Foreclosure Letter Template

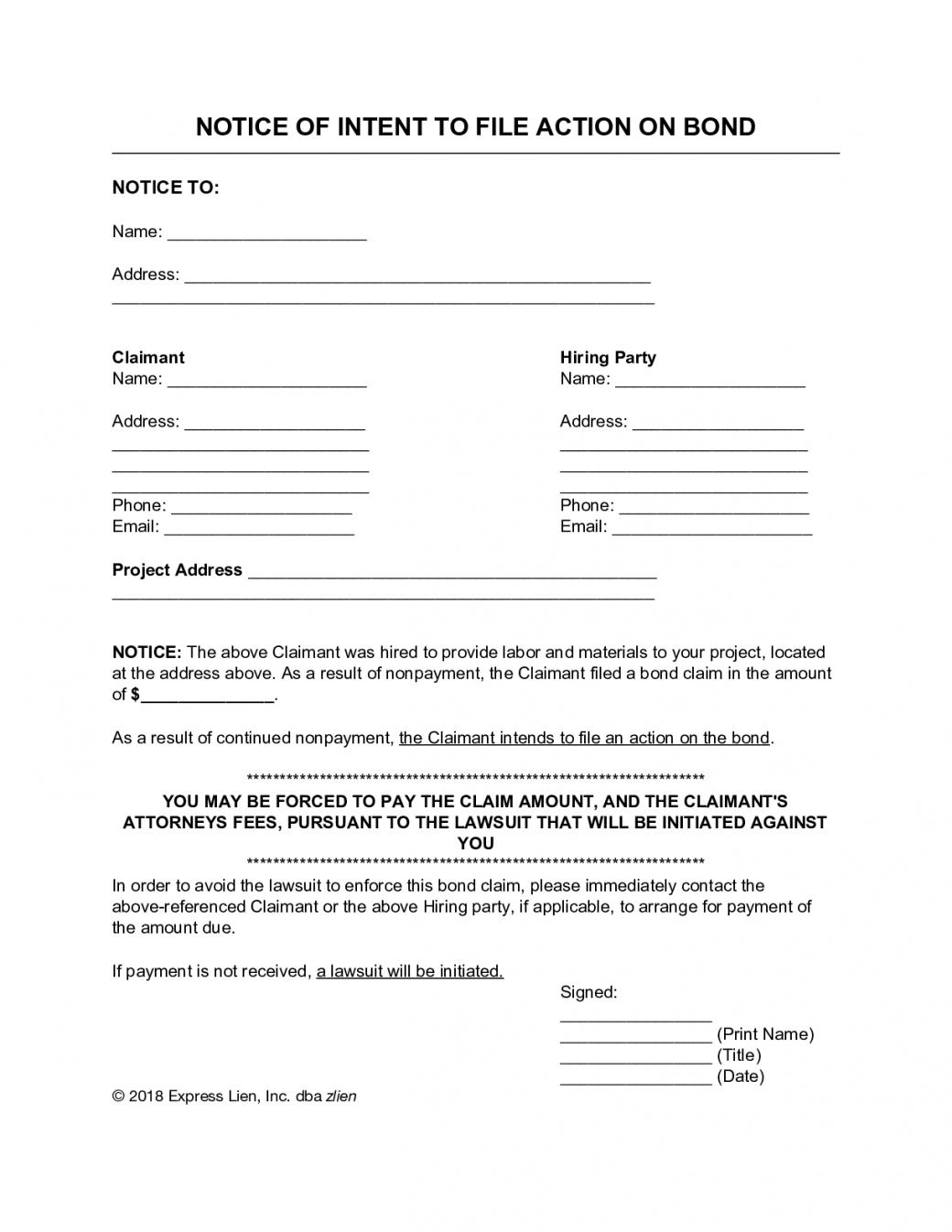

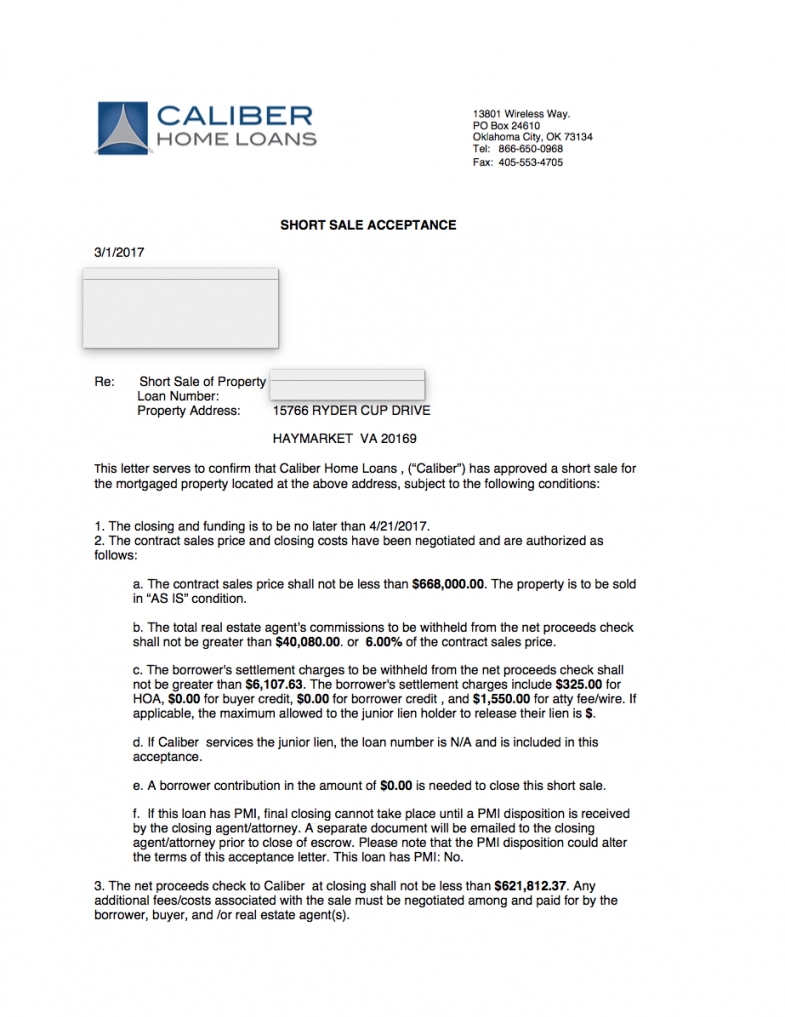

Foreclosure Letter Template - Web a sample foreclosure letter from a bank is a written communication addressed to a borrower who has fallen behind on their mortgage payments, informing them of the bank's intention to initiate foreclosure proceedings if the delinquency is not resolved promptly. Summary of florida's foreclosure protections for homeowners. If you decided to foreclose your loan by paying the pending amount in a single payment then you need to write a request letter to the bank (or) financial institution to foreclose that loan. You have missed one or more payments on your mortgage loan or you are otherwise in default. Web this letter is a formal notification that your lender intends to foreclose on your property if you do not take action to resolve your delinquent mortgage payments. A list of the borrowers with their interest in the property. Web a notice of intent to foreclose is a voluntary document, but it’s a powerful one. Available in a4 & us letter sizes. You can also choose from variations of templates to make a notice letter of your own. Consult with a local foreclosure attorney to learn exactly what type of notice you'll receive and how long a foreclosure will take in your state and particular circumstances. Receive a preforeclosure breach letter. You have missed one or more payments on your mortgage loan or you are otherwise in default. Get notice of the foreclosure and the chance to respond in court. Additionally, you have to mention the loan account number, your name, and other details. Summary of florida's foreclosure protections for homeowners. In a florida foreclosure, you'll most likely get the right to: Web get our foreclosure letter template to request early loan closure. Web a notice of foreclosure letter is a formal document sent by a lender or mortgage holder to inform a borrower that they are in default of their mortgage agreement and that foreclosure proceedings will begin if the. On the other hand, some cities don’t require such advanced notice. You are at risk of losing your property to foreclosure. Web a foreclosure letter format should include details such as the borrower’s name, property address, outstanding balance, the reason for foreclosure, a deadline for resolution, and contact information for the lender. Web a notice of intent to foreclose letter. Web a notice of foreclosure letter is a formal document sent by a lender or mortgage holder to inform a borrower that they are in default of their mortgage agreement and that foreclosure proceedings will begin if the outstanding debt is. Posted on feb 19, 2009 voted as most helpful. This letter is sent by the lender to the borrower. You can also choose from variations of templates to make a notice letter of your own. Receive a preforeclosure breach letter. Web a notice of foreclosure letter is a formal document sent by a lender or mortgage holder to inform a borrower that they are in default of their mortgage agreement and that foreclosure proceedings will begin if the outstanding. You are in default because you have failed to pay the required monthly installments commencing with the payment due mm/dd/ccyy. Under the terms of the mortgage or deed of trust (“security instrument”) securing your loan, “bank name,” hereby notifies you of the following: Web before these foreclosures, you’ll be informed of the risks, through a foreclosure notice. But 60 days. When the loan was defaulted. Web a foreclosure letter format should include details such as the borrower’s name, property address, outstanding balance, the reason for foreclosure, a deadline for resolution, and contact information for the lender. Gainesville — uf shifted to midday for the second day of fall camp thursday, practicing in a heat index of 99 degrees as a. If you do not respond within the proper time period, a. Web you can request a loan foreclosure letter format from your bank by writing a formal letter addressing the loan officer or relevant department, providing your loan details, expressing your intention to foreclose the loan, and requesting guidance on the foreclosure process. On the other hand, some cities don’t. August 1, 2024 at 5:04 p.m. Its purpose is to notify the borrower that the lender intends to initiate foreclosure proceedings if the overdue payments are not made promptly. When the loan was defaulted. The most important aspect of any lawsuit is filing a timely answer or motion to dismiss. A package of letters and forms to use in the. Web this letter is a formal notification that your lender intends to foreclose on your property if you do not take action to resolve your delinquent mortgage payments. Web a notice of foreclosure letter is a formal document sent by a lender or mortgage holder to inform a borrower that they are in default of their mortgage agreement and that. Web this letter is a formal notification that your lender intends to foreclose on your property if you do not take action to resolve your delinquent mortgage payments. This letter is sent by the lender to the borrower when they miss multiple mortgage payments. Web foreclosure procedures and timelines are different in each state. Web a foreclosure letter format should include details such as the borrower’s name, property address, outstanding balance, the reason for foreclosure, a deadline for resolution, and contact information for the lender. If you decided to foreclose your loan by paying the pending amount in a single payment then you need to write a request letter to the bank (or) financial institution to foreclose that loan. Get current on the loan and stop the foreclosure sale. Its purpose is to notify the borrower that the lender intends to initiate foreclosure proceedings if the overdue payments are not made promptly. A package of letters and forms to use in the process of foreclosure on real property. Details of the promissory note. But 60 days is also common, though less popular. On the other hand, some cities don’t require such advanced notice. You have missed one or more payments on your mortgage loan or you are otherwise in default. Web here are some different types of foreclosure letter samples with mortgage: Posted on feb 19, 2009 voted as most helpful. It serves as a warning and provides a specific timeframe for the borrower to cure the default by bringing the payments up to date. Web you can request a loan foreclosure letter format from your bank by writing a formal letter addressing the loan officer or relevant department, providing your loan details, expressing your intention to foreclose the loan, and requesting guidance on the foreclosure process.

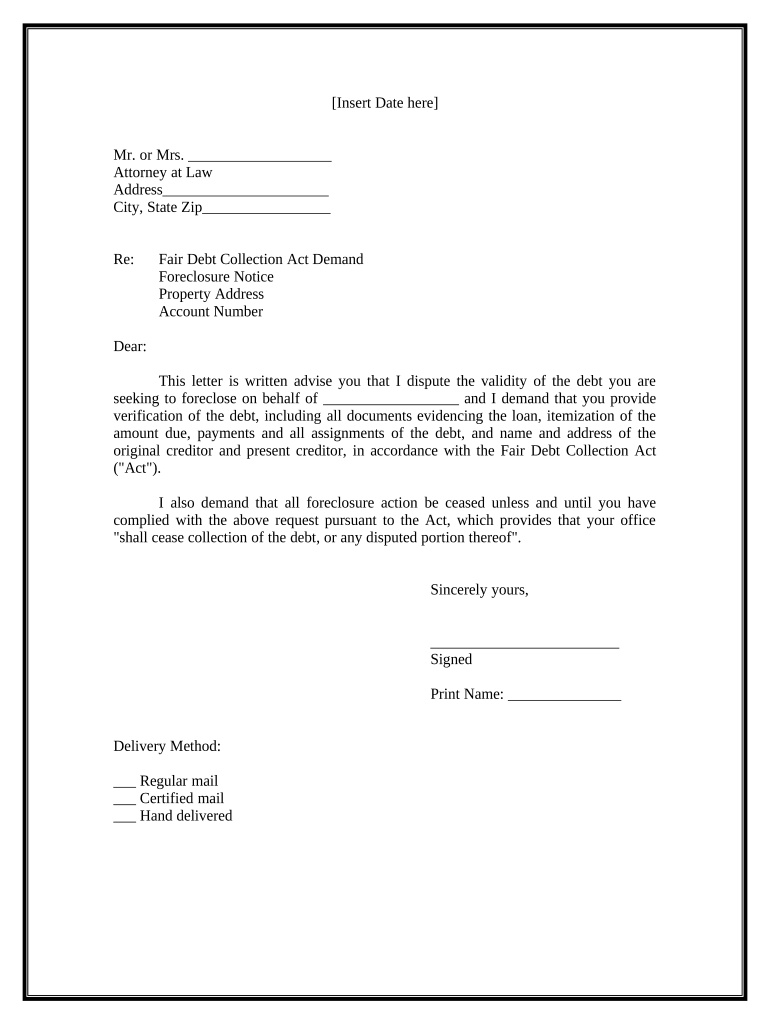

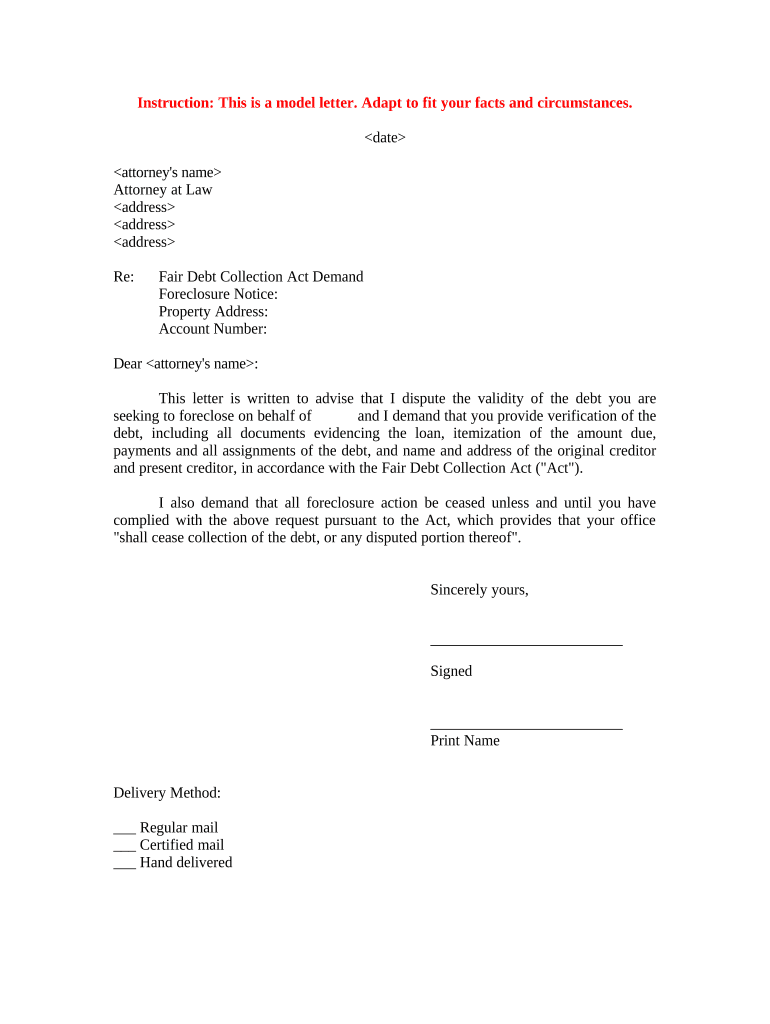

letter foreclosure notice Doc Template pdfFiller

Foreclosure Letter Form Fill Out and Sign Printable PDF Template

Printable Foreclosure Notice Template Doc Example Tacitproject

Professional Foreclosure Notice Template PDF Sample Tacitproject

Foreclosure Letter Sample Complete with ease airSlate SignNow

Foreclosure letter sample Fill out & sign online DocHub

Foreclosure Letter Template Free

foreclosure letter example Doc Template pdfFiller

Notice of Foreclosure Letter Sample Template with Examples

Notice of Foreclosure Letter with Examples in PDF and Word

Read On In This Article To Find Out More About Foreclosure Notices.

Web A Notice Of Foreclosure Letter Is A Formal Document Sent By A Lender Or Mortgage Holder To Inform A Borrower That They Are In Default Of Their Mortgage Agreement And That Foreclosure Proceedings Will Begin If The Outstanding Debt Is.

Also, Make Sure You State The Reason For Foreclosure Very Clear And Concise.

Web A Notice Of Intent To Foreclose Letter Is A Formal Document Sent By A Lender To A Borrower Who Has Fallen Behind On Mortgage Payments.

Related Post: