Head And Shoulders Pattern Bottom

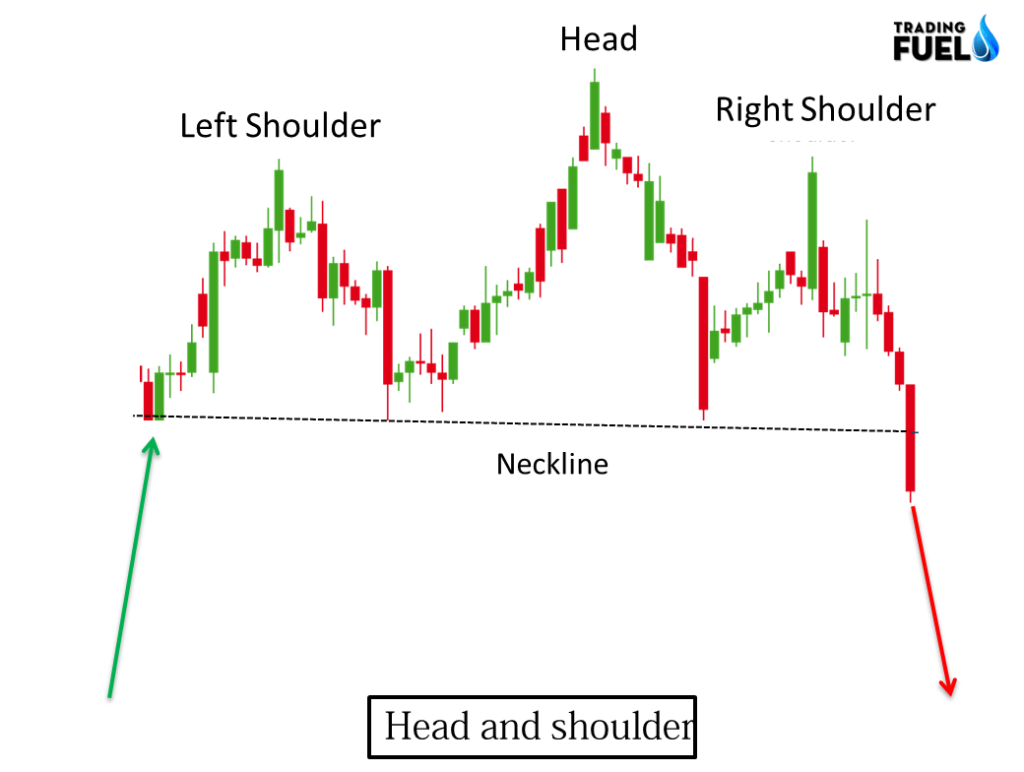

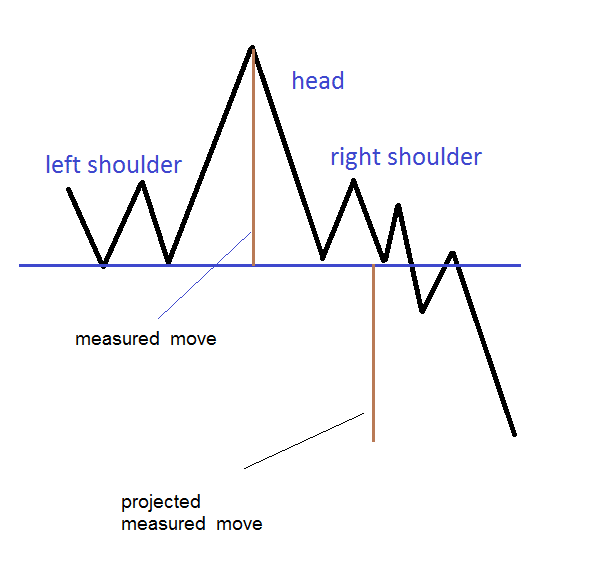

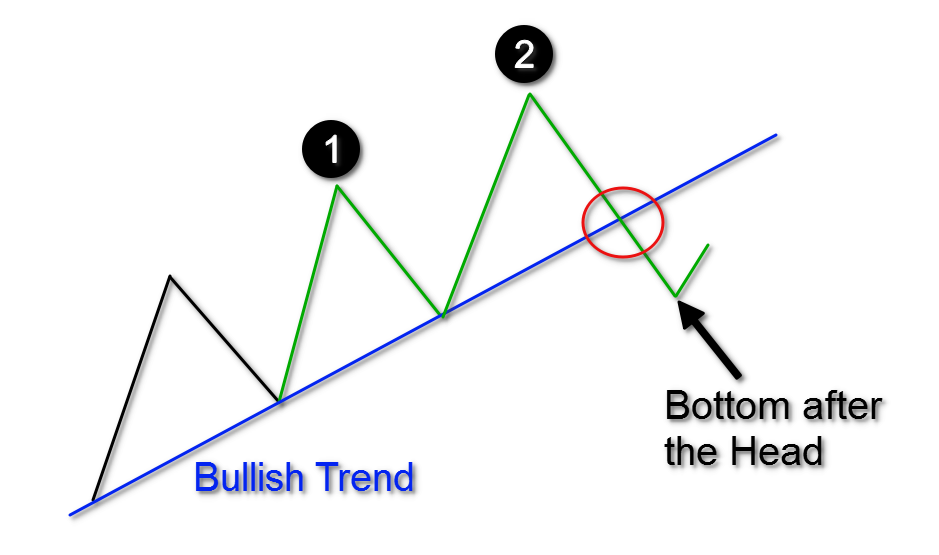

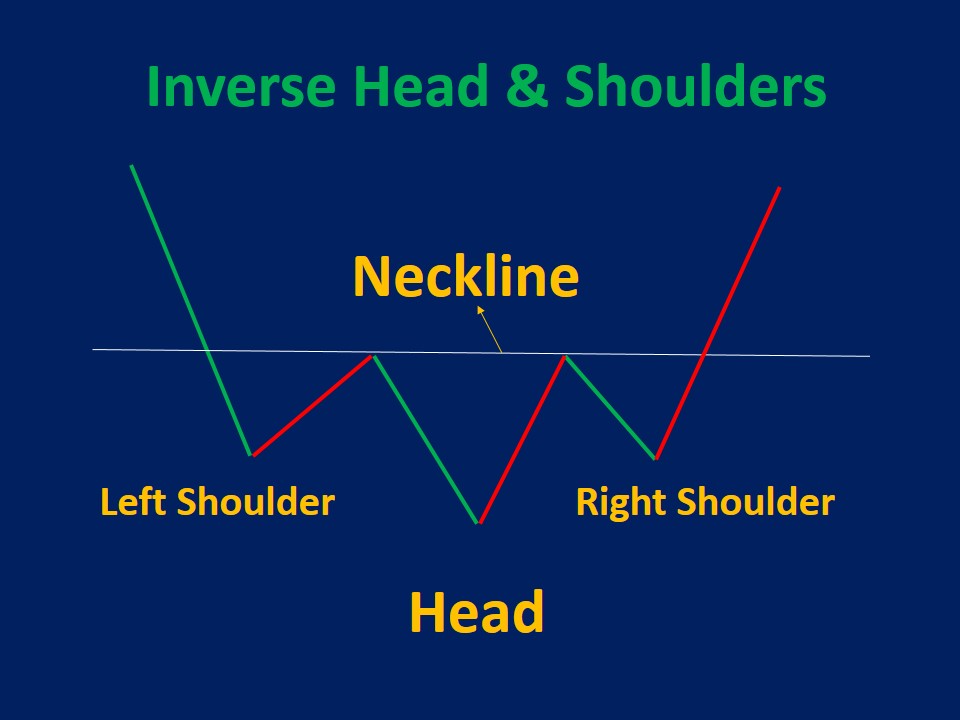

Head And Shoulders Pattern Bottom - That pattern is historically bullish. Web recognizing common chart patterns is essential for trading penny stocks effectively. They're subjective at times but the complete pattern provides. It is the mirror image of the head and shoulders top, also known as inverse head and shoulders. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher. The bullish version of the pattern establishes at the bottom of the downtrend and implies. Web an inverse head and shoulders, also called a head and shoulders bottom or a reverse head and shoulders, is inverted with the head and shoulders top used to. Web biles took home the gold, winning her ninth olympic medal and cementing her status as the most decorated us gymnast of all time. Web the head and shoulders pattern is a reversal trend, indicating price movement is changing from bullish to bearish. Specifically, head and shoulders charting signal an impending. Head and shoulders patterns occur in all timeframes and can be seen visually. That pattern is historically bullish. It represents a bullish signal suggesting. Web the head and shoulders bottom is a major reversal pattern that forms after a downtrend. Among the most widely recognized patterns are head and shoulders,. It is the mirror image of the head and shoulders top, also known as inverse head and shoulders. Web the bottom line. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. A higher “head” situated between two lower “shoulders”, all linked by a common baseline. Web a head and shoulders pattern on a stock chart includes three peaks with the middle being the highest. Web the head and shoulders pattern occurs when the price of security starts rising, marking the bullish trend, and reaches a new high level. Web the head and shoulders pattern is a reversal trend, indicating price movement is changing from bullish. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. Web this is known as the head and shoulders bottom or the inverse head and shoulders. Web the head and shoulders bottom is a popular pattern with investors. The pattern is never perfect in shape, as.. Web the first is a bullish case where bitcoin would confirm a triple bottom structure “around the 38.2 fib level” at $63,450. Web an inverse head and shoulders, also called a head and shoulders bottom or a reverse head and shoulders, is inverted with the head and shoulders top used to. Web biles took home the gold, winning her ninth. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. Web this is known as the head and shoulders bottom or the inverse head and shoulders. Web the inverse head and shoulders, or the head and shoulders bottom, is. Web a head and shoulders pattern on a stock chart includes three peaks with the middle being the highest. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher. A higher “head” situated between two lower “shoulders”, all linked by a. Web the head and shoulders pattern is a reversal trend, indicating price movement is changing from bullish to bearish. Web this is known as the head and shoulders bottom or the inverse head and shoulders. Web biles took home the gold, winning her ninth olympic medal and cementing her status as the most decorated us gymnast of all time. Web. The bullish version of the pattern establishes at the bottom of the downtrend and implies. Web the head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. Web recognizing common chart patterns is essential for trading penny stocks effectively. Web the head and shoulders chart pattern is a price reversal. It consists of 3 tops with a higher high in the. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Web this is known as the head and shoulders bottom or the inverse head and shoulders. It is considered one of the most. Head and shoulders patterns occur. It is the mirror image of the head and shoulders top, also known as inverse head and shoulders. Among the most widely recognized patterns are head and shoulders,. The bullish version of the pattern establishes at the bottom of the downtrend and implies. It consists of 3 tops with a higher high in the. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Web the bottom line. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher. The pattern is never perfect in shape, as. Web recognizing common chart patterns is essential for trading penny stocks effectively. Web this is known as the head and shoulders bottom or the inverse head and shoulders. Web head and shoulders bottom. Web the head and shoulders pattern is a reversal trend, indicating price movement is changing from bullish to bearish. This pattern marks a reversal of a downward trend in a financial instrument's price. It is often referred to as an inverted head.

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Head and shoulders bottoms MORE THAN MEETS THE EYE. Chances are you

Homily Chart(English) Learning Chart Pattern 6 Head and shoulders

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

What Is a Head and Shoulders Chart Pattern in Technical Analysis?

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

Head and Shoulders Pattern Types, How to Trade & Examples

A Short Explanation The Head and Shoulders chart pattern

Head and Shoulders Trading Patterns ThinkMarkets EN

The Head and Shoulders Pattern A Trader’s Guide

Chart Patterns The Head And Shoulders Pattern Forex Academy

Web Head And Shoulders Bottom.

Web An Inverse Head And Shoulders, Also Called A Head And Shoulders Bottom Or A Reverse Head And Shoulders, Is Inverted With The Head And Shoulders Top Used To.

Web The First Is A Bullish Case Where Bitcoin Would Confirm A Triple Bottom Structure “Around The 38.2 Fib Level” At $63,450.

They're Subjective At Times But The Complete Pattern Provides.

Related Post: