Divergent Pattern

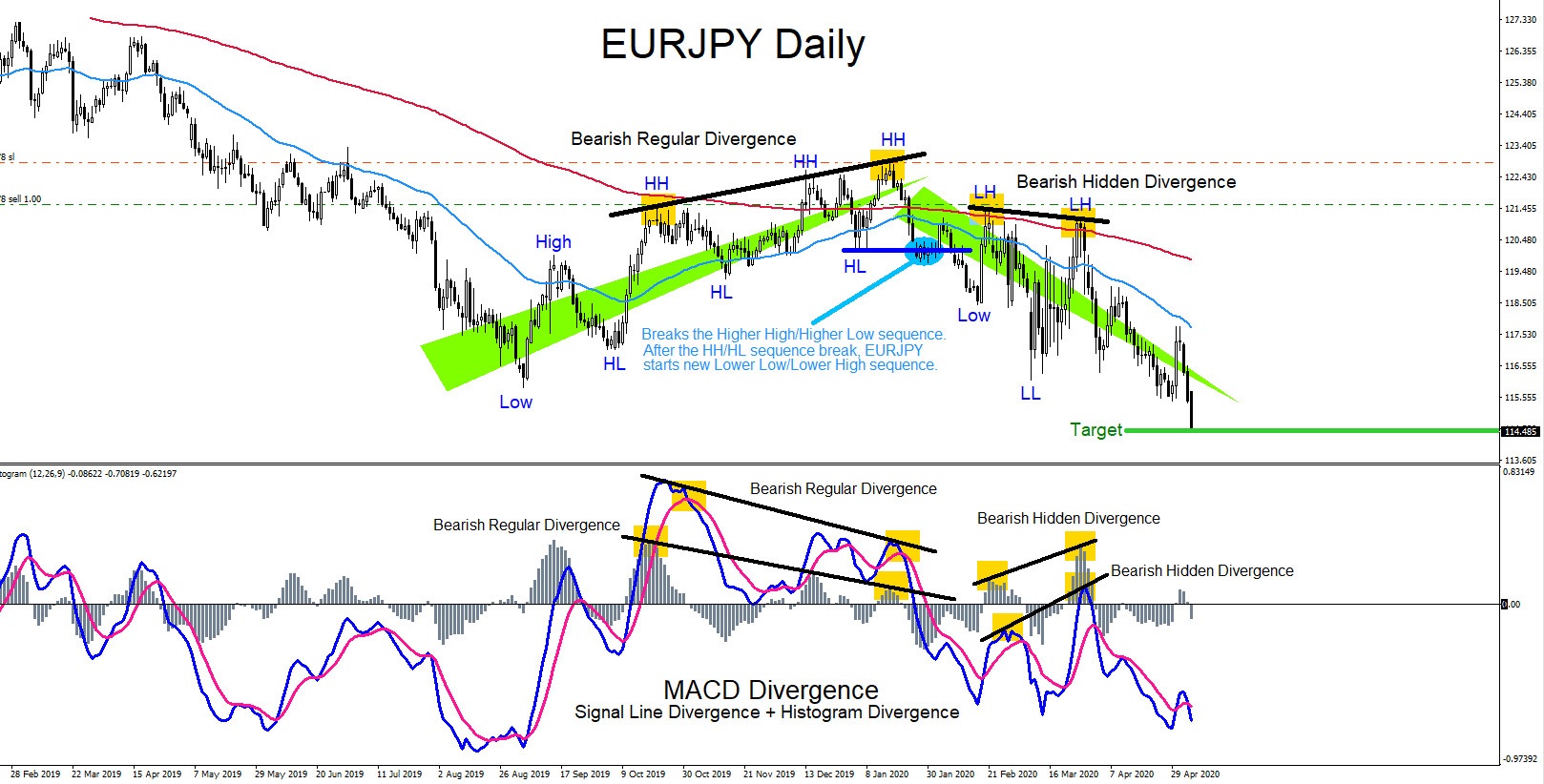

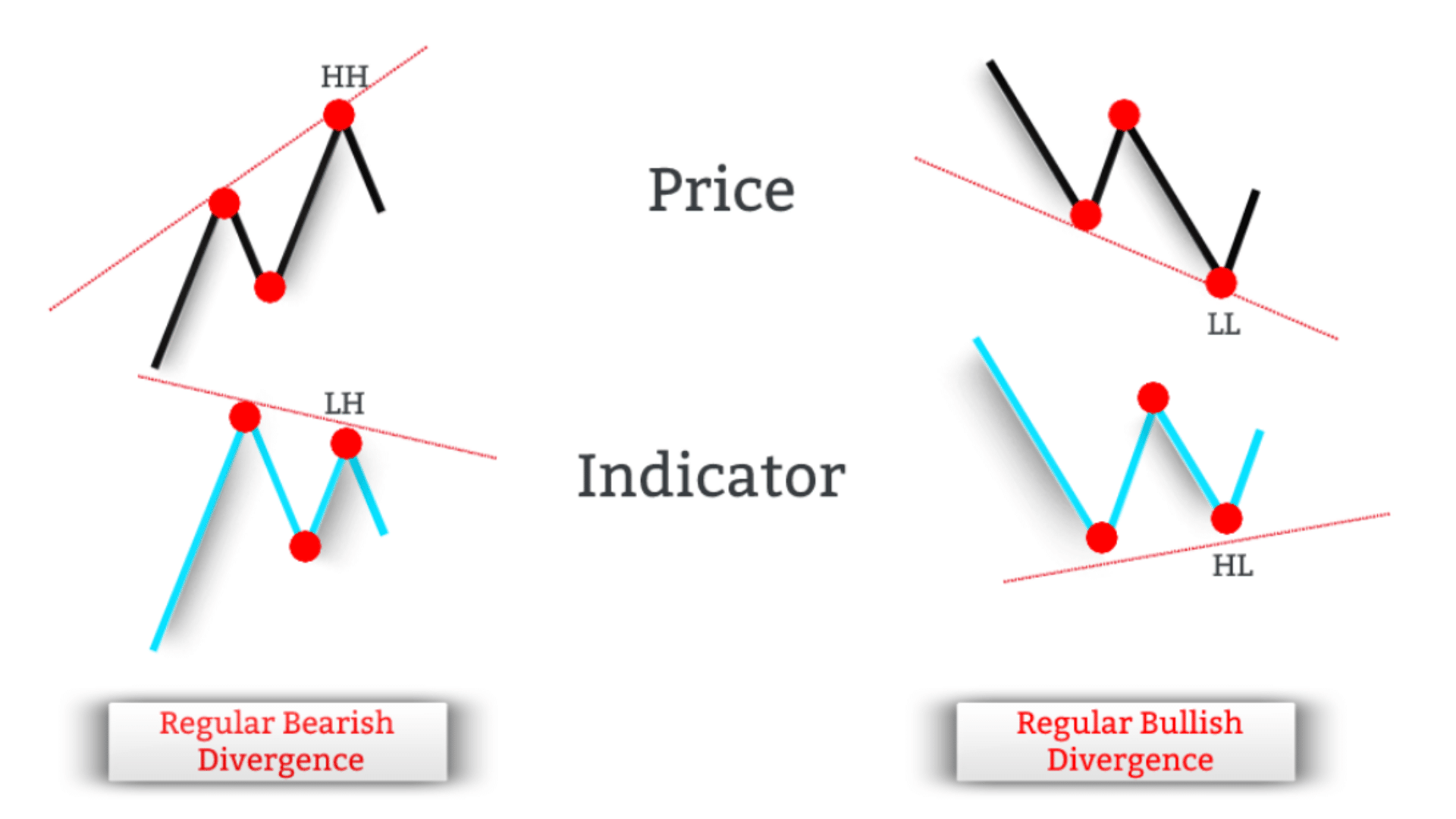

Divergent Pattern - Web divergence or disagreement between indicators can have major implications for trade management. Web divergence in stock trading is the contradiction between price action and indicators on the chart. This is usually represented by. Although some vernalization genes have. What is a bearish divergence? When we talk about divergence, we’re talking about what happens when the price continues to make higher highs in a bull trend. In other words, when the price of an asset is out of sync with the corresponding indicator’s readings, a divergence signal occurs. In the 1hr chart below, gbp/usd is building a bearish channel (black line). Each type of divergence will contain either a bullish bias or a bearish bias. Jerome powell told the press that there was a “real discussion” for cutting. Web wednesday was a day of divergent policies that saw the bank of japan (boj) hike rates more than expected and the fed signal a cut. Web divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation. Secondly, after the erroneous patterns in cuew are. With this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. Web firstly, it interprets the divergent patterns (patterns that deviate from those found in native english corpora) while distinguishing between systematic patterns (divergent patterns that make sense and are found in bnc) and erroneous patterns. As well as, providing some tips. This is something that occurs when the asset’s market price moves in the opposite direction of another piece of data. Web a divergence in a market is an early signal that an existing trend is likely to reverse and/or consolidate. Web divergence is a very useful tool to help traders spot trend reversals or continuation patterns. As well as, providing. This is usually represented by. In the 1hr chart below, gbp/usd is building a bearish channel (black line). Web in trading, divergences occur when the price of an asset and the indicator are moving in opposite directions. During this phase, flowering signals are generated and transported to the apical meristems, stimulating the transition to the inflorescence meristem while inhibiting tiller. Web firstly, it interprets the divergent patterns (patterns that deviate from those found in native english corpora) while distinguishing between systematic patterns (divergent patterns that make sense and are found in bnc) and erroneous patterns. In the 1hr chart below, gbp/usd is building a bearish channel (black line). Web in finance — including crypto trading — there is a technical. What is a bearish divergence? These indicators are designed to provide estimates of an asset's price. In this situation, bulls are losing their grip on the market. It’s a clarion call to traders that a trend could be weakening or changing direction. This is something that occurs when the asset’s market price moves in the opposite direction of another piece. Read blog to get familiar with how it works, types regular & hidden divergence & more. Web divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. With this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. Secondly,. Generally, the bullish divergence signals an uptrend reversal or a price correction in the market. Web in finance — including crypto trading — there is a technical pattern known as a divergence. What is an example of divergence in trading? Web divergence manifests as a discrepancy where the trajectory of an asset’s price contrasts with the movement of a related. Jerome powell told the press that there was a “real discussion” for cutting. Web in finance — including crypto trading — there is a technical pattern known as a divergence. In other words, when the price of an asset is out of sync with the corresponding indicator’s readings, a divergence signal occurs. In this article, we will focus on spotting. Web trading divergences is a common strategy focusing on finding a miscorrelation between the asset’s price and a technical indicator. Web background elevated systemic antibody responses against gut microbiota flagellins are observed in both crohn’s disease (cd) and myalgic encephalomyelitis/chronic fatigue syndrome (me/cfs), suggesting potential serological biomarkers for diagnosis. Since indicators themselves are based on price action, if the price. Web a broadening formation is a price chart pattern identified by technical analysts. Conversely, positive divergence happens when the price is in a downtrend, but the indicator is. This is usually represented by. Web the best indicator for divergence patterns is the awesome oscillator (chris’s favorite), but there are also others like macd.pro (nenad’s favorite), the rsi, cci, or stochastic. Web divergence in trading signifies a lack of alignment between the actual price movement of an asset and the technical indicators upon which traders rely. Web in trading, divergences occur when the price of an asset and the indicator are moving in opposite directions. Since indicators themselves are based on price action, if the price is going contrary to the indicator, this is a clear sign that trouble is on the horizon. This is more than a mere anomaly; Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. What is a bearish divergence? There are two types of divergences: What is an example of divergence in trading? Web divergence in stock trading is the contradiction between price action and indicators on the chart. With this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. This is something that occurs when the asset’s market price moves in the opposite direction of another piece of data. Web divergence trading patterns signal traders of possible trade setups.

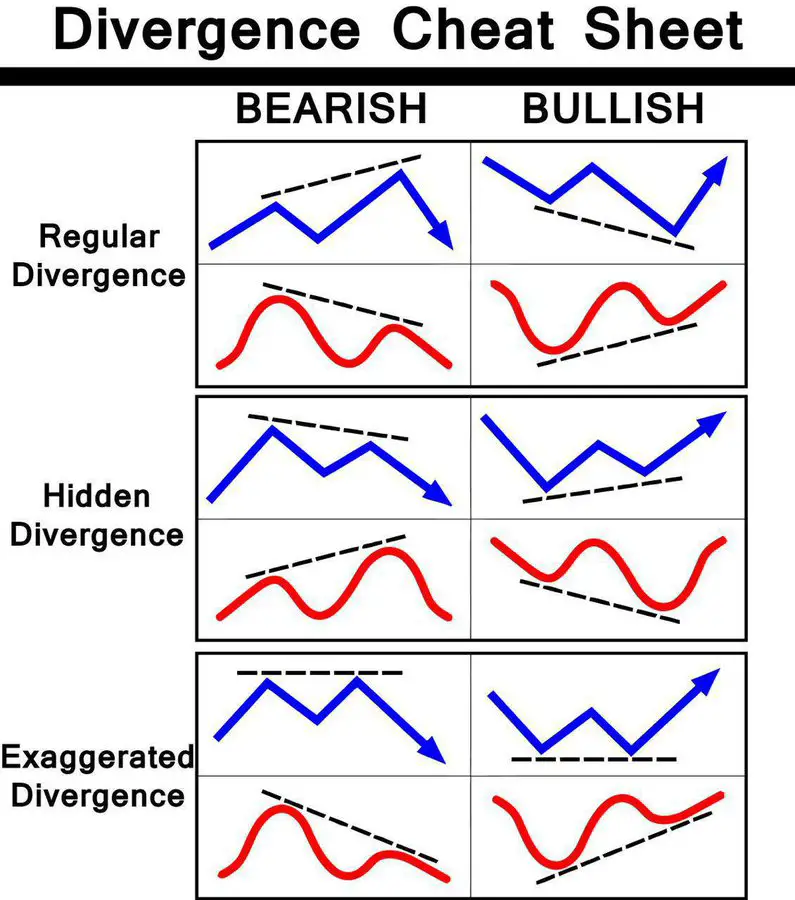

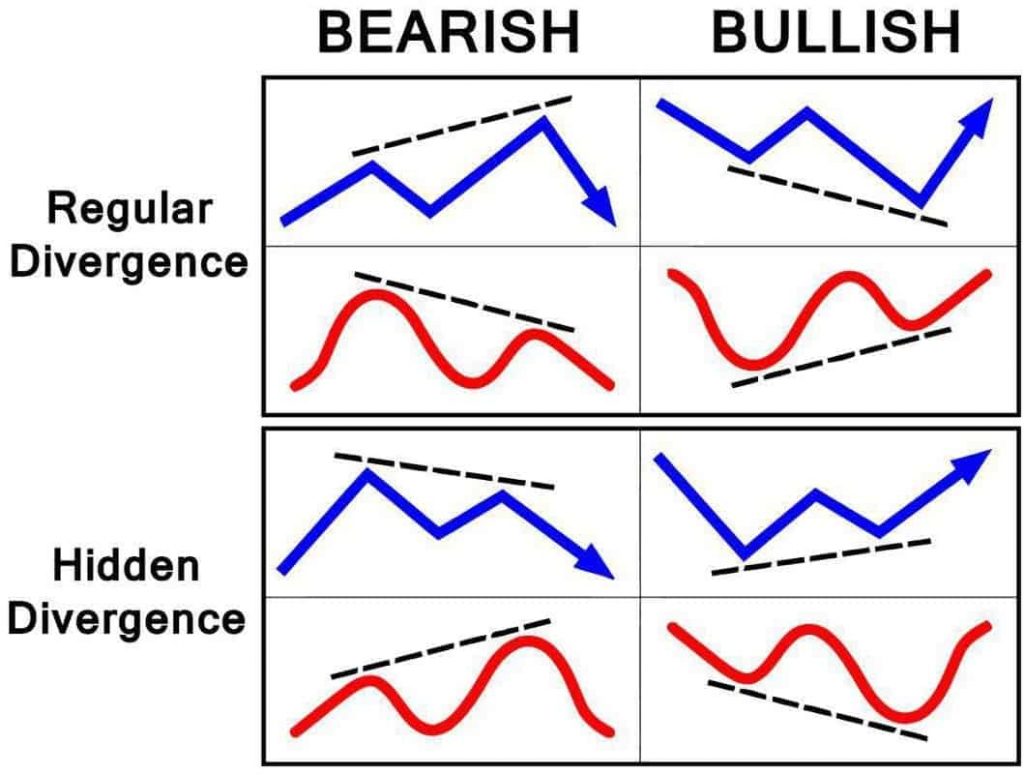

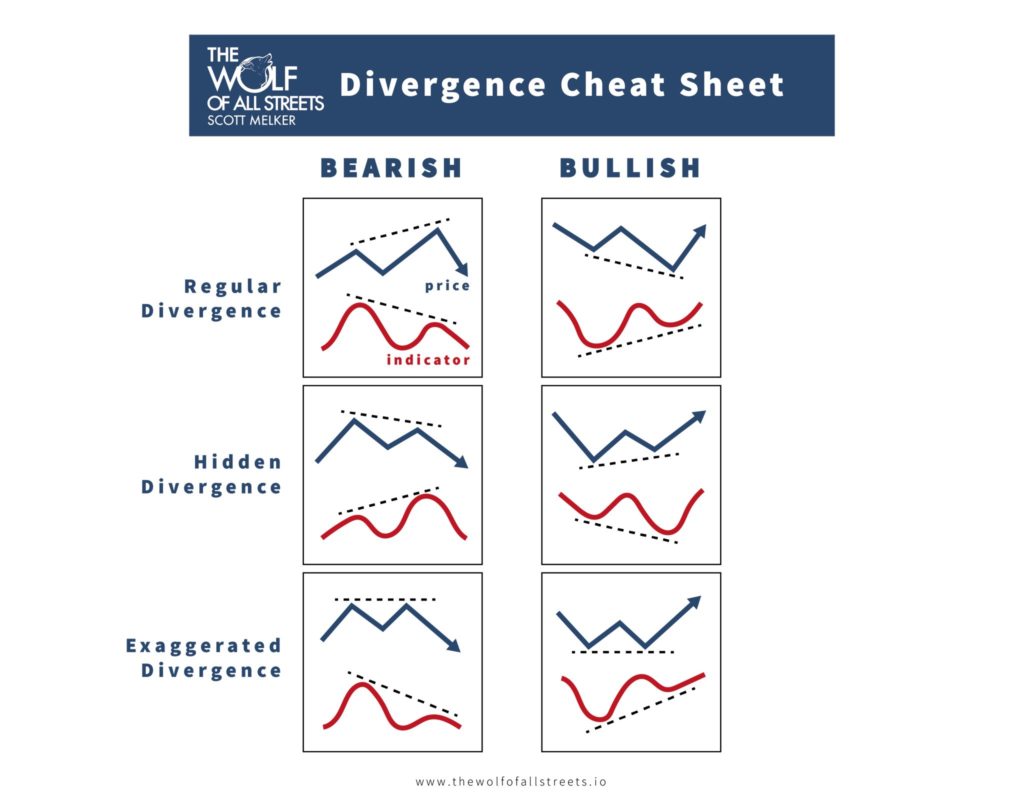

Divergence Cheat Sheet New Trader U

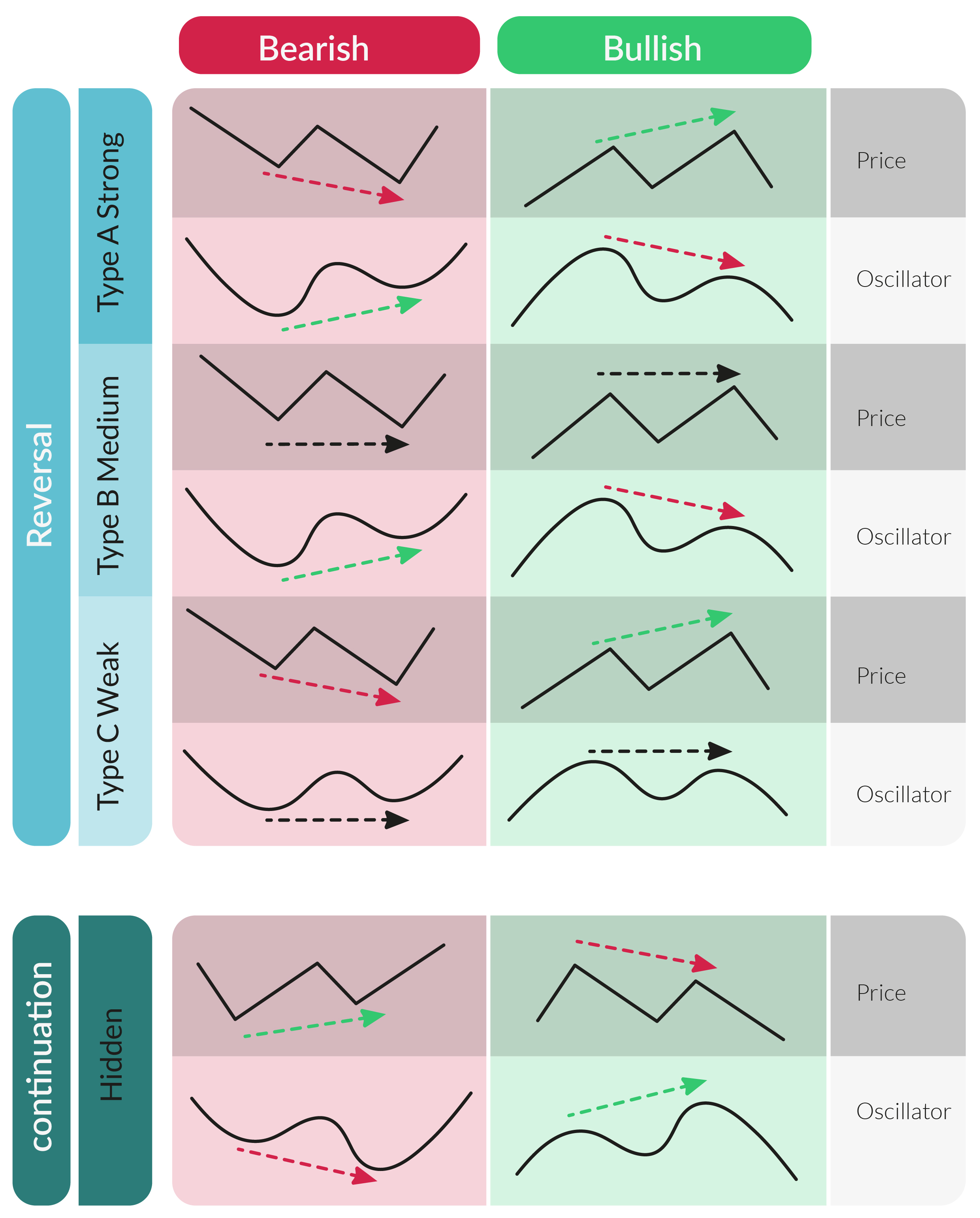

The New Divergence Indicator and Strategy 3rd Dimension

Divergence Trading Patterns

How to Find and Analyze The Bullish Divergence Pattern Pintu Academy

What Is RSI Divergence? Learn How To Spot It

RSI and Divergences 101 The Basics The Wolf of All Streets

Subpatterns corresponding to the divergent pattern Download

How To Trade Divergence Pattern

The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

Divergence Cheat Sheet and Free PDF

In This Article, We Will Focus On Spotting Bearish Divergences.

Web In Finance — Including Crypto Trading — There Is A Technical Pattern Known As A Divergence.

There Are Four Types Of Divergence Patterns:

During This Phase, Flowering Signals Are Generated And Transported To The Apical Meristems, Stimulating The Transition To The Inflorescence Meristem While Inhibiting Tiller Bud Elongation.

Related Post: