Fppa Retirement Chart

Fppa Retirement Chart - Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Saving, health care, naming and updating your beneficiaries, social security implications, and much more. Web the fire & police pension association of colorado (fppa) provides retirement, disability, and survivor benefits to colorado police officers, firefighters, and other first responders. Web the online retirement application is live. Web the benefit estimate summary below is intended for use by members of social security departments that are interested in joining the fppa statewide retirement plan. Not sure which fppa defined benefit component is best for you? Fppa collects, invests, administers and disburses funds for the fire & police members’ investment fund that was established under colorado state statutes. Web 5 things to know about the hybrid defined benefit and money purchase components. Web members covered by the statewide defined benefit plan may receive a monthly lifetime benefit upon meeting the eligibility requirements for retirement. Experienced advisorsfree consultationlocal financial advisors150+ offices nationwide Web to see what your fppa pension benefit could look like, use the partial entry benefit calculator. The report describes the current actuarial condition. Web active fppa defined benefit system members can use the member account portal to estimate retirement benefits and calculate the cost of service credits for prior. Web the fire & police pension association of colorado (fppa). Web our report presents the results of the january 1, 2024 actuarial valuation of the fppa statewide retirement plan (srp). Web the online retirement application is live. An overview of recent changes to fppa's cost of living adjustment policy. Web the benefit estimate summary below is intended for use by members of social security departments that are interested in joining. Within the statewide retirement plan, there are several ways for. Web to see what your fppa pension benefit could look like, use the partial entry benefit calculator. An overview of recent changes to fppa's cost of living adjustment policy. Saving, health care, naming and updating your beneficiaries, social security implications, and much more. Web under the rule of 80, members. Many fire and police departments across. Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Web fppa's proposal for the 2022 legislative session would affect members, employers, and other stakeholders differently depending on their associated retirement plan. Not sure which fppa defined benefit component is. An overview of recent changes to fppa's cost of living adjustment policy. Web based on the results of recent annual actuarial valuations of fppa plans, the fppa board of directors approved the funded ratios, contribution rates, irs. Web the benefit estimate summary below is intended for use by members of social security departments that are interested in joining the fppa. Within the statewide retirement plan, there are several ways for. Web 5 things to know about the hybrid defined benefit and money purchase components. Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Enter your information below to create. Web active fppa defined benefit system. Web 5 things to know about the hybrid defined benefit and money purchase components. Fppa collects, invests, administers and disburses funds for the fire & police members’ investment fund that was established under colorado state statutes. Saving, health care, naming and updating your beneficiaries, social security implications, and much more. Web our report presents the results of the january 1,. Web fppa's proposal for the 2022 legislative session would affect members, employers, and other stakeholders differently depending on their associated retirement plan. Web to see what your fppa pension benefit could look like, use the partial entry benefit calculator. Experienced advisorsfree consultationlocal financial advisors150+ offices nationwide Web active fppa defined benefit system members can use the member account portal to. Web members covered by the statewide defined benefit plan may receive a monthly lifetime benefit upon meeting the eligibility requirements for retirement. August 31, 2023 by kevin lindahl. Many fire and police departments across. Experienced advisorsfree consultationlocal financial advisors150+ offices nationwide Web active fppa defined benefit system members can use the member account portal to estimate retirement benefits and calculate. Web members covered by the statewide defined benefit plan may receive a monthly lifetime benefit upon meeting the eligibility requirements for retirement. Web the online retirement application is live. Among these changes was an adjustment. Web to see what your fppa pension benefit could look like, use the partial entry benefit calculator. An overview of recent changes to fppa's cost. Web use this calculator to estimate your potential benefit as an fppa member. Web fppa's proposal for the 2022 legislative session would affect members, employers, and other stakeholders differently depending on their associated retirement plan. Fppa collects, invests, administers and disburses funds for the fire & police members’ investment fund that was established under colorado state statutes. Web use the chart below to calculate a normal, early or vested retirement benefit using the member’s age at retirement and years of service. Among these changes was an adjustment. Not sure which fppa defined benefit component is best for you? Members covered by the statewide defined benefit plan may receive a monthly lifetime benefit upon meeting the eligibility requirements for retirement. The report describes the current actuarial condition. Web take control of your retirement planning with this brief handout about; Web under the rule of 80, members would be eligible to begin receiving a normal retirement at the following combinations of retirement age and years of service: Saving, health care, naming and updating your beneficiaries, social security implications, and much more. Web 5 things to know about the hybrid defined benefit and money purchase components. Enter your information below to create. Experienced advisorsfree consultationlocal financial advisors150+ offices nationwide Web members covered by the statewide defined benefit plan may receive a monthly lifetime benefit upon meeting the eligibility requirements for retirement. Web fppa’s updated cola policy.

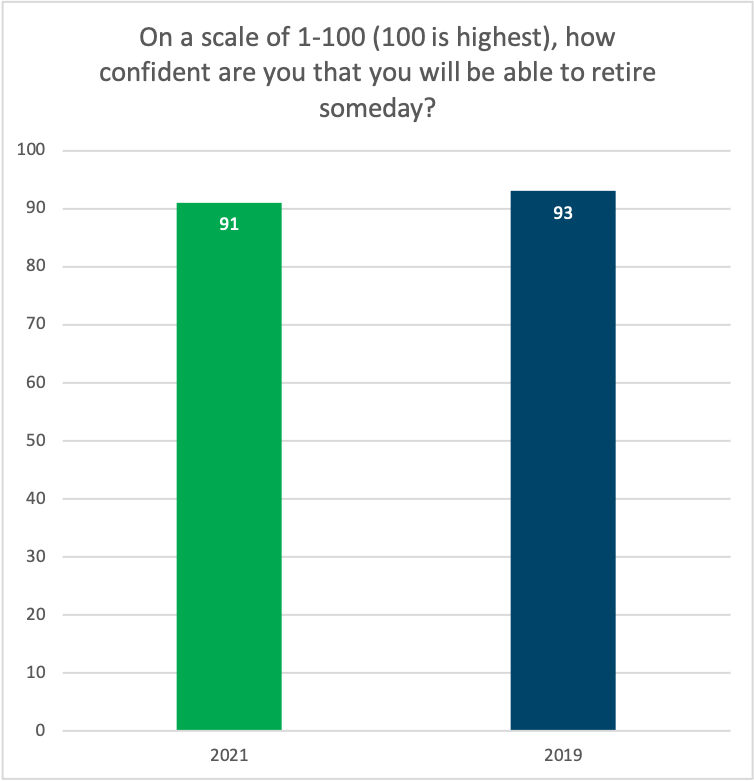

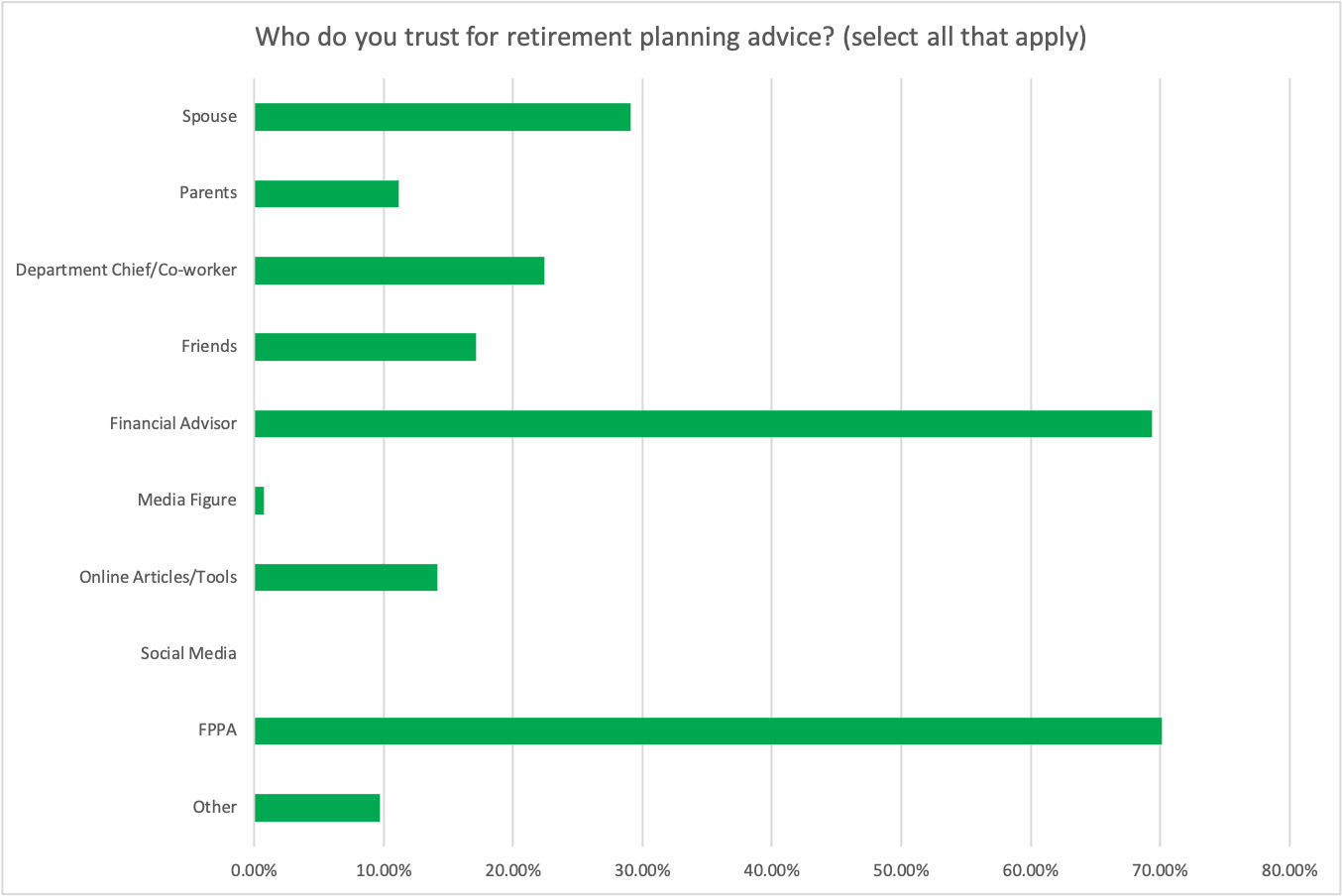

Results From FPPA’s Member Survey PensionCheck Online FPPA

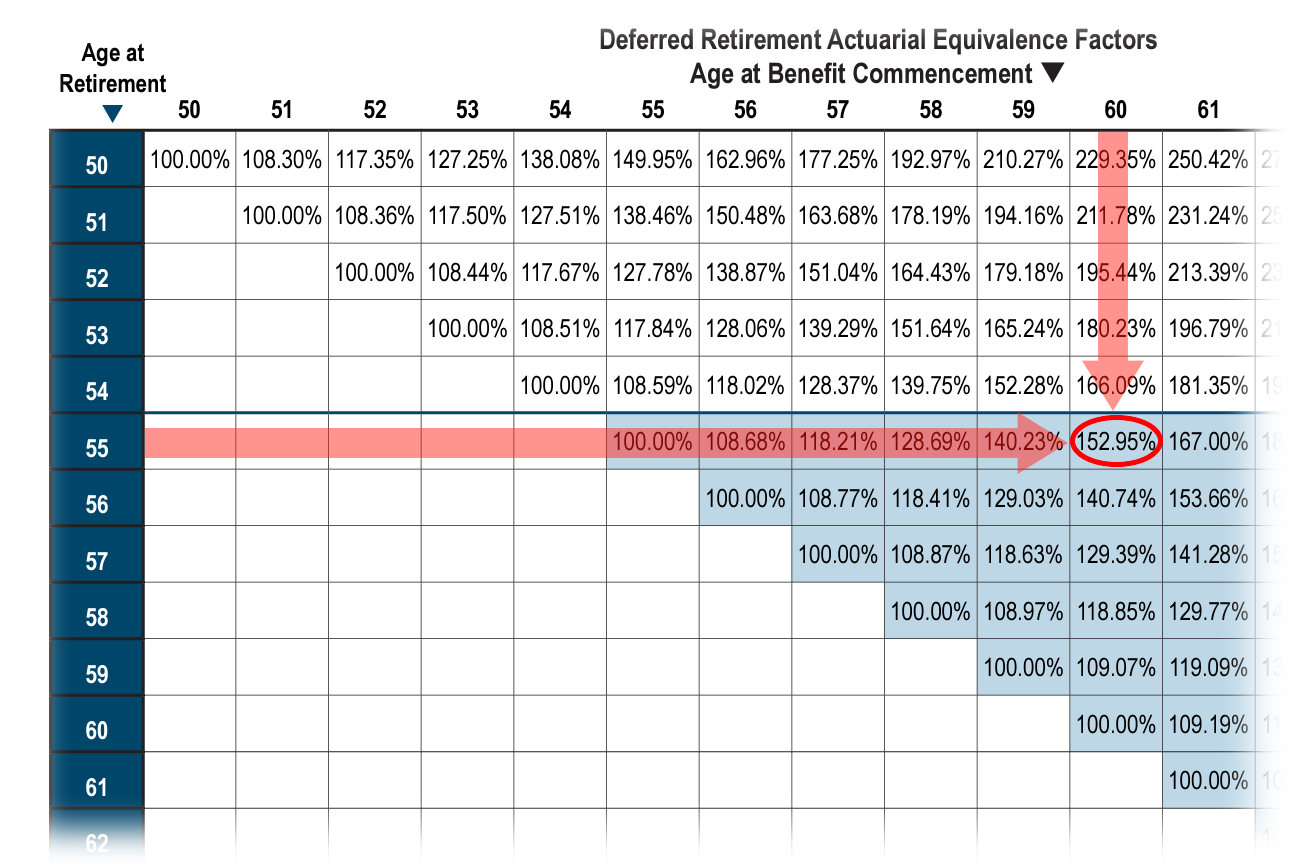

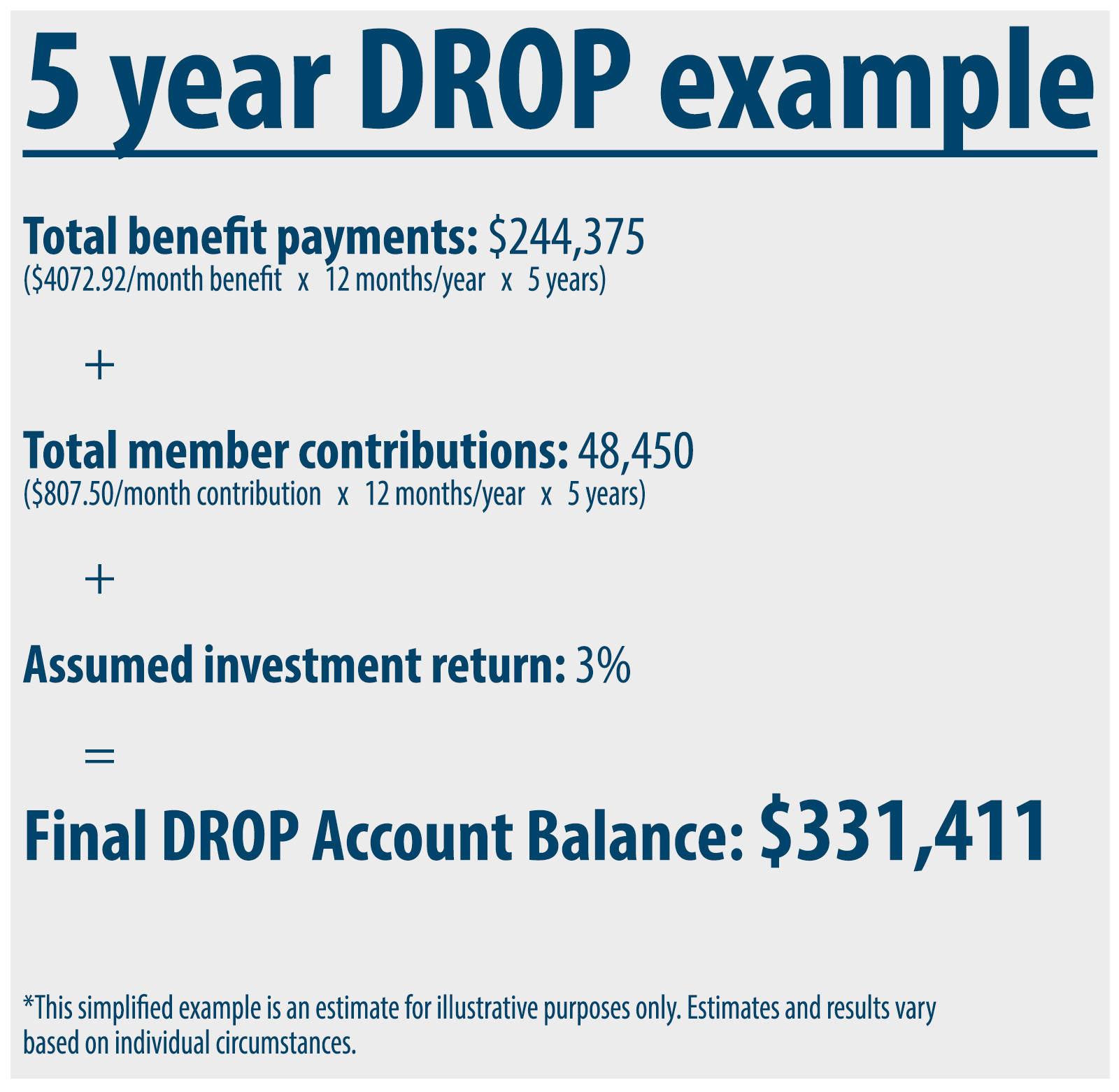

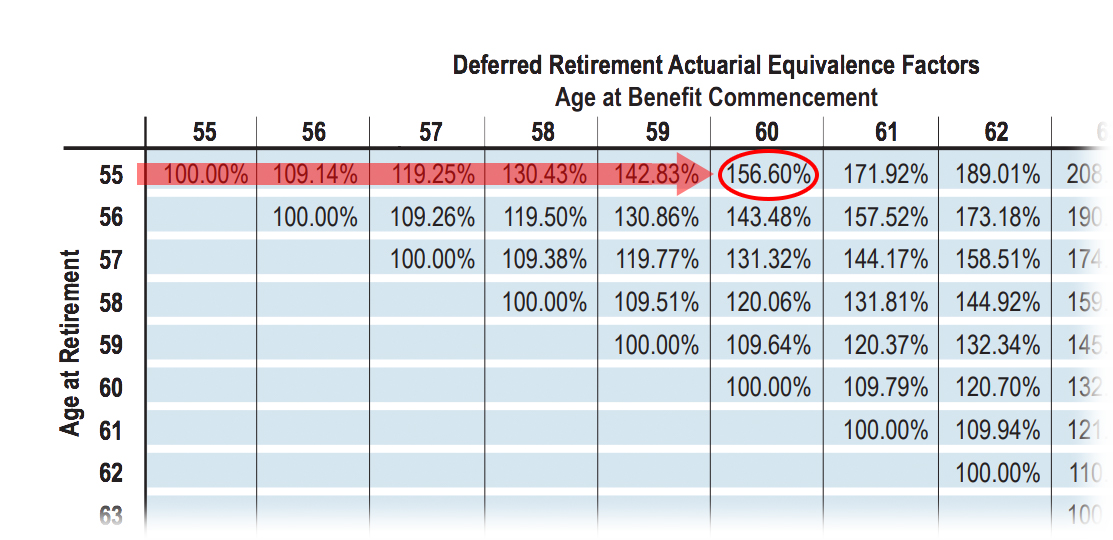

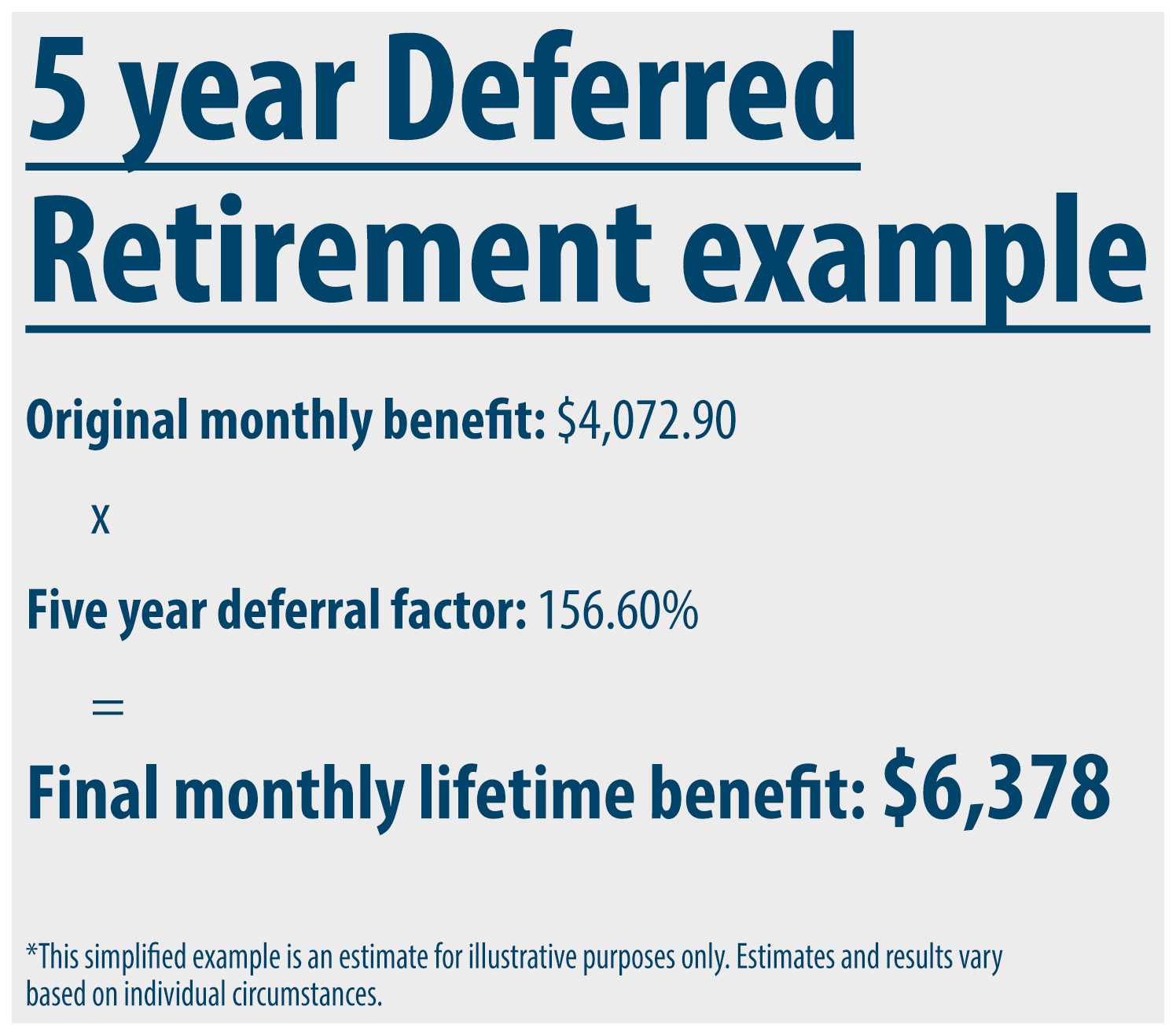

DROP vs. Deferred Retirement PensionCheck Online FPPA

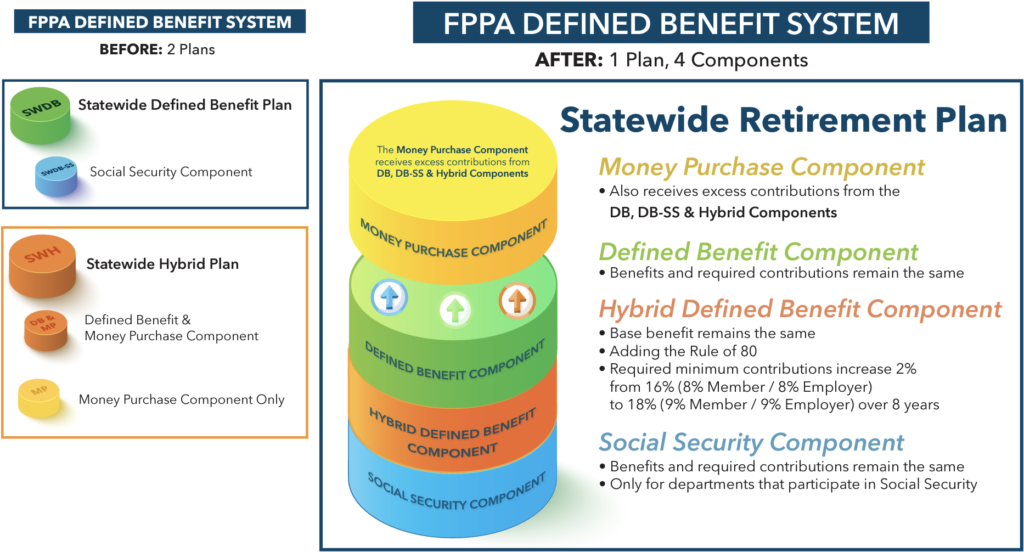

Looking Forward to the New Statewide Retirement Plan PensionCheck

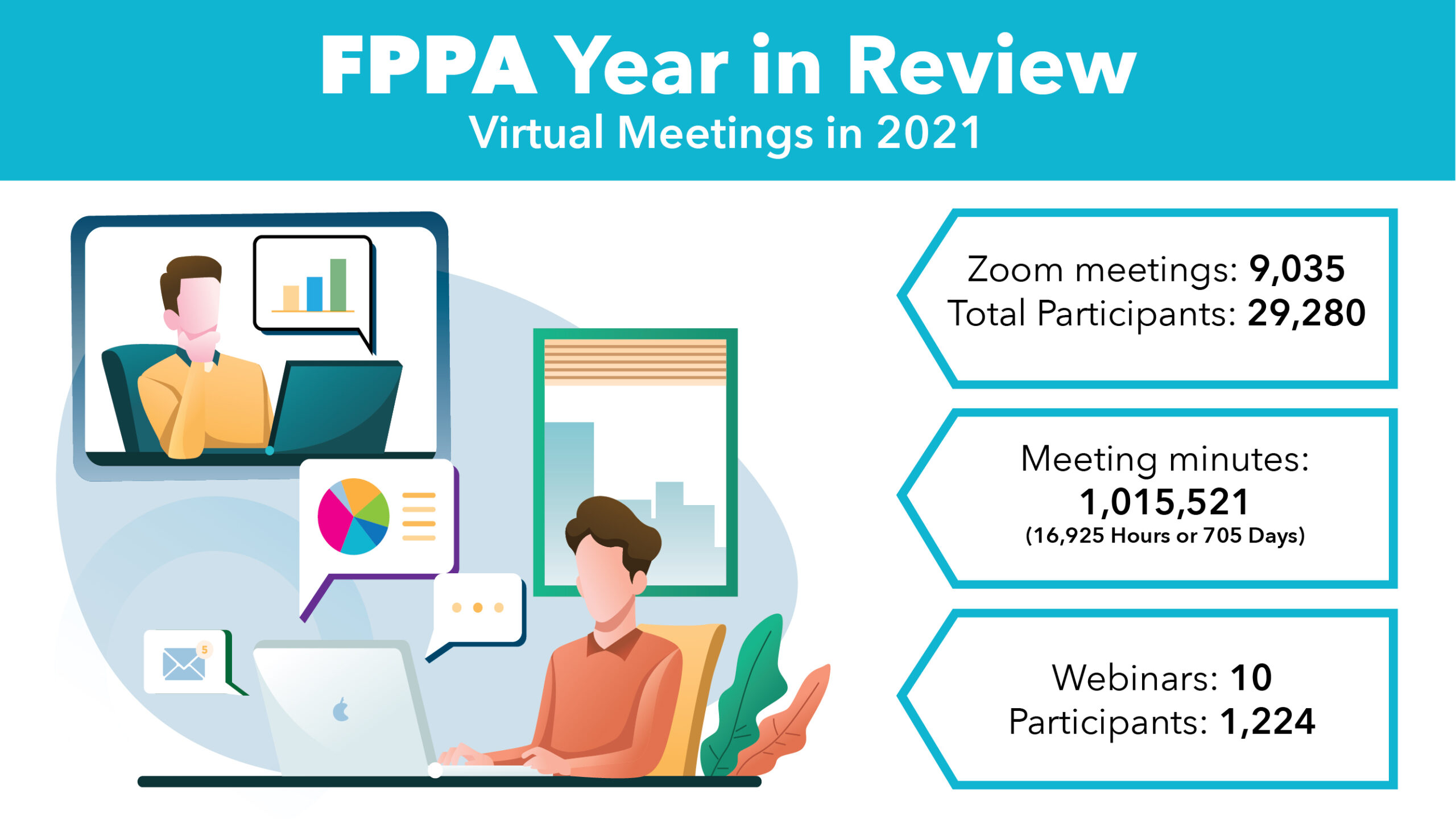

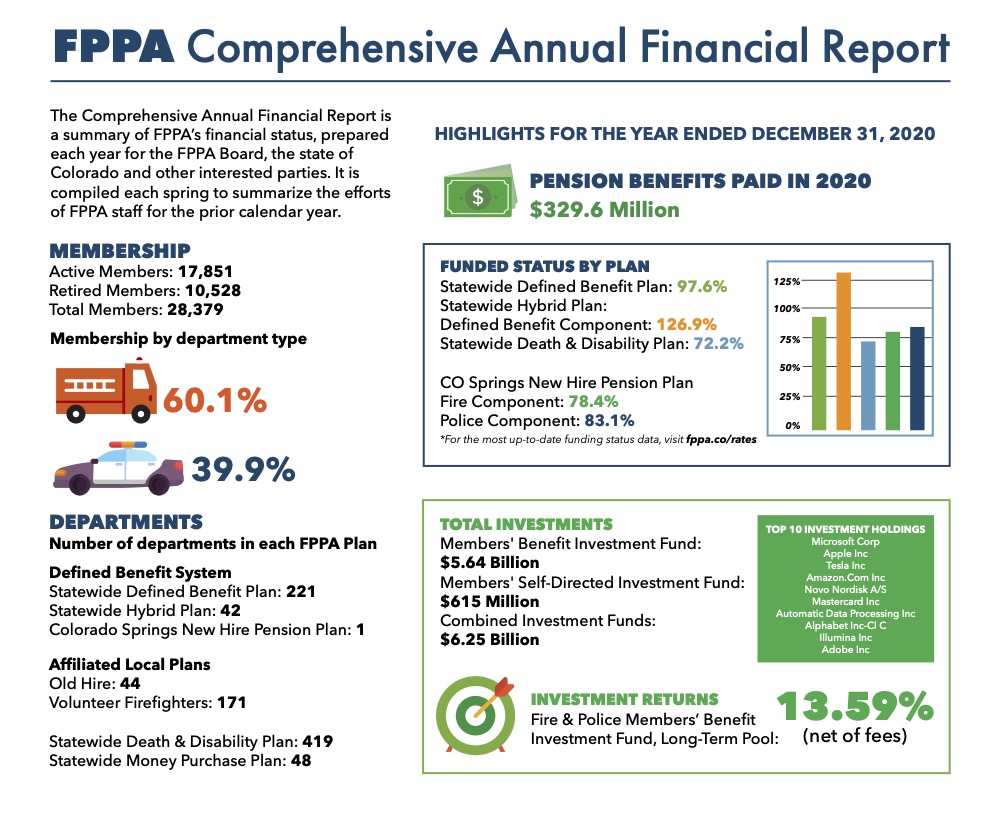

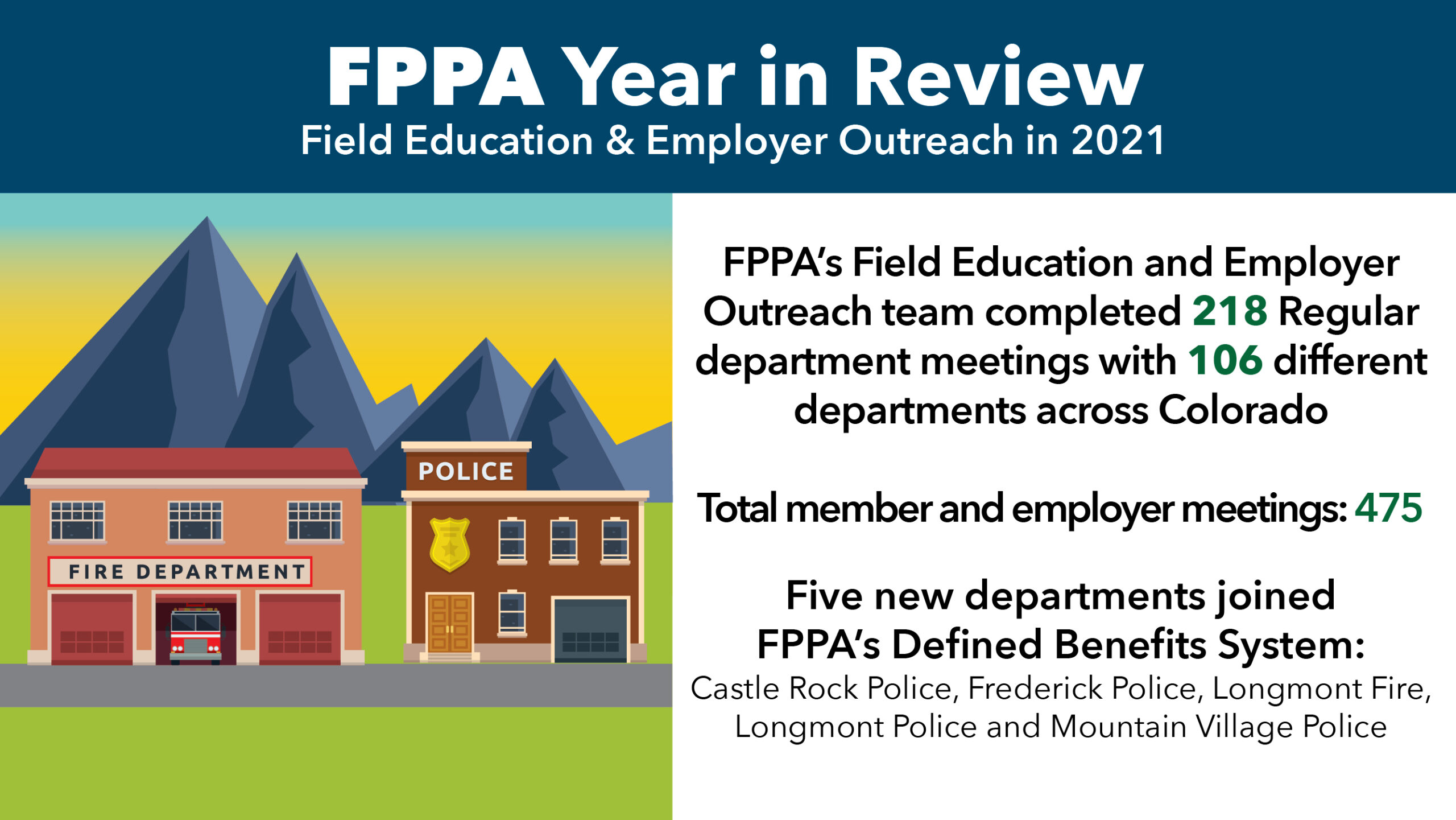

FPPA's 2021 Year in Review PensionCheck Online FPPA

DROP vs. Deferred Retirement PensionCheck Online FPPA

Results From FPPA’s Member Survey PensionCheck Online FPPA

Highlights from FPPA’s Comprehensive Annual Financial Report

DROP vs. Deferred Retirement PensionCheck Online FPPA

FPPA's 2021 Year in Review PensionCheck Online FPPA

DROP vs. Deferred Retirement PensionCheck Online FPPA

Web To See What Your Fppa Pension Benefit Could Look Like, Use The Partial Entry Benefit Calculator.

Web Based On The Results Of Recent Annual Actuarial Valuations Of Fppa Plans, The Fppa Board Of Directors Approved The Funded Ratios, Contribution Rates, Irs.

Web Our Report Presents The Results Of The January 1, 2024 Actuarial Valuation Of The Fppa Statewide Retirement Plan (Srp).

Web The Online Retirement Application Is Live.

Related Post: