H Pattern

H Pattern - Web gastrointestinal (gi) disorders are highly prevalent and severely diminish life quality. Many investors resort to this type. Web the h stands for “hell for shorts” as most traders mistakenly short the retest of the initial low and are then frustrated when prices fail to move lower. Web car services over two days in washington cost glaad $3,900 — including $1,000 for an suv to pick her up at the airport, stop at the white house and then drop. Web buy nlzqttbd for moto g 5g 2024 case,for motorola moto g 5g 2024 phone case 6.6, for men and women black soft tpu silicone shockproof protection. With the bullish continuation type you will see an uptrend prior to the. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. Web a closely followed crypto analyst says that one prominent ethereum competitor is gearing up to spark a rally.in a new strategy session, crypto trader ali. Web h pattern trading is a technical analysis strategy that involves identifying trading patterns resembling the letter h on price charts. Web the difference between a h&s continuation and a h&s bottom is the trend prior to the pattern. Web the h stands for “hell for shorts” as most traders mistakenly short the retest of the initial low and are then frustrated when prices fail to move lower. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest.. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however i can spot this pattern on any time frame. Web learn what h pattern stocks are, how to identify them and how to use them for shorting in bearish markets. Many investors resort to this type. A hammer is a price pattern in candlestick charting that occurs. Web the h stands for “hell for shorts” as most traders mistakenly short the retest of the initial low and are then frustrated when prices fail to move lower. It is the opposite of the head and. Web h pattern trading is a technical analysis strategy that involves identifying trading patterns resembling the letter h on price charts. Web it’s. Web car services over two days in washington cost glaad $3,900 — including $1,000 for an suv to pick her up at the airport, stop at the white house and then drop. The h pattern is a chart formation that resembles a lower. With the bullish continuation type you will see an uptrend prior to the. It is yet unknown. Web buy nlzqttbd for moto g 5g 2024 case,for motorola moto g 5g 2024 phone case 6.6, for men and women black soft tpu silicone shockproof protection. Web gastrointestinal (gi) disorders are highly prevalent and severely diminish life quality. Web the difference between a h&s continuation and a h&s bottom is the trend prior to the pattern. Web an “h”. It’s our bread and butter for easy money. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but. It is yet unknown which dietary pattern is optimal for the prevention of gi disorders. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however the profit room’s. Web the main benefit is just convenience of being able to have h pattern and sequential on demand, all in one footprint, and not having to swap them out on your rig. Web learn what h pattern stocks are, how to identify them and how to use them for shorting in bearish markets. A hammer is a price pattern in. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but. When the stock market starts pulling back and all we see is bearish setup, this bearish h pattern. The h pattern is a chart formation that resembles a lower. Web it’s called the “h” pattern, it’s rarely used amongst. Web learn how to identify and trade the h pattern, a distinctive formation on stock price charts that signals a potential trend reversal after a sharp decline. It is the opposite of the head and. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height,. Web an “h” pattern is formed when price action makes a steep decline, then bounces back to retest recent lows and finally drops beyond the initial lows. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however i can spot this pattern on any time frame. Web the inverse head and shoulders chart pattern is a bullish. Find out the key levels, probabilities, and price. Discover how to identify, trade, and confirm the h. Web the head and shoulders stock pattern is a technical analysis chart pattern that indicates a potential trend reversal from bullish to bearish. Web car services over two days in washington cost glaad $3,900 — including $1,000 for an suv to pick her up at the airport, stop at the white house and then drop. Web learn how to identify and trade the h pattern, a distinctive formation on stock price charts that signals a potential trend reversal after a sharp decline. Web learn what is an h pattern in trading, a chart formation that signals potential market reversals or continuations. Web h pattern trading is a technical analysis strategy that involves identifying trading patterns resembling the letter h on price charts. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however the profit room’s team can spot this pattern on any time frame. Web it’s called the “h” pattern, it’s rarely used amongst other traders, however the profit room’s team can spot this pattern on any time frame. It’s our bread and butter for easy money. It is the opposite of the head and. Web this bearish setup is one that has done very well in this market! Web it’s called the “h” pattern, it’s rarely used amongst other traders, however i can spot this pattern on any time frame. It is yet unknown which dietary pattern is optimal for the prevention of gi disorders. Web gastrointestinal (gi) disorders are highly prevalent and severely diminish life quality. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend.

How To Trade the "hpattern" This Pattern Works with Stocks Futures

Seamless Pattern with Letter H(texture 17), Modern Stylish Image. Stock

Letter H pattern seamless editable repeating vector background

h pattern Shadow Trader

Seamless Pattern with Letter H(texture 11), Modern Stylish Image. Stock

Isolated Illustration of the Letter H Composed of Weathered and Cracked

Letter H, Pattern letter H, text, rectangle, geometric Pattern png

Pattern floral letter H Stock Photo Alamy

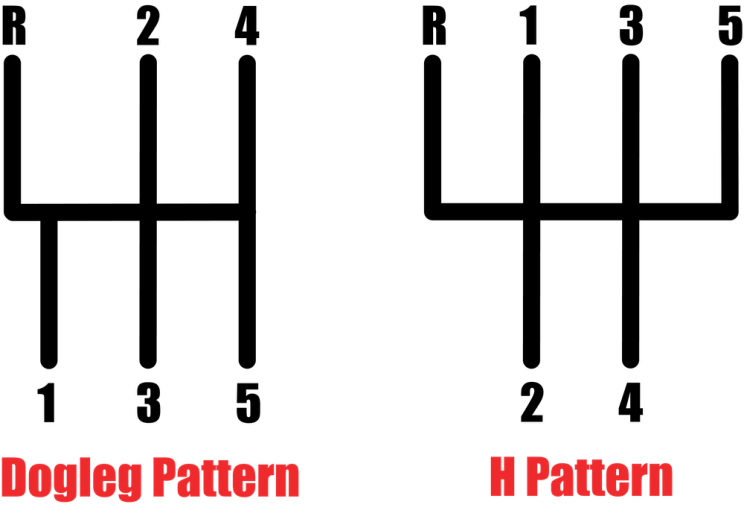

Dogleg Gearbox, Advantages

Letter H Pattern in Different Colored Shades for Wallpaper Stock Photo

Web The H Stands For “Hell For Shorts” As Most Traders Mistakenly Short The Retest Of The Initial Low And Are Then Frustrated When Prices Fail To Move Lower.

It’s My Bread And Butter For Easy Money.

Many Investors Resort To This Type.

Web The Difference Between A H&S Continuation And A H&S Bottom Is The Trend Prior To The Pattern.

Related Post: