Hangman Candle Pattern

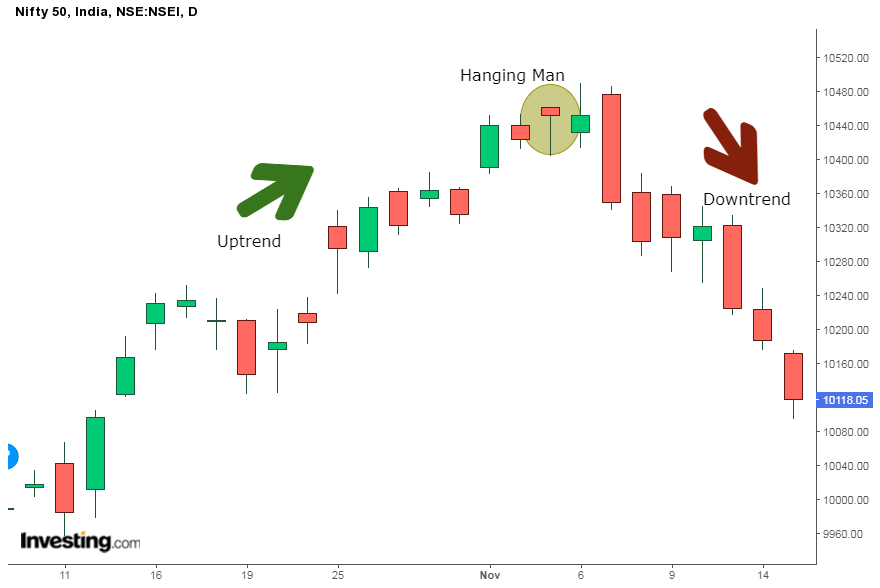

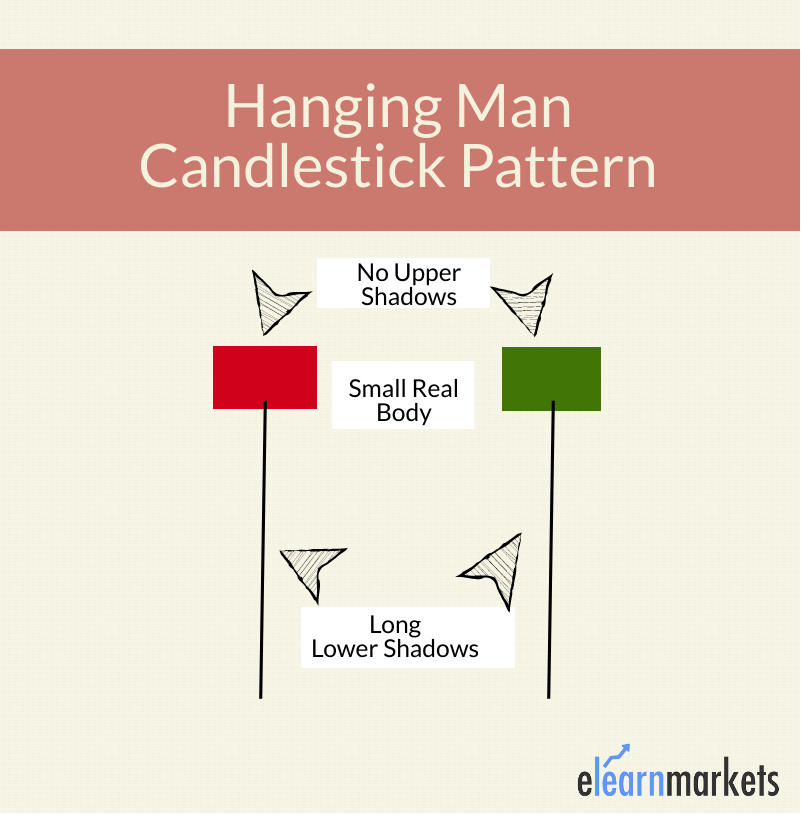

Hangman Candle Pattern - It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. It is a single candle formation that occurs during an upward price trend. Web bearish candlestick patterns: Web the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. It is a reversal pattern characterized by a small body in the upper half of the range, a long downside wick, and little to no upper wick. As the name suggests, it is a candlestick pattern that happenswhen the financial asset is in an upwardtrend. The pattern resembles the shape of a man hanging from a rope. It can be used and traded on all time frames and in many different markets making it very popular for analysis. As you will see below, it is earily similar to the hammer. The red flag is there even though the bulls regained control at the end of the day. It is a single candle formation that occurs during an upward price trend. As the name suggests, it is a candlestick pattern that happenswhen the financial asset is in an upwardtrend. This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal downward. Web a hanging man candlestick is a technical analysis. Web what is the hanging man candlestick pattern? This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. How to identify and use the hanging man candlestick? This article will cover identifying, interpreting, and trading the hanging man. Traders utilize this pattern in the trend direction of pattern changes. How to identify and use the hanging man candlestick? Web the hanging man is probably one of the better known candlestick patterns, but it does not work as many expect. What does hanging man pattern indicate. Web the hanging man candlestick meaning is a sign that buyers are losing control. Web everything you need to know about the hanging man. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. Web what is the hanging man candlestick pattern? Web a hammer candlestick pattern is a bullish candlestick pattern that comprises a small body, little to no upper. It can be used and traded on all time frames and in many different markets making it very popular for analysis. As the name suggests, it is a candlestick pattern that happenswhen the financial asset is in an upwardtrend. What is the hanging man candlestick? Web the hanging man is a japanese candlestick pattern that signals the reversal of an. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Traders utilize this pattern in the trend direction of pattern changes. The script defines conditions for shooting star, hanging man, and bearish marubozu candlestick patterns using math.max and math.min. It is a single candle formation that occurs during an upward. Candle theory says it acts as a bearish reversal of the prevailing price trend, but my tests show that it is really a bullish continuation 59% of the time. What does hanging man pattern indicate. Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. It is a reversal pattern characterized. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. As you will see below, it is earily similar to the hammer. You’ll learn what a hanging man looks like. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement.. The pattern resembles the shape of a man hanging from a rope. What does hanging man pattern indicate. Web what is a hanging man candlestick pattern? As you will see below, it is earily similar to the hammer. It can be used and traded on all time frames and in many different markets making it very popular for analysis. It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. Web a hammer candlestick pattern is a bullish candlestick pattern that comprises a small body, little to no upper wick, and a large lower wick which is at least twice as large as the body of the pattern. It is a. The hanging man is a single candlestick pattern that appears after an uptrend. The pattern resembles the shape of a man hanging from a rope. In the hammer pattern, the color of the body can either be red or green. Web the hanging man is a japanese candlestick pattern that signals the reversal of an uptrend. The sell condition is met when. While the underlying trend doesn’t need to be bullish for the hanging candlestick to appear, there must be a price rise before the pattern appears and changes the price action direction. Web learn what the hanging man candlestick pattern is and how to trade it effectively. This article will cover identifying, interpreting, and trading the hanging man. Web the hanging man is a candlestick pattern that indicates a new potential reversal lower is about to occur. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Web what is a hanging man candlestick pattern? Web the hanging man candlestick pattern is one pattern that affirms the seller’s footprint after a long bullish swing. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement. The hanging man candlestick pattern, as one could predict from the name, is viewed as a bearish reversal pattern. Traders utilize this pattern in the trend direction of pattern changes. It is a single candle formation that occurs during an upward price trend.

Hanging Man Candlestick Pattern Trading Strategy

What Is Hanging Man Candlestick Pattern With Examples ELM

Hanging Man Candlestick Pattern (How to Trade and Examples)

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

The Location Of A Candlestick Can Qualify Or Disqualify A Trade For A Trader.

How To Identify And Use The Hanging Man Candlestick?

You’ll Learn What A Hanging Man Looks Like.

What Hanging Man Pattern Candlestick Indicates About Market Sentiment, And How To Leverage The Hanging Dead Man Candlestick In Your Own Trading Strategy.

Related Post: