Form 2290 Printable

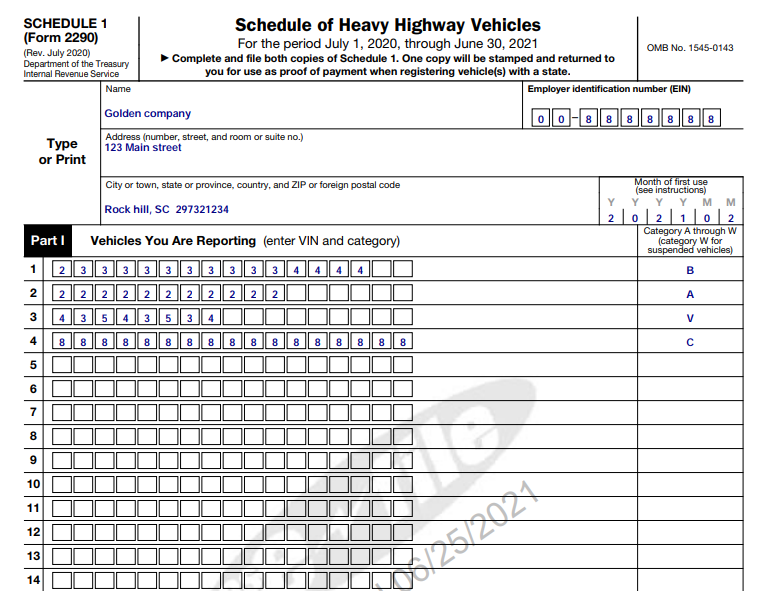

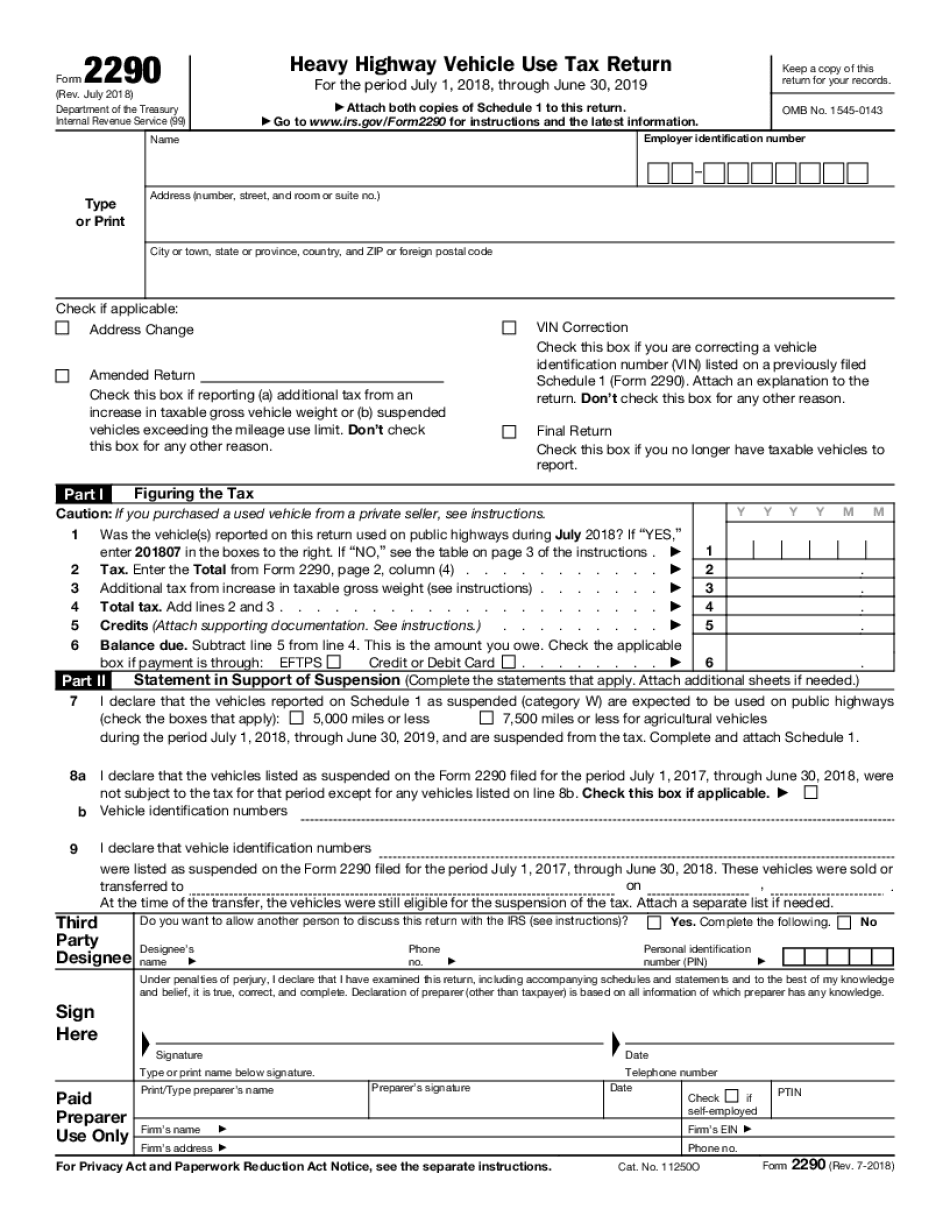

Form 2290 Printable - However, vehicles that run less than. Please review the information below. This july 2024 revision is for the tax period beginning on july 1, 2024, and ending on june Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. The form, instructions, or publication you are looking for begins after this coversheet. The hvut form 2290, as the name suggests, reports certain information on the heavy vehicles that utilize highways in a particular period. Web irsform 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways.this return must also be filed when the acquisition of used vehicles is made for the current tax period. Web what information is required to file form 2290? With full payment and that payment is not drawn from an international financial institution. And this gives you the perfect opportunity to review your 2290 forms before you submit them to the irs. This july 2024 revision is for the tax period beginning on july 1, 2024, and ending on june Heavy highway vehicle use tax return keywords: To file a form 2290, you will need to provide the following information: Web every year, millions of trucking companies file their 2290 forms. The 2290 filing season is just around the corner. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Please review the information below. With full payment and that. Please review the information below. And this gives you the perfect opportunity to review your 2290 forms before you submit them to the irs. Web what information is required to file form 2290? The 2290 filing season is just around the corner. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for. Web every year, millions of trucking companies file their 2290 forms. · business name, address, and employer identification number (ein) Please review the information below. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web irsform 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for. Web every year, millions of trucking companies file their 2290 forms. The form, instructions, or publication you are looking for begins after this coversheet. Web irsform 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that operate on public. Web every year, millions of trucking companies file their 2290 forms. The 2290 filing season is just around the corner. The form, instructions, or publication you are looking for begins after this coversheet. Web what information is required to file form 2290? Web irsform 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. And this gives you the perfect opportunity to review your 2290 forms before you submit them to the irs. Web if you are filing a form 2290 paper return: Figure and pay the tax due on a vehicle for which you completed the. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Heavy highway vehicle use tax return keywords: With full payment and. Please review the information below. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. The hvut. Please review the information below. With full payment and that payment is not drawn from an international financial institution. And this gives you the perfect opportunity to review your 2290 forms before you submit them to the irs. Web irsform 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for heavy highway motor vehicles. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 Web every year, millions of trucking companies file their 2290 forms. Web irsform 2290, heavy highway vehicle use tax return, is used to figure and pay road taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways.this return must also be filed when the acquisition of used vehicles is made for the current tax period. Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period. Please review the information below. The form, instructions, or publication you are looking for begins after this coversheet. And this gives you the perfect opportunity to review your 2290 forms before you submit them to the irs. Heavy highway vehicle use tax return keywords: The 2290 filing season is just around the corner. To file a form 2290, you will need to provide the following information: Web what information is required to file form 2290? The hvut form 2290, as the name suggests, reports certain information on the heavy vehicles that utilize highways in a particular period. · business name, address, and employer identification number (ein) Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. This july 2024 revision is for the tax period beginning on july 1, 2024, and ending on june

Are 2024 Tax Forms Available Vevay Jennifer

Irs 2290 Form 2021 Printable Customize and Print

20241940 Darb Minnie

Form 2290 2018 2021 Fill Online Printable Fillable Printable Form 2021

Printable 2290 Form

Ssurvivor 2290 Tax Form Printable

2290 Form Printable

2290 Form Printable

Free Printable Form 2290 Printable Form 2024

Printable 2290 Form Customize and Print

However, Vehicles That Run Less Than.

With Full Payment And That Payment Is Not Drawn From An International Financial Institution.

Web If You Are Filing A Form 2290 Paper Return:

Form 2290 Is Used To Figure And Pay The Tax Due On Certain Heavy Highway Motor Vehicles.

Related Post: