Head And Shoulders Pattern Bearish

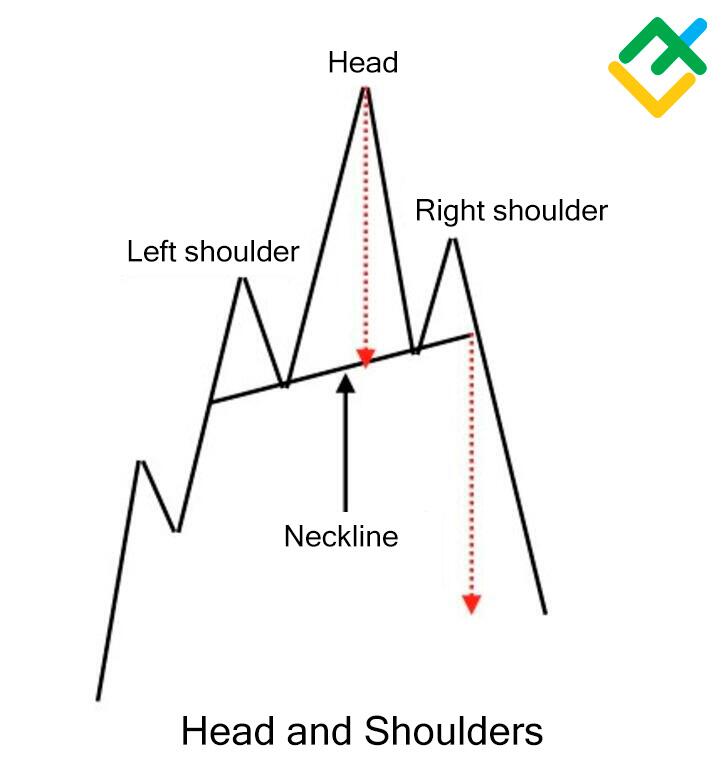

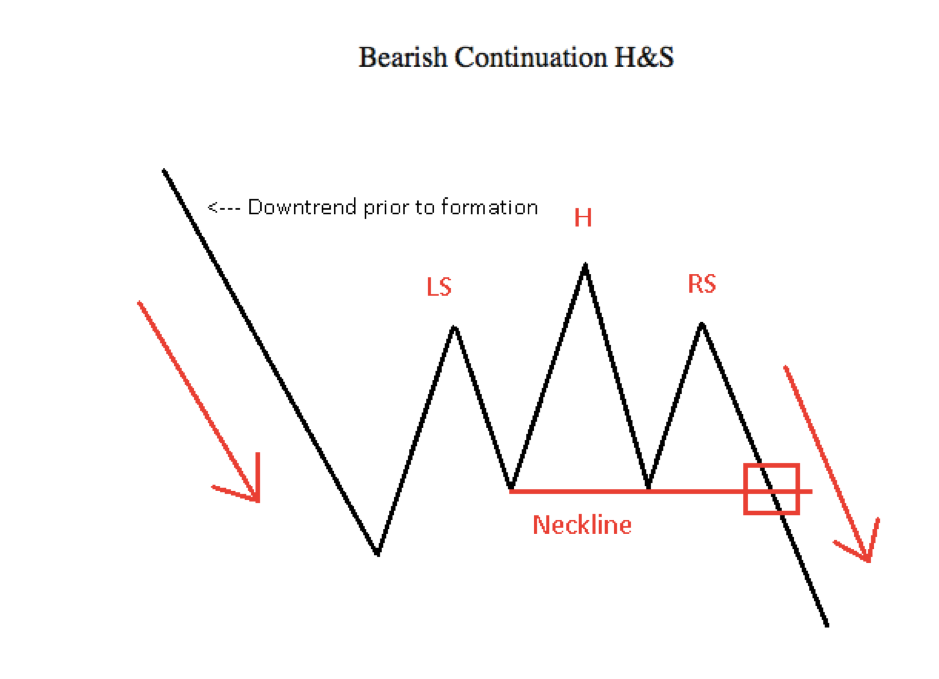

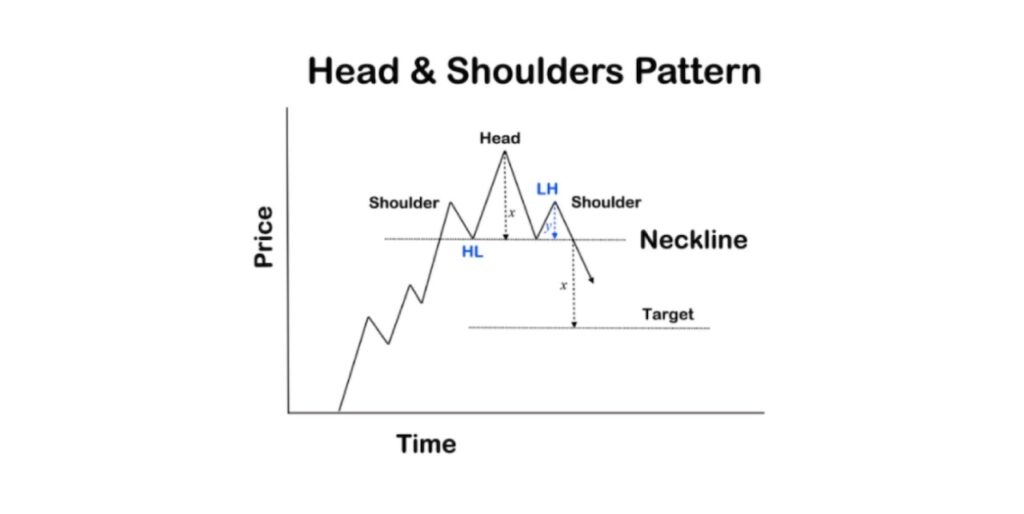

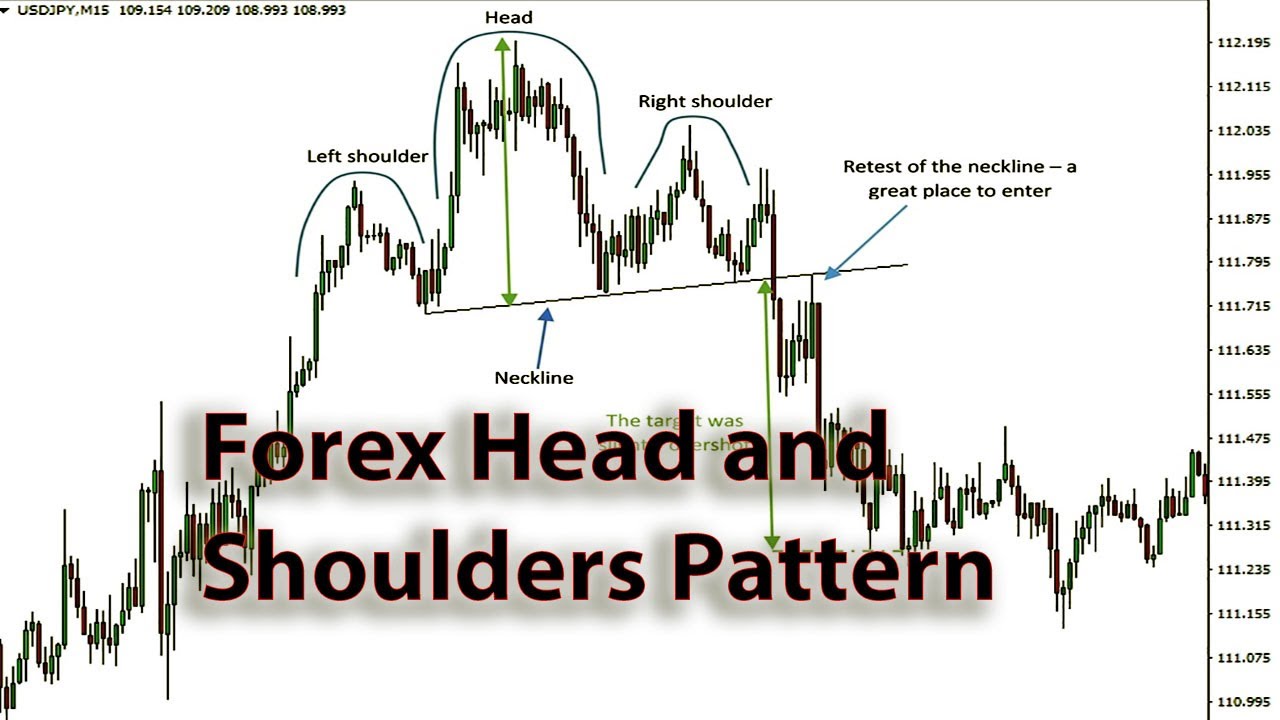

Head And Shoulders Pattern Bearish - The warning happens when the right shoulder is lower than the left shoulder. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Web what is a head and shoulders pattern? There are four main components of the head and shoulders pattern shown in the image below. Prices then find buyers at the new. It is considered a reliable and accurate chart pattern and is often used by traders and investors to. It starts as bullish but turns into a bearish reversal when the price fails the neckline area. Web if you're looking to add a position, the formation of an inverse head and shoulders, with a stock price breaking above the neckline, often indicates a bearish trend has ended and the stock is poised for higher highs. It typically forms at the end of a bullish trend. Web the second is a bearish case involving a breakdown of the support at $63,000, swiftly moving the price down to $61,000. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. The left shoulder forms at the end of a significant bullish period in the market. Price gains don’t last long before bears return. Web what is a head and shoulder pattern? The head and shoulders pattern is considered as one of the most reliable trend reversal patterns. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. • ascending broadening • broadening • descending broadening • double bottom. Read on, and you will know! Price gains don’t last long before bears return and push prices even lower than before; The formation consists of three distinct lows: The pattern can be used to predict both the reversal point and the target price. Web the head and shoulders trading pattern means bulls have lost conviction, and bears are gaining control. This is a reversal pattern and can act both as a bullish and bearish reversal pattern depending upon the prior trend and type of this pattern. A characteristic pattern takes shape and is recognized as reversal formation. The head and shoulders pattern is considered as one of the most reliable trend reversal patterns. This drop in prices is not for. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. The patterns included are as follows: Web the second is a bearish case involving a breakdown of the support at $63,000, swiftly moving the price down to $61,000. Web the head and shoulders pattern occurs when the price of security starts rising, marking. Considered to be a bearish chart pattern. However, bulls begin to return and push prices slightly higher. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Web the head and shoulders is. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. What does a head and shoulders pattern mean, and how to trade its signal? Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal. Web what is a head and shoulders pattern? Web head and shoulders pattern, as the name suggests the shape of a head along with two shoulders. Web a head and shoulders is a bearish pattern. The pattern can be used to predict both the reversal point and the target price. The right shoulder on these patterns typically is higher than. The pattern can be used to predict both the reversal point and the target price. The head and shoulders stock pattern is a common tool to help identify the fall of a previously rising stock. It starts as bullish but turns into a bearish reversal when the price fails the neckline area. Web is a head and shoulders pattern bullish. The pattern can be used to predict both the reversal point and the target price. The head and shoulders pattern is one of the most reliable reversal patterns. Web the head and shoulders pattern is a specific chart formation that predicts a bullish to bearish trend reversal. Web a head and shoulders pattern is a bearish reversal pattern in technical. It consists of 3 tops with a higher high in the middle, called the head. The head and shoulders pattern is one of the most reliable reversal patterns. What does a head and shoulders pattern mean, and how to trade its signal? It starts as bullish but turns into a bearish reversal when the price fails the neckline area. The patterns included are as follows: Web the head and shoulders pattern occurs when the price of security starts rising, marking the bullish trend, and reaches a new high level. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and. Web a head and shoulders is a bearish pattern. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. Web the head and shoulders is a bearish candlestick pattern that occurs at the end of an uptrend and indicates a trend reversal. Price gains don’t last long before bears return and push prices even lower than before; Web the regular head and shoulders pattern forms at the top of the uptrend and is referred to as the head and shoulders top. The 100 sma is above the 200 sma for now, but the gap between the moving averages has narrowed enough to hint at a likely bearish. Web the second is a bearish case involving a breakdown of the support at $63,000, swiftly moving the price down to $61,000. The left shoulder, a lower middle head, and a second right shoulder roughly at the same level as the left one, all located below a common downward trend.

Head and shoulders bearish pattern 4hr chart for COINBASEBTCUSD by

Head and Shoulders Pattern Definition, Stock Trading Chart, Bullish

How to Trade the bearish Head and Shoulders Pattern in Best Forex

A Short Explanation The Head and Shoulders chart pattern

Day Trading Patterns A Complete Guide (with Examples!)

Bybit Learn Head and Shoulders Pattern What Is It & How to Trade

How to Trade the inverse head and shoulders pattern bearish for

Head and Shoulders Pattern Trading Strategy Synapse Trading

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

Head and Shoulders — Chart Patterns — TradingView

The Head And Shoulders Pattern Is Considered As One Of The Most Reliable Trend Reversal Patterns.

Prices Then Find Buyers At The New.

The Pattern Can Be Used To Predict Both The Reversal Point And The Target Price.

• Ascending Broadening • Broadening • Descending Broadening • Double Bottom • Double Top • Triple Bottom • Triple Top • Bearish Elliot Wave • Bullish Elliot Wave • Bearish.

Related Post: