Elliott Wave Patterns

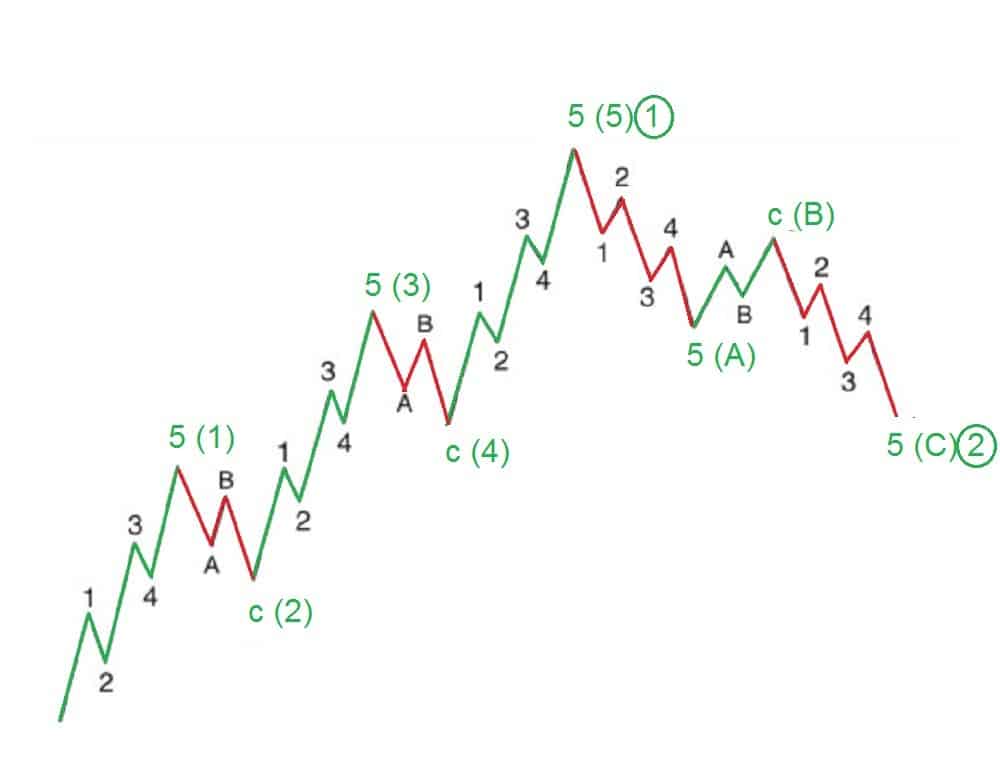

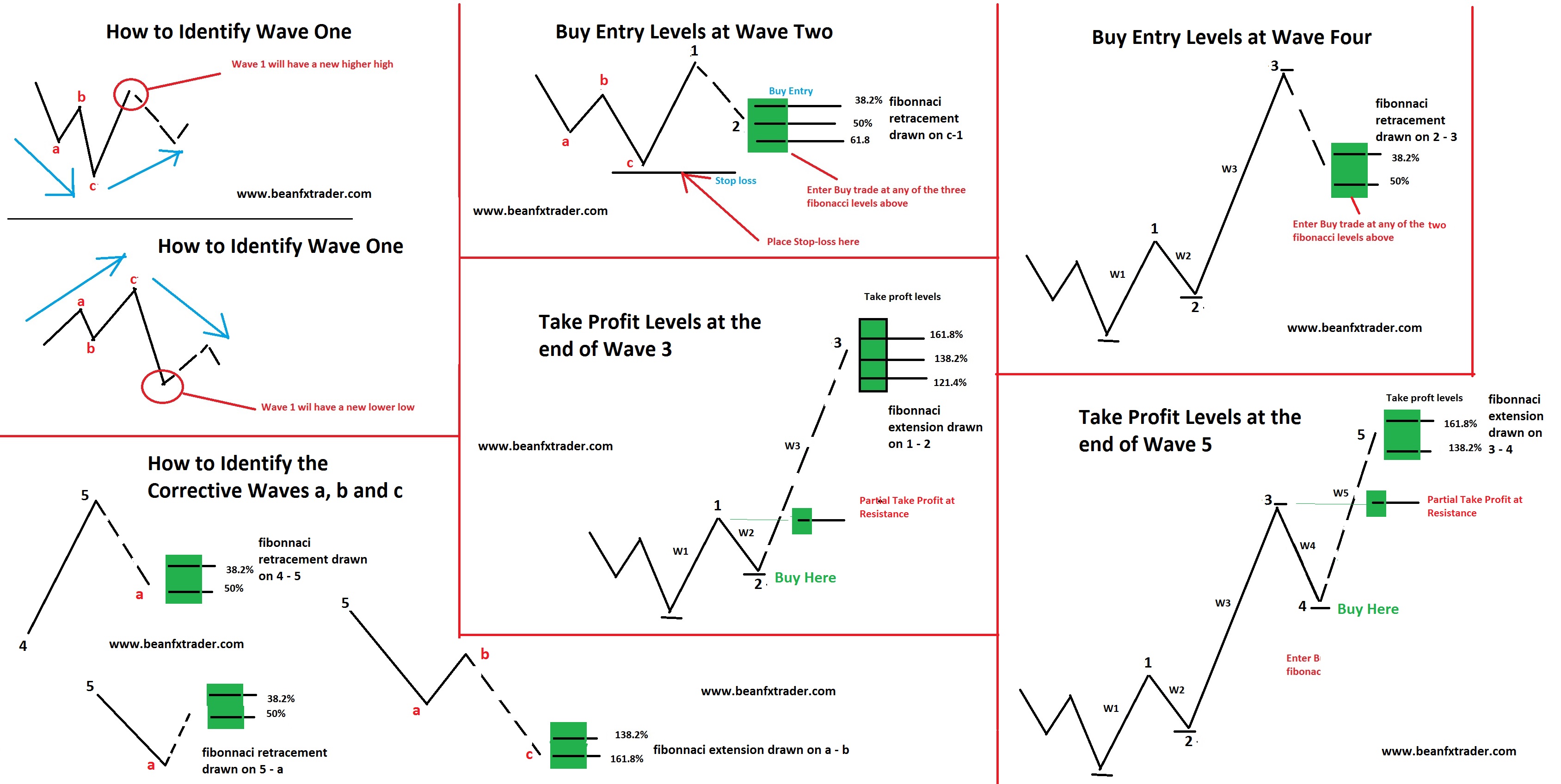

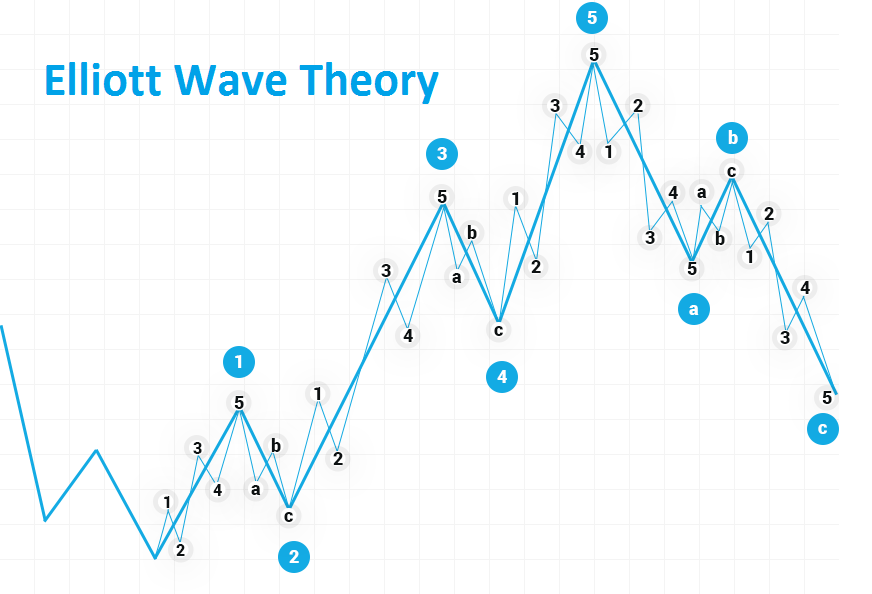

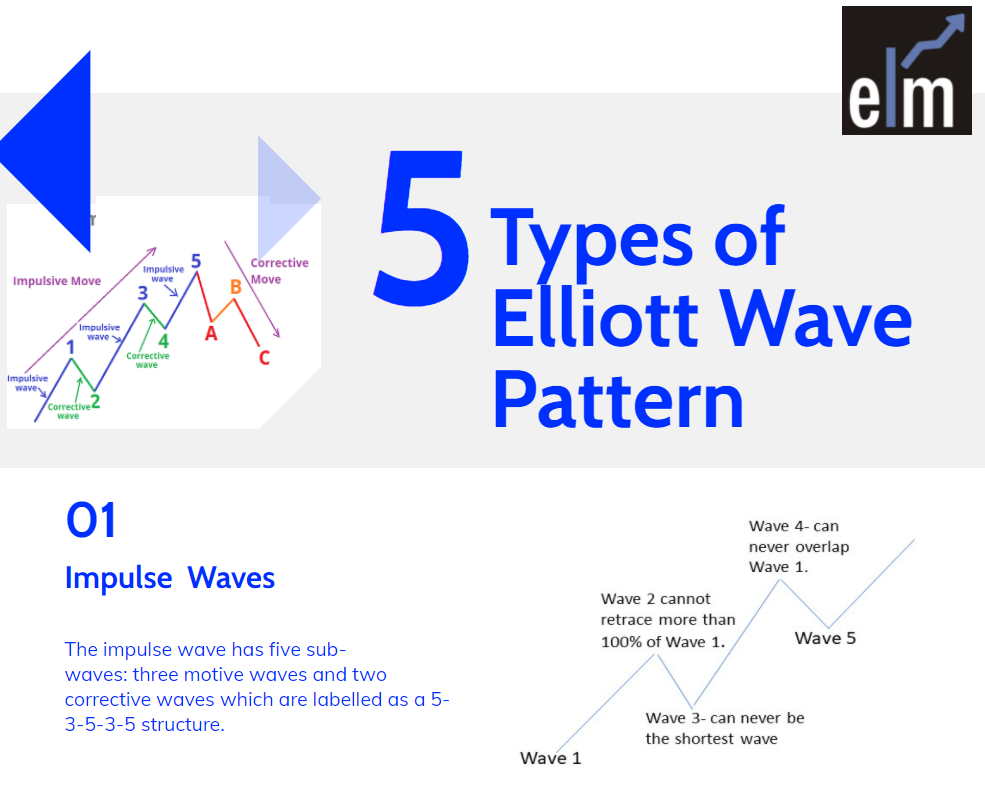

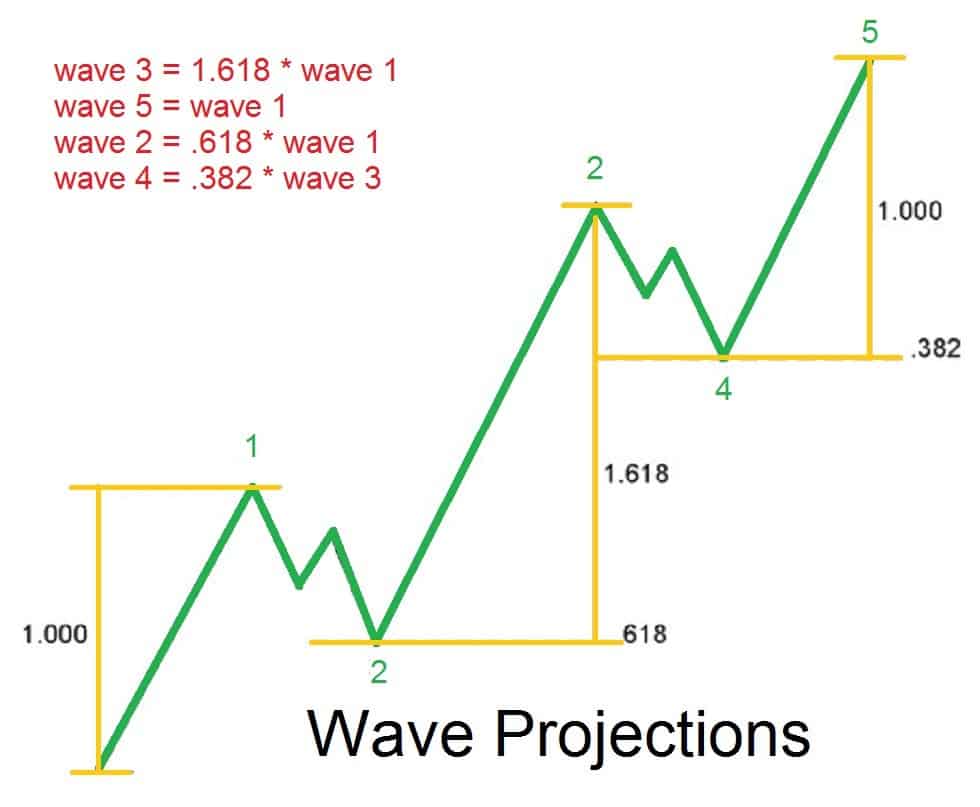

Elliott Wave Patterns - Web my journey to finding elliott wave and becoming profitable is a long and sad journey, it took countless losses and blowing up around 10 different accounts over 2 years to finally find an edge in the market. Ralph nelson elliott developed the elliott wave concept of trading in the late 1920’s. Nowadays, the elliott waves are one of the. Web the elliott wave theory is a technical analysis of price patterns related to changes in investor sentiment and psychology. An impulsive wave is composed of five subwaves and Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable patterns in financial markets. This bullish move should target at least the $30 key level, followed by a pullback, and then a stronger rally for wave 3 of (1). Wave patterns refer to the series of waves that make up a trend. The impulsive phases establish the trend and the corrective phases retrace those trends. After none of those worked, i started to research. The initial rally is expected to form an impulse wave, completing wave 1 of (1) of c (circled). Elliott wave theory & fibonacci retracement. Ralph nelson elliott developed the elliott wave concept of trading in the late 1920’s. Nowadays, the elliott waves are one of the. Origin of elliott wave theory. Web basic pattern example. Yet the chart and forecasts speak for themselves. Impulse waves move in the direction of the trend, while corrective waves move against the trend. Here is a visual illustration of the basic pattern of the elliott wave. While the corrective wave is the reaction to the first wave. Web the books are written by experts familiar with the work flows, challenges, and demands of investment professionals who trade the markets, manage money, and analyze investments in their capacity of growing and protecting wealth, hedging risk, and generating revenue. Elliott wave is based on crowd psychology of booms and busts, rallies and retracements. Impulse waves move in the direction. Rule of elliott wave pattern. Using stock market data as his main research tool, elliott isolated thirteen patterns of movement, or “waves,” that recur in market price data. Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable patterns in financial markets. Web the elliott wave principle, or elliott. Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable patterns in financial markets. After none of those worked, i started to research. Proper elliott waves follow strict counts (12345 for motive waves, abc for corrective waves). Ralph nelson elliott developed the elliott wave concept of trading in the. The initial rally is expected to form an impulse wave, completing wave 1 of (1) of c (circled). Impulse is the most common motive wave and also easiest to spot in a market. Learn what is elliott wave theory, its history, basic structures, and fibonacci relationship between waves. Ralph nelson elliott developed the elliott wave concept of trading in the. The theory identifies impulse waves that establish a pattern and. Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable patterns in financial markets. Web in markets, the elliott wave theory is interpreted as follows: Web the basic pattern elliott described consists of impulsive waves (denoted by numbers) and. Web the elliott wave principle, or elliott wave theory, is a form of technical analysis that financial traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices. Fifteen different degrees of waves can be identified with each of the. Web the basic pattern elliott described consists of impulsive waves (denoted by numbers) and corrective waves (denoted by letters). Web in markets, the elliott wave theory is interpreted as follows: The initial rally is expected to form an impulse wave, completing wave 1 of (1) of c (circled). Fifteen different degrees of waves can be identified with each of the. Impulse is the most common motive wave and also easiest to spot in a market. Web they can form different patterns such as ending diagonals, expanded flats, zigzag corrections and triangles. Web the elliott wave theory is a technical analysis of price patterns related to changes in investor sentiment and psychology. For more on ewi’s crypto pro service, please see. The theory proposed an alternative view to the notion that markets are random. The theory identifies impulse waves that establish a pattern and. Using stock market data as his main research tool, elliott isolated thirteen patterns of movement, or “waves,” that recur in market price data. You can be ready for the next major move. Elliott wave is based on crowd psychology of booms and busts, rallies and retracements. Web basic pattern example. Web his theory of pattern recognition argues that market trends unfold in five waves when traveling in the direction of a primary impulse and 3 waves when opposing that impulse. Origin of elliott wave theory. Proper elliott waves follow strict counts (12345 for motive waves, abc for corrective waves). Rule of elliott wave pattern. Impulse is the most common motive wave and also easiest to spot in a market. Waves 1, 2,3, 4 and 5 form an impulse wave, alternating between motive and corrective waves. Web the elliott wave theory, also known as elliott wave principle, is a technical analysis tool that aims to identify predictable patterns in financial markets. The impulsive phases establish the trend and the corrective phases retrace those trends. After none of those worked, i started to research. Here is a visual illustration of the basic pattern of the elliott wave.

Elliott Wave Pattern Candle Stick Trading Pattern

Awesome Traders Guide to Elliott Wave + a Simple Trading strategy!

Introduction to Elliott Wave Theory Learn Basics of Elliott Wave!

Elliott Wave Chart Patterns

Elliott Wave Patterns Advanced Forex Strategies

Forex Elliot Wave TradingThe 5 Wave PatternElliott WavesForex

Elliott Wave Theory Basic

:max_bytes(150000):strip_icc()/ElliottWaveTheory-b46a288b1cfe42c69bdbf3b502849b2c.png)

Elliott Wave Theory Definition

Elliott Wave Pattern 5 Powerful Elliott Waves Pattern

Advanced Elliott wave Analysis Trading Strategy Patterns, Rules and

Traders Often Use Fibonacci Numbers To Anticipate Where A Retracement Is Likely To End And Thus The Place Where They Should Place Their Trade.

Five Waves In The Direction Of The Main Trend Labeled 1,2 ,3 ,4 And 5, Followed By Three Corrective Waves Labeled A, B And C.

Here's The Four Types Of Elliott Wave Corrective Patterns:

Ralph Nelson Elliott Developed The Elliott Wave Concept Of Trading In The Late 1920’S.

Related Post: