Foreign Grantor Trust Template

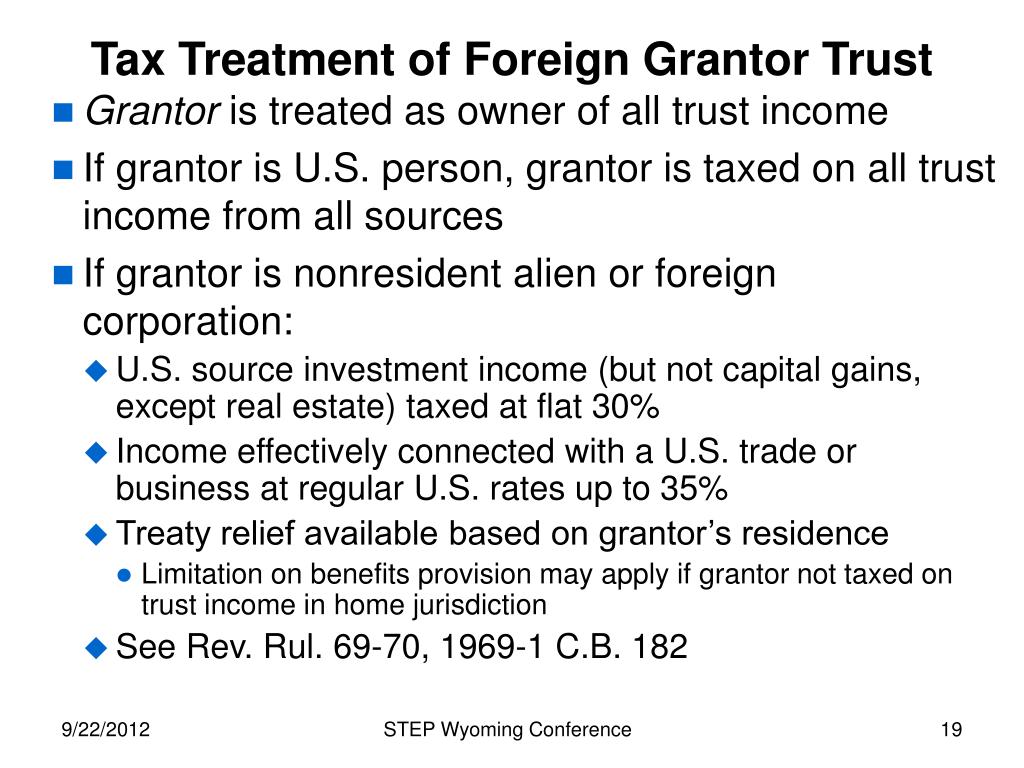

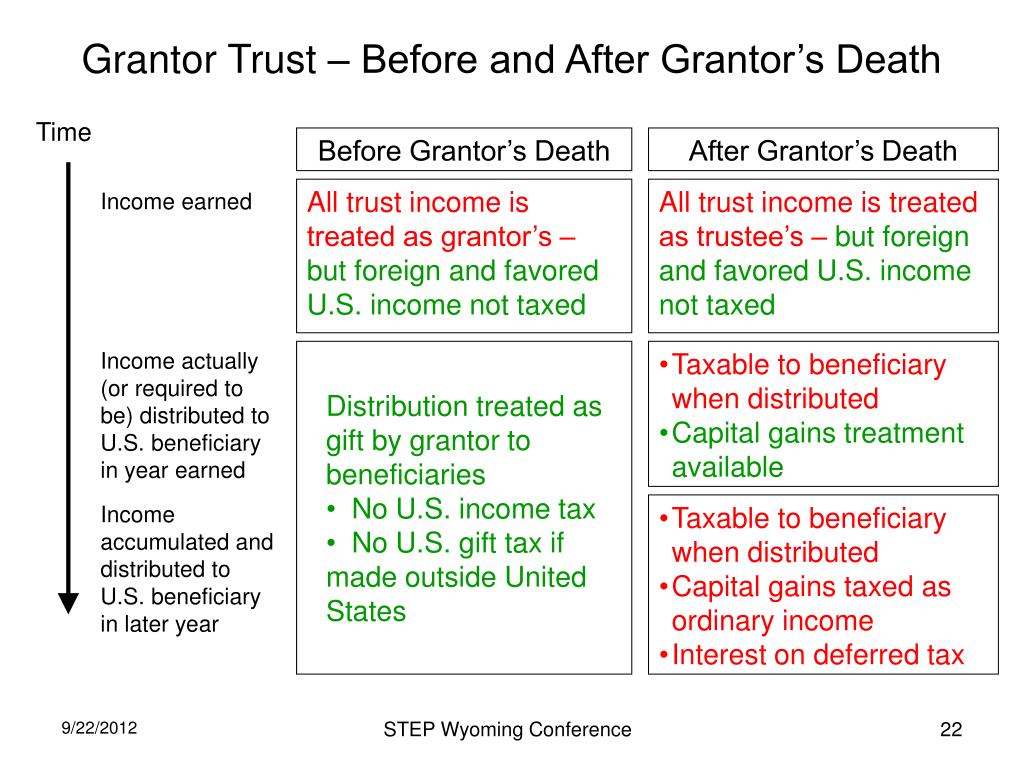

Foreign Grantor Trust Template - The foreign account tax compliance act (fatca) also requires foreign trusts to report. Web in this document we provide an overview of the us tax rules for foreign trusts, including some of the tax risks and opportunities for us persons who are grantors/settlors or. Beneficiaries, depending on the priorities of. The form provides information about the foreign trust, its u.s. Web this article provides trust officers and family advisers with a summary checklist. Web special rules prevent a u.s. Web know that moving your assets into a foreign trust will not exempt you from certain taxes. Web what is a “foreign grantor trust”? Web foreign trust documents aicpa continues to identify, monitor, and address various foreign trust reporting issues, including forms 3520 and 3520a compliance. Web you are (a) a u.s. Domestic trust, so neither the. The internal revenue service will enforce the taxation of foreign trusts as either a. Web a properly structured and administered fgt provides highly favorable us federal tax treatment for us family members including: Web you are (a) a u.s. Web over the years, u.s. Web this publication will provide an overview of the questions that must be addressed by foreign trustees, us owners of foreign trusts, and us beneficiaries of foreign trusts under. Web a foreign grantor trust (fgt) is a type of foreign trust treated as a grantor trust under sections 671 through 679 of the internal revenue code. Web what is a. Web a properly structured and administered fgt provides highly favorable us federal tax treatment for us family members including: Web what is a “foreign grantor trust”? Web foreign trust documents aicpa continues to identify, monitor, and address various foreign trust reporting issues, including forms 3520 and 3520a compliance. Lar tax status under the u.s. Web this publication will provide an. Web this informational guide provides an overview of u.s. Web what is a “foreign grantor trust”? Web this form is required by the trustee of the foreign trust, to provide the irs with information as to which us beneficiary received a foreign trust distribution. Web this publication will provide an overview of the questions that must be addressed by foreign. Lar tax status under the u.s. Web a foreign grantor trust (fgt) is a type of foreign trust treated as a grantor trust under sections 671 through 679 of the internal revenue code. Web a properly structured and administered fgt provides highly favorable us federal tax treatment for us family members including: Web this publication will provide an overview of. No annual tax or reporting with respect to. Web what is a “foreign grantor trust”? Web know that moving your assets into a foreign trust will not exempt you from certain taxes. Web foreign trust documents aicpa continues to identify, monitor, and address various foreign trust reporting issues, including forms 3520 and 3520a compliance. Lar tax status under the u.s. Web special rules prevent a u.s. Person who (1) during the. Web this form is required by the trustee of the foreign trust, to provide the irs with information as to which us beneficiary received a foreign trust distribution. Federal income tax purposes, a trust is foreign if it fails the “court” test or the “control” test, and is a. Web you are (a) a u.s. Beneficiaries, depending on the priorities of. Web what is a “foreign grantor trust”? Transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust; Web a foreign grantor trust is a legal entity created and governed under the laws of a foreign jurisdiction, often with the. No annual tax or reporting with respect to. Tax purposes, and explains that a foreign. Web you are (a) a u.s. Web a foreign grantor trust (fgt) is a type of foreign trust treated as a grantor trust under sections 671 through 679 of the internal revenue code. Web over the years, u.s. Web what is a “foreign grantor trust”? Web this article provides trust officers and family advisers with a summary checklist. Web a foreign grantor trust is a legal entity created and governed under the laws of a foreign jurisdiction, often with the primary purpose of estate planning, asset protection, and tax. The form provides information about the foreign trust, its. Web you are (a) a u.s. Lar tax status under the u.s. Person who (1) during the. Tax purposes, and explains that a foreign. Web know that moving your assets into a foreign trust will not exempt you from certain taxes. Web this publication will provide an overview of the questions that must be addressed by foreign trustees, us owners of foreign trusts, and us beneficiaries of foreign trusts under. Web a properly structured and administered fgt provides highly favorable us federal tax treatment for us family members including: The form provides information about the foreign trust, its u.s. Web what is a “foreign grantor trust”? Federal income tax purposes, a trust is foreign if it fails the “court” test or the “control” test, and is a foreign grantor trust (fgt) if it either. No annual tax or reporting with respect to. Transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust; Web a foreign grantor trust is a legal entity created and governed under the laws of a foreign jurisdiction, often with the primary purpose of estate planning, asset protection, and tax. Web a foreign grantor trust (fgt) is a type of foreign trust treated as a grantor trust under sections 671 through 679 of the internal revenue code. Web this article provides trust officers and family advisers with a summary checklist. The internal revenue service will enforce the taxation of foreign trusts as either a.

Foreign Grantor Trust Template

Foreign grantor trust template Fill out & sign online DocHub

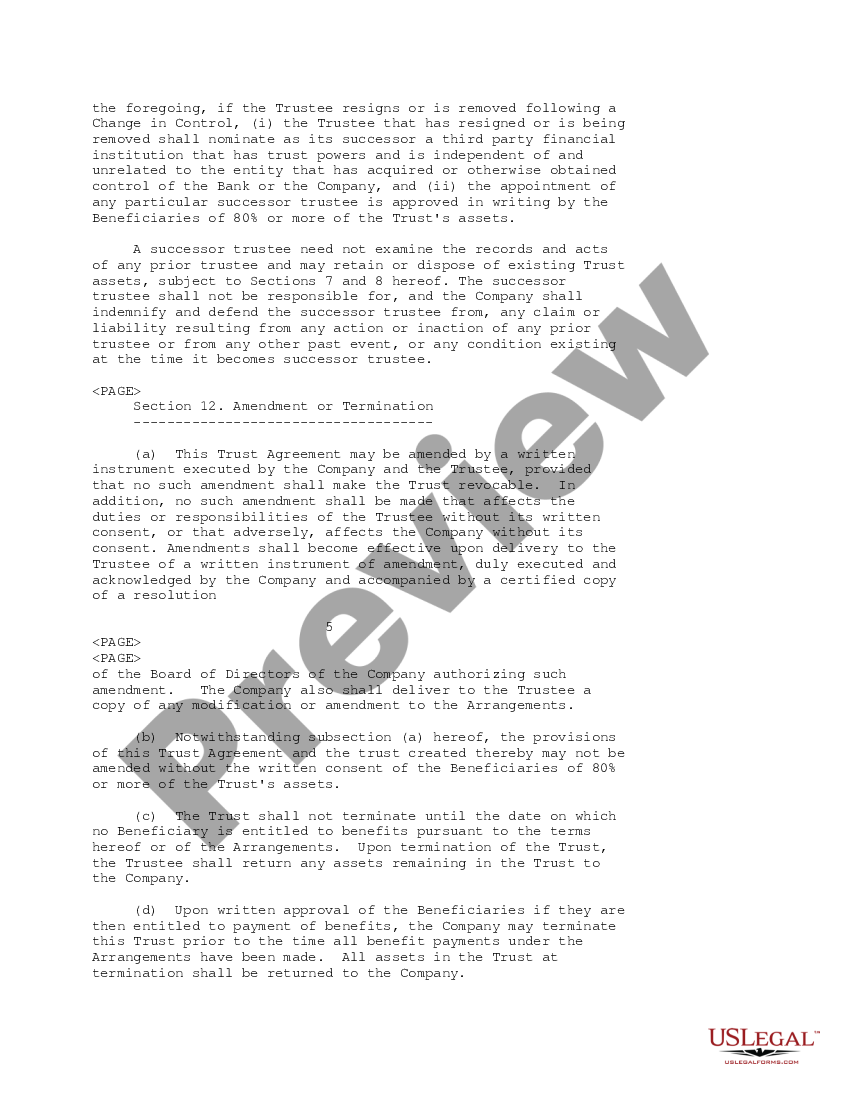

Grantor Trust Agreement Foreign Grantor US Legal Forms

Sample Letter To Trust Beneficiaries

How to get the 98 EIN number (foreign grantor trust)

Grantor Trust Form Complete with ease airSlate SignNow

Grantor Trust Agreement Foreign Grantor US Legal Forms

98 Number Foreign Grantor Trust To Estate Currency Of Exchange YouTube

Foreign Grantor Trust Template

Foreign Grantor Trust Template

There Are A Number Of Options To Consider For The Design Of A Trust By A Foreign Person Who Intends To Benefit U.s.

Domestic Trust, So Neither The.

It Defines A Foreign Trust And Foreign Grantor Trust For U.s.

Person Beneficiary Can Use To Possibly Reduce Taxes And Interest On The Distributions.

Related Post: