Gartley 222 Pattern

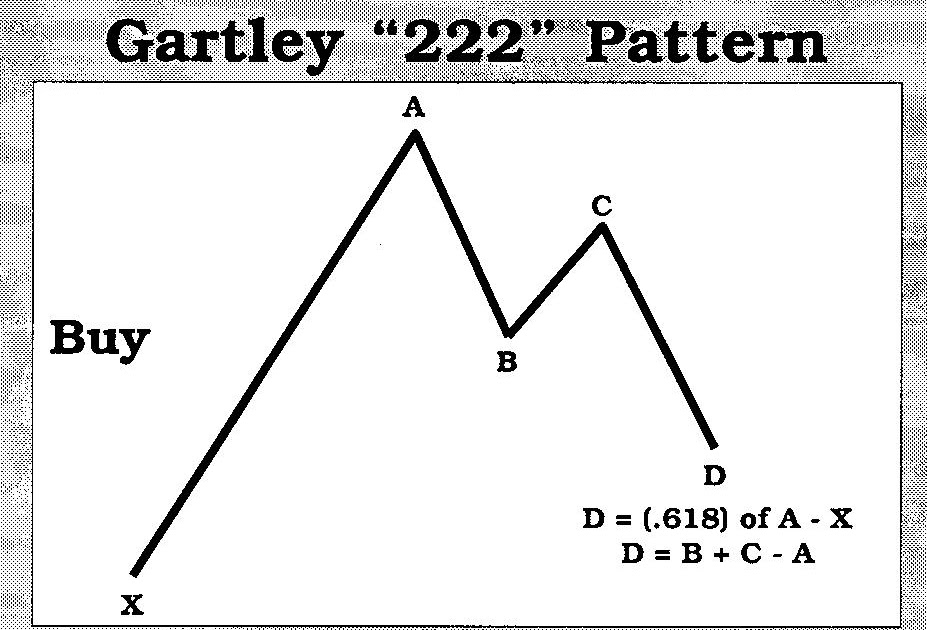

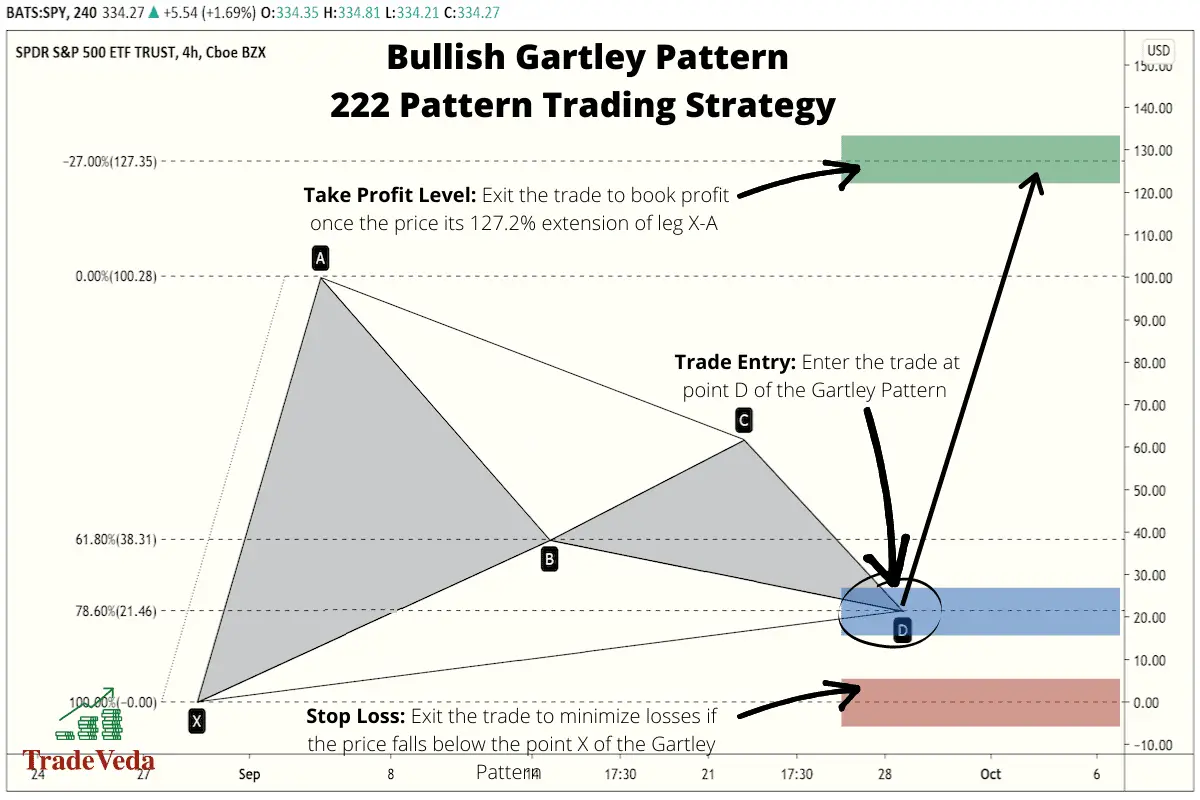

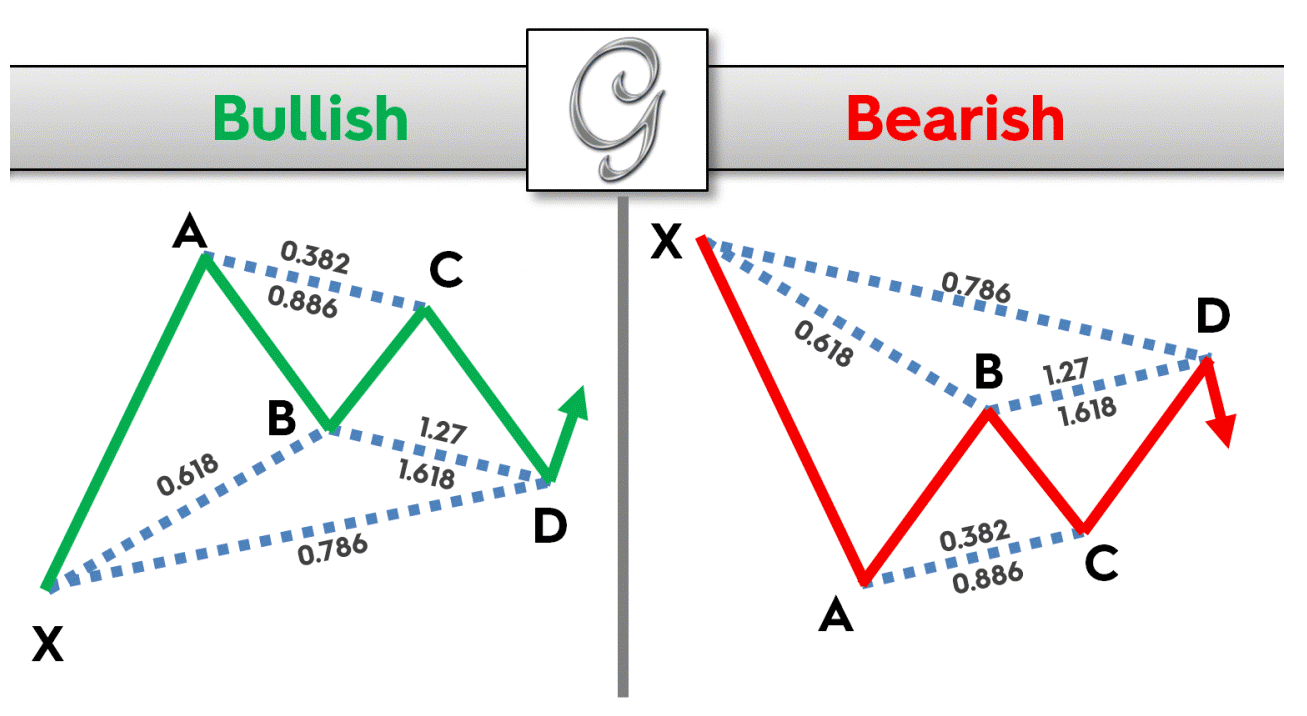

Gartley 222 Pattern - It uses fibonacci levels and has a bullish and bearish version. Web the gartley pattern is one of the most traded harmonic patterns and can be applied to many markets and timeframes. Web gartley 222因其在scott carney的书第222页中描述而得名。 蝴蝶谐波形态,像所有谐波形态一样,是一种可以在所有时间框架上交易的反转交易形态。 Web and so, the gartley pattern is also sometimes referred to as gartley 222 or the 222 pattern by some harmonic traders. The gartley 222 pattern consists of the abcd pattern that is followed by a significant low in downtrends and a significant high during uptrends. Gartley’s book, profits in the stock market, on page 222. Gartley and elaborated upon by scott carney, this pattern is widely applied across various markets and timeframes. The gartley pattern is a harmonic chart pattern, because it uses fibonacci numbers to attempt to identify precise price points at which a trend will either breakout or retrace. The gartley “222” pattern is named for the page number it is found on in h.m. They furnish the trader with price targets for taking profits and locating stop losses. Web the gartley 222 pattern, named after its page number in h.m. The gartley 222, also known as a butterfly pattern, is mathematically defined using specific proportions for the price swings that make up the pattern. It uses fibonacci levels and has a bullish and bearish version. Web the gartley “222” pattern is one of the classic retracement patterns. Web. The gartley “222” pattern is named for the page number it is found on in h.m. Web this gartley harmonic pattern trading strategy guide will teach you what the gartley pattern is, how to trade the gartley pattern, and how to incorporate it into your trading strategy and start making money with a new concept to technical analysis. Web the. Web it is also known as the ‘222 pattern’ because details of how to identify and use it are found on page 222 of gartley’s book, ‘profits in the stock market’. Internationally known author and trader thomas bulkowski tests how well it performs. It is distinguished by its use of specific fibonacci ratios to predict potential reversal points in the. Web gartley (or gartley 222) is a bullish but complex chart pattern (a trading setup, really). It is distinguished by its use of specific fibonacci ratios to predict potential reversal points in the market. They furnish the trader with price targets for taking profits and locating stop losses. Web the gartley pattern is named after its founder h.m. Web this. Gartley’s book, profits in the stock market, on page 222. Web what is the gartley 222 pattern? The gartley 222 pattern consists of the abcd pattern that is followed by a significant low in downtrends and a significant high during uptrends. The gartley pattern is a harmonic chart pattern, because it uses fibonacci numbers to attempt to identify precise price. The 222 gartley pattern is a continuation pattern that. Web the gartley pattern is one of six harmonic chart patterns in forex which uses fibonnaci ratio and numbers to define key points that define patterns. Internationally known author and trader thomas bulkowski tests how well it performs. Web the gartley pattern is a highly regarded and complex harmonic chart pattern. Web what is the gartley 222 pattern? Web the gartley pattern is one of six harmonic chart patterns in forex which uses fibonnaci ratio and numbers to define key points that define patterns. It uses fibonacci levels and has a bullish and bearish version. Web the gartley pattern is named after its founder h.m. The gartley pattern is a harmonic. The gartley 222, also known as a butterfly pattern, is mathematically defined using specific proportions for the price swings that make up the pattern. These legs form the framework of the pattern, with fibonacci ratios guiding the lengths and proportions of each segment. The gartley pattern is used by traders to get trading entry price. I will simply refer to. The gartley pattern is a harmonic chart pattern, because it uses fibonacci numbers to attempt to identify precise price points at which a trend will either breakout or retrace. These legs form the framework of the pattern, with fibonacci ratios guiding the lengths and proportions of each segment. The pattern resembles an m/w shape on the chart, depending on whether. These legs form the framework of the pattern, with fibonacci ratios guiding the lengths and proportions of each segment. They furnish the trader with price targets for taking profits and locating stop losses. The gartley “222” pattern is named for the page number it is found on in h.m. Web what is the gartley 222 pattern? It's sometimes known as. Gartley and detailed further by scott carney. Web gartley patterns are the most commonly used harmonic patterns in technical analysis. Gartley’s book “profits in the stock market,” is a popular harmonic chart pattern that helps traders identify potential reversal points in the market. Web gartley 222因其在scott carney的书第222页中描述而得名。 蝴蝶谐波形态,像所有谐波形态一样,是一种可以在所有时间框架上交易的反转交易形态。 It uses fibonacci levels and has a bullish and bearish version. Web the gartley pattern, named after its inventor, hm gartley, is one of the most classic retracement patterns followed by traders. Internationally known author and trader thomas bulkowski tests how well it performs. Web the gartley pattern, one of the most traded harmonic patterns, is a retracement and continuation pattern that occurs when a trend temporarily reverses direction before continuing on its original course. The pattern resembles an m/w shape on the chart, depending on whether it is a bullish or a bearish gartley. These legs form the framework of the pattern, with fibonacci ratios guiding the lengths and proportions of each segment. The gartley “222” pattern is named for the page number it is found on in h.m. It's sometimes known as the gartley 222 because it appeared on page 222 of his book, profits in the stock market , published in 1935. It is called a gartley 222 because it is found in h.m. To draw the gartley pattern, you need to follow the next steps: Web the gartley “222” pattern is one of the classic retracement patterns. Web the gartley pattern is a harmonic chart pattern, based on fibonacci numbers and ratios, that helps traders identify reaction highs and lows.

Identify Gartley 222 and Butterfly Patterns using Fibonacci 1 of 2

:max_bytes(150000):strip_icc()/GartleyPattern-5541ce000da34023a20348e5681bbffb.png)

Gartley Pattern Definition

Harold McKinley Gartley Who’s?

GARTLEY 222 PDF

Bearish Harmonic Gartley 222 Pattern Folge dem Echtzeit TradingSignal

Gartley "222" pattern formed for NASDAQAMZN by Prome — TradingView

Gartley Pattern Forex Trading The Gartley Pattern

serbuo gartley 222

bullishgartleypatter222strategy TradeVeda

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

Gartleys Book, Profits In The Stock Market.

Gartleys Are Patterns That Include The Basic Abcd Pattern We’ve Already Talked About, But Are Preceded By A Significant High Or Low.

Web The Gartley Pattern Is One Of The Most Traded Harmonic Patterns And Can Be Applied To Many Markets And Timeframes.

I Programmed My Computer To Automatically Find This Pattern And Tested How Well It Works.

Related Post: