Hanging Man Pattern

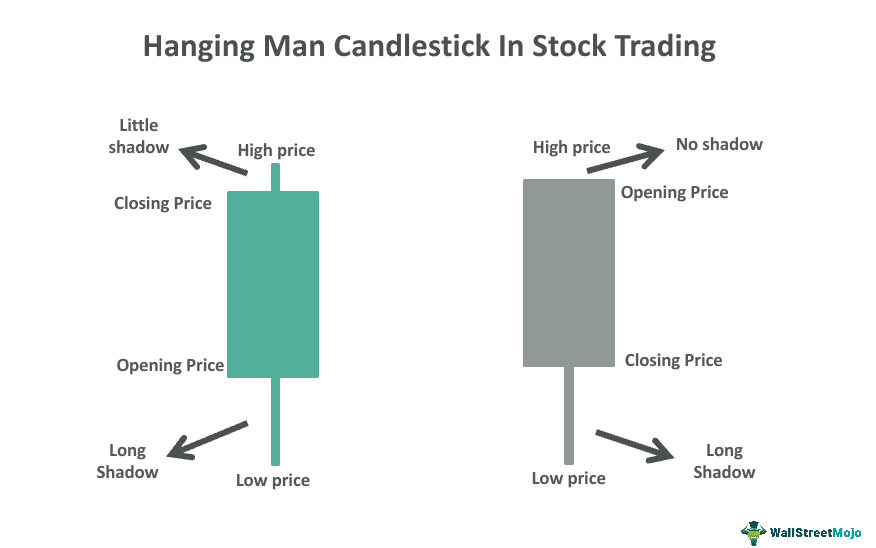

Hanging Man Pattern - Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. Here we cover hunting tips, season reports, gear reviews, trips ideas, and stories. Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. The real body of the candle is smaller with a long shadow. If the candlestick is green or white,. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. Traders utilize this pattern in the trend direction of pattern changes. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. The hanging man is a single candlestick pattern that appears after an uptrend. Web learn what the hanging man candlestick pattern is and how to trade it effectively. Web trading the hanging man candlestick pattern is easy once a bullish. Web a drag performance appearing to invoke leonardo da vinci's the last supper mural had people talking after the paris olympics opening ceremony. Web the hanging man candlestick pattern is a bearish reversal that forms in an upward price swing. It has the appearance of the hammer pattern — small body and long lower shadow — but unlike the latter,. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. A long lower shadow or wick Traders utilize this pattern in the trend direction of pattern changes. Web what is the hanging man candlestick pattern? Perhaps this is a consequence of the impressive name referring to the shape of the. Hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Web a drag performance appearing to invoke leonardo da vinci's the last supper mural had people talking after the paris olympics opening ceremony. It is a sign of weakness in the asset’s ability to sustain an uptrend. Web what is the. Web a hanging man is a bearish reversal candlestick pattern that takes place at the top of a bullish uptrend. Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. Hanging man is a bearish. Hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. It has the appearance of the hammer pattern — small body and long lower shadow — but unlike the latter, the hanging man is. It is a reversal pattern characterized by a small body in the upper half of the range,. Web what is a hanging man candlestick pattern? Web the hanging man pattern is used by traders to identify potential changes in market sentiment and make informed trade decisions. It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. Web the hanging man candlestick pattern is a bearish reversal that forms. Web the hanging man candlestick is a single candle stick formation that provides the first sign of weakness. A long lower shadow or wick Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. Here we cover hunting tips, season reports, gear reviews,. After a long bullish trend, this pattern is a warning that the trend may reverse soon, as the bulls appear to be losing momentum. Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. Web there are five many characteristics of the hanging man candle: It has the appearance of the hammer. The candle is formed by a long lower shadow coupled with a small real. Hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Web the hanging man pattern is a single candlestick pattern, recognized as a bearish reversal pattern that often occurs after an uptrend. It signifies a potential trend. This candlestick pattern appears at the end of the uptrend indicating weakness in. Web a hanging man candlestick is a bearish chart pattern used in technical analysis that potentially indicates a market reversal. Web what is a hanging man candlestick pattern? It has the appearance of the hammer pattern — small body and long lower shadow — but unlike the latter, the hanging man is. Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. Web what is the hanging man candlestick pattern? Web in technical analysis, the hanging man patterns are a single candlestick patterns that forms primarily at the top of an uptrend. The real body of the candle is smaller with a long shadow. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. Web the hanging man candlestick is a single candle stick formation that provides the first sign of weakness. Here we cover hunting tips, season reports, gear reviews, trips ideas, and stories. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. It is a sign of weakness in the asset’s ability to sustain an uptrend. It signifies a potential trend reversal, warning traders of a possible downward movement, and alerts them to make informed decisions. All one needs to do is find a market entry point, set a stop loss, and locate a profit target.

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging Man Candlestick

Hanging Man Candlestick Pattern Trading Strategy

The Hanging Man Candlestick Pattern A Trader’s Guide TrendSpider

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

Hanging Man Candlestick Pattern (How to Trade and Examples)

Web Learn What The Hanging Man Candlestick Pattern Is And How To Trade It Effectively.

Web A Hanging Man Is A Bearish Candlestick Pattern That Forms At The End Of An Uptrend And Warns Of Lower Prices To Come.

Web The Hanging Man Is A Japanese Candlestick Pattern That Technical Traders Use To Identify A Potential Bearish Reversal Following A Price Rise.

Web In This Article, We Will Share With You What The Hanging Man Candlestick Reversal Pattern Is And How To Trade It.

Related Post: