Football Field Chart Valuation

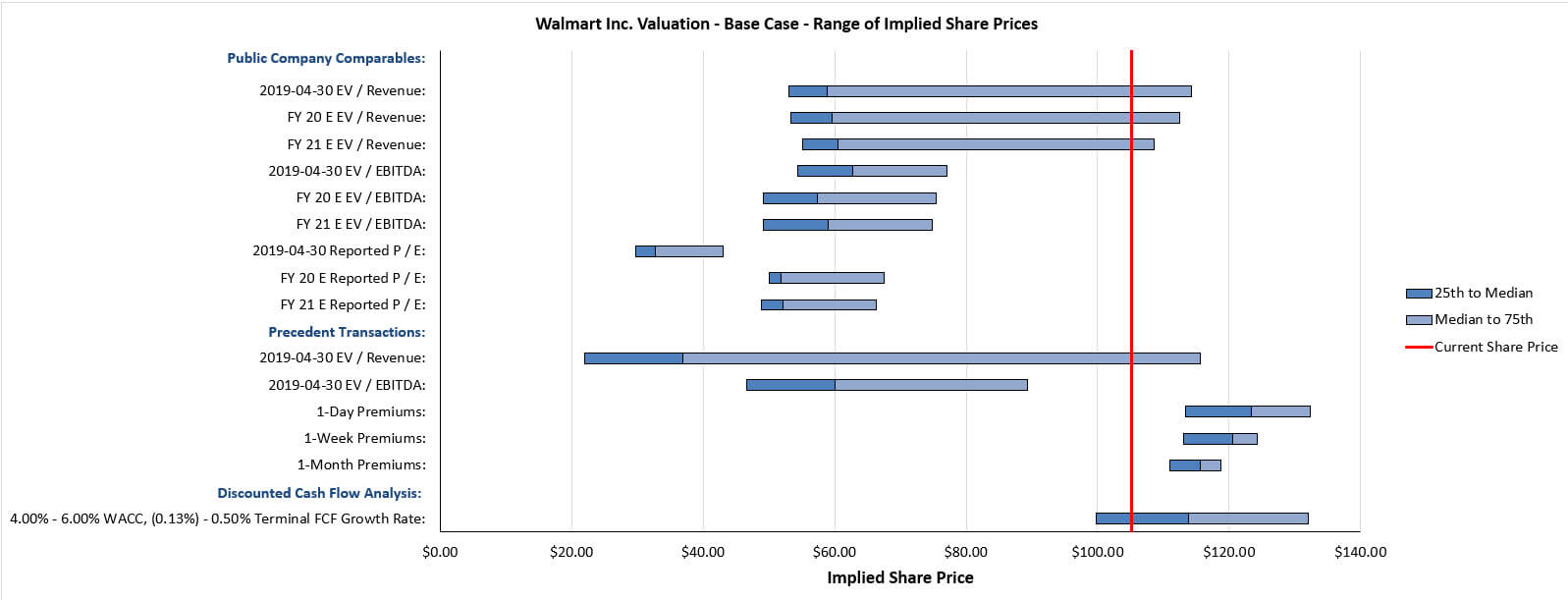

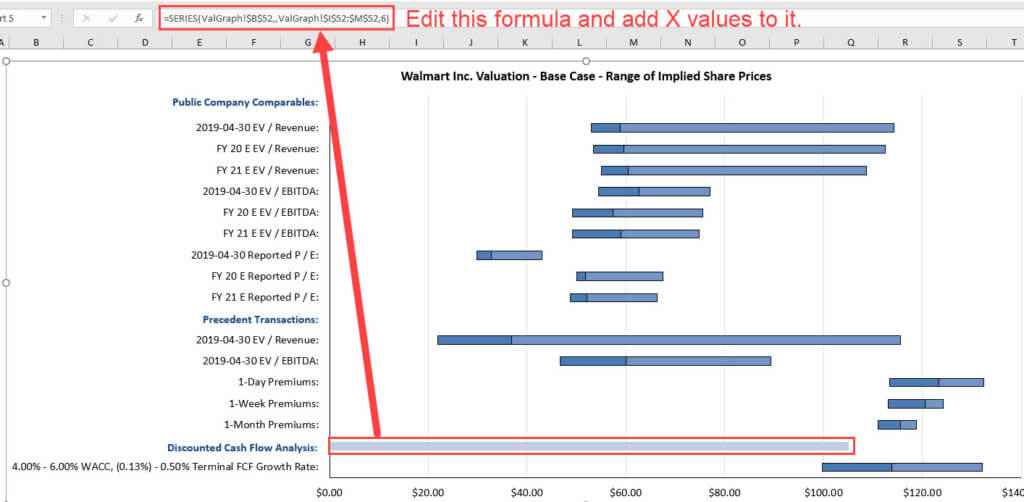

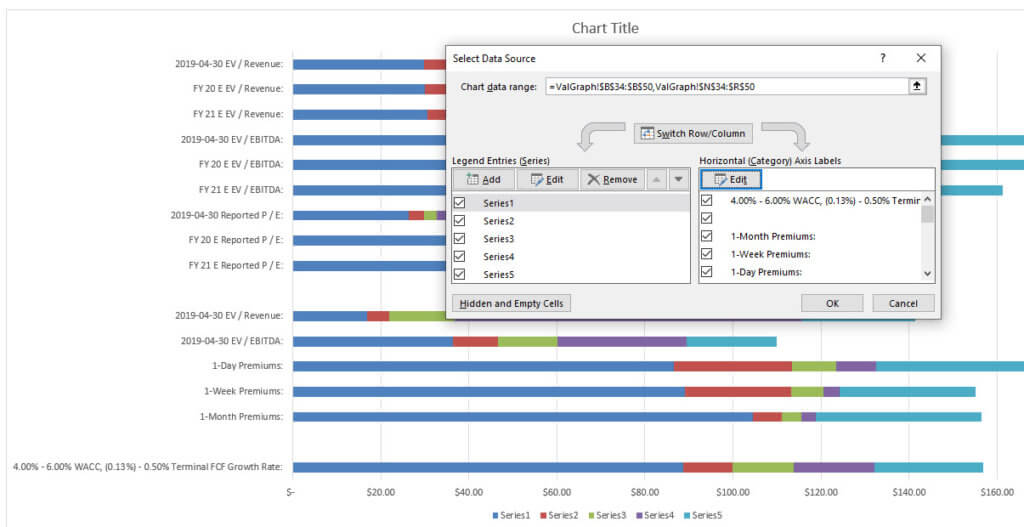

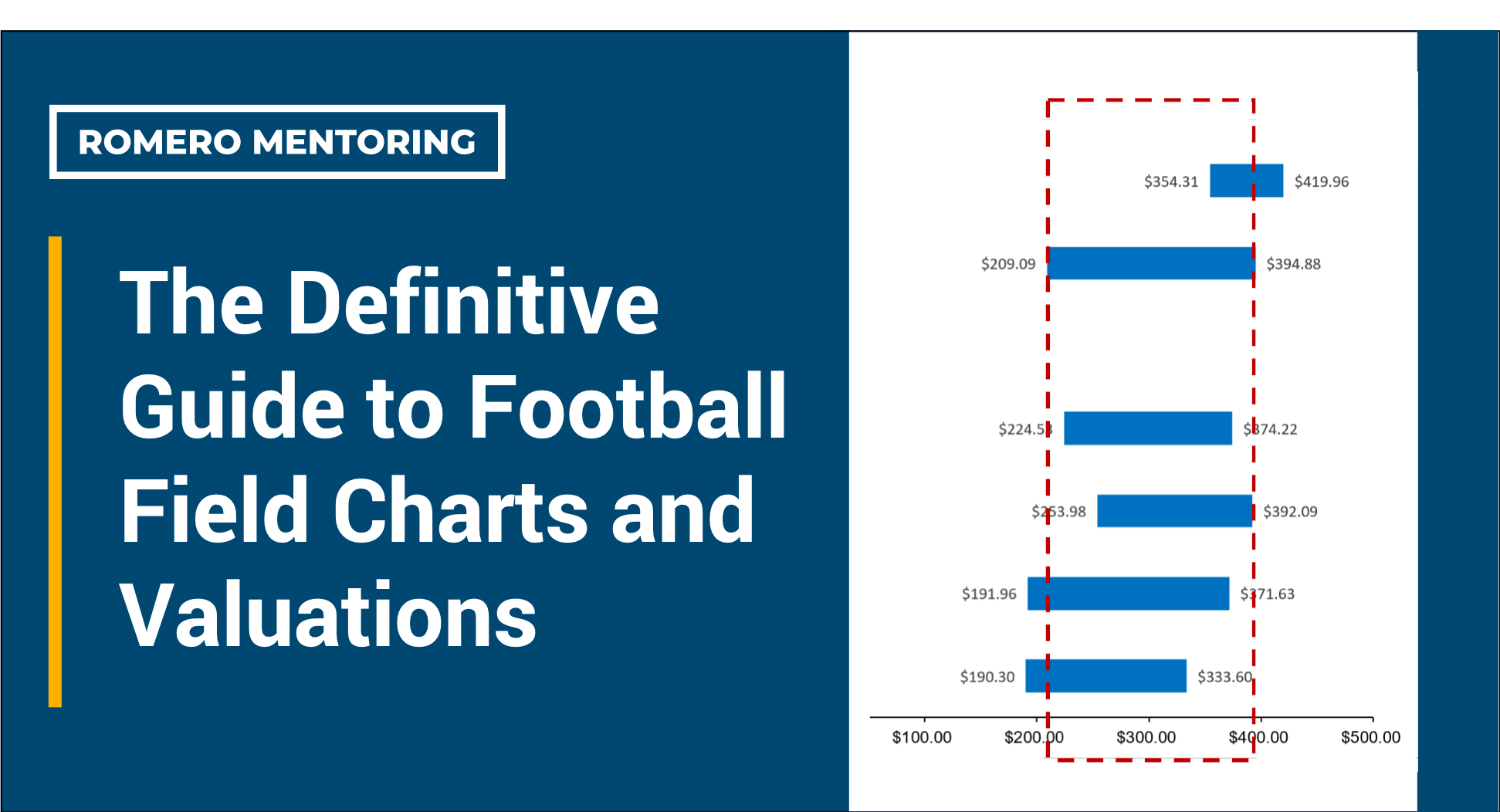

Football Field Chart Valuation - The accompanying video on this page takes you through the build, and there is a free football field template download to speed things up. It can show how different scenarios affect a company’s value. This article shows how to build a football field chart in excel. Web a football field chart is used in order to demonstrate different parts of a valuation analysis side by side, making them easily comparable. Web on this page i walk through how to create a football field diagram. A simple football field valuation matrix will include a company valued based on a dcf valuation (see 2023.09.19 technical), lbo analysis (see 2023.10.13 technical), comparable companies analysis (see 2023.09.27 technical),. Web this guide explains what football field charts are and the role that football field valuation plays in the valuation of a privately held business. Web what is a football field chart? Web this football field chart template can be used to summarize a range of values for a business, based on different valuation methods. Web a football field chart is used to summarize a range of values for a business, based on different valuation methods. Web what is a football field chart? In the football field chart below, we have 7 valuation methods: Web a football field is a way to quickly visualize lots of valuation data in and simple way. Web on this page i walk through how to create a football field diagram. Entrepreneurs, m&a professionals, and business consultants need to understand what. Web a football field chart is used to summarize a range of values for a business, based on different valuation methods. Web this chart allows you to easily compare multiple valuation ranges in a clean graphical format. Web on this page i walk through how to create a football field diagram. Steps to building a football field chart. You reach. Web on this page i walk through how to create a football field diagram. Web a football field chart is used to summarize a range of values for a business, based on different valuation methods. It is applicable to any version of excel from 2007 to 2016. The purpose of the football field chart is to show how much someone. Entrepreneurs, m&a professionals, and business consultants need to understand what a football field chart is. Useful for finance students and aspiring financial. A simple football field valuation matrix will include a company valued based on a dcf valuation (see 2023.09.19 technical), lbo analysis (see 2023.10.13 technical), comparable companies analysis (see 2023.09.27 technical),. Web a football field is a graph used. Web in this tutorial, you’ll learn how to create a flexible football field valuation template in excel, including a line for the company’s current share price that updates automatically when the. Web this guide explains what football field charts are and the role that football field valuation plays in the valuation of a privately held business. Web a football field. You reach this stage after carrying out your valuation using the popular methods like dcf, trading comps analysis, transaction comps analysis, lbo analysis etc. Web on this page i walk through how to create a football field diagram. The accompanying video on this page takes you through the build, and there is a free football field template download to speed. Steps to building a football field chart. Useful for finance students and aspiring financial. Web a quick video tutorial on how to create a football field chart in excel that can be useful to depict different valuation techniques. Web the football field graph is a floating bar chart in excel. Web on this page i walk through how to create. Web a football field chart is used to summarize a range of values for a business, based on different valuation methods. This article shows how to build a football field chart in excel. To determine a company’s fair value range, we can apply several valuation methods like discounted cash flow analysis and comparable company analysis. Steps to building a football. Its purpose is to create a visual representation of the valuation methods used. Web the chart type used to build a football field chart is the waterfall chart.the waterfall chart is useful for visually representing the cumulative effect of positive and negative values, making it suitable for presenting the valuation of a. It is applicable to any version of excel. It is prepared using a floating bar chart in excel and summarizes a range of values for a company, which is based on different valuation methodologies and assumptions. In the football field chart below, we have 7 valuation methods: Web a quick video tutorial on how to create a football field chart in excel that can be useful to depict. A simple football field valuation matrix will include a company valued based on a dcf valuation (see 2023.09.19 technical), lbo analysis (see 2023.10.13 technical), comparable companies analysis (see 2023.09.27 technical),. Web this football field chart template can be used to summarize a range of values for a business, based on different valuation methods. The accompanying video on this page takes you through the build, and there is a free football field template download to speed things up. Web a quick video tutorial on how to create a football field chart in excel that can be useful to depict different valuation techniques. Useful for finance students and aspiring financial. The ultimate goal is to show a valuation range based on those methods. Web the football field. The football field chart exhibits a company’s valuation range through the application of various valuation methods. Web “football field” charts are commonly used to compare the results of different valuation methodologies when applied to a given asset or corporation. It can show how different scenarios affect a company’s value. Web this document contains a football field chart comparing valuation methods for determining the intrinsic value of a share, including comps, precedents, discounted cash flow (dcf), dividend discount model (ddm), and research insights (ri). Web the chart type used to build a football field chart is the waterfall chart.the waterfall chart is useful for visually representing the cumulative effect of positive and negative values, making it suitable for presenting the valuation of a. Web a football field chart is used to summarize a range of values for a business, based on different valuation methods. It is prepared using a floating bar chart in excel and summarizes a range of values for a company, which is based on different valuation methodologies and assumptions. The purpose of the football field chart is to show how much someone might be willing to pay for a business, whether acquiring all of it, part of it, or even a single share (depending on th. Web this chart can be used to price companies during their ipo process or find the enterprise value of an m&a target.

Football Field Valuation Chart

Football Field Valuation Excel Template, Tutorial, and Full Explanation

Football Field Valuation Chart with Dynamic Share Price Line [Tutorial

Football Field Valuation Excel Template, Tutorial, and Full Explanation

Football Field Valuation Excel Template, Tutorial, and Full Explanation

Football Field Chart

Football Field Valuation Chart

Valuation Chart/Football Field Chart Qlik Community 1730481

Football field valuation chart Comps, PT, DCF YouTube

Football Field Charts & Valuations 2020 Definitive Guidw

In The Football Field Chart Below, We Have 7 Valuation Methods:

This Will Give Your Clients The Chance To See The Full Context Of A Company's Valuation,.

Web A Football Field Chart Combines Various Valuation Methods In One View.

You Reach This Stage After Carrying Out Your Valuation Using The Popular Methods Like Dcf, Trading Comps Analysis, Transaction Comps Analysis, Lbo Analysis Etc.

Related Post: