Hammer In Candlestick Chart

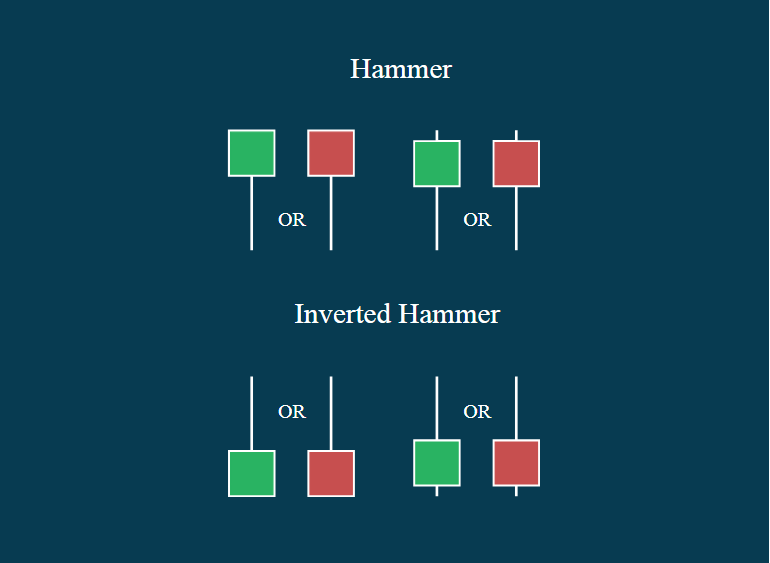

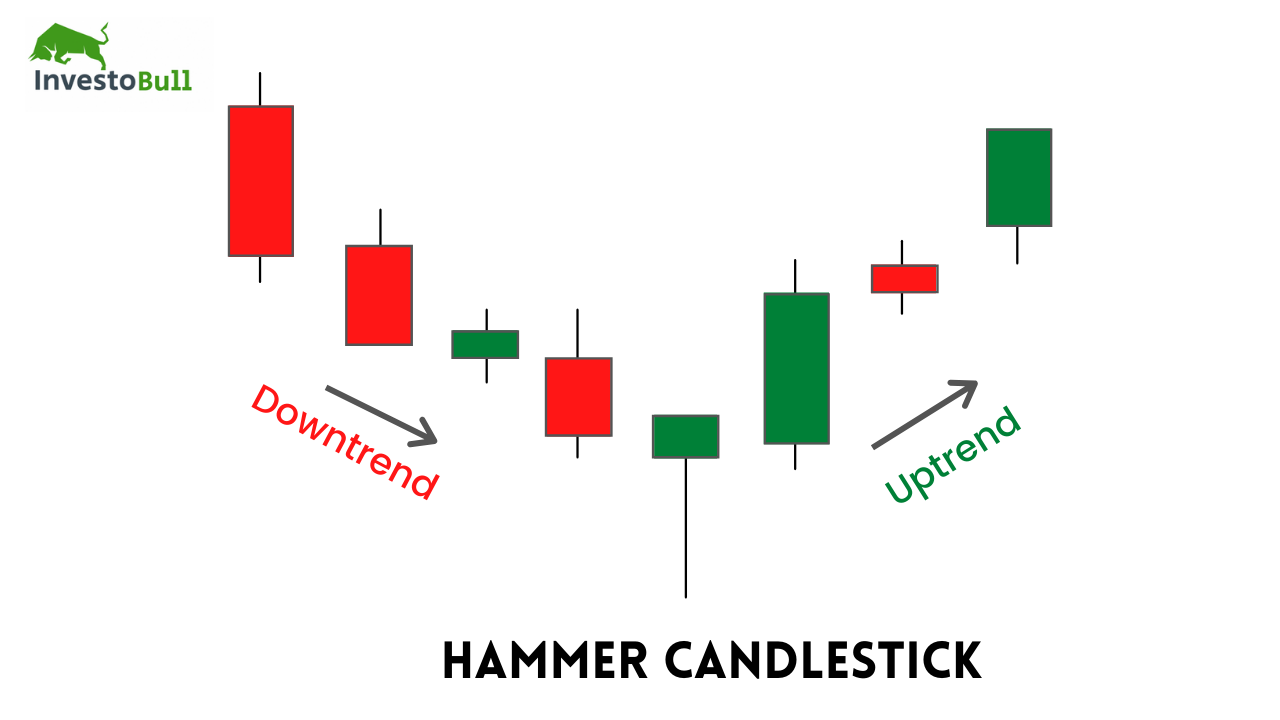

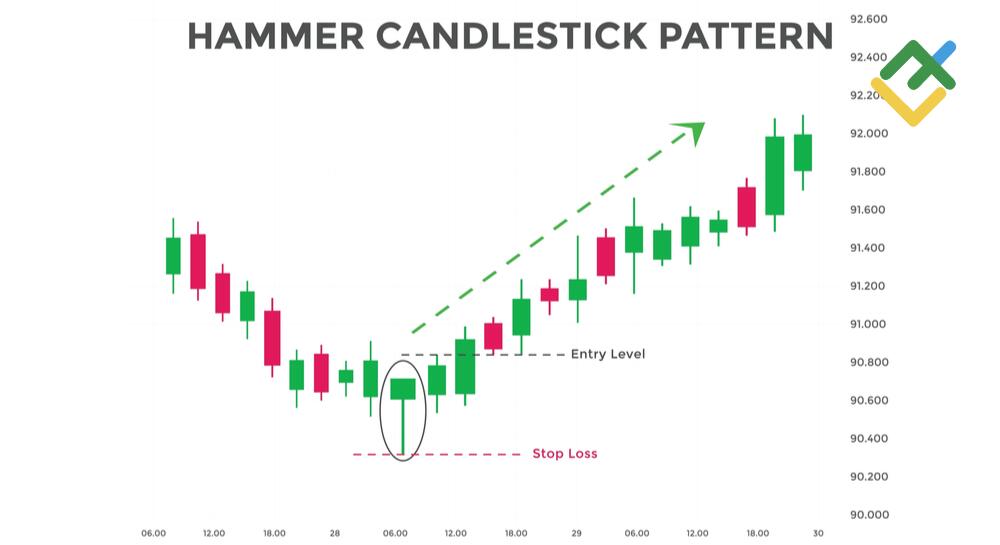

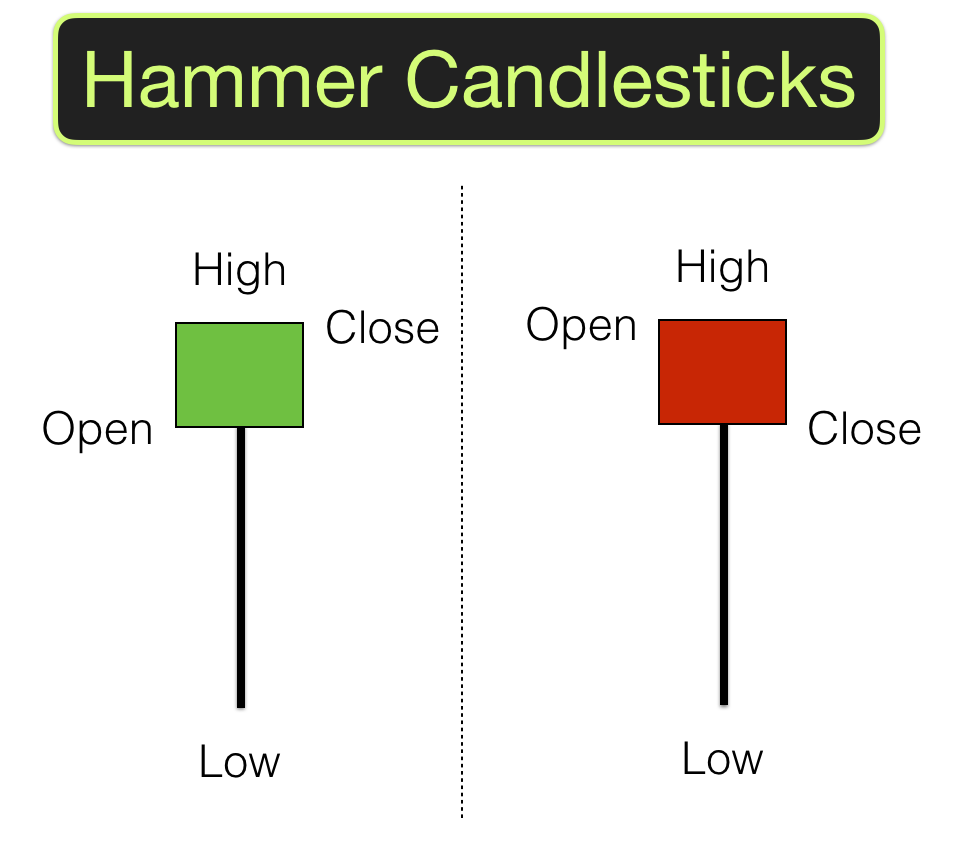

Hammer In Candlestick Chart - Web a hammer candle or candlestick is a widely recognized chart pattern that can be used by forex traders to identify potential bullish or bearish trend reversals. Bullish (hammer), need not require confirmation. It is a price pattern that usually occurs at the lower end of a down trend. The candlestick pattern looks like a. If the pattern occurs after an extensive. The pattern is formed at the bottom after a downtrend. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a. Web the hammer candlestick pattern is a bullish trading pattern that may indicate that a price swing has reached its bottom and is positioned to reverse to the upside. What is a hammer candlestick? The hammer signals that price may be about to make a reversal back higher after a recent. In candlestick charting, it points to a bullish reversal. The price reached new lows but closed at a higher level due to resultant buying pressure. Web september 12, 2022 zafari. It is a price pattern that usually occurs at the lower end of a down trend. If the pattern occurs after an extensive. A hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. Bullish (hammer), need not require confirmation. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening. It is a price pattern that usually occurs at the lower end of a down trend. Web if the pattern occurs after a market decline, it indicates a potential reversal: A candle signals the start of a new. Bullish (hammer), need not require confirmation. Hammer candlestick indicates reversal of bearish trend and helps traders to find a buy position at. Web the hammer is candlestick with a small body and a long lower wick. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. Web one of the classic candlestick charting patterns, a hammer is a reversal pattern consisting of a single candle with the appearance of a hammer. The hammer. A candle signals the start of a new. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. The candlestick pattern looks like a. It is a price pattern that usually occurs at the lower end of a down trend. The price reached new lows but closed at a higher level due to resultant. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover. The hammer signals that price may be about to make a reversal back higher after a recent. The hammer candlestick pattern is viewed. Web if the pattern occurs after a. Web the hammer candlestick pattern is a bullish trading pattern that may indicate that a price swing has reached its bottom and is positioned to reverse to the upside. The candlestick pattern looks like a. Hammer candlestick indicates reversal of bearish trend and helps traders to find a buy position at the end of bearish trend. Web a hammer candle. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Hammer candlesticks comprise a smaller real body with no upper wick. There are two types of hammers: The hammer candlestick pattern is viewed. The opening price, close, and top are approximately. Web the hammer candlestick pattern is a bullish trading pattern that may indicate that a price swing has reached its bottom and is positioned to reverse to the upside. There are two types of hammers: Web if the pattern occurs after a market decline, it indicates a potential reversal: What is a hammer candlestick? Hammer candlesticks comprise a smaller real. The hammer candlestick pattern is viewed. Web a hammer candlestick is typically found at the base of a downtrend or near support levels. What is a hammer candlestick? Web a hammer is a candlestick pattern, when a stock opens then moves a lot lower during the day then rallies back near the opening price. In candlestick charting, it points to. The hammer signals that price may be about to make a reversal back higher after a recent. There are two types of hammers: Learn what it is, how to identify it, and how to use it for. Web september 12, 2022 zafari. A hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. What is a hammer candlestick? The price reached new lows but closed at a higher level due to resultant buying pressure. Web a hammer is a candlestick pattern, when a stock opens then moves a lot lower during the day then rallies back near the opening price. Hammer candlestick pattern is a bullish reversal candlestick pattern. A candle signals the start of a new. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. If the pattern occurs after an extensive. Hammer candlestick indicates reversal of bearish trend and helps traders to find a buy position at the end of bearish trend. Web a hammer candle or candlestick is a widely recognized chart pattern that can be used by forex traders to identify potential bullish or bearish trend reversals. Web in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with.

Powerful Hammer Candlestick Pattern Formation, Example and

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern Trading Guide

What is a Hammer Candlestick Chart Pattern? NinjaTrader

What is Hammer Candlestick Pattern June 2024

What is a Hammer Candlestick Chart Pattern? LiteFinance

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick Pattern Trading Guide

The Candlestick Pattern Looks Like A.

Hammer Candlesticks Comprise A Smaller Real Body With No Upper Wick.

Bullish (Hammer), Need Not Require Confirmation.

The Hammer Candlestick Pattern Is Viewed.

Related Post: