potential Reversal From A Downtrend To An Uptrend.

Web Learn How To Identify And Use The Inverse Head And Shoulders Pattern, A Bullish Reversal Formation That Signals A Potential Uptrend In Stock Prices.

Web Inverse Head And Shoulders Is A Price Pattern In Technical Analysis That Indicates A Potential Reversal From A Downtrend To An Uptrend.

Web The Pair Has Formed A Shooting Star Candlestick Pattern, A Popular Bearish Reversal Sign.

Related Post: