Head And Shoulders Pattern Failure

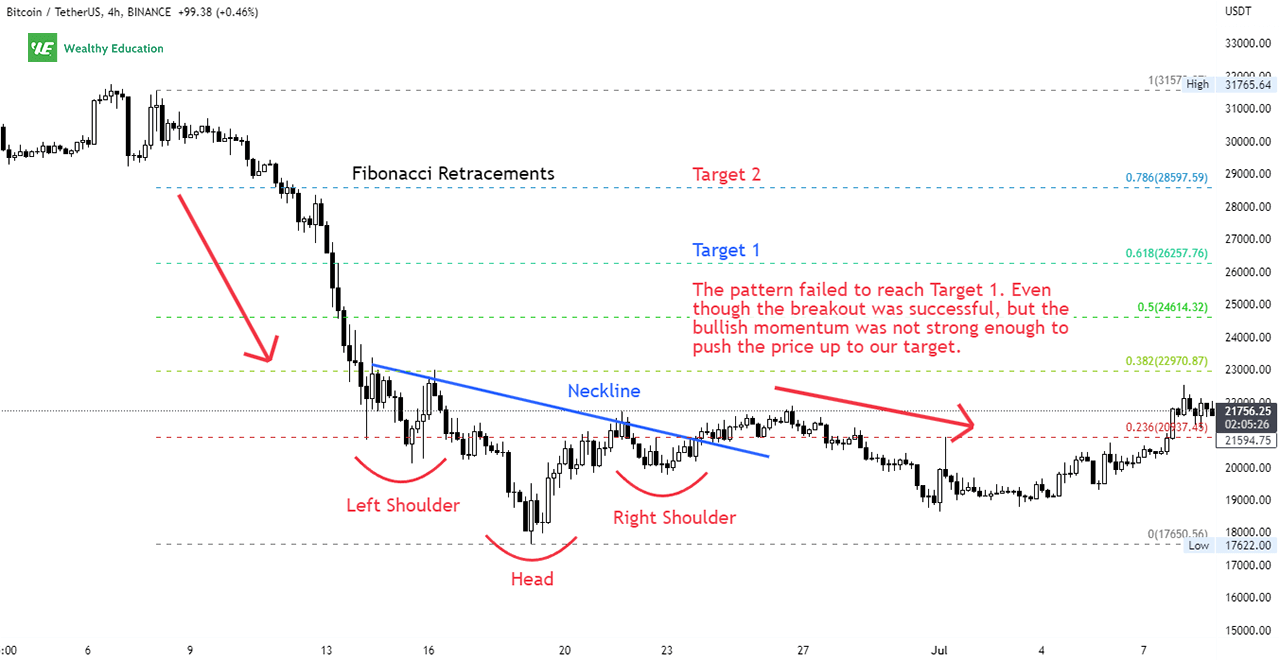

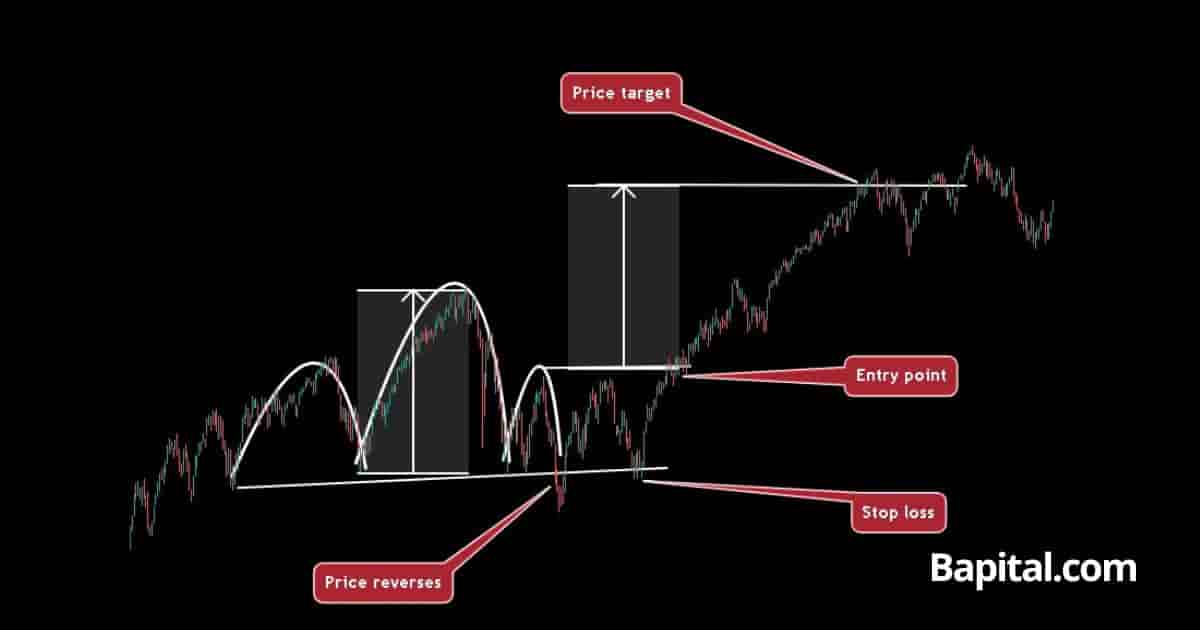

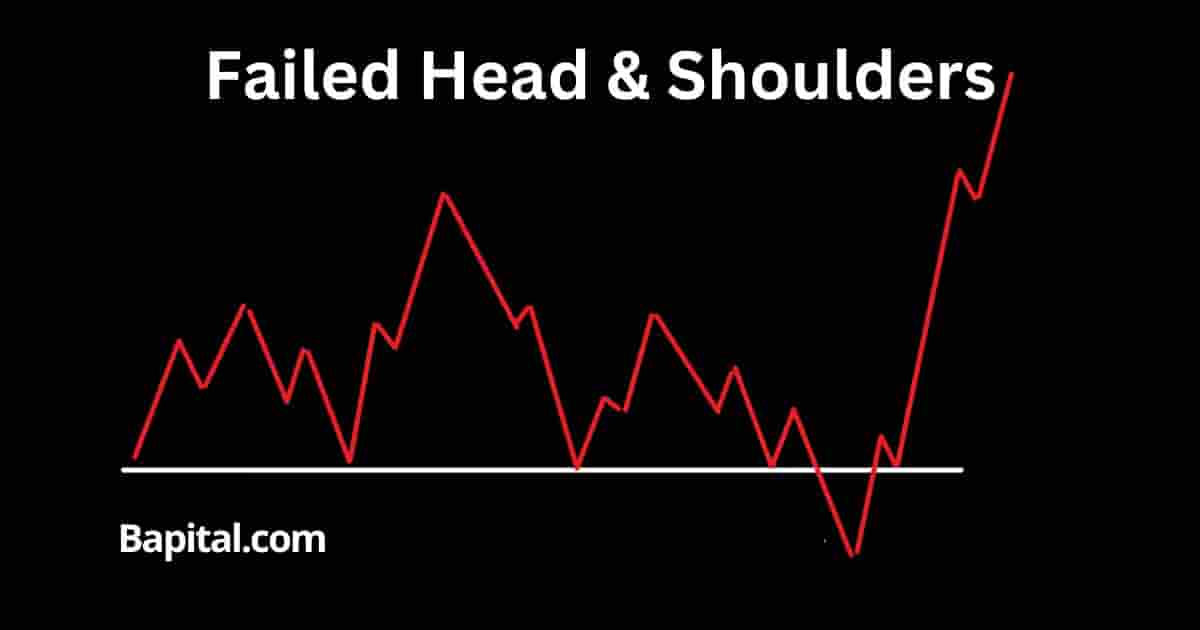

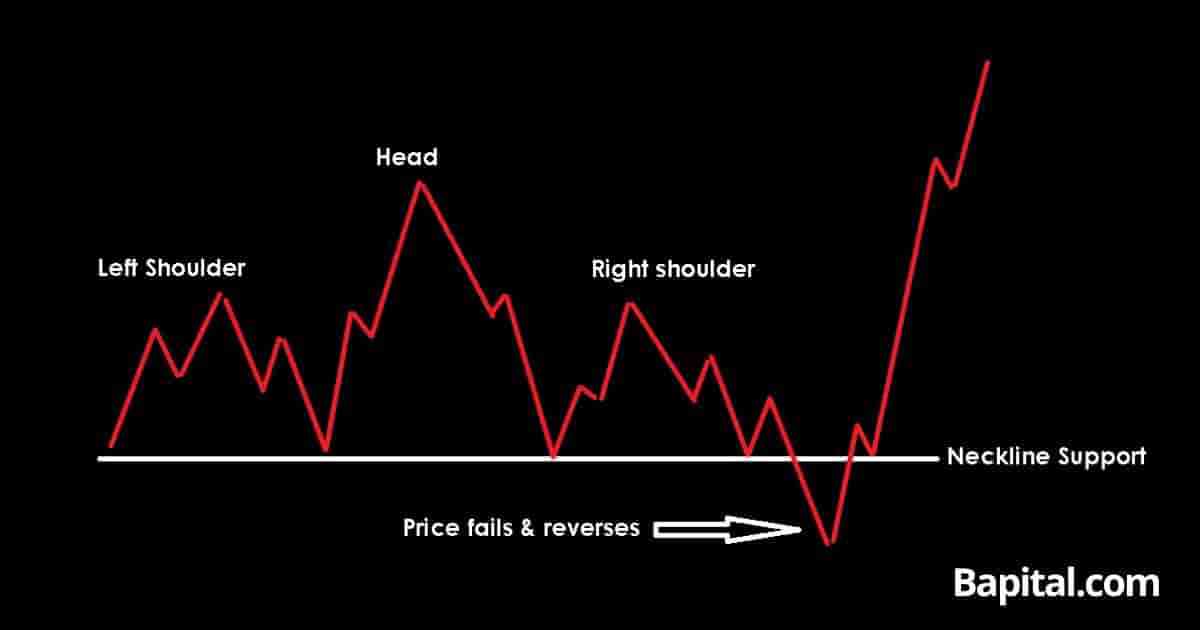

Head And Shoulders Pattern Failure - This guide, chocked full of practical chart examples, covers everything you need to know about this high performing pattern: The head and shoulders chart pattern indicates a potential trend reversal of the current uptrend. The height of the pattern plus the breakout price should be your target price using this indicator. A piece of exchanging productively is to work out the gamble and likely prize of each exchange that you make. Here we explain how it works, and how to interpret charts, rules, and failures. 65% percentage meeting price target: Web guide to what is head and shoulders pattern. Have you considered the complex head and shoulders top variety? The head and shoulders pattern is invalidated and considered a failed pattern when the market security price declines and breaks down below the neckline support area but quickly results in a major reversal and. Not all inverse head and shoulders pattern will work like a charm. Here we explain how it works, and how to interpret charts, rules, and failures. It is a bearish reversal formation. The head and shoulders pattern is invalidated and considered a failed pattern when the market security price declines and breaks down below the neckline support area but quickly results in a major reversal and. Here are a few things that. It is a bearish reversal formation. In the event of a failure, you need to be disciplined in order to stop out and cut your losses. Global equity markets report focuses mainly on chart patterns with horizontal boundaries. Web in this video, our analyst fawad razaqzada discusses how to spot and trade the failure of the head and shoulders pattern.. The pattern resembles a human head and shoulders, hence the name. A failed head and shoulders pattern occurs when the price action violates the expected breakout or breakdown of the classic head and shoulders pattern, indicating a potential continuation of the prevailing trend. While failure of the h&s and other. General pattern failure occurs when a chart pattern breaks out,. Web what is general pattern failure? To avoid confusion, the explanation in this guide is for the head and shoulders top pattern. Not all inverse head and shoulders pattern will work like a charm. It consists of three peaks, with the middle peak (the head) higher than the two surrounding peaks (the shoulders). The head and shoulders chart pattern indicates. Web the head forms when enthusiasm peaks and then declines to a point at or near the stock's previous low. Web inverse head and shoulders failure. General pattern failure occurs when a chart pattern breaks out, fails to hit target, quickly reverses then rejects off that same breakout level back inside the pattern continuing in the opposite direction of the. It is a bearish reversal formation. The pattern resembles a human head and shoulders, hence the name. Sometimes, we will receive our confirmation signal and the price does not reach our minimum target. Web what is general pattern failure? Web the head forms when enthusiasm peaks and then declines to a point at or near the stock's previous low. Web how do you know when an (inverse) head and shoulders pattern has failed? You have to wait for them to complete. Not all inverse head and shoulders pattern will work like a charm. It is a bearish reversal formation. Web the head and shoulders stock pattern is a technical analysis chart pattern that indicates a potential trend reversal from. Web what is failed head and shoulders pattern? It is a bearish reversal formation. Web the head and shoulders pattern is not infallible and can produce false signals or pattern failure. The height of the pattern plus the breakout price should be your target price using this indicator. Web head & shoulder failure. Web inverse head and shoulders failure. The head and shoulders pattern is invalidated and considered a failed pattern when the market security price declines and breaks down below the neckline support area but quickly results in a major reversal and. To avoid confusion, the explanation in this guide is for the head and shoulders top pattern. Web instead of a. Web when does the head and shoulders pattern fail. It consists of three peaks, with the middle peak (the head) higher than the two surrounding peaks (the shoulders). You have to wait for them to complete. Lack of demand along the lows of the pattern or the breakout; Web a head and shoulders pattern failure, also known as a failed. Web a head and shoulders pattern failure, also known as a failed head and shoulders, is when a head and shoulders forms but fails. Web inverse head and shoulders failure. Have you considered the complex head and shoulders top variety? Sometimes, we will receive our confirmation signal and the price does not reach our minimum target. Web when does the head and shoulders pattern fail. The pattern resembles a human head and shoulders, hence the name. Overall performance rank (1 is best): General pattern failure occurs when a chart pattern breaks out, fails to hit target, quickly reverses then rejects off that same breakout level back inside the pattern continuing in the opposite direction of the breakout. Web what is general pattern failure? This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). The right shoulder forms as the stock price rallies once again but fails to reach its previous high before falling again. It is a bearish reversal formation. Web instead of a trend reversal, the head and shoulders pattern failure may hint at a continuation of the current trend or even the birth of a new directional move, thus demanding a strategic shift in risk management and opportunity assessment. Lack of demand along the lows of the pattern or the breakout; 65% percentage meeting price target: Web the head and shoulders stock pattern is a technical analysis chart pattern that indicates a potential trend reversal from bullish to bearish.

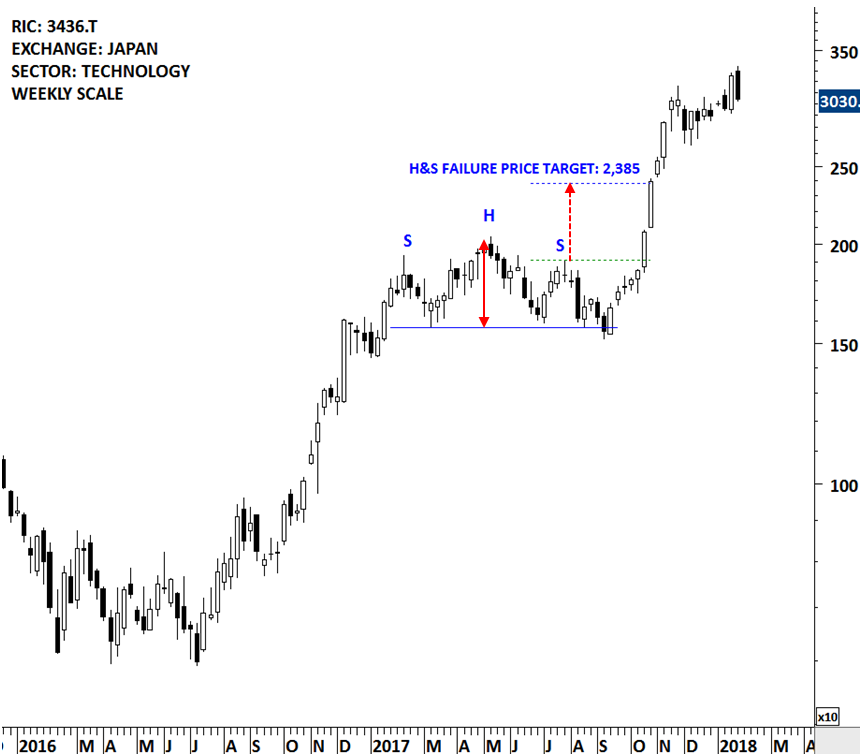

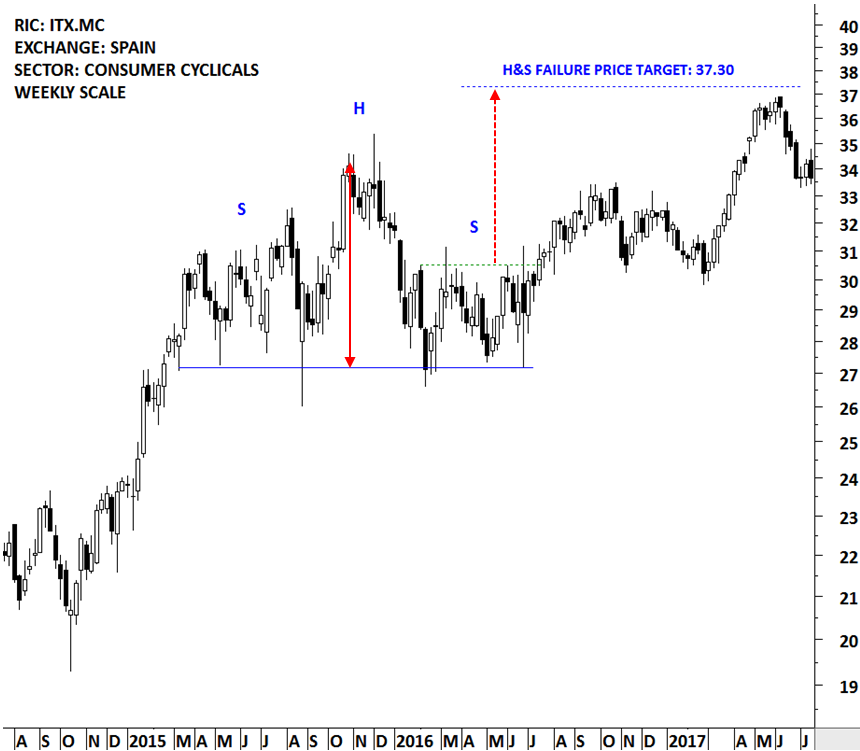

HEAD & SHOULDER FAILURE Tech Charts

Reverse Head And Shoulders Pattern (Updated 2023)

Failed Head and Shoulders Pattern What does failure mean?

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

HEAD & SHOULDER FAILURE Tech Charts

Cara Trading Dengan Head And Shoulders Failure Pattern Artikel Forex

The Head And Shoulders Chart Pattern Indicates A Potential Trend Reversal Of The Current Uptrend.

You Have To Wait For Them To Complete.

Web What Is Failed Head And Shoulders Pattern?

Head And Shoulder Is A Reliable Reversal Chart Pattern That Forms After An Advance Or A Decline And The Completion Of The Formation Suggests A Reversal Of The Existing Trend.

Related Post: