Hammer Candlestick Pattern Meaning

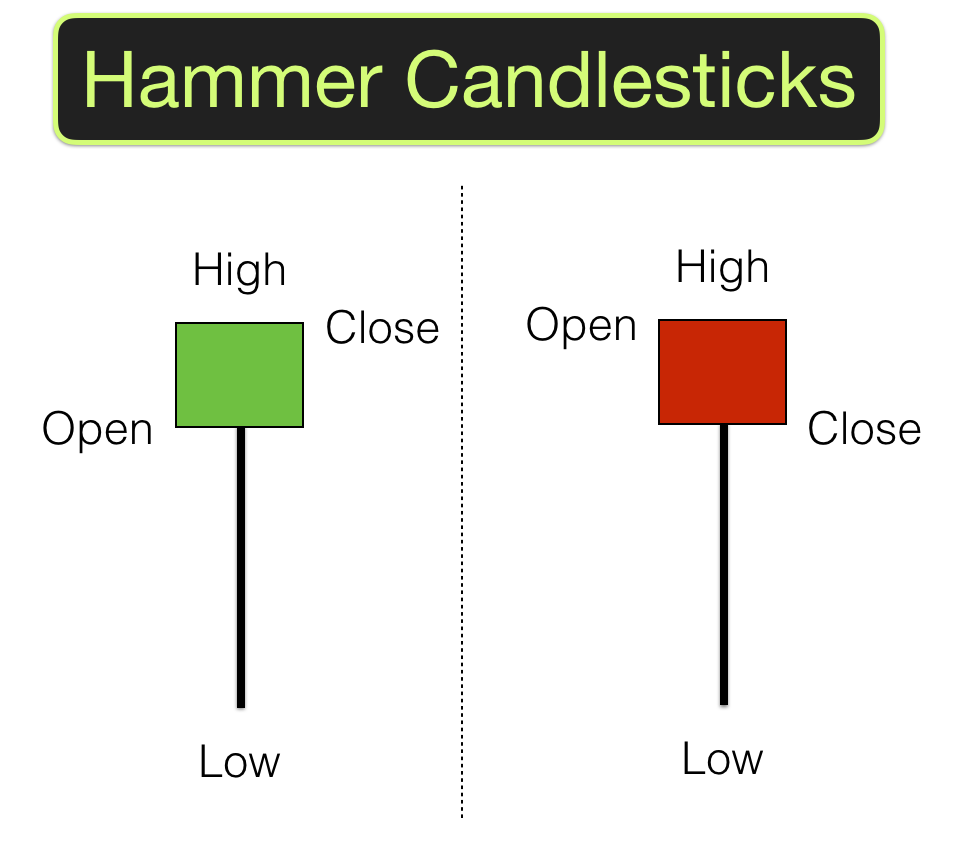

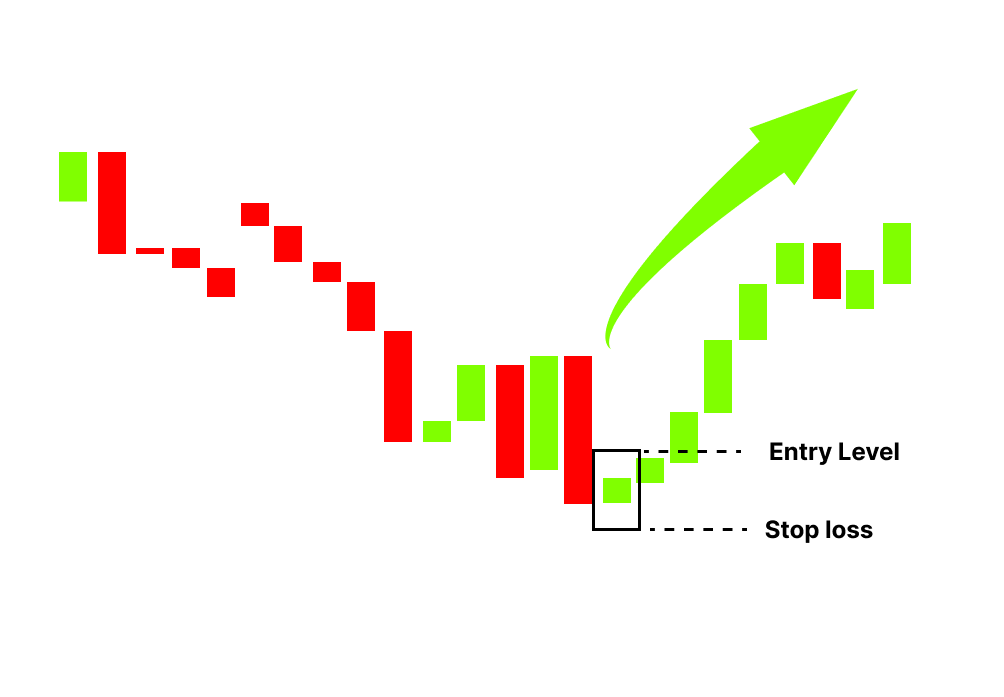

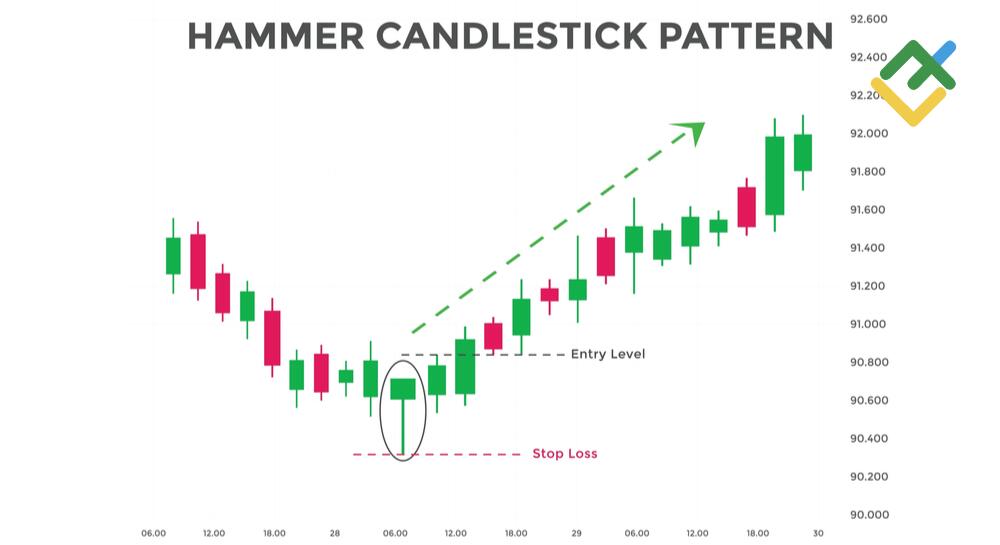

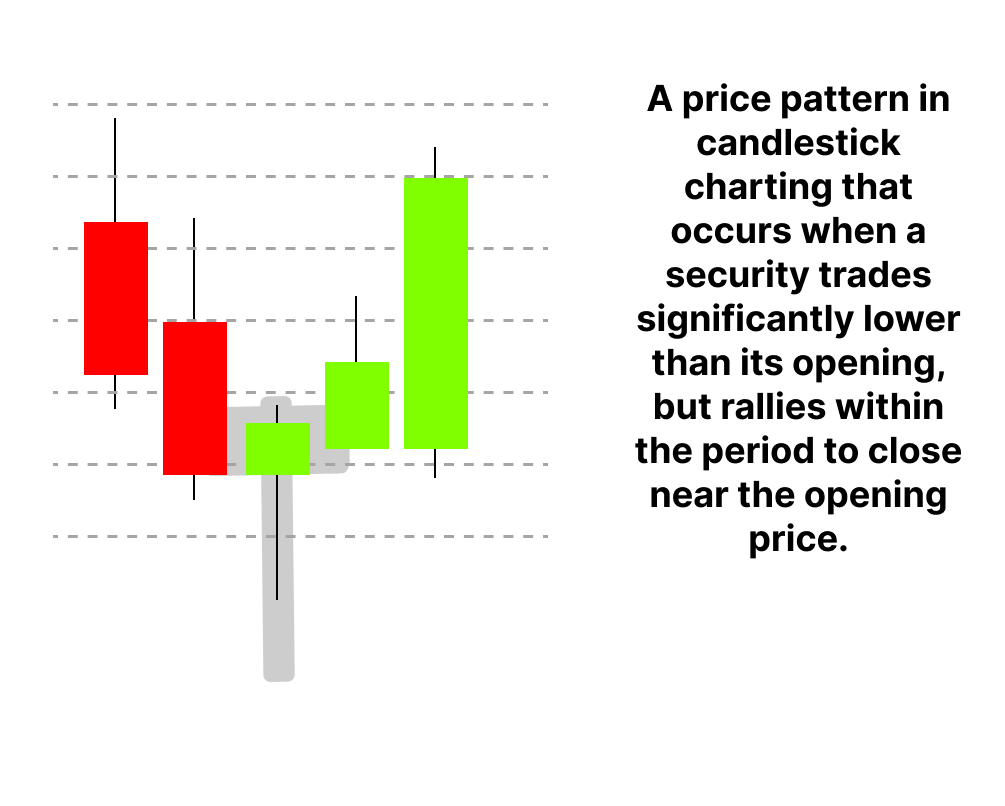

Hammer Candlestick Pattern Meaning - For example, identifying a bullish candlestick pattern like a hammer at a major support level can provide a stronger signal for a potential reversal. Web a hammer candlestick pattern is a candlestick pattern that resembles a hammer or the letter 't' in the english alphabet. Lower shadow more than twice the length of the body. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and signals a. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web the hammer candlestick is a pattern formed when a financial asset trades significantly below its opening price but makes a recovery to close near it within a particular period. In the hammer pattern, the color of the body can either be red or green. Web the aud/usd pair continued its downward trend on wednesday after the fed decision and australian inflation data. The information below will help you identify this pattern on the charts and predict further price dynamics. Web eur/gbp hammer candlestick at area of value: Web the hammer candlestick is a type of bullish reversal chart pattern that suggests that the price of a stock has hit its ground bottom and is poised for an imminent trend reversal. The hammer. Traders can observe the hammer candlestick pattern on the chart's bottom trend, which depicts price movements. The hammer candlestick pattern is regarded as a reversal pattern mainly bullish reversal which occurs at the end of a downtrend. Web the hammer candlestick is a pattern formed when a financial asset trades significantly below its opening price but makes a recovery to. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. This is a reversal pattern that appears at the end of a downtrend. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Traders can. It resembles a candlestick with a small body and a long lower wick. Examples of use as a trading indicator. It signals that the market is about to change trend direction and advance to new heights. The hammer candlestick pattern is regarded as a reversal pattern mainly bullish reversal which occurs at the end of a downtrend. This pattern typically. It’s important to analyse the assets you trade and start to come up with your own meaning and understanding of the variety of candlestick patterns. Lower shadow more than twice the length of the body. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower. Only a hammer candle is not a strong enough sign of a bullish reversal. You will improve your candlestick analysis skills and be able to apply them in trading. Learn what it is, how to identify it, and how to use it for intraday trading. Web the hammer candlestick is found at the bottom of a downtrend and signals a. The hammer candlestick is a bullish market reversal pattern. Web a hammer candlestick pattern is formed when a stock trades much lower than its opening price. Web however, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. Only a hammer candle is. Web the hammer candlestick pattern is considered as one of the key candlestick patterns used by traders to analyse price action trading. For example, identifying a bullish candlestick pattern like a hammer at a major support level can provide a stronger signal for a potential reversal. Traders can observe the hammer candlestick pattern on the chart's bottom trend, which depicts. A hammer occurs when a stock trades significantly lower than its opening price at the end of the session but rallies back to the close near the opening price at the end of the session. This pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Web a hammer candlestick. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. It is often referred to as a bullish pin bar, or bullish rejection candle. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web what is a hammer candlestick. It's a short green candle with a lengthy bottom shadow, indicating lower market price rejection. The hammer candlestick is a bullish market reversal pattern. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. A hammer occurs when a stock trades significantly lower than its opening price at the end of the session but rallies back to the close near the opening price at the end of the session. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web shares of gap (gps) have been struggling lately and have lost 5.3% over the past week. For example, identifying a bullish candlestick pattern like a hammer at a major support level can provide a stronger signal for a potential reversal. Web however, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. Web the hammer candlestick is a type of bullish reversal chart pattern that suggests that the price of a stock has hit its ground bottom and is poised for an imminent trend reversal. Occurrence after bearish price movement. Only a hammer candle is not a strong enough sign of a bullish reversal. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. So, it could witness a trend. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Web the hammer candlestick is found at the bottom of a downtrend and signals a potential (bullish) reversal in the market.the most common hammer candle is the bullish hammer which has a small. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are.

Hammer Candlestick Pattern Definition, Structure, Trading, and Example

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick A Detailed Study And Procedures To Use It TechDuffer

Hammer Candlestick Patterns (Types, Strategies & Examples)

Hammer Candlestick Pattern Definition, Structure, Trading, and Example

What is a Hammer Candlestick Chart Pattern? LiteFinance

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

It Is Named So Because It Indicates That The Market Is Hammering Out At The Bottom Before A Potential Reversal.

Web Eur/Gbp Hammer Candlestick At Area Of Value:

It Is Often Referred To As A Bullish Pin Bar, Or Bullish Rejection Candle.

If The Candlestick Is Green Or White,.

Related Post: