Falling Channel Pattern

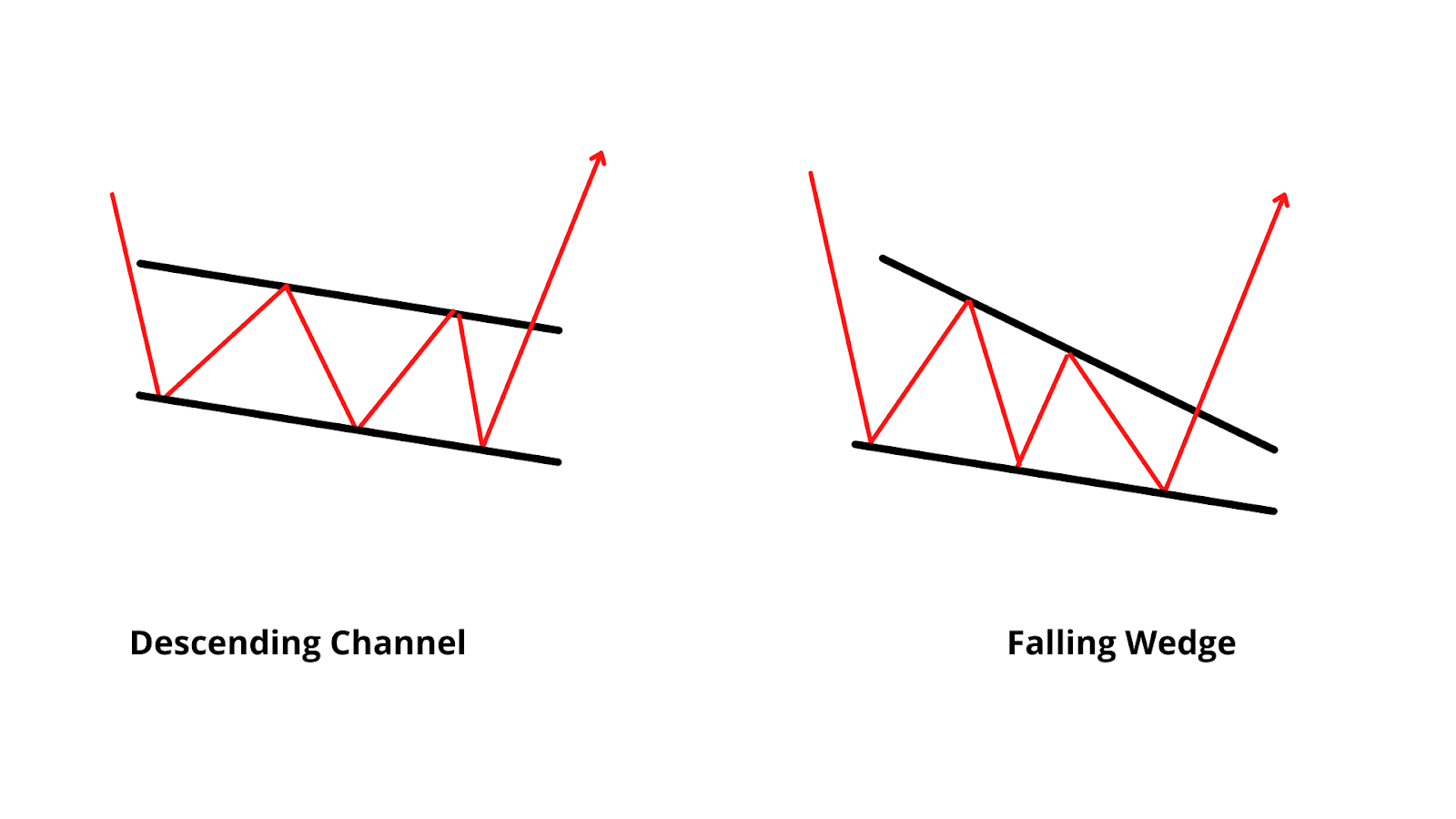

Falling Channel Pattern - Web a descending channel is a chart pattern formed from two downward trendlines drawn above and below a price representing resistance and support levels. Learn how to spot the falling wedge and how to trade it. I haven't studied channels for performance (statistics). In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. There are two main categories of chart patterns:. Bitcoin has made a bullish divergence on the weekly rsi, meaning the price went lower while the rsi is making a higher high. Chart patterns are graphical patterns that are formed regularly on price histories over all units of time. The descending channel pattern is also known as a “falling channel” or “channel down“. The upper line is identified first, as running along the lows: This pattern appears in the market when price oscillates between two lines with the same slope. This pattern appears in the market when price oscillates between two lines with the same slope. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. Web when price trends upward or downward and fits between two parallel trendlines, the chart pattern is called a channel. As outlined. Web what is a falling wedge pattern? Web the channel pattern is a technical analysis pattern that capitalizes on the trending tendencies of the market. Bullish divergence on weekly rsi. The channel lines are directed downwards. I haven't studied channels for performance (statistics). Web what is an ascending channel? It is expected that after the price breaks the upper line of the wedge, it will move further up to approximately the height of the base of the wedge. I haven't studied channels for performance (statistics). See rectangle tops or rectangle bottoms for horizontal channels. This pattern appears in the market when price oscillates. In other words, the cryptocurrency. Web a descending channel is a chart pattern that indicates a downward trend in prices. It develops within pronounced downtrends in asset pricing. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. The upper line of the channel acts as the resistance. The upper line of the channel acts as the resistance line whereas the lower line acts as the support line. See rectangle tops or rectangle bottoms for horizontal channels. Web there are three main types of trading channels: A falling wedge pattern is regarded as a bullish chart formation, it can also signify continuation or reversal patterns depending on where. Web what is the falling wedge chart pattern? Web a descending channel is a chart pattern formed from two downward trendlines drawn above and below a price representing resistance and support levels. An ascending channel is the price action contained between upward sloping parallel lines. The falling wedge is a bullish pattern that begins wide at the top and contracts. Not only do we see a bullish divergence, the divergence is happening in a falling channel. Web the descending channel pattern (also called the falling channel) is a bearish chart formation. As outlined earlier, falling wedges can be both a reversal and continuation pattern. The falling wedge is a bullish pattern that begins wide at the top and contracts as. Web the channel chart pattern is a continuation pattern which is formed by the combination of two lines. Bitcoin has made a bullish divergence on the weekly rsi, meaning the price went lower while the rsi is making a higher high. Web a falling wedge is a reversal pattern that is an inclined, converging channel that limits the price movement.. Web there are three main types of trading channels: These two lines are parallel to each other and they resemble a channel when drawn on the price chart. Web the falling wedge pattern is a continuation pattern that forms when the price oscillates between two trendlines sloping downward and converging. Web a falling channel pattern is a technical analysis chart. When the direction of the channel is downward, it is called a falling channel and when the channel is flat, then it is termed a flat channel. As outlined earlier, falling wedges can be both a reversal and continuation pattern. The price has been squeezing within this pattern, indicating a potential breakout as the convergence point nears. Bitcoin has made. The falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. The upper line of the channel acts as the resistance line whereas the lower line acts as the support line. Market securities for stocks up 5% or more on daily trade volume over 1 million shares. Web the wedge is formed by two descending, converging trendlines. Ascending, which indicates prices are rising, descending, or falling, which indicates prices are falling, and horizontal, which indicates prices. Bullish divergence on weekly rsi. Web the channel chart pattern is a continuation pattern which is formed by the combination of two lines. Not only do we see a bullish divergence, the divergence is happening in a falling channel. Learn how to spot the falling wedge and how to trade it. Chart patterns are graphical patterns that are formed regularly on price histories over all units of time. These two lines are parallel to each other and they resemble a channel when drawn on the price chart. Web a channel chart pattern is defined by the addition of two parallel lines that serve as support and resistance zones. Higher highs and higher lows characterize this price pattern. It is also known as price channel. Web a falling channel pattern is a technical analysis chart pattern that occurs when a financial asset such as a stock or currency follows a downward trend within two parallel lines that. Learn stock market technical analysis.

Falling Wedge Patterns How to Profit from Slowing Bearish Momentum

Falling Channel Pattern Indicator for MT4/MT5

How Does the Price Channel Pattern Work? Official Olymp Trade Blog

FALLING CHANNEL / BEARISH CHANNEL / PRICE CHANNEL / CHART PATTERNS

USDCHF Trading Plan Falling Channel + Structure for FXUSDCHF by

Topic 42 Falling Channel Neutral Chart Pattern Basic Share Market

Parallel Channel Pattern CoinGape

Parallel Channel Pattern CoinGape

Falling Channel + Wedge Pattern COMBO ! for NSEBBTC by headymuk

21. Continuation Pattern with Price Trading Inside Falling Channel

Web There Are Three Main Types Of Trading Channels:

Web The Descending Channel Pattern (Also Called The Falling Channel) Is A Bearish Chart Formation.

An Ascending Channel Is The Price Action Contained Between Upward Sloping Parallel Lines.

Web A Falling Wedge Is A Reversal Pattern That Is An Inclined, Converging Channel That Limits The Price Movement.

Related Post: