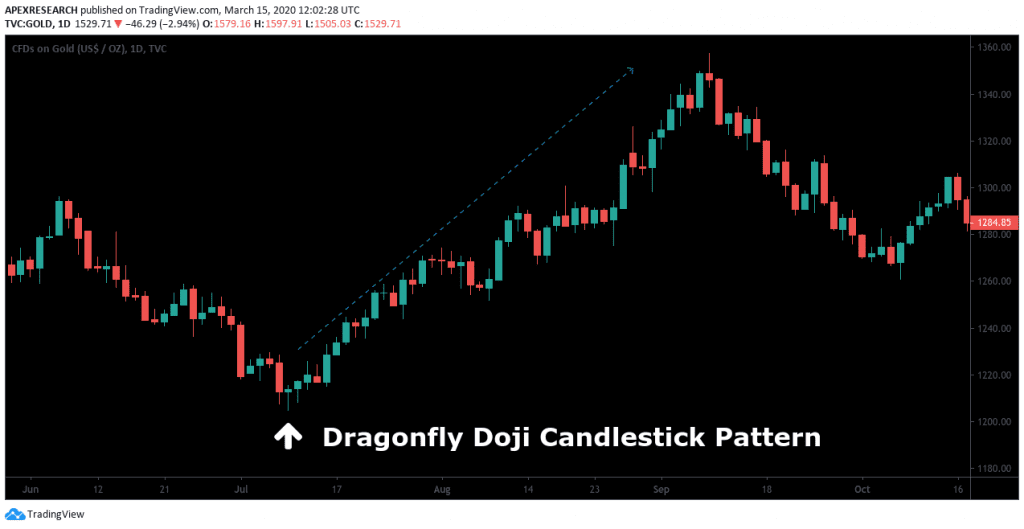

Dragonfly Candlestick Pattern

Dragonfly Candlestick Pattern - As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter t. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. They look like a hammer candlestick but have much thinner real bodies. Web a dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. They are also found at support levels signifying a. Web a dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the former. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter t. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. They are also found at support levels signifying a.. Web a dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. They are also found at support levels signifying. Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. Web a dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower. Web a dragonfly doji candlestick pattern is formed when a candlestick has the same high, open, and closing prices. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. Web a dragonfly. They look like a hammer candlestick but have much thinner real bodies. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of. Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. Web a dragonfly doji candlestick pattern is formed when. They are also found at support levels signifying a. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and. Web the dragonfly doji is a specific type of doji candlestick pattern that occurs when the opening and closing prices are almost identical and at the high of the trading session. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. Web a dragonfly doji is a candlestick pattern described by the. Web a dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the former. Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on. They are also found at support levels signifying a. Web a dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the former. Web a dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. Web in this guide to understanding the dragonfly doji candlestick pattern, we’ll show you what this technical indicator looks like, explain its components, teach you how to interpret it, and discuss its limitations. As shown below, the dragonfly doji has a similar appearance to the hammer pattern or capital letter t. Web a dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. It creates a long lower shadow, indicating that buyers have been in control during the session, pushing the price down. They look like a hammer candlestick but have much thinner real bodies.:max_bytes(150000):strip_icc()/dotdash_Final_Dragonfly_Doji_Candlestick_Definition_and_Tactics_Nov_2020-01-eb0156a30e9745b687c8a65e93f54b07.jpg)

Dragonfly Doji Candlestick Definition

Dragonfly Doji Candlestick Pattern, Technical Analysis, Episode 3

Dragonfly Doji Candlestick Pattern Explained (With Examples)

Candlestick Patterns

Candlestick Patterns The Definitive Guide (2021)

All Candlestick Patterns in Forex The Complete Guide

Dragonfly Doji Candlestick Understand The Pattern

Dragonfly Doji How to Spot and Trade Candlestick Patterns Freedom

Dragonfly Doji Candlestick Pattern I How to Use Dragonfly Doji Candle I

A Dragonfly Doji Candlestick Pattern Definition, Interpretation, and

Web The Dragonfly Doji Is A Specific Type Of Doji Candlestick Pattern That Occurs When The Opening And Closing Prices Are Almost Identical And At The High Of The Trading Session.

Web A Dragonfly Doji Candlestick Pattern Is Formed When A Candlestick Has The Same High, Open, And Closing Prices.

Related Post: