Evening Start Pattern

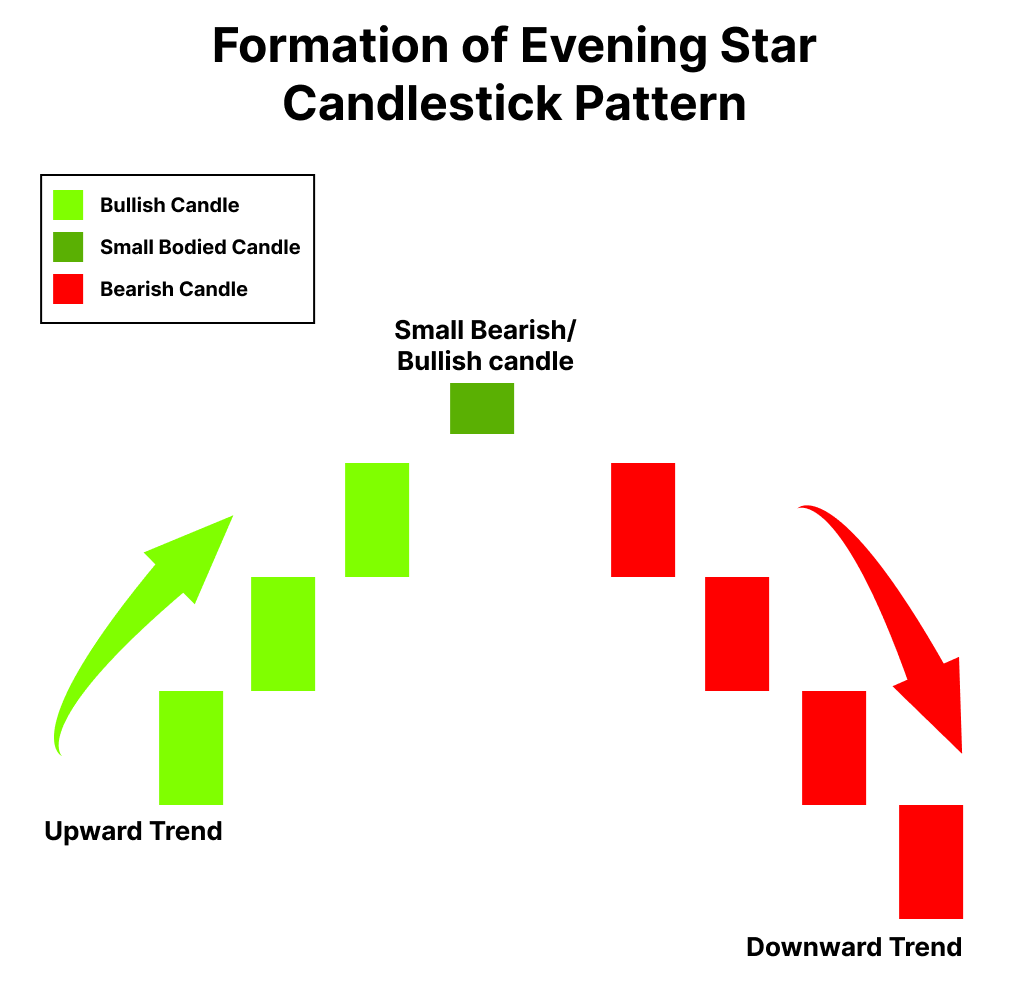

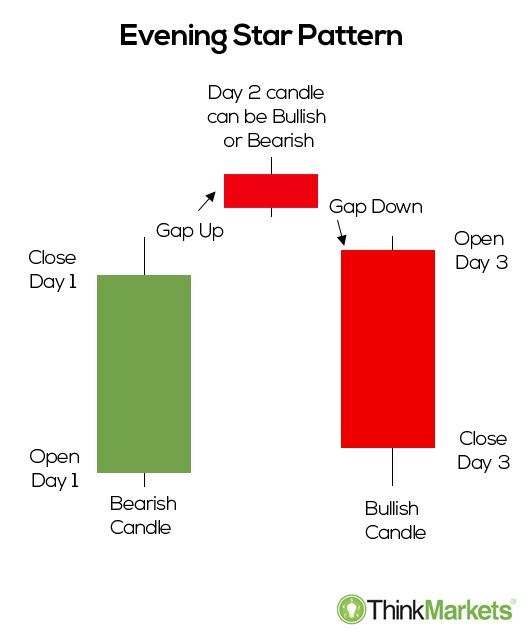

Evening Start Pattern - The pattern is made up of three main candlesticks. It's a bearish candlestick pattern that consists of three candles: The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. Stay hydrated and take breaks as needed to beat the heat safely. Here’s how to spot it: The evening star pattern is a vital tool for technical analysts to predict potential reversals in stock trends. It usually occurs at the top of an uptrend. An evening star is a candlestick pattern that is used by technical analysts for analyzing when a trend is about to reverse. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. Web the evening star pattern is a type of reversal pattern of asset price charts. This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. Web the evening star pattern is a bearish candlestick formation used in technical analysis to indicate a potential reversal in an uptrend. Evening star is a bearish reversal candlestick that appears at the top of. Wednesday, july 31st 2024, 6:36 pm. Web the evening star pattern is a bearish candlestick formation used in technical analysis to indicate a potential reversal in an uptrend. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. A large bullish candle, a doji candlestick, and a large bearish. Web the evening star pattern is a bearish candlestick formation used in technical analysis to indicate a potential reversal in an uptrend. As such, it usually appears at the end of an uptrend and beginning of a downtrend. It is formed by three candles. Web july ends with more nasty heat and humidity. It usually appears at the top of. Web in the realm of technical analysis, the evening star pattern stands as a beacon, signaling potential downtrends and offering traders a strategic position to anticipate and adapt to market shifts. Web storms exit early tuesday with heat and humidity taking the headlines. Web understanding the evening star pattern. Therefore, traders use it to either sell an existing long position. Here’s how to spot it: Web in the realm of technical analysis, the evening star pattern stands as a beacon, signaling potential downtrends and offering traders a strategic position to anticipate and adapt to market shifts. Stay hydrated and take breaks as needed to beat the heat safely. The pattern is made up of three main candlesticks. Therefore, traders use. The first candle is bullish, the second is a spinning top or doji, and the third is a bearish candlestick. There’s a small chance for isolated thunderstorms across central and southern ky later in the day. Here’s how to spot it: Web the evening star is a bearish reversal pattern that forms in an upward price swing, which can be. The first candle is bullish, the second is a spinning top or doji, and the third is a bearish candlestick. An evening star is a candlestick pattern that is used by technical analysts for analyzing when a trend is about to reverse. Web storms exit early tuesday with heat and humidity taking the headlines. It consists of three candles: Consisting. Storms will continue to develop southwest of our area tuesday night, eventually affecting quite a. The pattern is made up of three main candlesticks. It usually appears at the top of an uptrend and is a bearish signal. Web in the realm of technical analysis, the evening star pattern stands as a beacon, signaling potential downtrends and offering traders a. Skies will stay bright and dry for the most part. This bearish candlestick pattern, comprising three distinct candles, marks the. It's a bearish candlestick pattern that consists of three candles: Web july ends with more nasty heat and humidity. Temperatures top out in the mid 90s with a heat index above 100°. Skies will stay bright and dry for the most part. The evening star pattern is a vital tool for technical analysts to predict potential reversals in stock trends. Stay hydrated and take breaks as needed to beat the heat safely. Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. It’s a bearish reversal pattern. It’s a bearish reversal pattern that traders use as a signal to sell or short an asset because it shows a weakening of the bullish momentum followed by the emergence of a bearish trend. An evening star is a candlestick pattern that is used by technical analysts for analyzing when a trend is about to reverse. Web storms exit early tuesday with heat and humidity taking the headlines. This bearish candlestick pattern, comprising three distinct candles, marks the. The first one is a bullish candlestick that affirms the market is in an uptrend backed by bullish momentum. This pattern can help you make informed decisions and capture profitable trades correctly. The evening star consists of three consecutive candles: It signals the slowing down of upward momentum before a bearish. Web a heat advisory will be in effect until friday evening. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. Temperatures top out in the mid 90s with a heat index above 100°. Web the evening star pattern is a stock chart pattern that some traders use to spot a trend reversal. Wednesday, july 31st 2024, 6:36 pm. It usually occurs at the top of an uptrend. Traders do not commonly see an evening star pattern, but it is a reliable indicator for technical analysis.

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

How To Trade The Evening Star Forex Pattern (in 3 Easy Steps)

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

Powerful Evening Star Pattern Formation, Example, Pros; Cons2022

:max_bytes(150000):strip_icc()/dotdash_Final_Evening_Star_Dec_2020-01-2e934a9c033c47debb64279250a18ea2.jpg)

Evening Star Definition

What Is Evening Star Pattern Formation With Examples ELM

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

What Is Evening Star Pattern & How to Identify It? Finschool

How to Trade with the “Evening Star” Pattern Forex Academy

Evening Star The Bearish Reversal Pattern Chart Pattern

Web An Evening Star Is A Stock Price Chart Pattern That's Used By Technical Analysts To Detect When A Trend Is About To Reverse.

A Large Bullish Candle, A Doji Candlestick, And A Large Bearish Candle.

Web In The Realm Of Technical Analysis, The Evening Star Pattern Stands As A Beacon, Signaling Potential Downtrends And Offering Traders A Strategic Position To Anticipate And Adapt To Market Shifts.

Therefore, Traders Use It To Either Sell An Existing Long Position Or Enter A New Short Position.

Related Post: