Engulfing Pattern Bullish

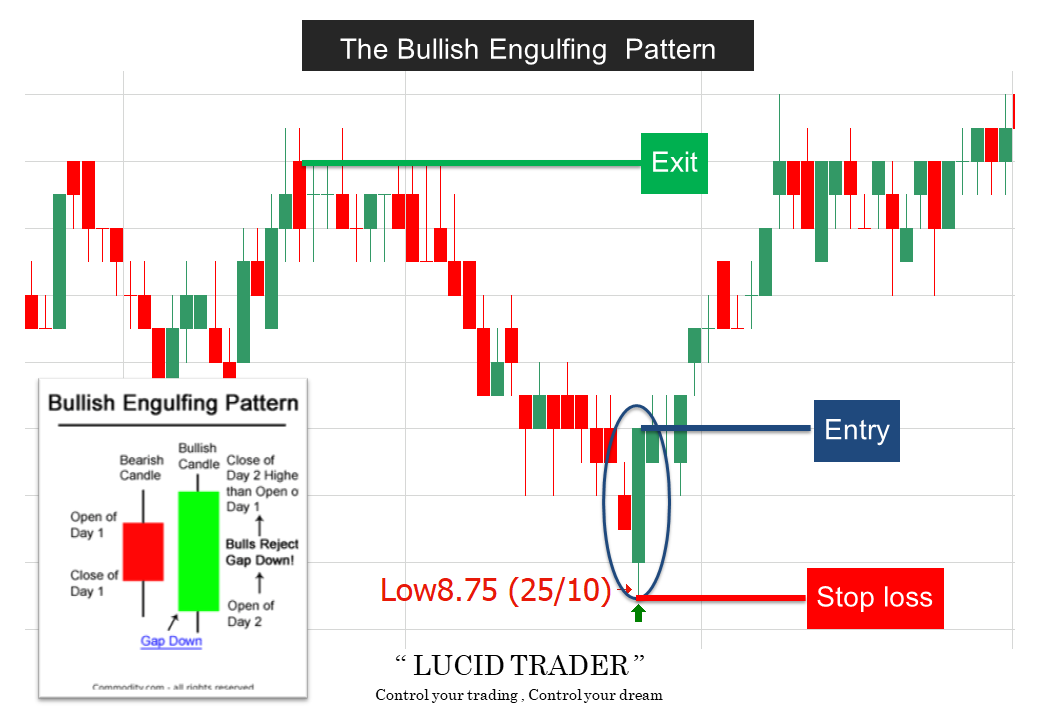

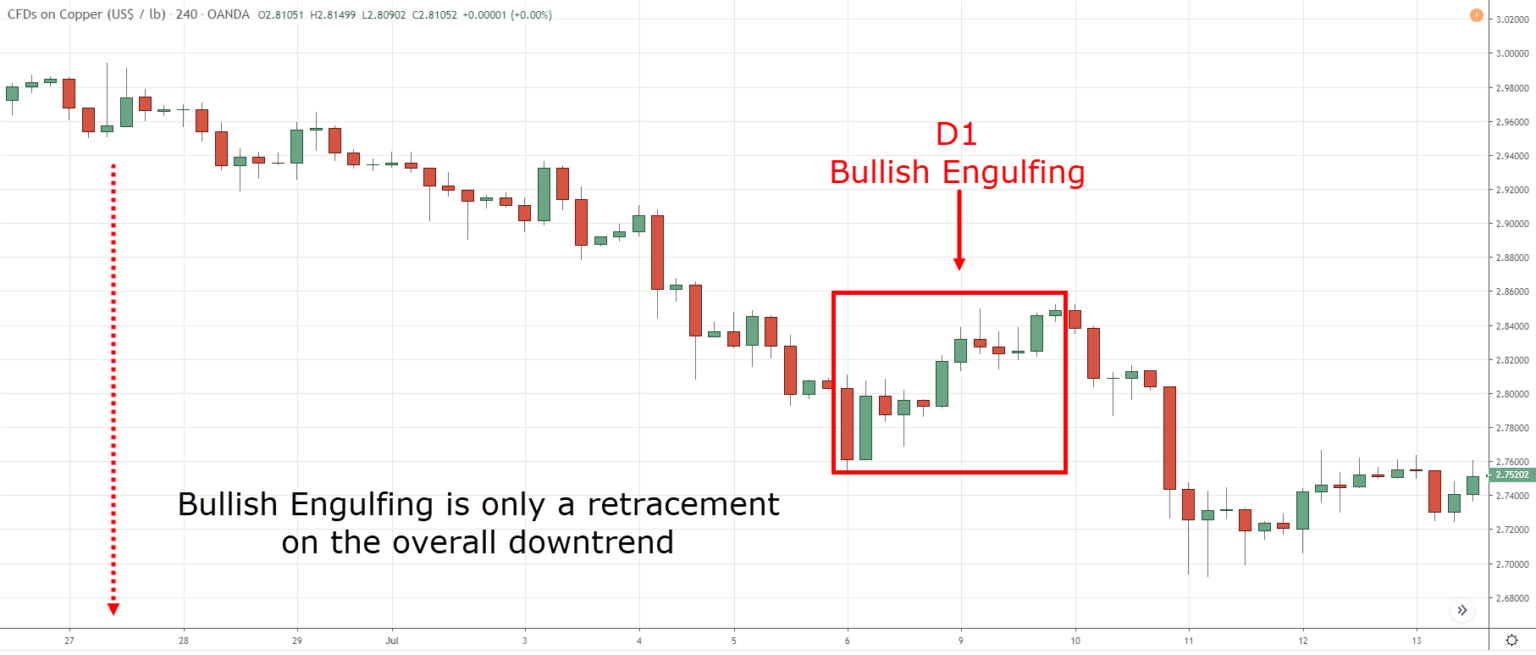

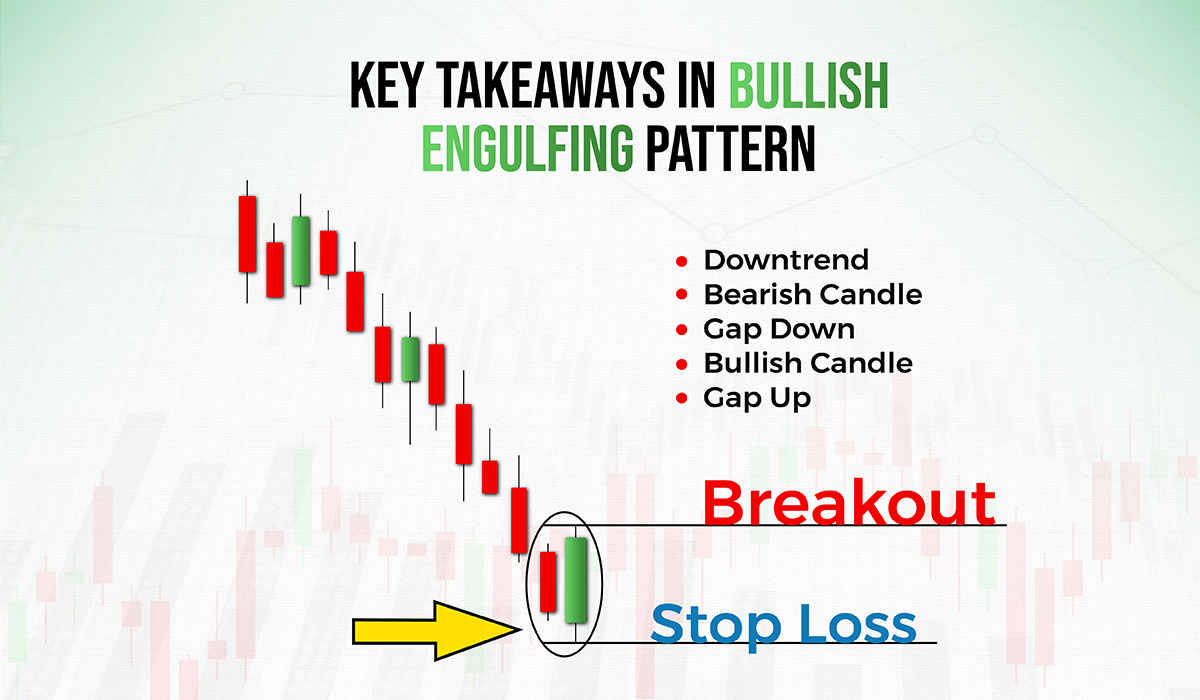

Engulfing Pattern Bullish - It is a popular technical analysis indicator used by traders to anticipate bullish uptrend in the price of an asset. It's made up of two candlesticks, where the second candle completely engulfs the first one, and the second candle is bullish. Web the bullish engulfing pattern, a potent tool in technical analysis, unfolds when a small black (or red) candlestick—indicating a bearish trend—is followed by a larger white (or green) candlestick, marking a bullish shift. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. It signals a potential shift to a bullish trend. Web a bullish engulfing pattern is a candlestick pattern that forms when a small black candlestick is followed the next day by a large white candlestick, the body of which completely overlaps or. Web a bullish engulfing pattern is a technical analysis pattern that signals a potential reversal from a downtrend to an uptrend. Comprising two consecutive candles, the pattern features a. A bullish engulfing pattern is a graphical representation of a certain price movement in technical analysis that can signal a potential market reversal from a bearish trend to a bullish trend. Web what is the bullish engulfing pattern? It starts with a bearish candle on the chart. This pattern creates a bullish potential on the chart and it could reverse the current bearish trend. Many traders will use this candlestick pattern to identify price reversals and continuations to. It is a popular technical analysis indicator used by traders to anticipate bullish uptrend in the price of an asset.. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. This pattern implies that buyers have complete control in the market overpowering the sellers. Web a bullish engulfing pattern is a technical analysis pattern that signals a potential reversal from a downtrend to an uptrend. A small candle will. Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. Web the engulfing trading strategy is a price action trading method that uses the engulfing candlestick pattern to find trading opportunities. The engulfing pattern is known as a “bullish engulfing” pattern if it appears at the bottom of a downtrend. Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. It's made up of two candlesticks, where the second candle completely engulfs the first one, and the second candle is bullish. Web bullish engulfing candlestick pattern occurs when a small bearish candlestick is completely covered by a bullish. This quick introduction will teach you how to identify the pattern, and how traders use this in technical analysis. Web the bullish engulfing pattern is a reversal pattern, which means it can be used to signal that a declining stock or other asset is about to move higher. It signals a potential shift to a bullish trend. Then this candle. Web the bullish engulfing pattern indicates a potential reversal of investor sentiment and is suggestive of a stock having reached its minimum value over a given time period. Web the engulfing trading strategy is a price action trading method that uses the engulfing candlestick pattern to find trading opportunities. Web a bullish engulfing candle pattern is a two candlestick pattern. Many traders will use this candlestick pattern to identify price reversals and continuations to. Web the bullish engulfing pattern provides the strongest signal when appearing at the bottom of a downtrend and indicates a surge in buying pressure. The 2nd bullish candle engulfs the smaller 1st bearish candle. Web a bullish engulfing pattern consists of two candlesticks that form near. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. The engulfing pattern is known as a “bullish engulfing” pattern if it appears at the bottom of a downtrend trend. Typically, when the 2nd smaller candle engulfs the first, the. Web bullish engulfing candlestick pattern occurs when a small. The first candle in the pattern is bearish, followed by a bullish candle that completely engulfs the body of the first candle. Comprising two consecutive candles, the pattern features a. A small bearish (red or black) candlestick and a larger bullish (green or white) candlestick that engulfs or covers the entire body of the previous candlestick. Web the engulfing trading. It is a reversal candlestick pattern that consists of two candlesticks, with the second candlestick consuming (engulfing) the. Web the engulfing trading strategy is a price action trading method that uses the engulfing candlestick pattern to find trading opportunities. Many traders will use this candlestick pattern to identify price reversals and continuations to. Web a bullish engulfing pattern consists of. A small bearish (red or black) candlestick and a larger bullish (green or white) candlestick that engulfs or covers the entire body of the previous candlestick. A bullish engulfing pattern is a graphical representation of a certain price movement in technical analysis that can signal a potential market reversal from a bearish trend to a bullish trend. Typically, when the 2nd smaller candle engulfs the first, the. Web what is a bullish engulfing pattern? It gets its name from the second candle that engulfs the first candle in the bullish direction. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a downtrend. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. The bullish engulfing pattern could be found during bearish trends. It's made up of two candlesticks, where the second candle completely engulfs the first one, and the second candle is bullish. Web the engulfing trading strategy is a price action trading method that uses the engulfing candlestick pattern to find trading opportunities. Then this candle gets fully engulfed by the body of the next candle on the chart, which is bullish. Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. It starts with a bearish candle on the chart. This makes the bullish engulfing pattern an important tool for traders to use when making decisions about when to buy or sell a stock. It consists of two candlesticks: The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow.

Bullish Engulfing Candlestick Pattern

Bullish Engulfing Pattern What is it? How to use it?

Trading the Bullish Engulfing Candle

Bullish Engulfing Candlestick Chart Pattern Life To Circle Images

Bullish Engulfing Candlestick Pattern PDF Guide

Bullish Engulfing Pattern Trading Strategy Guide

Trading the Bullish Engulfing Candle

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)

Bullish Engulfing Pattern Definition, Example, and What It Means

Trading the Bullish Engulfing Candle

What is Bullish Engulfing Pattern? Definition and Examples

Web A Bullish Engulfing Candle Pattern Is A Two Candlestick Pattern Used In Technical Analysis That Can Indicate A Trend Reversal.

If Properly Examined And Verified, This Pattern Can Offer Excellent Opportunities To Participate In Market Dynamics.

Web The Bullish Engulfing Candle Is A Reversal Pattern That Confirms The Dominance Of The Buyer Over The Seller And Indicates A Potential Reversal In The Trend Direction.

The First Candle In The Pattern Is Bearish, Followed By A Bullish Candle That Completely Engulfs The Body Of The First Candle.

Related Post: