Hanging Man Candlestick Chart

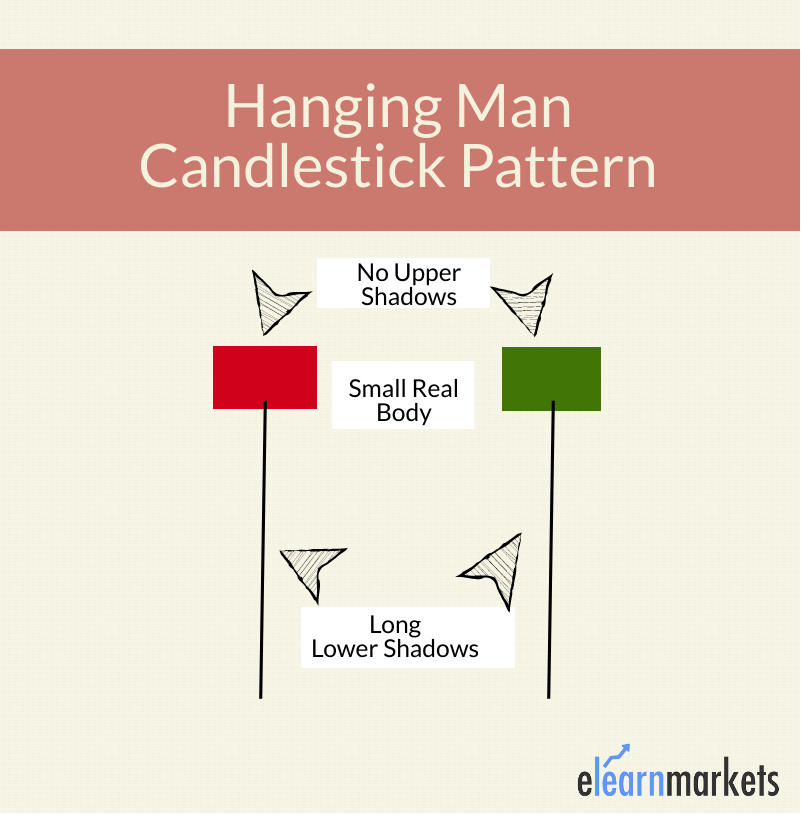

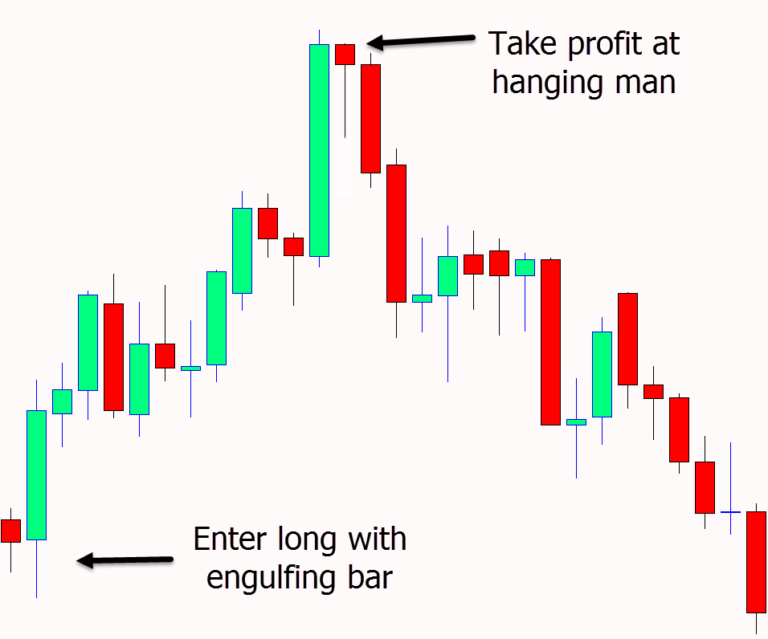

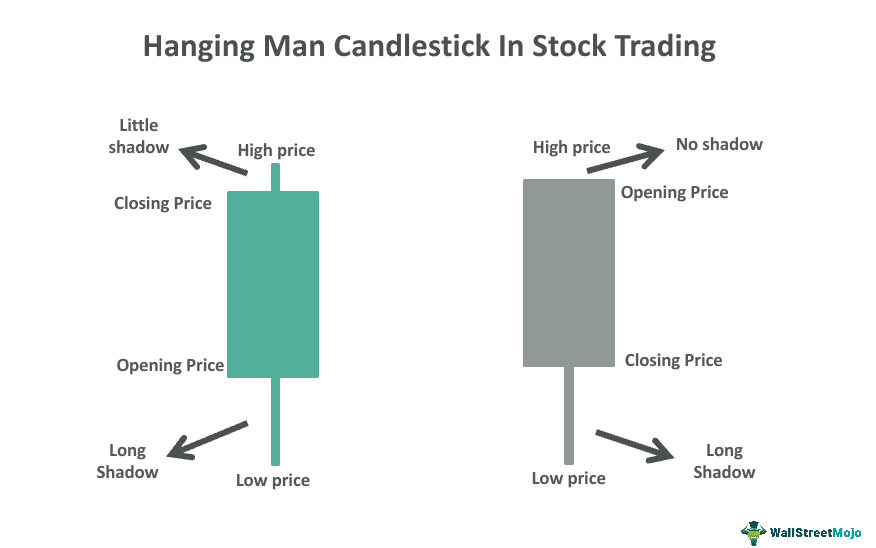

Hanging Man Candlestick Chart - Web in essence, the hanging man candlestick chart shows a battle between eager sellers and increasingly weak buyers. If the candlestick is green or white,. These candlesticks look like hammers and have a smaller real body with a longer lower shadow and no upper wick. Web a hanging man is a candlestick with a short real body, little to no upper shadow, and a longer lower shadow. It indicates that the open and close prices are close together and near the top of the trading range. It signals a weak bull and strong bear presence in the market at the far end of an uptrend. Web a hanging man candlestick is typically found at the peak of an uptrend or near resistance levels. How to trade the hanging man candlestick pattern. No upper shadow or the shadow cannot be longer than the body. Trend prior to the pattern: Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. It indicates that the open and close prices are close together and near the top of the trading range. The hanging man is one of the best crypto and forex candlestick patterns. It signals a weak bull and. The hanging man is a single candlestick pattern that appears after an uptrend. It is formed during an upward price trend and indicates that sellers are starting to gain control and may push prices lower. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. Web the hanging man pattern. It is formed during an upward price trend and indicates that sellers are starting to gain control and may push prices lower. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. This candlestick pattern appears at the end of the uptrend indicating weakness in further price movement.. They are typically red or black on stock charts. Web bearish candlestick patterns: Web a hanging man candlestick is typically found at the peak of an uptrend or near resistance levels. It is a reversal pattern characterized by a small body in the upper half of the range, a long downside wick, and little to no upper wick. Web the. White or black candle with a small body. Web hanging man is a bearish reversal candlestick pattern that has a long lower shadow and a small real body. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. It signals a weak bull. Web identifying hanging man candlestick trading signals. No upper shadow or the shadow cannot be longer than the body. If the candlestick is green or white,. The script defines conditions for hammer, bullish engulfing, and bullish harami candlestick patterns. Web in essence, the hanging man candlestick chart shows a battle between eager sellers and increasingly weak buyers. These candlesticks look like hammers and have a smaller real body with a longer lower shadow and no upper wick. Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. They are typically red or. Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. The script defines conditions for shooting star, hanging man, and bearish marubozu candlestick patterns using math.max and math.min. It resembles a man hanging from a. The script defines conditions for shooting star, hanging man, and bearish marubozu candlestick patterns using math.max and math.min. Sellers were able to drive prices lower intraday but lacked the momentum to sustain the down move. Price reversals are some of the most traded setups in the financial markets. Web the hanging man candlestick pattern is characterized by a short wick. What is the hanging man candlestick pattern. Web in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss its limitations. Web identifying hanging man candlestick trading signals. Hanging man candlesticks are commonly seen during topping formations, reversals, trending. How to trade the hanging man candlestick pattern. It indicates that the open and close prices are close together and near the top of the trading range. It is formed during an upward price trend and indicates that sellers are starting to gain control and may push prices lower. It also can appear after a gap up, which is perceived by traders to be a stronger bearish sign. All one needs to do is find a market entry point, set a stop loss, and locate a profit target. Price reversals are some of the most traded setups in the financial markets. The small real body is usually near the candle’s top and can be bullish or bearish. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. Hanging man candlesticks form when the end of an uptrend is occurring. No upper shadow or the shadow cannot be longer than the body. Web a hanging man is a candlestick with a short real body, little to no upper shadow, and a longer lower shadow. Web identifying hanging man candlestick trading signals. How to identify the hanging man candlestick pattern. The hanging man is one of the best crypto and forex candlestick patterns. Web a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Strategies to trade the hanging man candlestick pattern.

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

Hanging Man Candlestick Pattern (How to Trade and Examples)

Hanging Man Candlestick Pattern Trading Strategy

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

Hanging Man Candlestick Forex Trading

Hanging man candlestick chart pattern. Trading signal Japanese

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

Hanging Man Candlestick Pattern Trading Strategy

Hanging Man Candlestick Pattern Meaning, Explained, Examples

Web The Hanging Man Candlestick Pattern Has A Small Real Body, A Long Lower Shadow, And Little To No Upper Shadow.

Trend Prior To The Pattern:

Web A More Bearish Candlestick Following The Hanging Man Pattern Affirms The Uptrend Has Lost Momentum, And Sellers Are Likely To Push Prices Lower.

Here Are The Key Characteristics Of The Hanging Man Pattern:

Related Post: