Hammer Pattern Chart

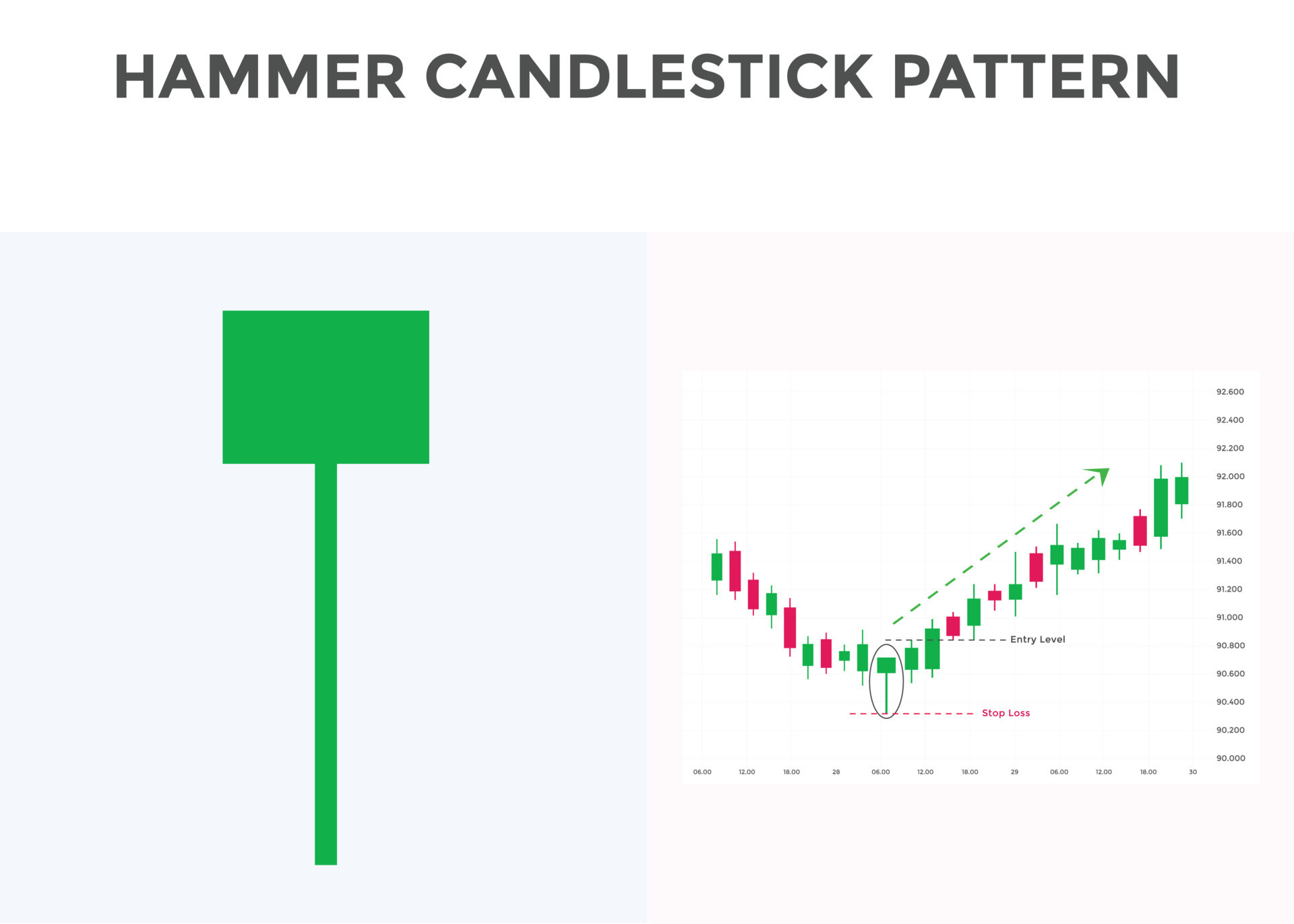

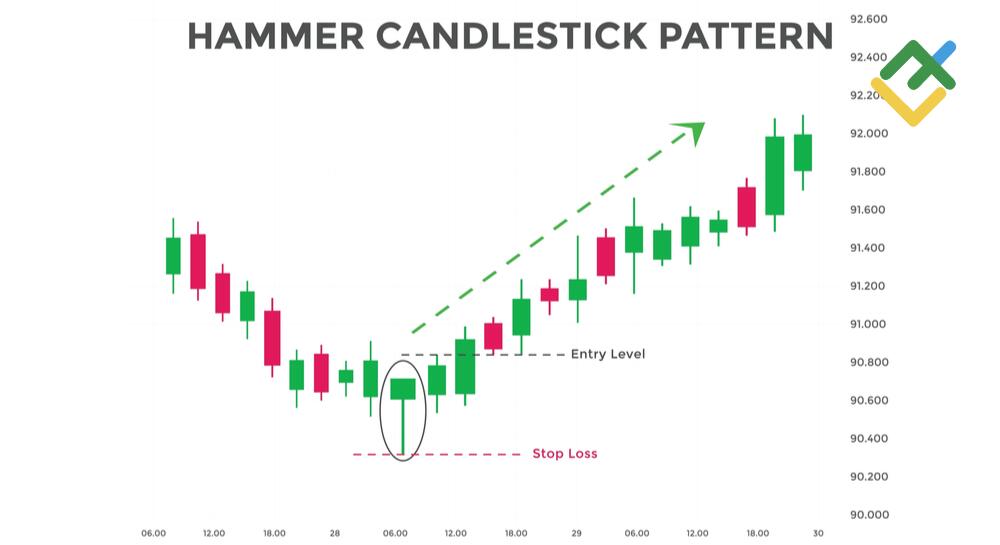

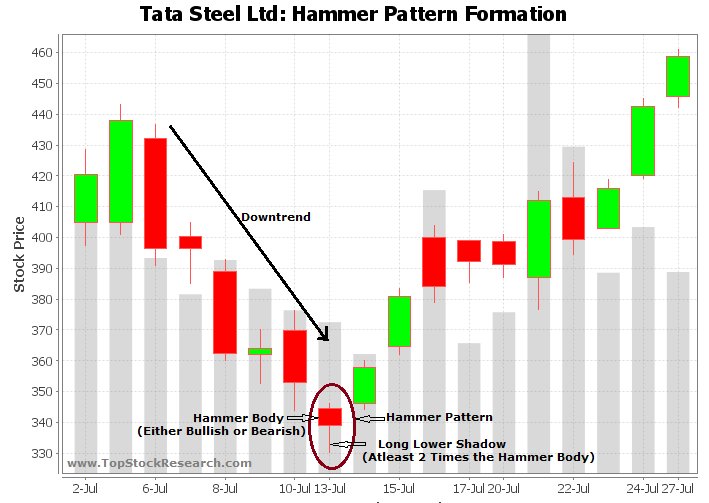

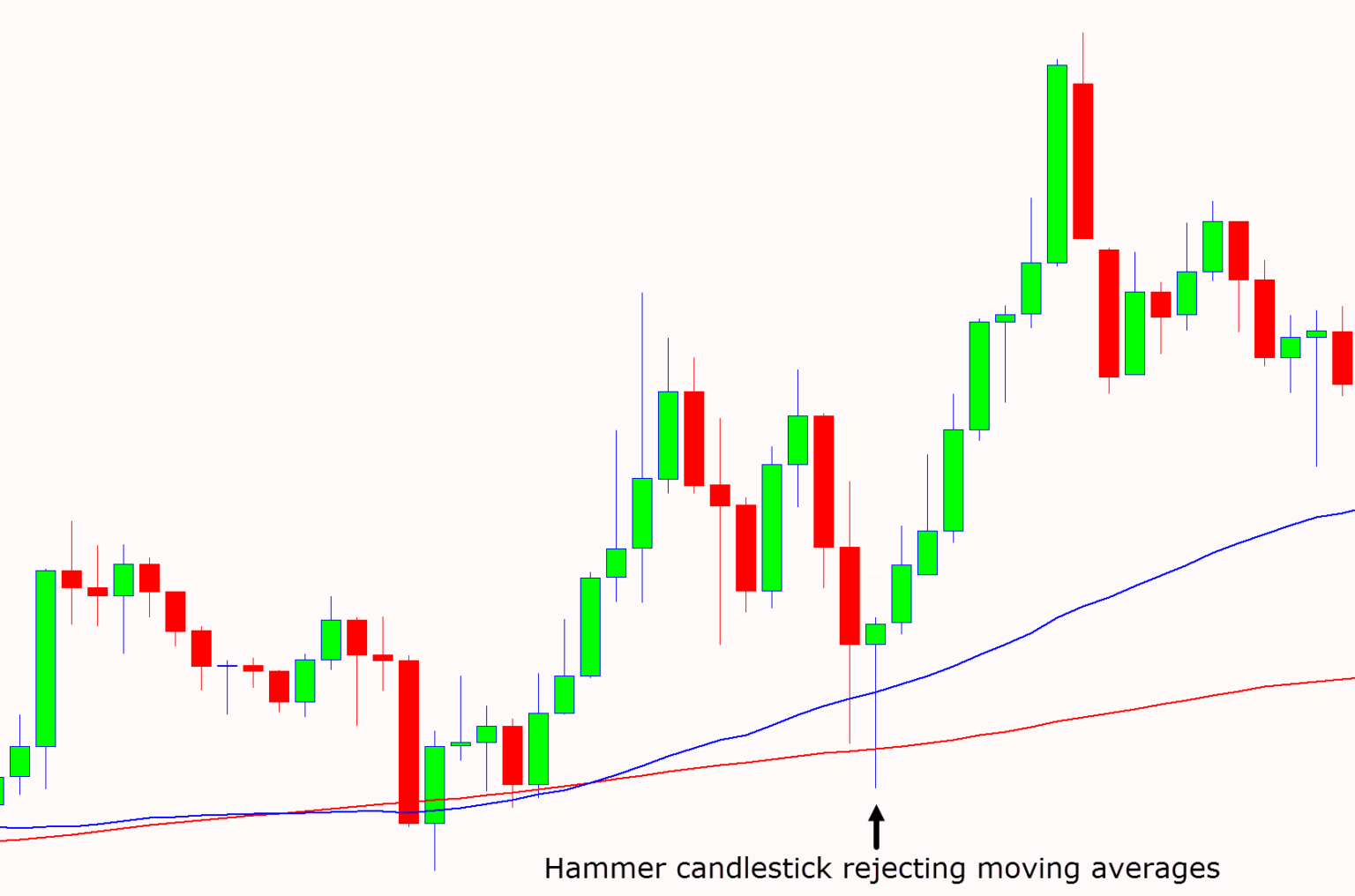

Hammer Pattern Chart - Web a hammer candlestick is typically found at the base of a downtrend or near support levels. Our guide includes expert trading tips and examples. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. It is very easy to identify this pattern in the market. It signals that the market is about to change trend direction and advance to new heights. It consists of a lower shadow which is twice long as the real body. Web the bullish hammer candlestick pattern is a significant reversal indicator, typically appearing at the bottom of downtrends, signifying potential bullish momentum. The hammer candle typically appears at the end of a downtrend, indicating a potential reversal in price movement. So, it could witness a trend. So, it could witness a trend. An umbrella line has the shape of an open umbrella with a short real body located at the upper end of the price range, and very little or no upper shadow, and a long lower shadow, which is at least twice the length of the real body. Web. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. The hammer candle typically appears at the end of a downtrend, indicating a potential reversal in price movement. It consists of a lower shadow which is twice long as the real body. Web hammer candlestick patterns occur when. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web at its core, the hammer pattern is considered a reversal signal that can often pinpoint the end. Web a hammer candle is a popular pattern in chart technical analysis. Web a hammer candlestick is typically found at the base of a downtrend or near support levels. You can recognize this bullish reversal pattern by its key features: Web however, a hammer chart pattern was formed in its last trading session, which could mean that the stock found. We will dissect the hammer candle in great detail, and provide some practical tips for applying it in the forex market. Web to effectively use the hammer pattern in your trading strategy, you need to understand its characteristics and how to identify it in a price chart. Web the hammer candlestick pattern is a bullish candlestick that is found at. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. It consists of a lower shadow which is twice long as the real body. An umbrella line has the shape of an open umbrella with a short real body located at the upper end of the price range, and. If the candlestick is green or. Hammer candlesticks comprise a smaller real body with no upper wick and a long lower shadow. Look for downtrend conclusion, long shadow, and confirmation candle for trading. Web the hammer pattern consists of a single candlestick that is called an umbrella line because of its form or shape. A long shadow extending below the. It is very easy to identify this pattern in the market. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. Hammer variations include inverted hammers, hanging men, and doji, each indicating distinct trends and reversals. Web understanding hammer chart and the technique to trade it. It signals that the market is about to. Hammer candlesticks comprise a smaller real body with no upper wick and a long lower shadow. Look for downtrend conclusion, long shadow, and confirmation candle for trading. Web hammer candlestick pattern is a bullish reversal candlestick pattern. Web the bullish hammer candlestick pattern is a significant reversal indicator, typically appearing at the bottom of downtrends, signifying potential bullish momentum. It. Hammers signal trend changes and short position exits. 4/5 (8,406 reviews) It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Hammer candlesticks are bullish reversal signs. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back. Web a hammer candlestick is typically found at the base of a downtrend or near support levels. Hammer candlesticks comprise a smaller real body with no upper wick and a long lower shadow. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web however, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. Web the bullish hammer candlestick pattern is a significant reversal indicator, typically appearing at the bottom of downtrends, signifying potential bullish momentum. This candlestick is formed when the open and close prices are almost the same. This pattern appears like a hammer, hence its name: Hammer candlesticks are bullish reversal signs. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Hammers signal trend changes and short position exits. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. Web at its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase.

Hammer pattern candlestick chart pattern. Bullish Candlestick chart

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

What is a Hammer Candlestick Chart Pattern? LiteFinance

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern Trading Guide

Tutorial on Hammer Candlestick Pattern

Hammer Candlestick Pattern Trading Guide

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer Candlestick Pattern Trading Guide

Inverted Hammer Candlestick Pattern Quick Trading Guide

A Long Shadow Extending Below The Real Body, A Small Real Body, And A Minimal Or Absent Upper Shadow.

In Short, A Hammer Consists Of A Small Real Body That Is Found In The Upper Half Of The Candle’s Range.

You Can Recognize This Bullish Reversal Pattern By Its Key Features:

4/5 (8,406 Reviews)

Related Post: