Fisher Investments Fee Chart

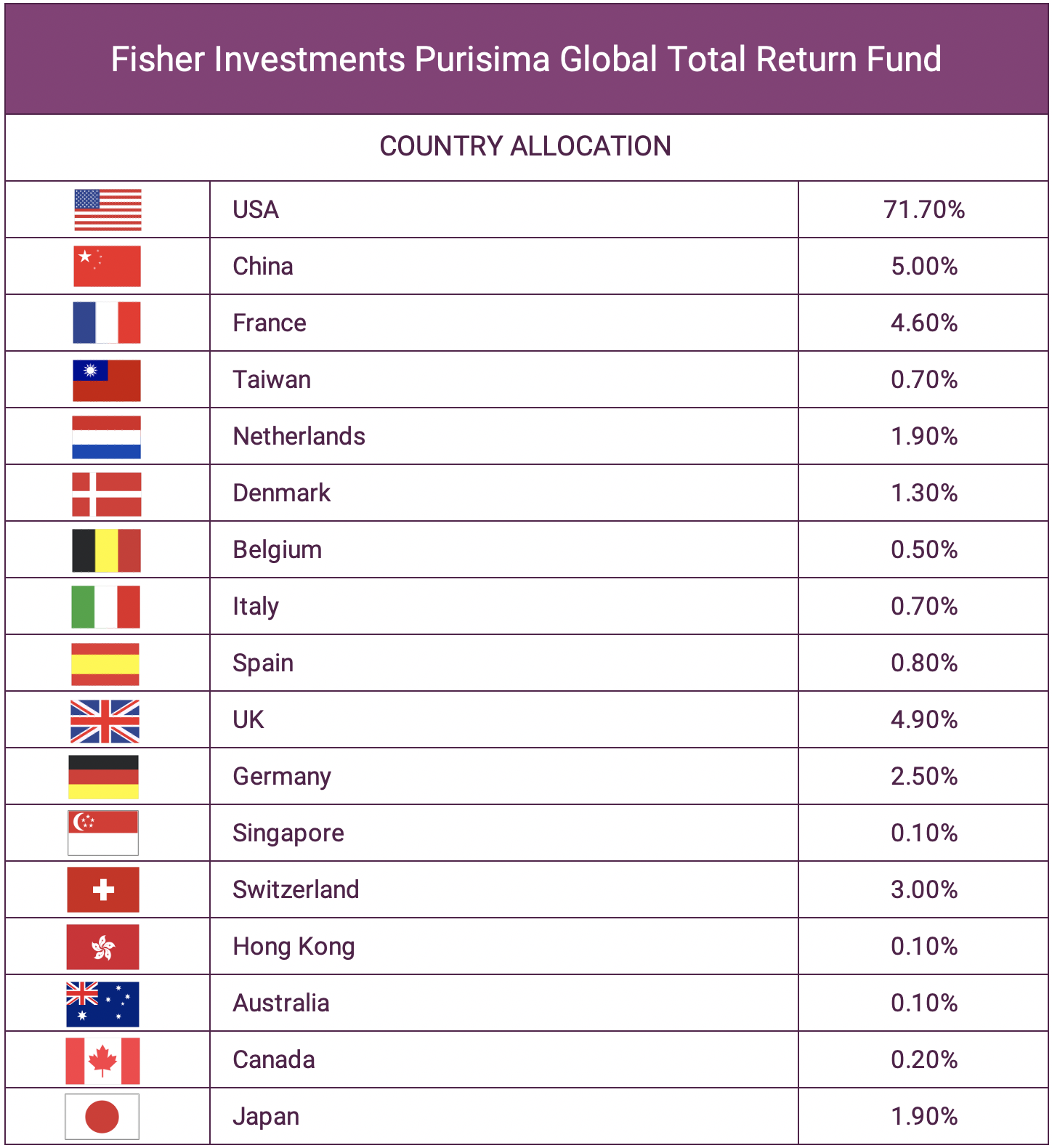

Fisher Investments Fee Chart - We believe this helps align our interests with clients’ interests. Web fisher investments fees there is typically a $500,000 minimum deposit, although a wealthbuilder account with “only” a $200,000 minimum may be available for select clients. However, these types of collective investment vehicles may not be the best asset type for everyone. There are no commissions or hidden fees based on trading within your account. Fisher investments manages $235.9 billion and provides investment advisory services for 148,462 clients (1:69 advisor/client ratio). How to determine fee reasonableness. Learn more about retirement plan fees and use this cost estimator to calculate your 401 (k) costs. How to estimate plan fees. Web fisher investments fees are transparent, competitive and aligned with your best interests. What is the average return on fisher investments? However, these types of collective investment vehicles may not be the best asset type for everyone. What is the average return on fisher investments? The annual advisor fee decreases with a minimum investment of $500,000+. What fee does fisher investments charge? Web 1 to 8 of 8 results. Web fisher investments fees there is typically a $500,000 minimum deposit, although a wealthbuilder account with “only” a $200,000 minimum may be available for select clients. What fee does fisher investments charge? Web unlike some money managers, we don’t earn commissions on trades. Eight ways you can benefit from choosing fisher investments. Fisher investments manages $235.9 billion and provides investment. Web fisher investments fees are transparent, competitive and aligned with your best interests. Web the fee is a percentage of the total amount you invest with fisher investments, and it depends on the size of your portfolio: Learn more about fisher investments fee structure. Compare investing accounts, online trading fees, stock broker cost, and differences. (video) unboxing a fisher investment. Fisher investments typically bills its private clients based on a percentage of assets under management. This approach means we don’t earn commissions on trades. We believe this helps align our interests with clients’ interests. This list shows only funds that are open to new purchases or limited and does not include funds that are closed to new. Wealthbuilder accounts, as. Web 1 to 8 of 8 results. (video) unboxing a fisher investment solicitation. Compare investing accounts, online trading fees, stock broker cost, and differences. We bill only on assets under management—we do not sell products or earn commissions on trades. Which is better edward jones or fisher investments? Fisher investments charges a fee of 1.25% of assets under management on the first $1 million invested in its equity and blended accounts, plus whatever costs come from executing trades. Learn more about fisher investments fee structure. The fee drops on higher account balances, to as low as 1.25%. (video) unboxing a fisher investment solicitation. What is the average return. Fisher investments manages $235.9 billion and provides investment advisory services for 148,462 clients (1:69 advisor/client ratio). Compare investing accounts, online trading fees, stock broker cost, and differences. Web if you have $500,000 or more in investable assets, contact us today to find out how our private client group can help you achieve a successful financial future in retirement. The annual. Investopedia) the specific fee charged by fisher investments varies based on several factors including the amount of assets being managed, the type of account, and the investment strategy being used. Web fisher investments fees are transparent, competitive and aligned with your best interests. Eight ways you can benefit from choosing fisher investments. The toolkit will show you: (video) unboxing a. Which is better edward jones or fisher investments? Learn more about retirement plan fees and use this cost estimator to calculate your 401 (k) costs. Web fisher investments offers a simple, transparent and competitive fee structure for clients. This list shows only funds that are open to new purchases or limited and does not include funds that are closed to. Web fees on the higher side that aren’t reduced much for large accounts: Investopedia) the specific fee charged by fisher investments varies based on several factors including the amount of assets being managed, the type of account, and the investment strategy being used. Web fees under fisher investments. Web july 29, 2024. 1.25% per year next $4 million: How to estimate plan fees. Eight ways you can benefit from choosing fisher investments. Fisher investments typically bills its private clients based on a percentage of assets under management. The annual advisor fee decreases with a minimum investment of $500,000+. The four type of plan fees. Which is better edward jones or fisher investments? Fisher investments manages $235.9 billion and provides investment advisory services for 148,462 clients (1:69 advisor/client ratio). Web • your fees are based on the value of your assets managed, ranging from 1.0% to 1.5% annually. Fisher investments, registered in 1987, serves 53 state (s) with a licensed staff of 2,149 advisors. Learn more about retirement plan fees and use this cost estimator to calculate your 401 (k) costs. How does fisher investments work? Wealthbuilder accounts, as well as any accounts that are below the $500,000 threshold, will be billed at an annual rate of 1.50%. Web fisher investments vs fidelity: The toolkit will show you: The fee drops on higher account balances, to as low as 1.25%. Web fisher investments charges a fee based on the total amount of assets it manages on your behalf.Investments

Fisher Investments Review MagnifyMoney (2023)

Annuity Investment Fisher Investments

.jpg?auto=compress,format)

Fisher Investments on the Perils of Technical Analysis

Fisher Investments Fee Chart

What Are Fisher Investment Fees? Retire Gen Z

Retirement Diversification Fisher Investments

Fisher Investments

Data Spotlight Commodity Prices Insights Fisher Investments

401(k) Plan Fees Business 401(k) Services Fisher Investments

Web Fisher Investments Offers A Simple, Transparent And Competitive Fee Structure For Clients.

This Means We’re Always Focused On Your Best Interests, And When You Do Better We.

What Is The Normal Fee For A Financial Advisor?

This Transparent Fee Structure Aligns Our Interests With Yours—When You Do Well, We Do Well.

Related Post: