H Pattern Stocks

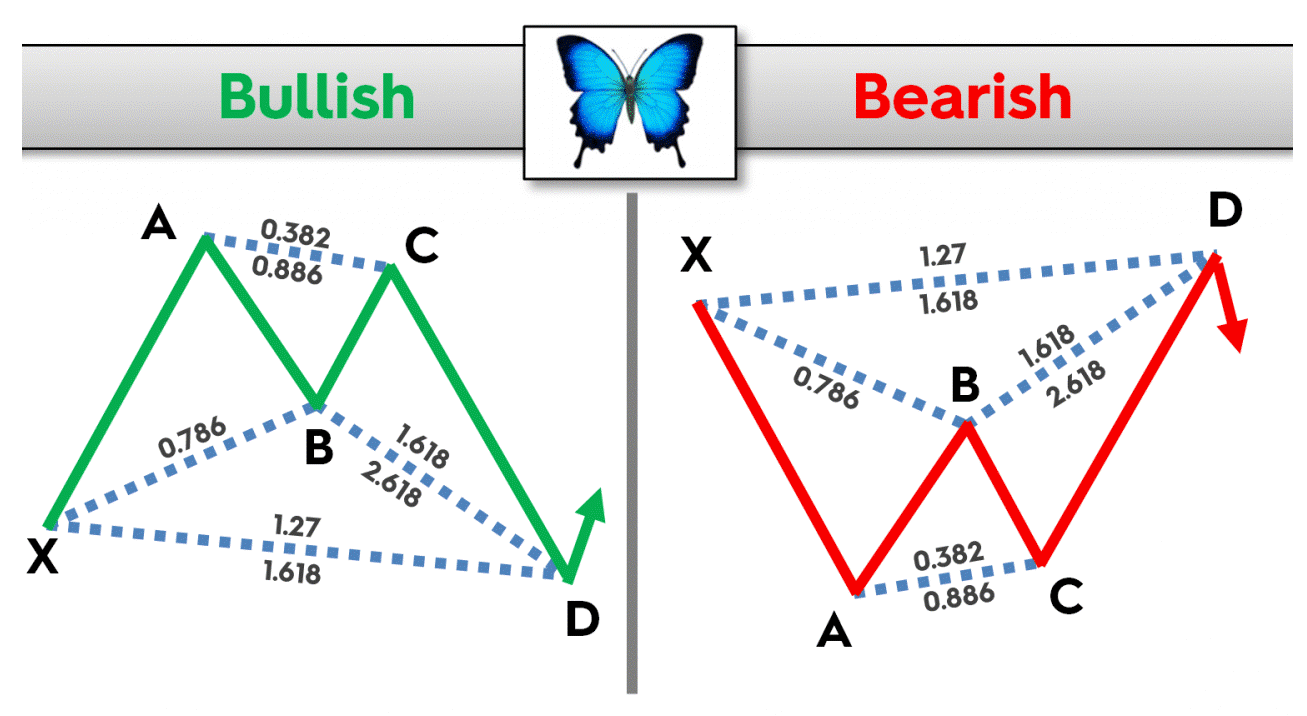

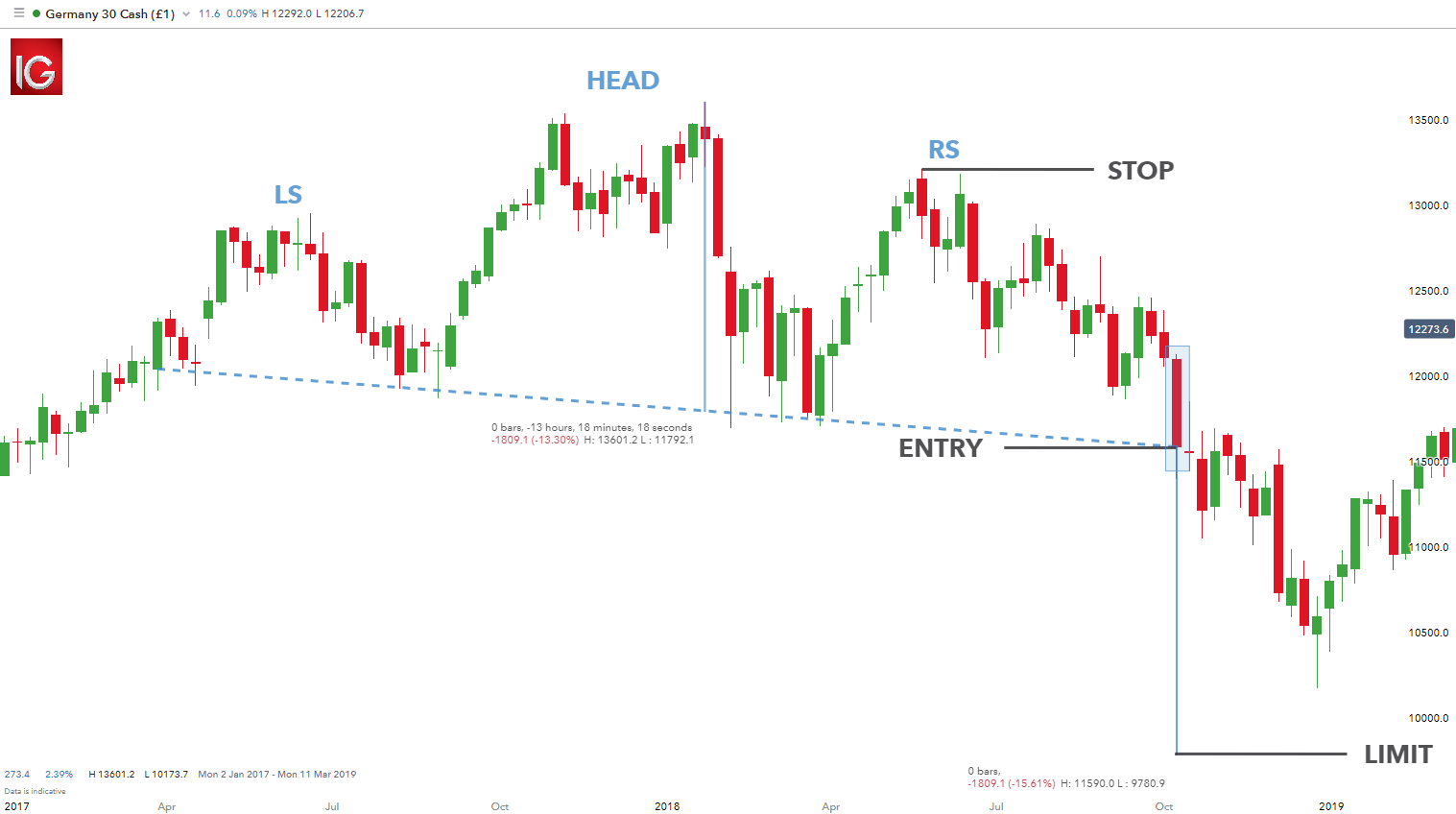

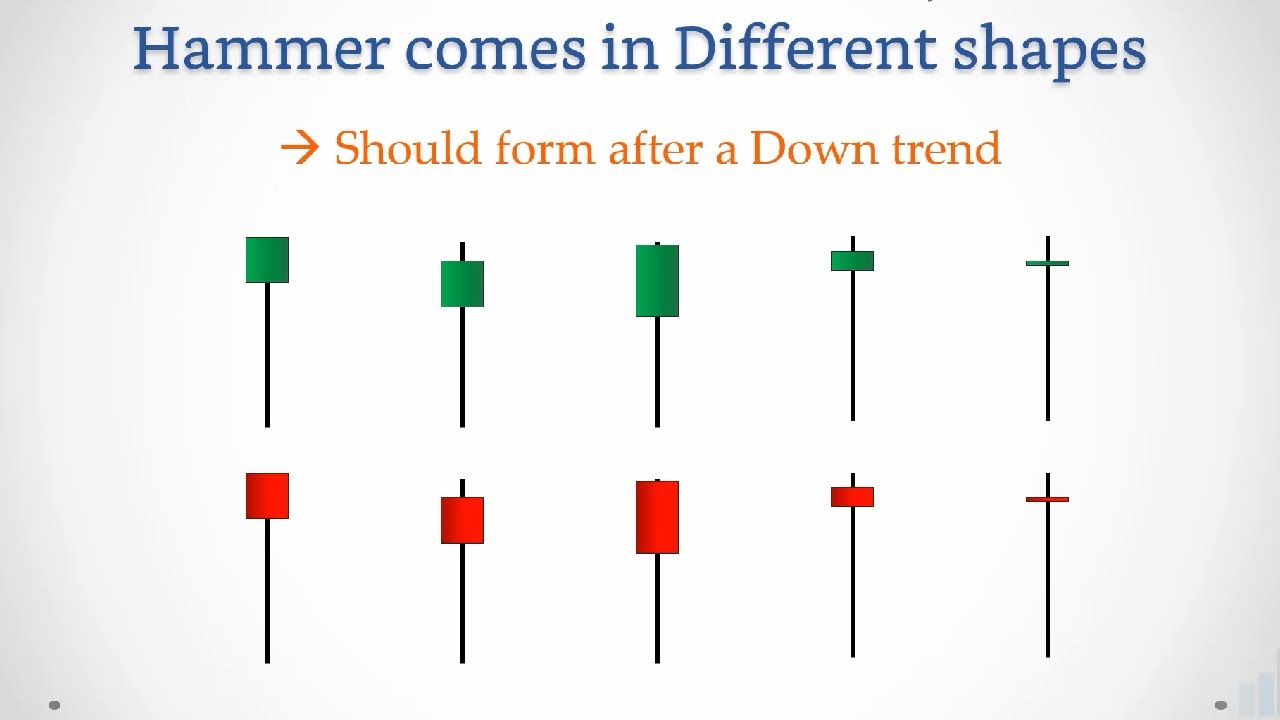

H Pattern Stocks - Web what are h pattern stocks? Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. The trading strategy of h pattern is similar to the classic h&s. Web the pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. Web a technical pattern that often brings about erratic action until it is resolved. Web in stock analysis, an “h pattern” refers to a technical chart pattern that resembles the letter “h” when plotted on a price chart. Web the pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) as the bounce begins. Web stock chart patterns include double tops, double bottoms, cup and handle, flags, and triangles (ascending, descending, and symmetrical). Web what is an h pattern in trading? Its stock has soared by over 166%, giving it a. Web what are h pattern stocks? Web what are harmonic patterns in stock trading? Web the pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) as the bounce begins. Web h pattern trading is a technical analysis strategy that involves identifying trading patterns resembling the. Web the pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. Web this bearish setup is one that has done very well in this market! The trading strategy of h pattern is similar to the classic h&s. Web what are harmonic patterns in stock trading? The setup shows a steep decline, followed by a brief. Web the hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal. Web the pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. Its stock has soared by over 166%, giving it a. The setup shows a steep decline, followed by a. Web what is an h pattern in trading? Harmonic patterns are used in technical analysis that traders use to find trend reversals. Web the h pattern is a powerful continuation pattern that forms at a support level that is quickly taken out in subsequent trading sessions. When the stock market starts pulling back and all we see is bearish setup,. Web a technical pattern that often brings about erratic action until it is resolved. Web the pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. Web learn how to spot and trade the h pattern, a bullish reversal formation that can be applied to stocks, forex and futures markets. The “h” pattern is a style. Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. Web a technical pattern that often brings about erratic action until it is resolved. Harmonic patterns are used in technical analysis that traders use to find trend reversals. Web what is an h pattern in trading? Web the h. Web what is an h pattern in trading? The following h pattern trading. When the stock market starts pulling back and all we see is bearish setup, this bearish h pattern. Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. The trading strategy of h pattern is similar. This pattern usually emerges after a steep bearish trend. Web the pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) as the bounce begins. Web the pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the. Web stock chart patterns include double tops, double bottoms, cup and handle, flags, and triangles (ascending, descending, and symmetrical). The following h pattern trading. Web the hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal. This pattern usually emerges after a steep bearish trend. Web learn. Web what are harmonic patterns in stock trading? Marketingdownload the apphow to invest in stocksinvestors Web what is an h pattern in trading? It resembles the letter ‘h’ on stock. Web the pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. Harmonic patterns are used in technical analysis that traders use to find trend reversals. Web the pattern is easily identified on all types of market assets, including stocks and cryptocurrencies. Web what are harmonic patterns in stock trading? Web there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. Its stock has soared by over 166%, giving it a. It is a type of pattern that traders. Web stock chart patterns include double tops, double bottoms, cup and handle, flags, and triangles (ascending, descending, and symmetrical). Marketingdownload the apphow to invest in stocksinvestors Web what is an h pattern in trading? Web this bearish setup is one that has done very well in this market! The “h” pattern is a style that emerges on a chart shaped like a lower case letter 'h', and it can emerge in the forex, futures, and. Web h pattern trading is a technical chart analysis strategy that identifies potential trend reversals after a stock has experienced a sharp decline. The following h pattern trading. Web the pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) as the bounce begins. The trading strategy of h pattern is similar to the classic h&s. Web the h pattern is a powerful continuation pattern that forms at a support level that is quickly taken out in subsequent trading sessions.

HOW TO TRADE THE H PATTERN! DAY TRADING BEARISH PATTERNS DURING A

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

How To Trade the "hpattern" This Pattern Works with Stocks Futures

The Head and Shoulders Pattern A Trader’s Guide

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Completed H&S pattern for NYSEGRAM by FAST_insights — TradingView

How To Read Stock Chart Patterns

h pattern Shadow Trader

Lecture 3 ! HH HL LH Pattern ! Stock market! Share market! Optional

Chart Patterns Cheat Sheet Book Pdf

Web A Technical Pattern That Often Brings About Erratic Action Until It Is Resolved.

Web The Pattern Occurs When The Stock Has A Steep Or Sudden Decline Followed By A Very Weak Bounce (All The Following Candles Are Inside Bars) As The Bounce Begins.

The Setup Shows A Steep Decline, Followed By A Brief.

Web The Hammer Candlestick Is A Bullish Trading Pattern That May Indicate That A Stock Has Reached Its Bottom And Is Positioned For Trend Reversal.

Related Post: