Evening Star Candlestick Pattern

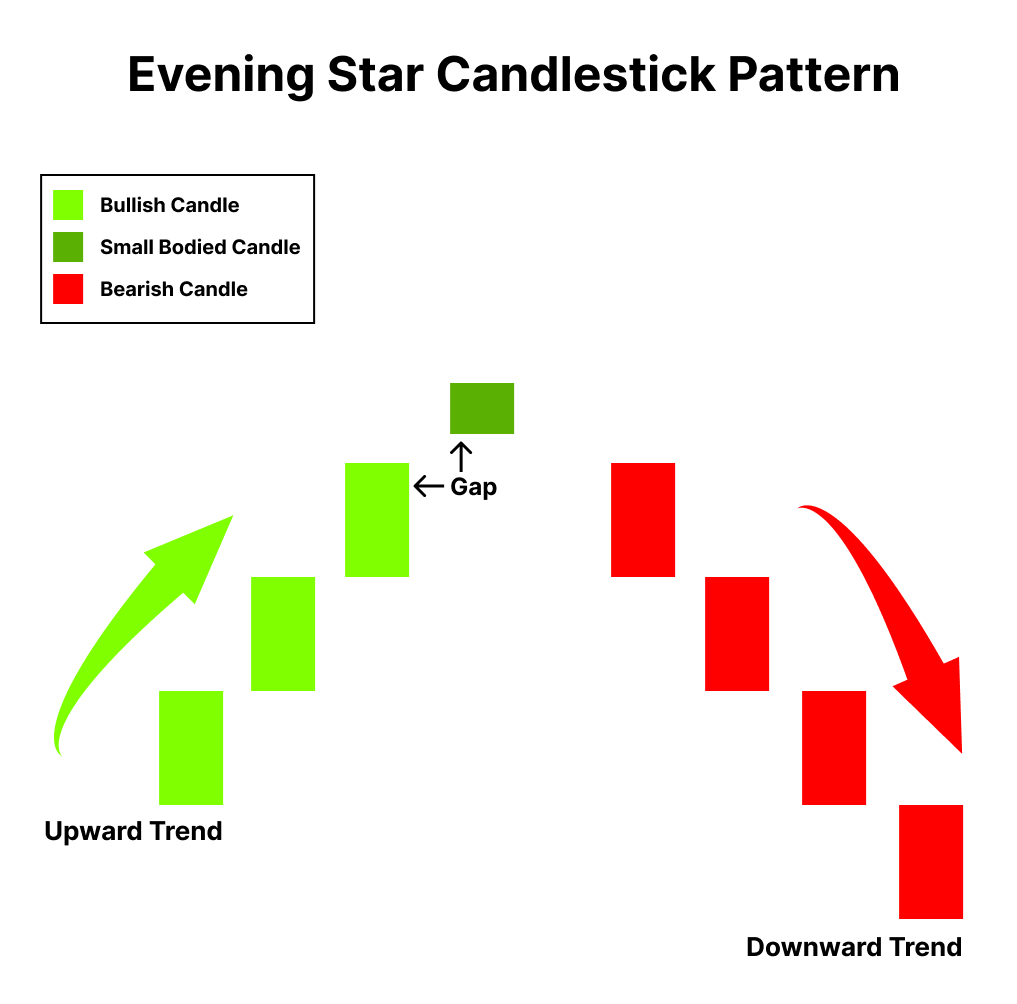

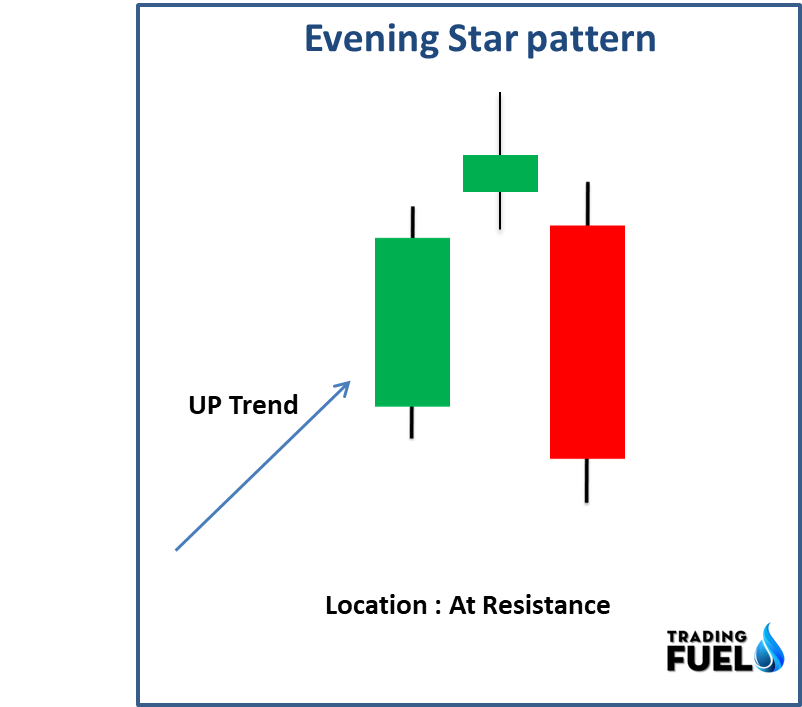

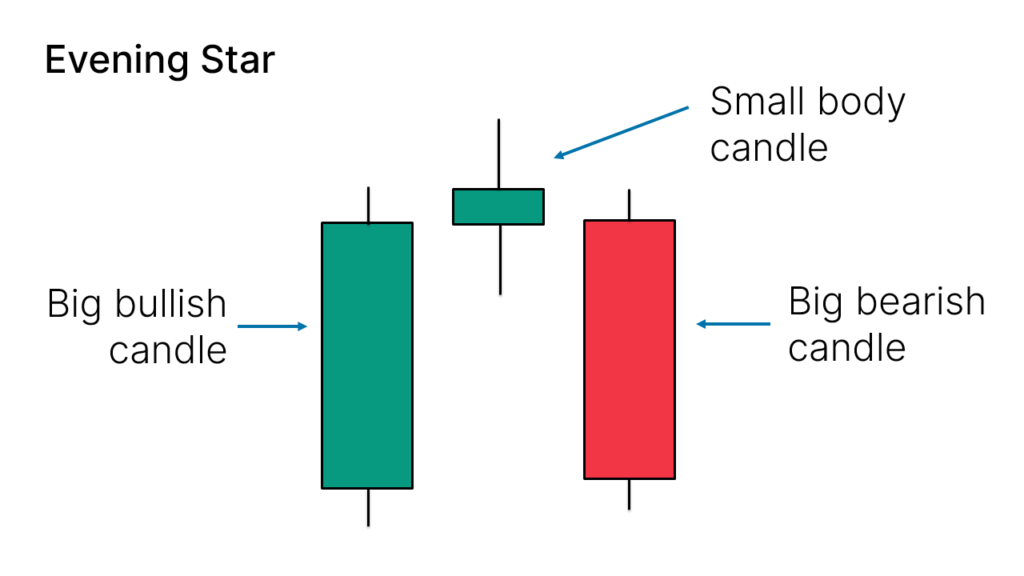

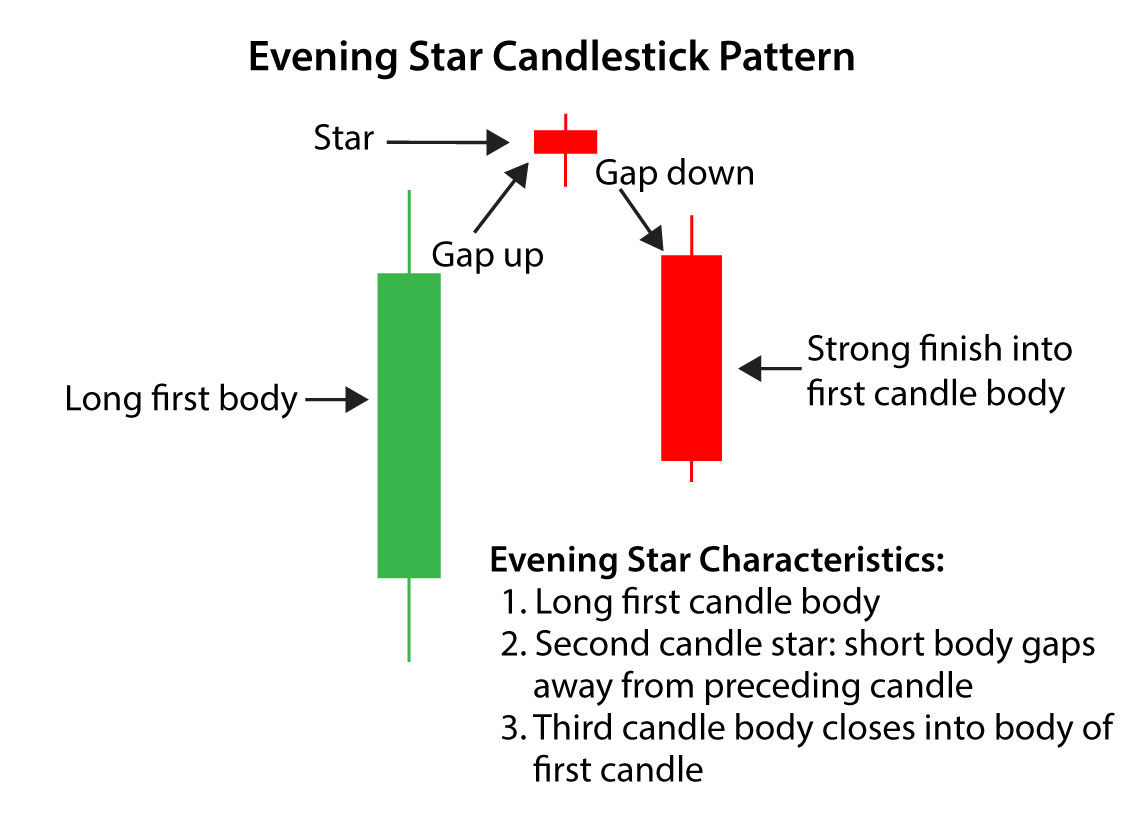

Evening Star Candlestick Pattern - It usually occurs at the top of an uptrend. This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. This pattern can help you make informed decisions and capture profitable trades correctly. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls into the body of the first candle. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. Web an evening star is a candlestick pattern that's used by technical analysts to predict future price reversals to the downside. It consists of three candles: The second candlestick covers half of the first candle with the dark cloud cover. Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. The evening star pattern is rare but. Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. This pattern can help you make informed decisions and capture profitable trades correctly. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle. Web an evening star is a candlestick pattern that's used by technical analysts to predict future price reversals to the downside. The second candlestick covers half of the first candle with the dark cloud cover. This pattern can help you make informed decisions and capture profitable trades correctly. It usually occurs at the top of an uptrend. The best evening. This pattern can help you make informed decisions and capture profitable trades correctly. This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. The evening star pattern is rare but. It consists of three candles: Web an evening star is a candlestick pattern that's used. This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. Web an evening star is a candlestick pattern that's used by technical analysts to predict future price reversals to the downside. Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders. The evening star pattern is rare but. Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. Web an evening star is a candlestick pattern that's used by technical analysts to predict future price reversals to the downside. The second candlestick covers half of the first candle with the dark cloud cover. The best evening. Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. Web the evening star candlestick pattern is a powerful. This pattern can help you make informed decisions and capture profitable trades correctly. Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders can use to identify a potential trend change at the. The evening star pattern is rare but. Web an evening star is a candlestick pattern that's used by technical analysts to predict future price reversals to the downside. Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders can use to identify a potential trend change at the top of an uptrend. Web the evening star. Web an evening star is a candlestick pattern that's used by technical analysts to predict future price reversals to the downside. The evening star pattern is rare but. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls into the body of the first. It usually occurs at the top of an uptrend. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. This pattern can help you make informed decisions and capture profitable trades correctly. Web the evening star pattern is viewed as a bearish. Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. Web the evening star candlestick pattern is a powerful bearish reversal pattern that traders can use to identify a potential trend change at the top of an uptrend. This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. It usually occurs at the top of an uptrend. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls into the body of the first candle. The second candlestick covers half of the first candle with the dark cloud cover. It signals the slowing down of upward momentum before a bearish. The evening star pattern is rare but. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. It consists of three candles:

Evening Star Candlestick Pattern Best Analysis

What Is Evening Star Pattern & How to Identify It? Finschool

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

How to Trade the Evening Star Candlestick Pattern

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

Evening Star Candlestick Pattern Trading Fuel

Technical Analysis Evening Star Candlestick Pattern Trade Brains

Evening Star Candlestick Pattern What Is And How To Trade Living

Evening Star Candlestick Pattern How to Trade It in 7 Steps Timothy

Web The Evening Star Pattern Is Viewed As A Bearish Reversal Pattern In Technical Analysis.

This Pattern Can Help You Make Informed Decisions And Capture Profitable Trades Correctly.

Web An Evening Star Is A Candlestick Pattern That's Used By Technical Analysts To Predict Future Price Reversals To The Downside.

Related Post: