Falling Wedge Pattern

Falling Wedge Pattern - This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. As outlined earlier, falling wedges can be both a reversal and continuation pattern. The trend lines drawn above the highs and below the. Web the falling wedge is a bullish pattern that suggests potential upward price movement. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web a falling wedge can be defined by a set of lower lows (support) and lower highs (resistance) that slope downwards and contract into a narrower range before price finally breaks above the resistance line and a change in trend direction occurs. When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Web the falling wedge pattern happens when the security's price trends in a bearish direction, with two to three lower highs forming. As outlined earlier, falling wedges can be both a reversal and continuation pattern. This pattern, while sloping. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Web the falling wedge. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. It reverses to bullish once the price. Web the falling wedge pattern happens when the security's price trends in a bearish direction, with two to three lower highs forming. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. When a. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. It reverses to bullish once the price breaks out of the last lower high formation. Web the falling wedge pattern happens when the security's. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and. As outlined earlier, falling wedges can be both a reversal and continuation pattern. The trend lines drawn above the highs and below the. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull. Web the falling wedge pattern happens when the security's price trends in a bearish direction, with two to three lower highs forming. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern. As outlined earlier, falling wedges can be both a reversal and continuation pattern. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. It reverses to bullish once the price breaks out of the last lower high formation. Web the falling wedge is a bullish pattern that. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. It reverses to bullish once the price breaks out of the last lower high formation. When. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a. Web the falling wedge pattern is a continuation pattern formed when price bounces between two downward sloping, converging trendlines. When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move. This pattern, while sloping downward, signals a likely trend reversal or continuation, marking a potential inflection point in trading strategies. Web the falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. The trend lines drawn above the highs and below the. Web the falling wedge is a bullish chart pattern that signals a buying opportunity after a downward trend or mark correction. Web a falling wedge can be defined by a set of lower lows (support) and lower highs (resistance) that slope downwards and contract into a narrower range before price finally breaks above the resistance line and a change in trend direction occurs. It reverses to bullish once the price breaks out of the last lower high formation. When the pattern occurs, it can be interpreted as a trend reversal or continuation pattern and.

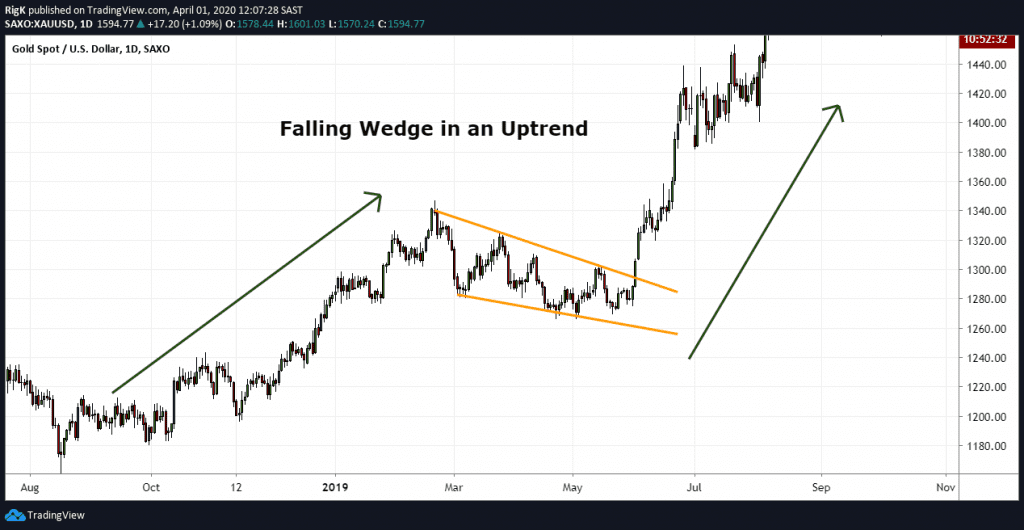

The Falling Wedge Pattern Explained With Examples

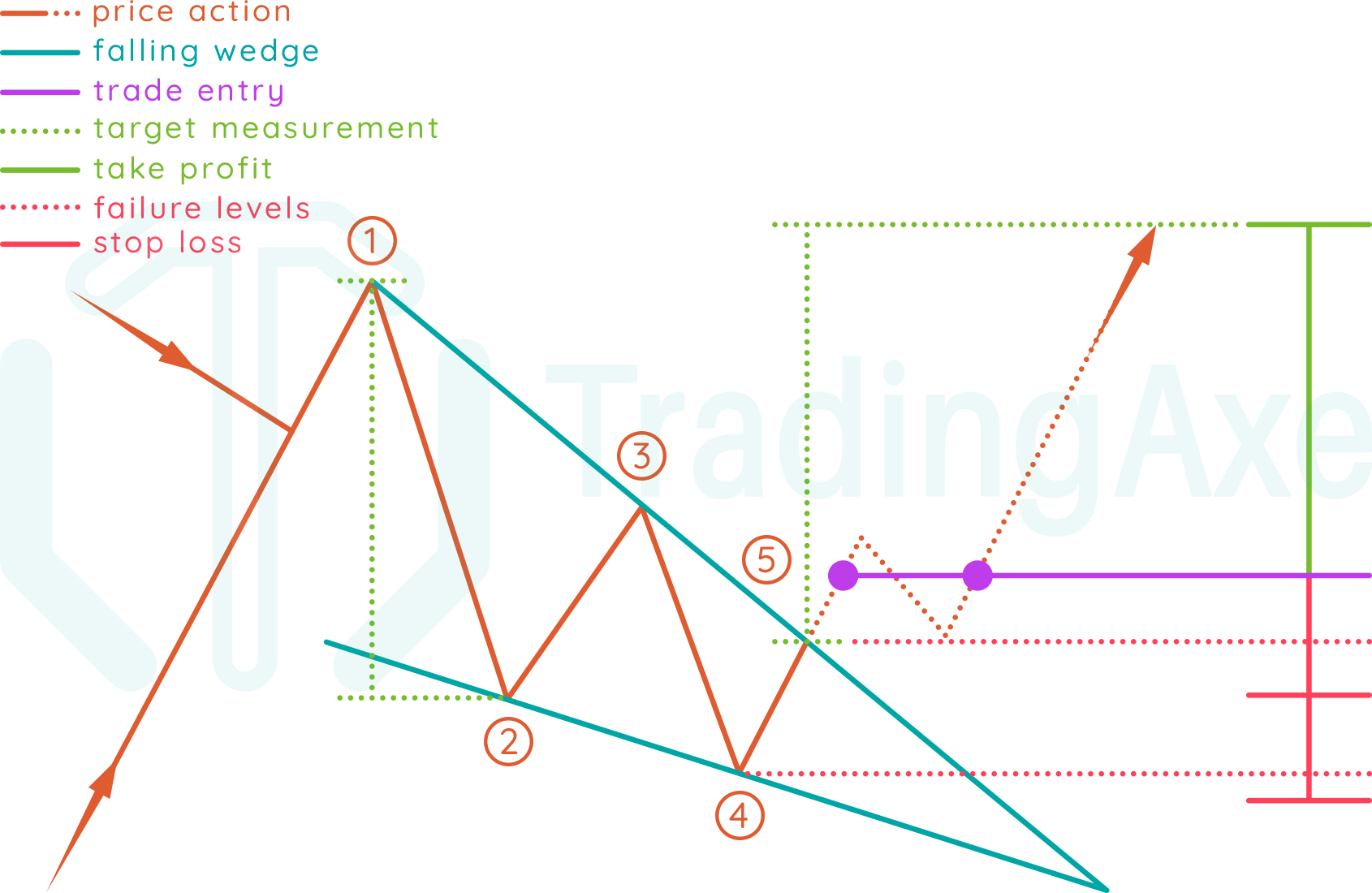

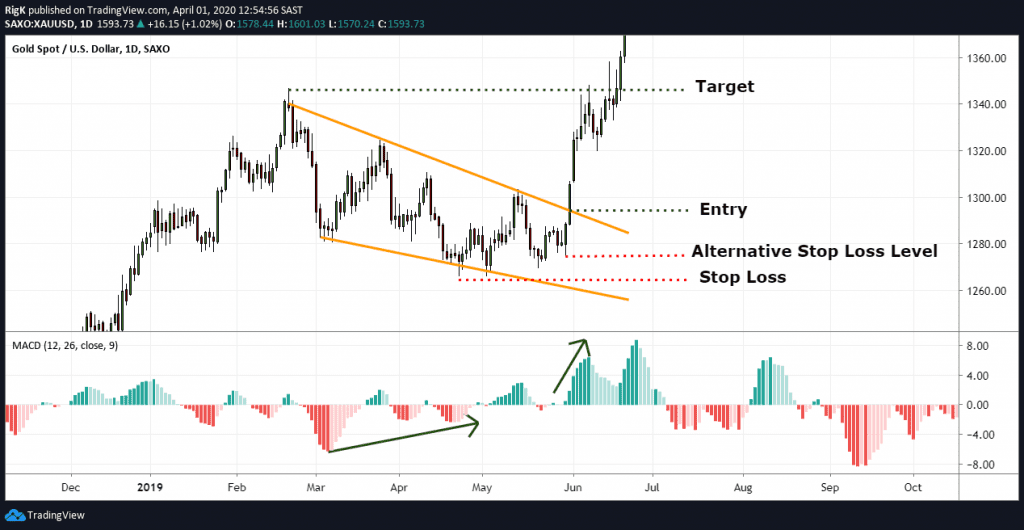

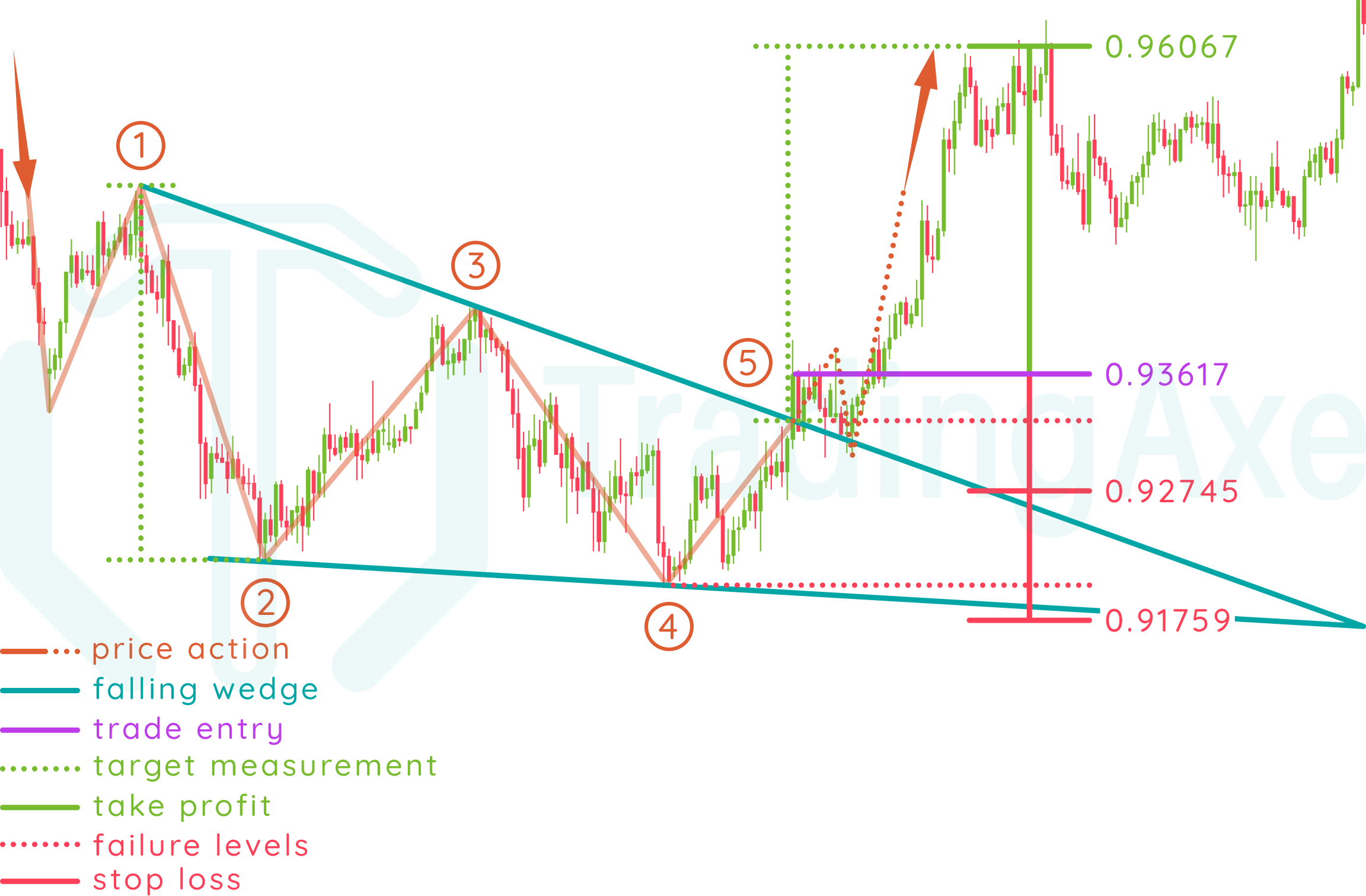

Trading the Falling Wedge Pattern

How To Trade Falling Wedge Chart Pattern TradingAxe

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Falling Wedge Chart Pattern Trading charts, Technical trading

How To Trade Blog What Is A Wedge Pattern? How To Use The Wedge

The Falling Wedge Pattern Explained With Examples

Forex chart pattern trading on Wedge Pattern

Simple Wedge Trading Strategy For Big Profits

How To Trade Falling Wedge Chart Pattern TradingAxe

Web The Falling Wedge Is A Bullish Pattern That Suggests Potential Upward Price Movement.

As Outlined Earlier, Falling Wedges Can Be Both A Reversal And Continuation Pattern.

Web The Falling Wedge Pattern Happens When The Security's Price Trends In A Bearish Direction, With Two To Three Lower Highs Forming.

Related Post: